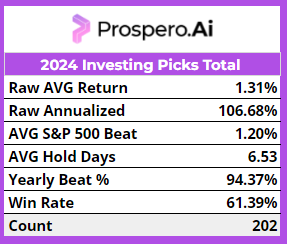

The investing newsletter picks beat the S&P 500 by around 50% in 2022 and 2023, and are strong again in 2024. Beating by 94% so far this year (on an annualized basis). Our win rates continue to be impressive and consistent. 61% this year, 60% last year and in our Model Trading Portfolio that engages in a high frequency trading strategy, is at 59% on almost 1,200 investments since inception (6/4/23).

It has been one of the more interesting years we can remember in the stock market. And our signals have again proven vital. Look no further than last week to see how our SPY and QQQ Index Net Options Sentiment sounded the alarm clearly before one of the worst days of the year.

If you are new to our products this 48 second video gives a quick overview of what our products are and how they work.

Letter Outline:

Bull Strategy / Comparison to Last Year

Bear Strategy / Comparison to Last Year

2024 Macro Summary

Bonus Sector / Cap Review for Paid Users

Follow us on TikTok if you’d like to see how we teach our investing lessons in different forms on a daily basis!

2024 Bull / Long Strategy & Comparison to 2023 - link to a chronological view of our picks by letter (as of 4/19/24)

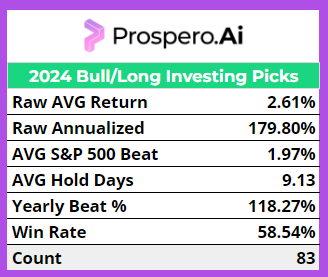

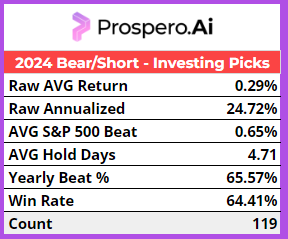

Even in a Bull market our Bear picks still outnumbered our Bulls 119 to 83. That is because the hold time is almost double for our Bull picks as we tend to hold for longer if our signals are good and momentum starts to turn. Why? Because our top longs tend to be less volatile in Net Options Sentiment above all and this is our biggest buy/sell trigger when we see it hit lower highs or lows. Looking at our longs by Sector is very interesting year over year.

