In centuries past, before the invention of GPS and other electronic navigational systems, all sailors had to guide their path were the stars and a good compass. But what happened when a storm hit and you couldn't see the stars? You headed in the right direction and prayed to God you saw a lighthouse. You've probably seen pictures. Lighthouses are huge cylindrical buildings with a massive light that shines at the top of it. Even in the middle of a storm, their light can be seen from miles away. I recently read a story about a U.S. Navy vessel from the 1800's that had gotten lost during a storm. The captain described the utter relief he felt when he first saw that light shining in the darkness. The relief was replaced by confidence as he steered the ship toward the light, because he knew the light meant safe harbor. For centuries, literature has described that moment as a "Beacon of Hope". It's a phrase that's become metaphorical for anything that gives us courage and hope despite whatever storm we might find ourselves in. I chose to talk about this metaphor, because Prospero's Net Options Sentiment has been that beacon of hope for us over the last couple of months during the storm of this crazy, up and down, volatile market! For those of you who are new to Prospero, one of the greatest tools we offer to retail investors (for free) is our "Net Options Sentiment". It's called "NET Options" because it looks at short term Institutional/Hedge Fund Call and Put Options in real-time. Buying a "call" is betting that a stock will go up. Buying a "put" is betting the stock will go down. "Net Options Sentiment" takes all the Positive (Call) Options for a stock and subtracts the Negative (Put) Options and gives you a score that's measured between 0 to 100. Zero being the lowest. One hundred being the highest score. As an overall rule, a Net Options Score above +80 is bullish (each stock's net option is relative to its market cap. Small Cap Stocks will have lower overall Net Options score. QQQ and SPY (ETF) Net Options are actually Bullish at +40). I'm an active trader/investor and I personally use Net Options Score every day the market is open. I've been stunned at how accurate QQQ and SPY Net Options Sentiment are at predicting the overall direction of the market. It's one of the primary tools that our CEO George Kailas uses to determine his risk level for a given day or week. Is he half long, half short the market? Is he overall defensive in this buys and sells of stocks? Is he all-in long and heavy on Tech? All those decisions are highly influenced by Net Options Sentiment. Let me give you one recent example of how Net Options Sentiment has been a "Beacon of Hope" during the storm of this crazy market. The example I'll use is COIN. That's the stock ticker for Coinbase Global Inc. COIN engages in technology and financial infrastructure for Crypto Markets. If you're reading this before the market opens on Tuesday, pull out your Prospero App and hit the "Search" button at the bottom of the home page. Now find the "Net Options Sentiment" tab under "Browse by Signals". When you do, it's going to list the stocks with the top (most bullish) Net Options Signals. What do you see after you hit the tab? COIN. And what's fascinating is that COIN's Net Options has remained at or near 100 since 10/23. (Think about the election timing there) And even that week it only went as low as the 80’s consistently. Even when the stock declined almost 20%, their Net Options Score remained near or at 100. Even when most talking heads on TV and X were saying the Bitcoin run was over; COIN stayed at 100. What was that "beacon of hope" telling us? It was telling us that even though Bitcoin was declining Institutions were betting and betting strongly that it was going to have a reversal. Sure enough, about a week and a half ago, COIN began to reverse to the upside. Even though the Fear and Greed Index had fallen to Extreme Fear; the market was declining and it looked like we might be at the end of this Bull run, our signals were telling a different story. As of last Friday and over this weekend we've seen Bitcoin retrace back up, close to all time highs. Now, is Net Options Sentiment the ONLY thing to look at? NO. Last week VST was showing strong Net Options Sentiment and there was a fire in one of their manufacturing facilities that caused the stock to drop. Unfortunately, our Net Options Signals can't predict catastrophes (or Presidents dropping meme coins causing calamity in the crypto markets). But it can help you navigate them, for example we hedge the LA fires well by shorting EIX. (Con Edison) But regardless, there aren't too many days that go by that I'm not thankful for the confidence Prospero Signals give me in this turbulent market. After Trump's inauguration, watching what SPY and QQQ Net Options will be crucial to see whether we'll see more upside or a stronger correction might begin. Now a word from our CEO.

A WORD FROM OUR CEO

We noticed that because of the sale we ran last year that some people’s yearly discounts expired this week. So we decided to run one more 33% off for our investing letter and trading letter.

It has been an absolutely crazy start to the year but we have been highly active to mange the twists and turns and are doing it well. We are currently beating the S&P 500 by 138% annualized with a win reag of 72%!

To help newer readers get up to speed linking our short intro + learning videos.

Because of the holliday streams are tomorrow Tuesday 1/21 at 11 AM ET and Thursday 1/23 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

A BEACON OF HOPE

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Last week was an outlier for Small Cap value although as mentioned in Wednesday’s piece these stocks could see the most asymmetric upside after Inauguration. These stocks usually don’t appear in our screeners but I would still keep an eye out if you have any favorites that you’ve been looking at, as de-regulation has the biggest effect on smaller enterprises. Aside from, growth stocks still have had the best run in the last 3 months so that’s where we’ll be focusing our strengths on, unless we see a significant sector rotation to value stocks in the market.

