Happy Sunday evening! You are receiving this if you downloaded our app or subscribed via Substack.

99% above SPY on our 2023 picks and a 75% win rate per pick against S&P 500 benchmarks. Shorting is especially difficult and we are 31/38 (81%) in 23’ including 15 of the last 16. We dig into our process below.

YouTube livestream tomorrow 8/21 at 11 AM EST. We have also made major updates to our video learning resources. Some highlights:

10 minute walkthrough of all the signals and features on the way

Enhanced dollar cost averaging and going beyond TA for longs

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

81% on Bear picks in 2023: how we pick

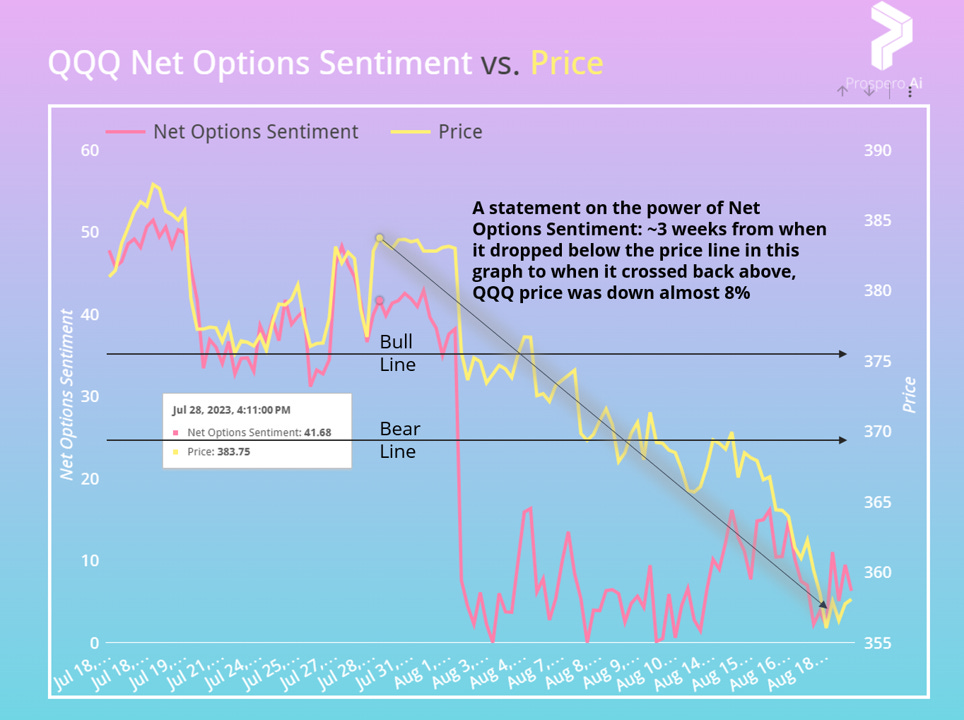

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

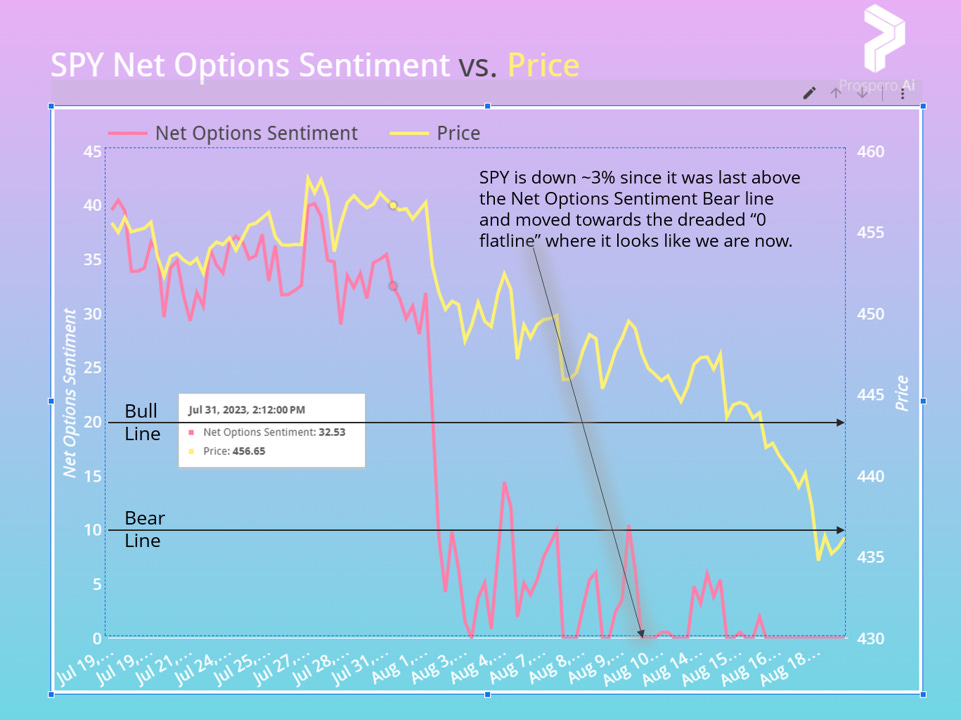

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned -2.21% this week vs -2.05% for SPY. If you’ve been reading these letters you know this performance is no surprise to us. See what made us sound the Bear alarm on 8/2.

