Prospero continues to have superior performance for the year. We are currently beating the S&P 500 by 205% with a win rate of 69% against that benchmark.

For newer readers linking our short intro + learning videos.

We have another special edition modeled after one of my favorite Beatles songs. A Day in the Life. Going to give you an insight into how I think about portfolio moves on one of my busiest days ever 3/19!

Normal Mid-week letter to follow:

Market Analysis

Sector Analysis

Favorite Screener

A Day in the Life - 3/19/24

8:01 AM drinks tea and glances at phone. Damn market is moving and not in my expected direction… Better gear up to make some moves!

9:14 AM Monday: I’m a little concerned about my tech exposure (Adds XRX and PRGS as shorts they were locked and loaded for this occasion if I wanted to hedge Tech)

9:17 AM: Actually I might be too long in general. ***pulls out Prospero app and finds GL and EURN (due to 2X energy exposure) in Bear picks*** short them too!

9:25 AM: I’m thinking this Bear move might be because of Macro concerns, what else would get hammered with a bad interest rate report? Biotech! (Because these companies tend to be even more reliant on growth than tech and growth is the first thing people go after) Checks my go to Biotech Bears. MIST is a no, Net Options Sentiment on the upswing and 44. PTCT next, I like what I see! Lower Net Options sentiment (35) and always good to get into a profitability (12) + growth (10) if the market goes bearish.

9:29 AM: Waiting until the last moment to make a decision on SMCI, down 11% pre-market, could get worse, shorts are hammering after S&P 500. I’ll see you later (added back this morning lol) but for now we must part ways. Do not want to see what those shorts do to you at open.

10:05 AM: I’m about as much short as long but not enough, this could get uglier today maybe people are worried about what Powell is going to say tomorrow… Add KW, 100 Downside, and Real Estate could get hit with worries about less rates cuts this year.

10:19 AM: Not enough Consumer Discretionary to protect my downside. MED, a frequent Bear of mine is a comfortable add, declining Net Options sentiment under 50 now after closing yesterday at 69.

11:26: More consumer discretionary ESCA Net Options Sentiment closed yesterday at 50 and now at 30.

***All of these shorts were added because I was not ready to get rid of my risky longs like NVDA or SNPS due to their ability to move up quickly if this worry turned around***

…

5:26 PM: After taking off my CIO hat and spending some much needed CEO time, back at it. I think SBGI has run it’s course up 20% on that short ready to close. Better close META too because I’m holding GOOGL as my higher risk communications pick (I say on my livestreams a lot but people come for ad heavy communications businesses after consumer spending worries mount because ads will get cut. Many times in automated ways now, if spending decreases revenue per click is going down and the ROI on those investments are reduced. Which in turn results in dollars moving elsewhere or just defensive positioning for profitability.

5:31 PM: ***Looks at short vs. long positions and rising after-market prices, especially in Tech*** Hey, maybe this was just a little correction and people are actually Bullish about Powell’s speech tomorrow. Am I sure about this given the morning? No. But I don’t want to be 8 long and 12 short anymore, need to get closer to neutral.

5:48 PM: ***Looks at short vs. long positions and rising after-market prices, especially in Tech*** Hey, maybe this was just a little correction and people are actually Bullish about Powell’s speech tomorrow. Am I sure about this given the morning? No. But I don’t want to be 8 long and 12 short anymore, need to get closer to neutral. I ask myself what would do the best in a Bullish interest rate environment that has good Prospero signals? I know, Coinbase! Really has made big moves up in Upside rating the last few weeks (below 80 into the 90’s) and I always like to do a sanity check. Does this make sense. Of course, with all the good ETF news lately, why wouldn’t institutions bet more on this company?! And unlike pure coins it has a real business that survived when it’s competitors were dropping like flies.