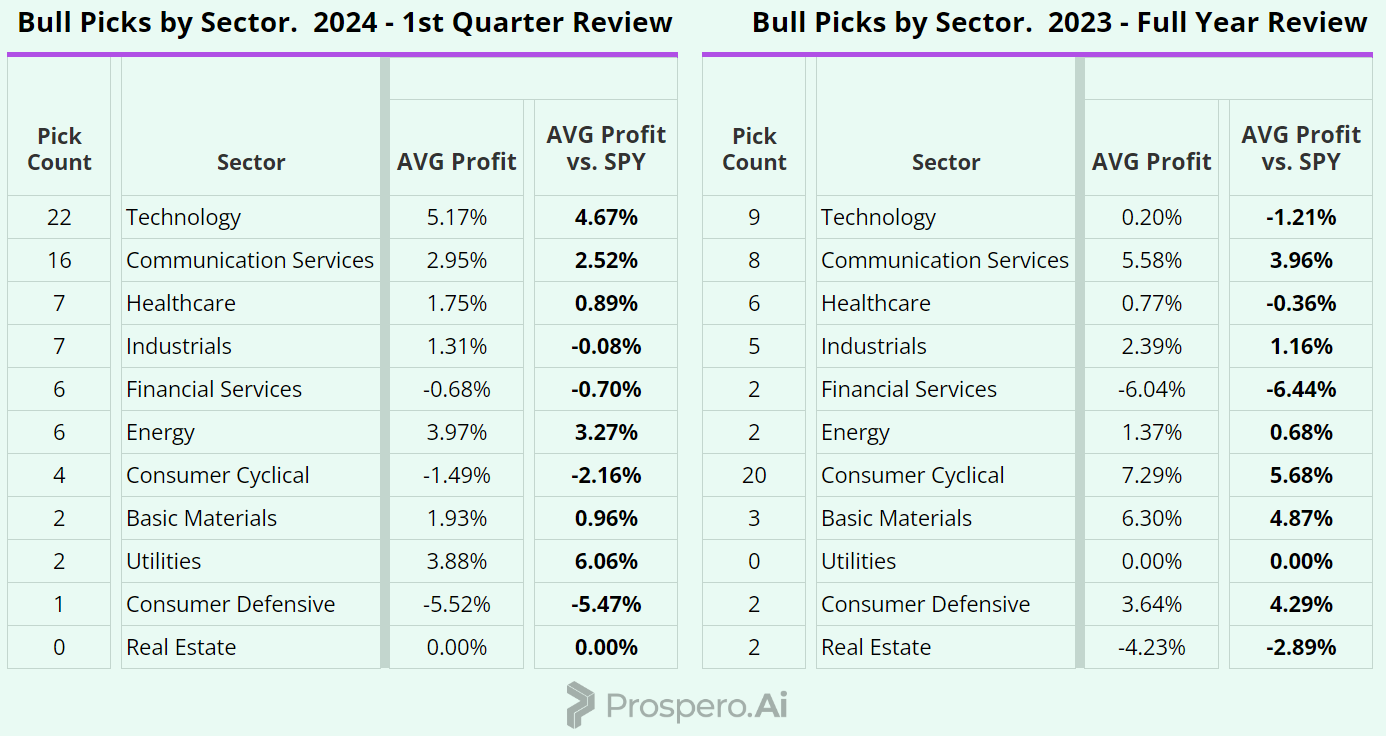

We often say in our livestream you “take what the defense gives you”, and we always practice what we preach. After the bulk of our returns in 2023 was made up by Consumer Cyclical wins, we have shifted that focus to Tech this year around the AI boom.

More importantly we opened ourselves up to new Sectors as Tech has started to show issues. After 2 picks between Utilities and Energy with underwhelming returns in all of 2023 we are already at 8 through Q1, not only that but it represents 2/3 of our best Sectors!

A final thought on another piece of advice we always give: “Get to know the signals in the app.” Check out a breakdown of the Sector making our returns this year, Tech.

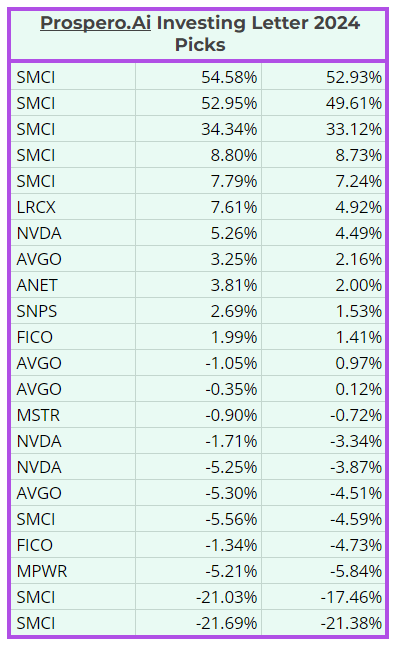

Our 5 biggest wins are all SMCI. We always say the signals aren’t perfect, but they will make anyone a better investor if you get to know them. This is a great example. We have made a mint this year on SMCI, but it is also our 2 biggest losses. We are willing to be aggressive with this stock because we feel the signals work well overall with SMCI, but people see us bail on trades quickly sometimes too. This embodies our overall advice: you can’t be afraid to be aggressive, but always trade defensively. It is better to leave money on the table than suffer huge losses.

