Welcome to the 31st edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack. We are sharing more content like this TSLA graph on our Twitter, which could help time the market mid-week.

Working with a new design team to make our signals easier to learn. One of the leaders was a creative director at Apple for 7 years, linking more on them/1st cut designs. They are looking to learn more about our users. Fill out this <30 second intake survey and if selected to talk, you will get 3 months free of our paid newsletter.

If you do not yet have the app:

Newer to investing? Confused by any terms? Click our glossary help file.

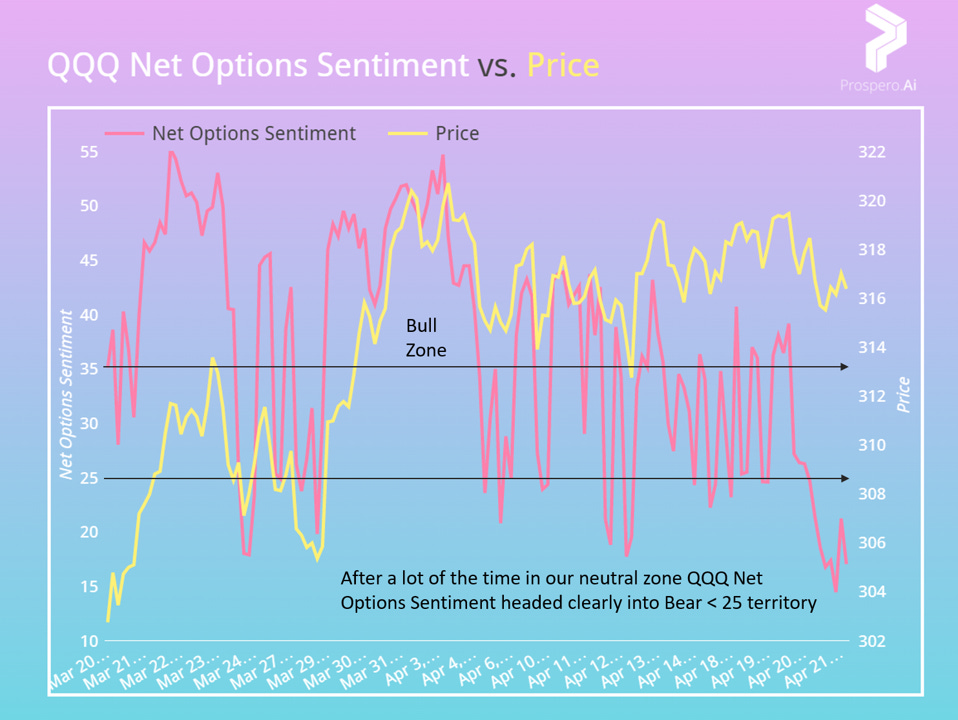

After indecisive signaling the last few weeks QQQ and SPY Net Options Sentiment are both moving in a clearly Bearish direction

From 4/16 letter: For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned -.78% this week vs. -.23% for the SPY. Pre-Market 4/17 to After-Market 4/21. A slightly Bearish week is in line with the graphs below. It was not until the end of the week we saw decisively Bearish movement.