We showed you last week, many small leads down on price Net Options Sentiment has had recently. But in the picture above we see a gap filled where QQQ Net Options Sentiment jumped way out in front of price on the decline. It shows what the metric was designed to inform retail investors of. When options bets are being placed against the QQQ that far outpace current price dynamics.

We are more Bearish on the whole and will set lower levels on QQQ. But as a last warning, watch out for a Bull trap this week, it is becoming too popular to be Bearish and anything getting to popular puts that strategy in danger of being tested.

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

Adding a number of Bears, and how we pick them

Some key things about this screener

We added sector because we filtered out Real Estate, Financial Services and Healthcare. (After selecting WSBC as our favorite of many Financial Services stocks on the pre-filtered list)

Orange highlights were not selected because Net Options Sentiment > 40

Green highlights were not selected because of significant positive price momentum

NL was not selected because it is small cap, VEON is about 4X the market cap and was still on the edge. We are de-risking shorts right now by avoiding small caps. We like $1B or more market cap generally. We cut anything trading < $1

SWX was selected but not SR and BKH because 1 Utility stock was enough exposure for us there. (Tech is the only Sector we will 2X right now)

We selectively and carefully break these on a case to case basis but these are our general rules for shorts to generalize the above:

Market cap > $1B

Net Options Sentiment < 40

1 short per Sector unless overvalued in our view (how we feel about Tech now)

Avoid EMA crosses and oversold on RSI but whenever possible invest only where technical and Net Option Sentiment are overall seeing the same thing (I use tradingview, check out VEON here)

Adding VEON, AAL, SWX, WSBC and RXT as shorts (XRX is a keep)

For all these stocks Bearish this week if:

Net Options Sentiment < 50

Net Social Sentiment < 60

SPY Net Options Sentiment < 8

Bull Potential - ORCL (Oracle Corp)

ORCL Achieved Authorization for Top-Secret Cloud Data last week.

This recent approval allows the Intelligence Community to utilize more than 50 Oracle Cloud services via Top Secret networks and additional services are set to be accessible through an ongoing accreditation process. These offerings encompass core networking, computing, storage as well as various advanced cloud-native services that contribute to enhancing mission outcomes.

So it is moving up consistently in key short term metrics (with higher lows) based on a news event and as a bonus we expect it to do well if NVDA surprises with “AI guidance” up without nearly the same downside risk if it disappoints. Longs are risky in our view right now keep a close eye if you enter, we will be.

Bullish this week if:

ORCL Net Options Sentiment > 60

ORCL Net Social Sentiment > 60

QQQ Net Options Sentiment > 30

Bull Potential - SQ (Block, Inc.)

We have been looking for signs of a bottom on SQ and/or PYPL and this Net Options Sentiment recovery combined with a good day 8/18 and extremely high Net Social Sentiment has us optimistic it could open hot and have a good week even in an ongoing Bear market.

Bullish this week if:

SQ Net Options Sentiment > 60

SQ Net Social Sentiment > 60

QQQ Net Options Sentiment > 30

Keeps - Staying as a pick but unchanged guidance

Bear review - XRX (Xerox Holdings Corp) from 8/13 letter and Bullish this week if:

Bearish this week if:

XRX Net Options Sentiment < 50

XRX Net Social Sentiment < 60

QQQ Net Options Sentiment < 35

XRX returned -1.88% this week vs -2.05% for SPY. XRX still looks like a great Bear pick in all the signals, especially seeing it atop the Bear watchlist.

Drops - 5 wins!

SCL is dropped as a Bear due to Net Options Sentiment climbing above our guidance levels > 50. Covered 8/13-8/18 and finished -4.99% and a Win, Beating the SPY benchmark by 2.93%.

NNI is dropped as a Bear due to Net Options Sentiment climbing above our guidance levels > 50. Covered 8/13-8/18 and finished -2.87% and a Win, Beating the SPY benchmark by .82%.

FORM is dropped as a Bear due to higher lows on Net Options Sentiment looking like the stock has perhaps bottomed out. Covered 8/13-8/18 and finished -4.69% and a Win, Beating the SPY benchmark by 2.64%.

BKNG is dropped as a Bull mostly because of high standards for Bulls in this environment not taking anything with < 170 Net Options + Net Social Sentiment. Covered 8/6-8/18 and finished and finished -.15% and a Win, Beating the SPY benchmark by 2.15%.

ELF is dropped as a Bull regrettably it is getting attacked by shorts and is up to 78 in Short Pressure, we think it could shoot up or keep getting shorted heavily and as a result presents too much risk to hold. Covered 7/2-8/18 and finished and finished 3.34% and a Win, Beating the SPY benchmark by 4.86%.

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.