2024 Bear / Short Strategy & Comparison to 2023 - link to a chronological view of our picks by letter (as of 4/19/24)

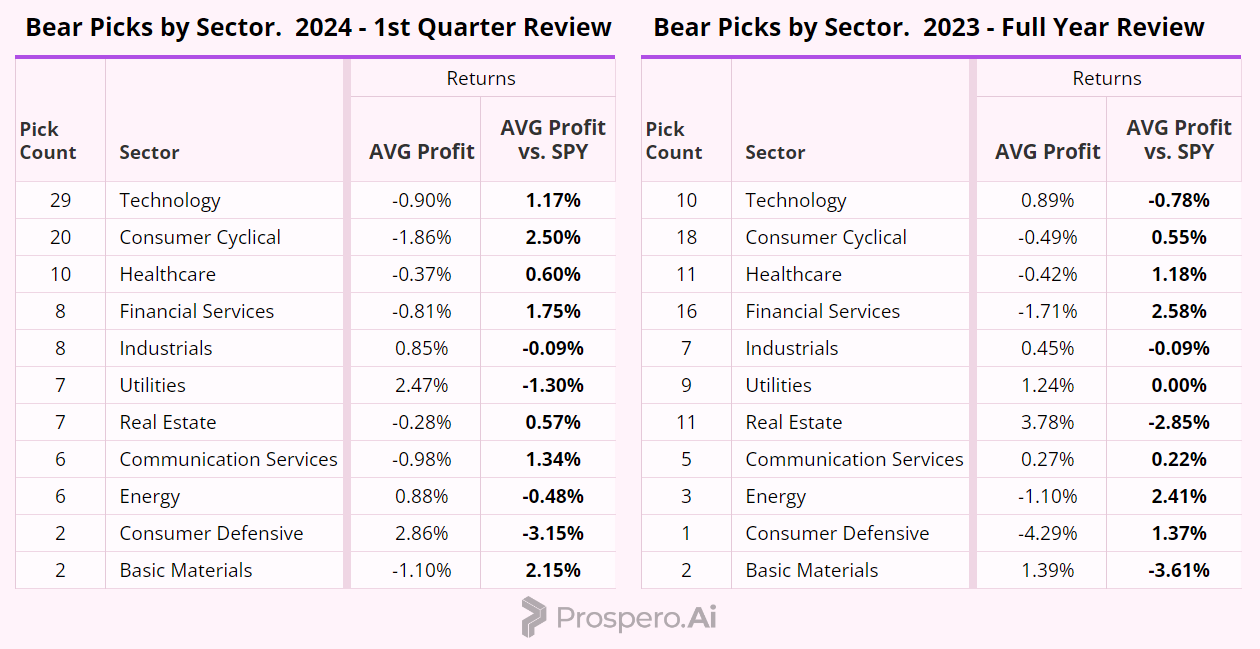

Our shorts are hitting at a higher rate yet returning less this year. This is a reflection of a strategy we feel is vital in a volatile market. Take profits quickly. When our shorts are profitable and momentum shifts we get out of them quickly, generally we like to do that, but in a Bull market that is especially important because even companies with poor underlying fundamentals can get hot in a Bull market and blow up a short that has a strong investment thesis. Let’s see how we approached Sectors this year vs. last:

There is a continuation of the shift we talked about on the Bull side. Not only did we move away from Consumer Cyclical longs in 2024, we turned it into a short target based on our Macro view. This really underscores how valuable having a Macro view and signals like QQQ and SPY Net Options Sentiment to support it can be. We do have some consistency with our Financial Services shorts. We are proud that not only have we done well on longs in tech, but we also did well on shorts too. This shows how powerful our signals are that we can push out such a large quantity of Tech longs and shorts and win on both sides! (Especially after being in the red on Tech last year.)

2024 Macro Summary:

2024 has been a year of strategic navigation for investors, balancing between growth opportunities in emerging technologies and the safe havens of established sectors during periods of heightened volatility.