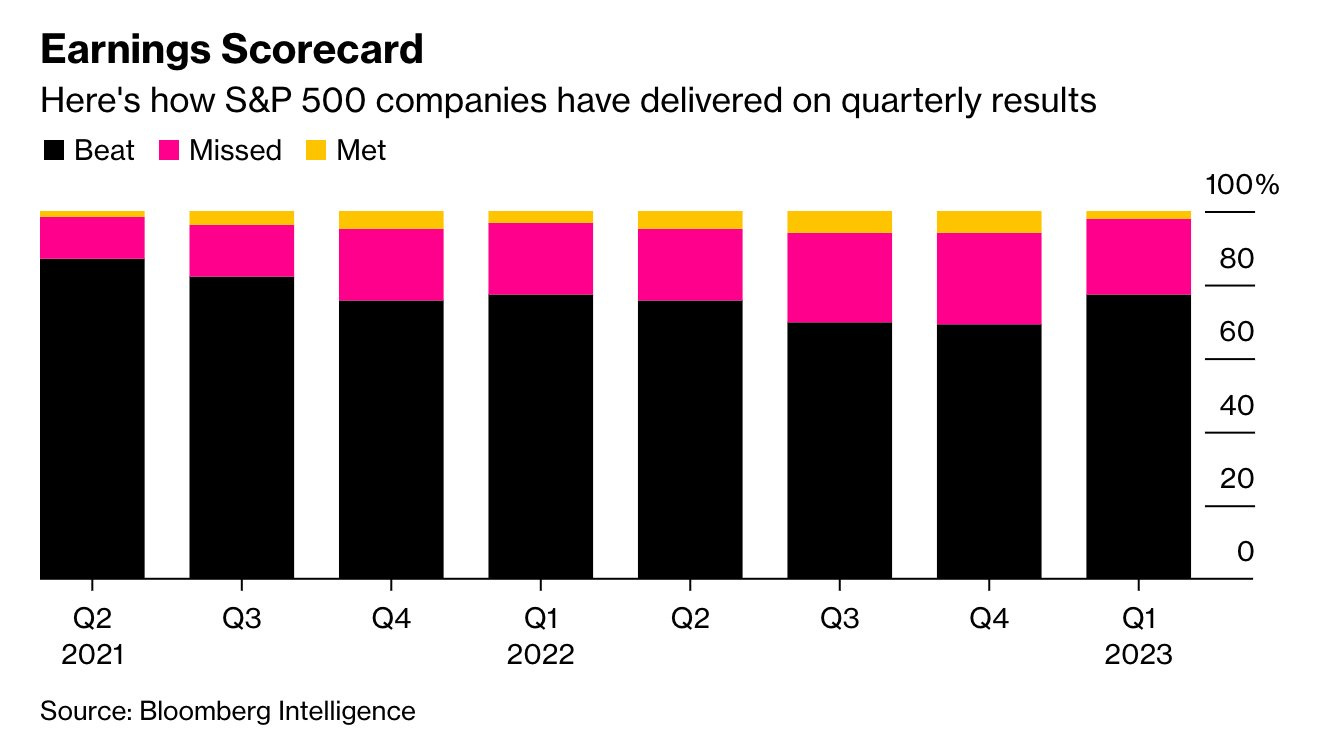

Sometimes it is important to take a step back from price. It might sound obvious but what moves stock and market prices on longer time horizons is Earnings Per Share (EPS).

Raw earnings aside, nothing moves price faster than a number missing expectations, especially EPS. This positive April we’ve seen is easy to attribute to higher beat % per graph above, even as Bloomberg survey shows 65% recession odds, up from 60% the prior month. This drives important forecasting issue: As especially tech companies cut costs, will those measures do enough to protect profits / stock prices as economic difficulties further drive spending down?

Poor trends in QQQ and SPY Net Options Sentiment form our short term Bearish view. But, given the above data, it is certainly possible that even with a recession, the market bottom is behind us due to the earnings impact of cost cutting measures. Our guidance for this week reflects a more Bearish view.

