Welcome to our 1st trade review letter. We strive to impact your investing process with high caliber information. From the same data we share for free, our trades returned:

52.87% in 94 days since the 1st newsletter picks. (09/19 to when we closed out 12/22 for the year) Follow us on Twitter as we share more ideas.

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment. If you don’t have the Prospero.Ai app:

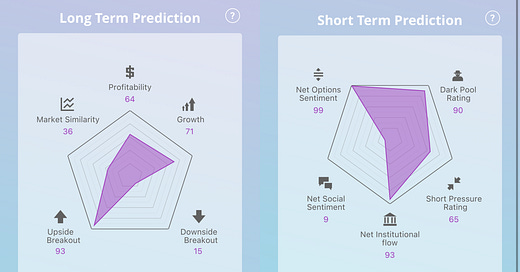

Net Options Sentiment was the main driver of success, especially on QQQ. Full list of transactions too long to cover but linking case study highlights and we will discuss thematic strategies below:

Traded aggressively on QQQ when rate yields and Net Options Sentiment moved in the same direction.

(Yields up + Net Options Sentiment Down = Bear,. Yields down + Net Options Sentiment up = Bull)

We also identified battle tested Bear market Net Options Sentiment ranges for QQQ. > 40 often Bullish and < 20 often Bearish when these levels aligned with yield movement.

A closely adjacent strategy was on individual stocks (I.E NVDA) with consistent up or down trends in Net Options Sentiment and declining volatility (distance between highs and lows). These kinds of trades were aided successfully by identifying companies with high Upside Breakout and low Downside Breakout.

Using Net Social Sentiment to sell puts on AMC. A lot of the early Prospero testers I met through my early investment in AMC.

In my estimation social sentiment needed a bigger place in Value Investing but it is difficult to quantify.

Value investors did not invest in tech stocks for a long time, because it was difficult to determine how much growth was built into price. What is a fair growth multiple on companies in a sector with frequently model breaking growth? My strategy was fairly simple, I would look for Net Social Sentiment to decline followed by price then Sell Puts when Net Social Sentiment started to recover. (A sign that retail investors were more Bullish at the lower price)

How you can beat the market with us

Some large % of the market is going to win by mostly luck

Some smaller % will win because they have a repeatable process that works time and time again. (I.E. Warren Buffet)

Some smaller % will win because they have superior technology (I.E. Renaissance Technologies)

Some smaller % will win because they make markets (I.E. Citadel)

Some smaller % will win because they move markets (I.E. Blackrock)

Category 3, 4 and 5 do the hard work for us.

Prospero’s Net Options Sentiment created is a simple signal for you to track options. Big moves are driven by major options traders (3,4,5).

Win with us:

Upside Breakout and Downside Breakout leverage similar architecture to track institutions in the long term options markets.

Prospero aspires to give retail the advantage, which at scale is in our grasp.

Prospero has a genuine interest in teaming up with retail investors to generate informational advantages vs. Wall St and create a virtuous cycle. Larger numbers of users will help us gather more resources and share exponentially better information and technology.

Let’s even the playing field

I left my last full time job in Finance 12 years ago — not to start Robinhood but to be Robinhood and build a charitable Hedge Fund.

On the way we developed joint IP with NYU in AI and Finance.

The foundations of Prospero came from doing paid R&D for institutions.

Instead of continuing that work we focused on the ultimate goal of free technology to educate retail investors and level the playing field.

3 years ago, my co-founders and I embarked on an extensive product testing journey through V1, V2 and the version that you see today.

We did this to ensure that the metrics worked but also to create design concepts people could learn quickly.

None of us have been paid and all of us have put our own money in the company. There will never be hidden charges like PFOF, that is our promise.

We have not raised capital if it meant charging for these features. We preferred to earn trust. A community built on trust is the only way for us all to win.

Net Options Sentiment originates from this commitment.

Retail investors working together is all I’ve ever wanted.

I bought AMC in Jan 2020 before it took off, but I did not get to be in the faceless mob for long. While teaching a number of individuals investing, I struggled to educate on options. I was frustrated one day and said, “what if I told you the options markets liked this stock.” And our hero metric was born.

This is what I would do anyway, before we had a product, a lot of people I was teaching became Prospero’s early users.

I want to work with you, hear what you need, and build a product meant for you.

To that end please help us by filling out this survey. It will give you a voice in determining what features we build. And share our Apple Download Link and Android Download Link. The more people we have using our app, the faster we can build even better technology than what yielded these excellent results.

Thanks so much for providing this amazing tool/service. Please forgive me if this is an ignorant question, but are there any plans for a desktop version?