SPY/QQQ NET OPTIONS SENTIMENT

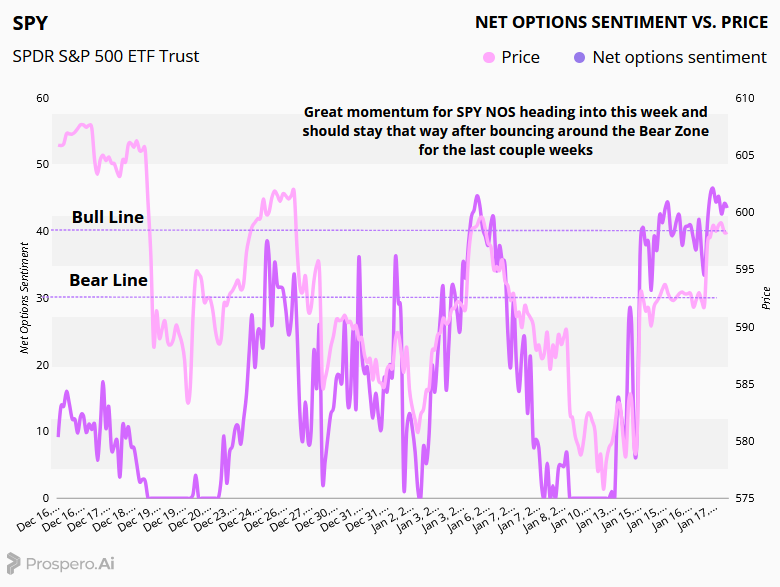

After starting the week at near-zero levels, SPY NOS surged past the Bull Line for the first time since early this month, signaling renewed optimism in the equity market. Although we remain cautious due to ongoing market volatility, we are adopting a more bullish stance in our portfolio by shifting focus to sectors beyond tech to capture additional upside potential. However, we remain vigilant as market sentiment can swiftly change.

QQQ is still relaying the same bullish tale it did last week, signaling a promising earnings season for both tech and the broader market. Institutional investors likely anticipate strong performance. However, even in this bullish phase, conditions can shift quickly. A few earnings disappointments, tariff disputes, or unforeseen events could result in subpar outcomes. We'll be closely monitoring the situation and are ready to quickly adjust our positioning if the market takes a downturn.

SECTOR ANALYSIS

Look at the Sector Analysis table above. We see that the Materials, Financials, and Energy sectors experienced a stellar week. This outperformance was driven by multiple positive earnings surprises, the announcement of stock buyback programs, and rising commodity prices attributed to higher-than-anticipated demand coupled with constrained supply. In particular, the Materials sector stands to benefit significantly, as trade wars can fragment global supply chains and temporarily boost prices for domestically produced goods. However, beyond tactical trades, it remains prudent to focus on stocks with secular tailwinds in sectors like Consumer Discretionary, Technology, and Communications to minimize exposure to significant market volatility.

PORTFOLIO STRATEGY

As SPY and QQQ Net Options Sentiment transitioned from bearish to bullish mid-week, we adjusted our approach to align with the prevailing sentiment, while continuing to emphasize downside protection through sector diversification. On the long side, we will maintain our positions in winning investments and add diversifiers to safeguard against potential losses. On the short side, we will remain defensive by focusing on larger cap names with strong signals. 9 longs, 6 shorts.

Long / Bull Moves

Long / Bull Moves - TRGP, MELI, ONTO, GEO, TGLS adds/ META, APP and COIN holds/ SNOW, ORLY and SE drops

Adds

TRGP is about as high as you see an Energy stock in the Bull Screener. ONTO was added for its smaller market cap, good Momentum and great Tech Flow. Lastly, MELI was added for sector diversification with decent signals across the board. GEO and TGLS was for sector diversification as well as great Screener marks for Smaller Cap.

Holds

META remained at the top of our screener and was a no brainer with excellent Upside Breakout and Net Options Sentiment. We kept COIN as the last Trump pick with great Net Options Sentiment, Upside Breakout and improved Tech Flow over last week. APP was kept for its great Net Options Sentiment and Upside Breakout.

Drops

SNOW was dropped as we liked other Technology names this week. ORLY and SE were dropped because they performed poorly in our screener.

Short / Bear Moves

Short / Bear Moves - FL, FYBR, INFY, TXN, NVS and AMH adds/ XRX, POST, NXST and DELL drops

Adds

FL was an easy pick as it was at the top of our screener this week with solid metrics all around for a short. FYBR was added for its larger market cap with extremely favorable Net Options Sentiment. INFY was a great addition because of its larger market cap and low Tech Flow. TXN and NVS were the best ranked Large Cap hedges to an overall Bullish portfolio. Lastly we added AMH for similar market cap reasons with its decent Net Options Sentiment for a short.

Drops

XRX, POST, NEST and DELL were all dropped as they didn’t perform well in our screener.

Portfolio Summary

Long / Bull Moves - TRGP, MELI, ONTO, GEO, TGLS adds/ META, APP and COIN holds/ SNOW, ORLY and SE drops

Short / Bear Moves - FL, FYBR, INFY, TXN, NVS and AMH adds/ XRX, POST, NXST and DELL drops

9 Longs: META, APP, TRGP GEO, TGLS, ONTO, MELI and 2XCOIN

6 Shorts: FL, FYBR, INFY, TXN, NVS and AMH

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.