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

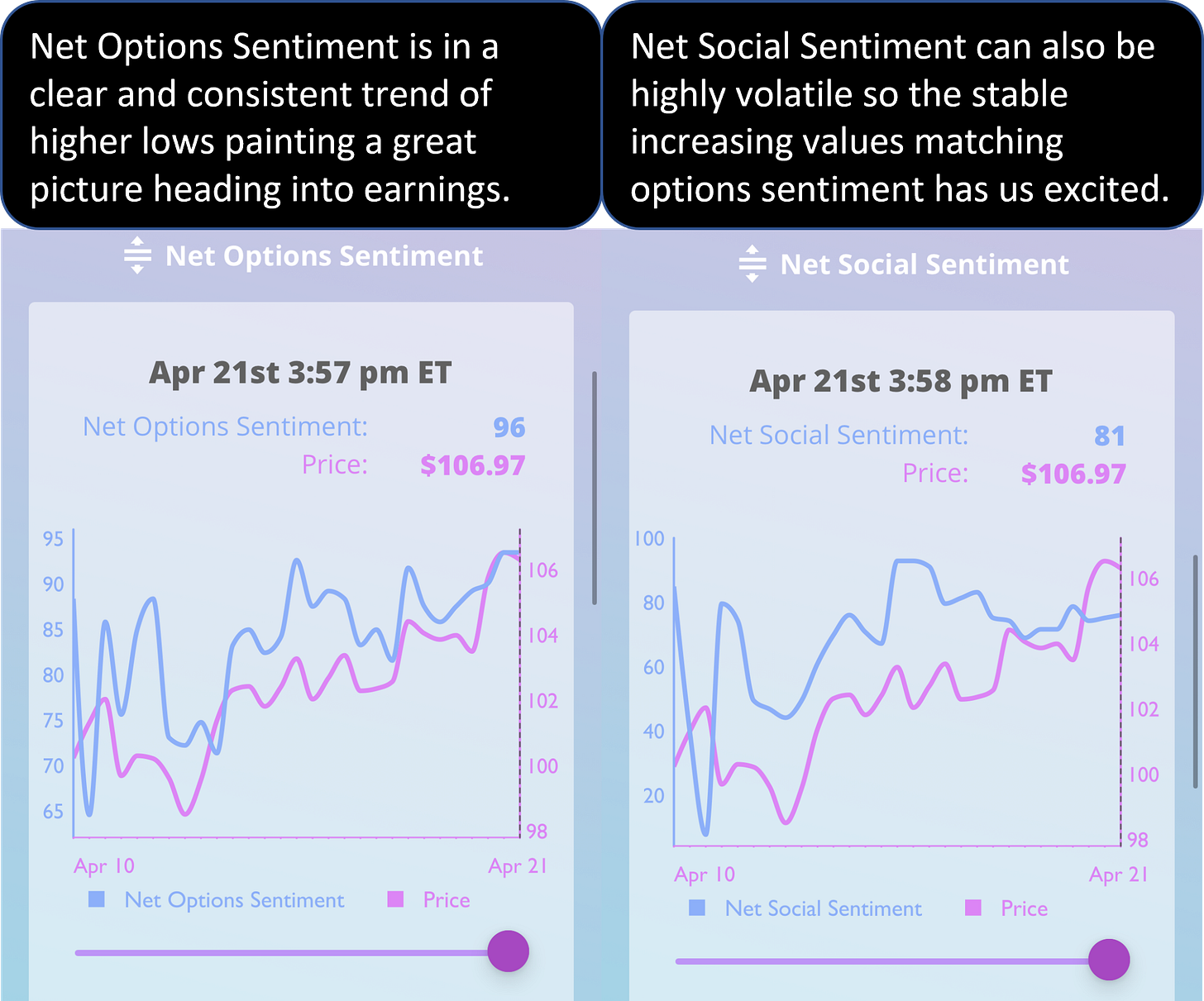

Bull Potential - AMZN (Amazon.com, Inc.)

AMZN is up 3.63% since we put it as one of our Bull picks in our paid newsletter pre-market 04/17.

Net Options Sentiment and Net Social Sentiment are both trending in the right direction heading into earnings 04/27. Earnings plays are risky and AMZN price could go in the wrong direction but we are banking on the above indicating a report the market likes. However, keep an eye on these trends as the 27th approaches for indications of a pre-earnings run only. For those that haven’t seen, our long term Bull case.

Bullish if: AMZN Net Options Sentiment > 70, AMZN Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

Bear Review - PRK (Park National Corporation)

From 4/16 letter: Bearish if: PRK Net Options Sentiment < 50, PRK Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

PRK returned .05% this week vs. -.23% for the SPY. Pre-Market 4/17 to After-Market 4/21. With both positive and negative headlines (below) PRK moving similarly to the market makes sense.

We were considering removing PRK as a Bear due to an RSI alert “A stock is considered to be oversold if the RSI reading falls below 30. In the case of PRK, the RSI reading has hit 29.8” Our signals exist because we found other offerings, including technical analysis (TA) to fall short. However, you cannot ignore TA because many algorithms trade in line with those signals. We keep PRK at least least 1 more week as PRK Q1 Earnings and Revenues Miss Estimates.

Still Bearish if: PRK Net Options Sentiment < 50, PRK Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