Market sentiment was periodically influenced by political events both domestically and internationally, adding layers of complexity to investment strategies focused on long-term growth and stability.

Early in the year, investor optimism was fueled by strong corporate earnings reports, leading to gains in major indices like the S&P 500 and the Nasdaq. Technology stocks, particularly in the AI and biotech sectors, showed notable growth because of increased investments and promising innovations.

As the year progressed, the market faced volatility, driven by changes in interest rates and inflation expectations. The Federal Reserve's decisions on interest rates played a significant role, with periods of hawkish stances causing market dips that particularly affected growth-driven sectors like technology. Conversely, dovish signals provided temporary uplifts, especially benefiting utility and consumer staple stocks, which are often seen as safer bets during uncertain times.

Energy stocks also had a dynamic year, impacted by fluctuating oil prices and geopolitical tensions. Companies in renewable energy saw increased investor interest as global commitments to sustainability spurred government subsidies and policies favoring green energy solutions.

Financial sector stocks experienced mixed fortunes, reflecting the changing economic landscape and regulatory environment. Banks and financial institutions were closely watched by investors, analyzing their adaptability to higher interest rates and the potential impacts on consumer lending and profitability.

Consumer discretionary stocks were influenced by retail spending trends, with shifts in consumer confidence reflecting broader economic signals. High inflation rates initially dampened consumer spending, but subsequent easing saw a rebound in this sector, particularly benefiting from strong online sales growth.

The real estate sector faced challenges, including rising mortgage rates that dampened homebuyer enthusiasm. However, commercial real estate found a footing later in the year as businesses adjusted to hybrid working models, renewing interest in office spaces in certain urban areas.

In terms of individual stock movements, certain tech giants continued to dominate the market conversation, with their performance significantly impacting the broader index movements. Startups in cutting-edge technologies like AI and quantum computing also drew attention, offering high-risk but potentially high-reward opportunities for speculative investors.

Throughout the year, the international market context also played a crucial role, with global economic recovery patterns affecting multinational corporations and sectors like industrials and materials, which are sensitive to international trade dynamics.

Guess what? Our marketing lead helped us train a “GeorgeGPT.” Everything from college papers to speech transcripts from our CEO were loaded in. How did we do?

Sector Update

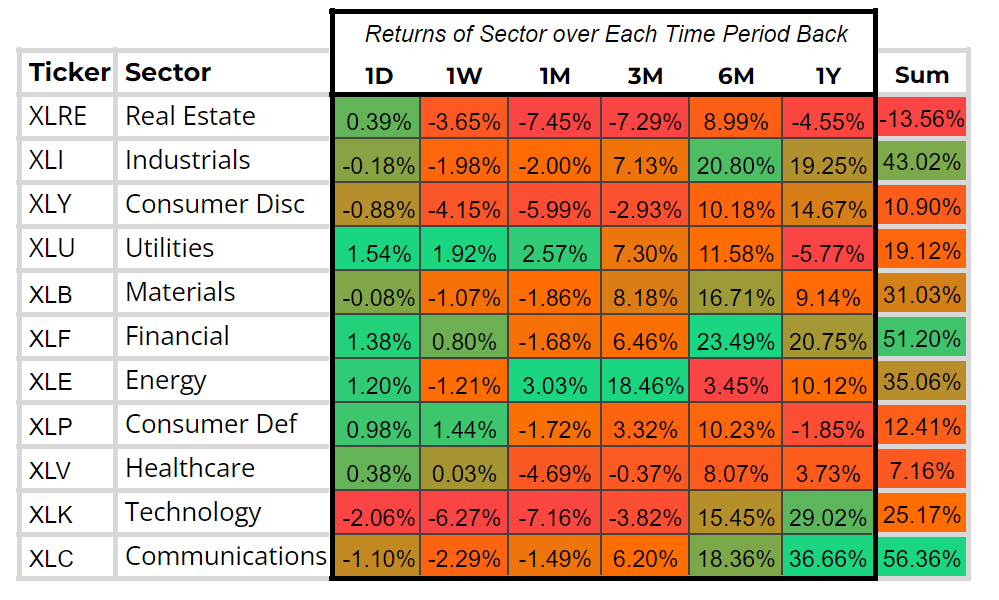

From 4/21 Letter:

Current:

Takeaways:

This is what makes this market so tough to read. After getting hammered last week and at times today Technology finished up. Not to mention Energy flipping again until Tech especially can find some consistency we recommend trading highly defensively and being close to evenly distributed long/short. And if you are long only and tech heavy 15% in SQQQ until we see Net Options Sentiment hold > 25 comfortably for a day.

Market Cap and Value/Growth Update

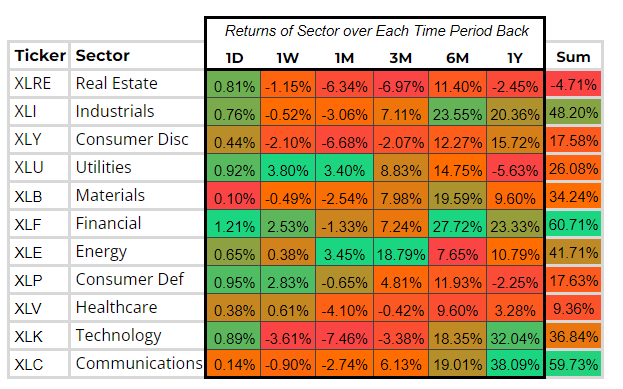

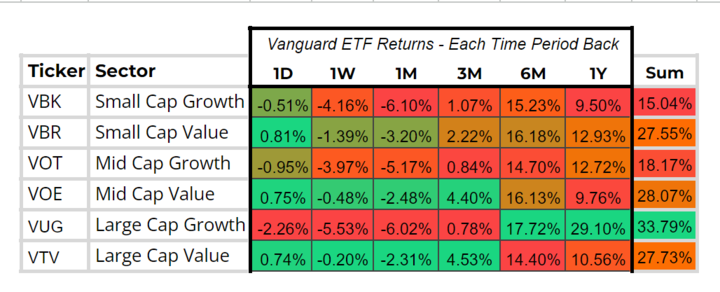

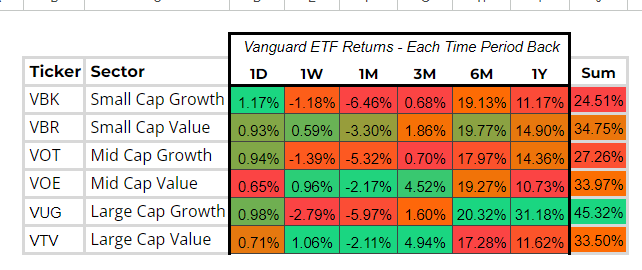

From 4/21 Letter:

Current:

Takeaways:

It isn’t just Tech being frenetic, volatile and indecisive. As you can see above, Large and Midcap value were two of the leaders on Friday and laggards today. In our defensive move, we oriented around value, and we will give it one more day to see if it flips again before perhaps getting back to our more normal strategy. No easy task to trade in this market where you take the data and attempt to trade defensively around it and the market doesn’t even wait 1 day to completely change its mind. To expand on our points from the Sectors, the best thing you can do right now is balance value and growth. The easiest way to find value stocks is in the Screener we shared last night: look for stocks that have a low percentage of P/E relative to their Sector. That is a great value metric to add to your repertoire to control for overexposure to Growth in this market.

Hi Gary, this is the first time we ever used it for part and we made a joke of it and acknowledged that. Did you see that part? We are an AI company it was meant to be tongue in cheek.

Question in the value screener. When you say to look for a stock with a low PE compression to the sector, is that referring to the % diff from sector? As in a lower percentage in that column?