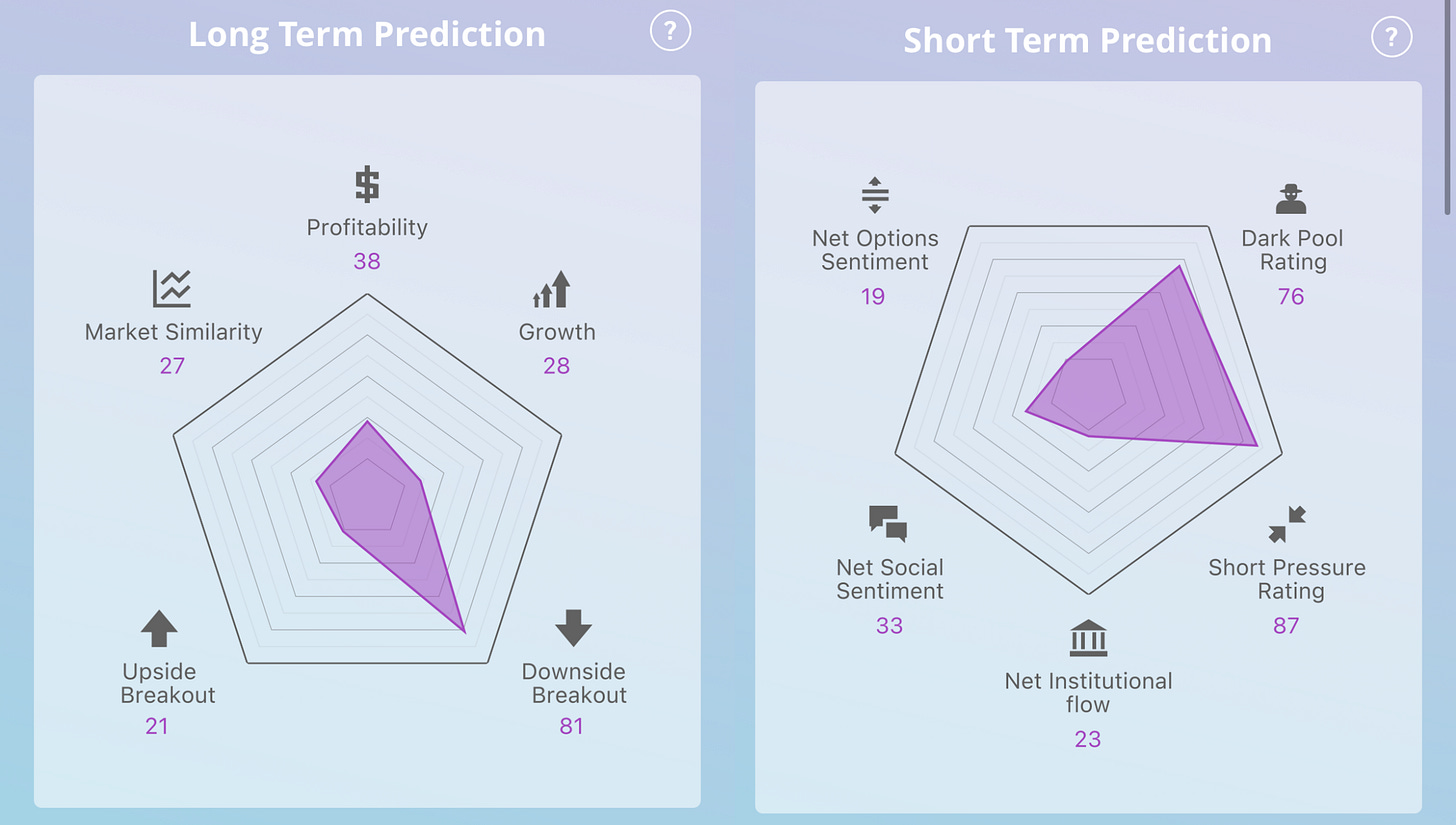

Bear Potential - HUSA (Houston American Energy Corporation)

With this letter’s focus on earnings we look for a new Bear from an earnings focused filter: Profitability + Growth emphasizes returns, paired with Upside Breakout (long term options bets) and Net Options Sentiment (short term) these stocks could be hurt as earnings data comes in.

While we typically like to avoid Bear picks with such high Short Pressure Rating (due to Short Squeeze risk) the especially low Profitability and Growth as well as poor ratings in everything else, make this a good Bear.

Bearish if: HUSA Net Options Sentiment < 50, HUSA Net Social Sentiment < 60 and SPY Net Options Sentiment < 10

Bull Potential - NOW (ServiceNow Inc)

With this letter’s focus on earnings we look for a new Bull from an earnings focused filter: Profitability + Growth emphasizes returns, paired with Upside Breakout (long term options bets) and Net Options Sentiment (short term) these stocks could be winners as earnings data comes in.

Profitability + Growth is excellent (22nd out of 2K+ stocks) and Net Options Sentiment has seen Bullish higher lows the last week. But we like NOW better than most in a Bearish turn. ServiceNow (NOW) is Poised to Beat Earnings Estimates Again. A few important quotes give us comfort in a potentially tough week:

“average surprise for the past two quarters of 9.69%.” and “Earnings ESP of +4.34%, which suggests that analysts have recently become bullish on the company's earnings prospects”

Will watch the stock market to see how the earnings and tech companies cutting costs go.

One of the criterias for NOW to be bullish = QQQ Net Options Sentiment > 30.

However QQQ Net Options Sentiment is below 25 now.

So NOW does not fit the bullish criteria.

So what's the point of adding NOW as a potential bull into the newsletter then?

Just trying to learn how to read your newsletter.