Market Analysis

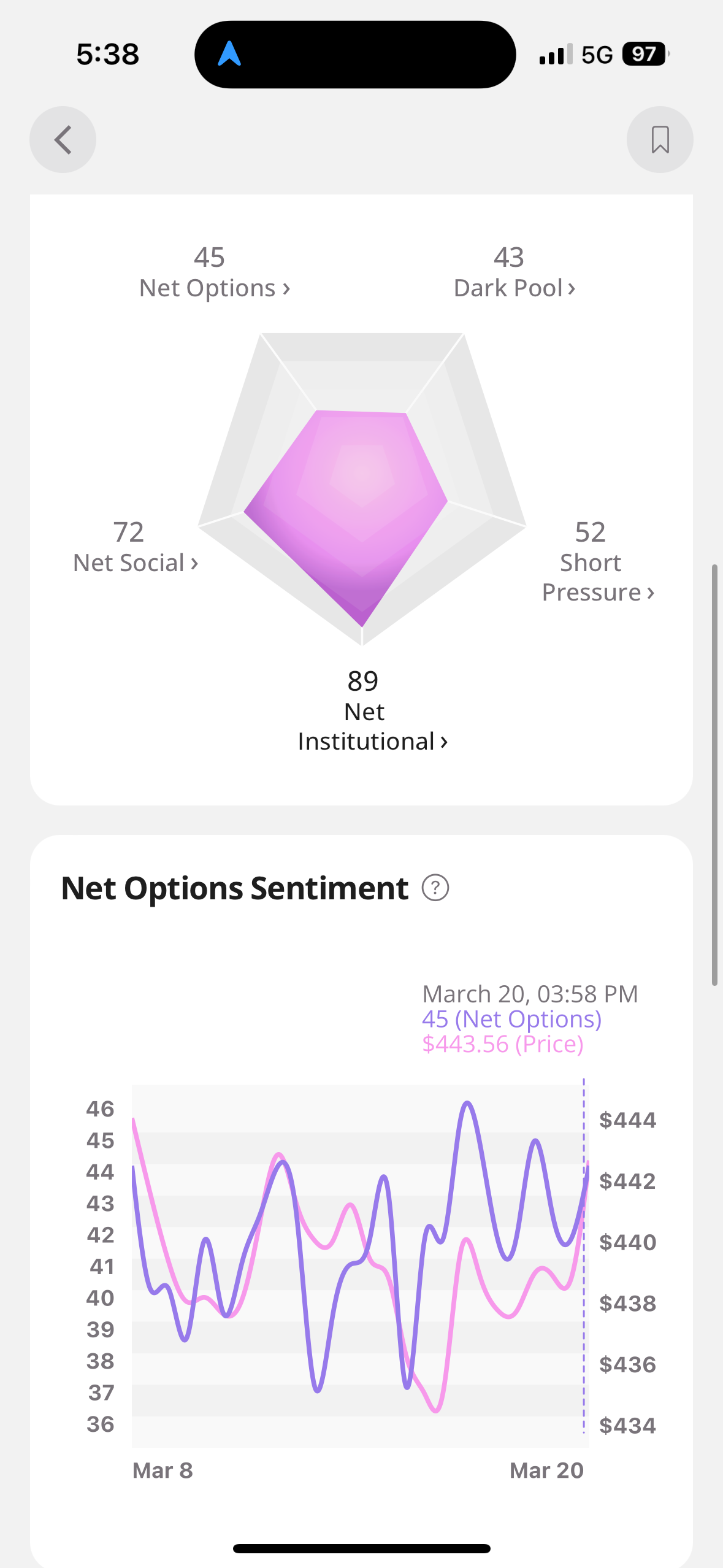

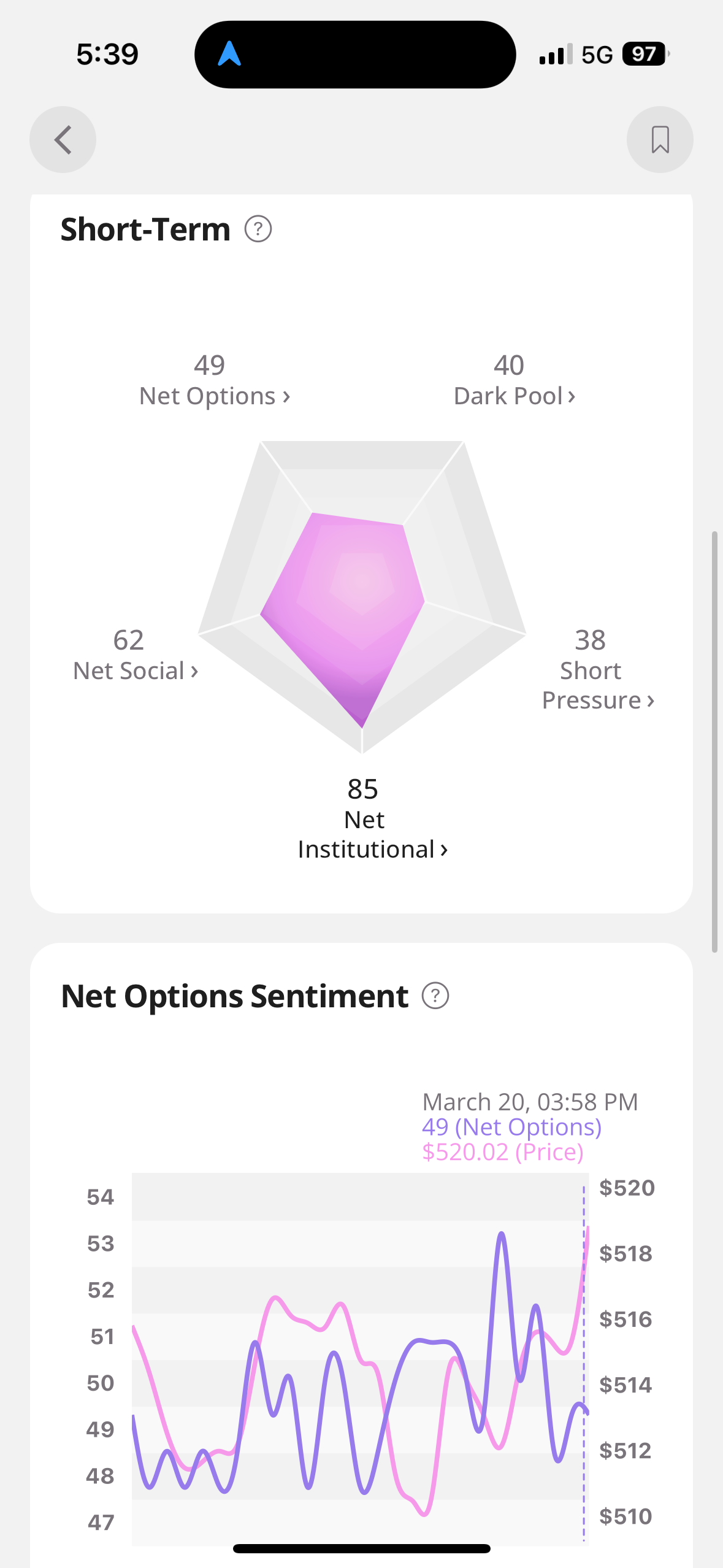

QQQ Net Options Sentiment looking to be breaking out of its negative pattern with higher lows!

SPY Net Options Sentiment not as Bullish of an upswing, but it has stayed Bullish for a LONG time now. One of the reasons I am Bullish for the full year now, the major consistent strength of this number is a major reason why

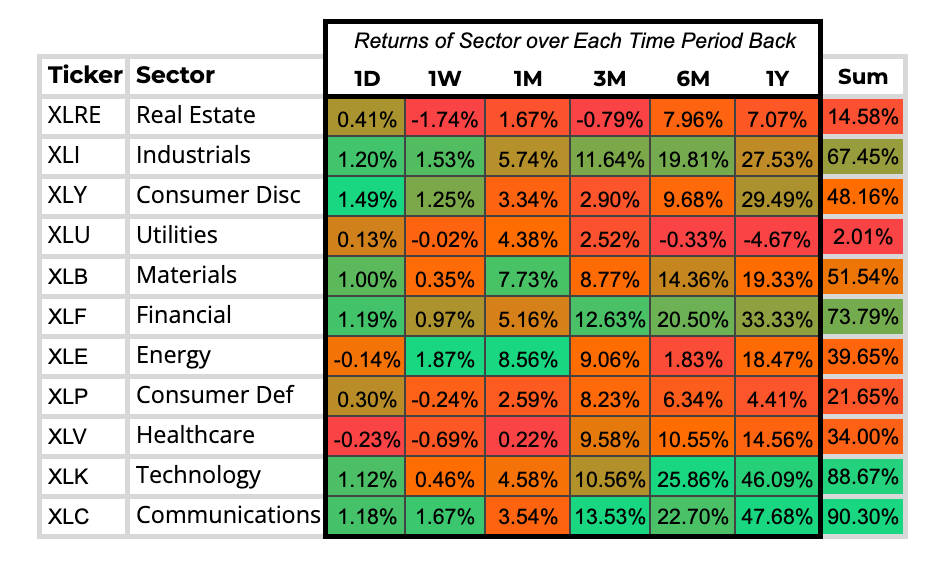

Sector Analysis

Some quick hits:

Big takeaway here is that Energy might be losing some steam especially seeing a lot of other green. Likely means we get out of one of our two Energy plays TRGP / FANG after I see the first Net Options Sentiment reading today. (Energy, XLE only Sector down Pre-market)

Might be time to get out of LLY for a short time too as Healthcare is looking bad.

We will talk more about below, probably time to load up more on Tech due to accelerating strength.

Perhaps also get out of my HSBC short (will watch this at open) Financials looks to be gaining steam too.

Time to get back into SMCI with Short Pressure falling to reasonable levels…

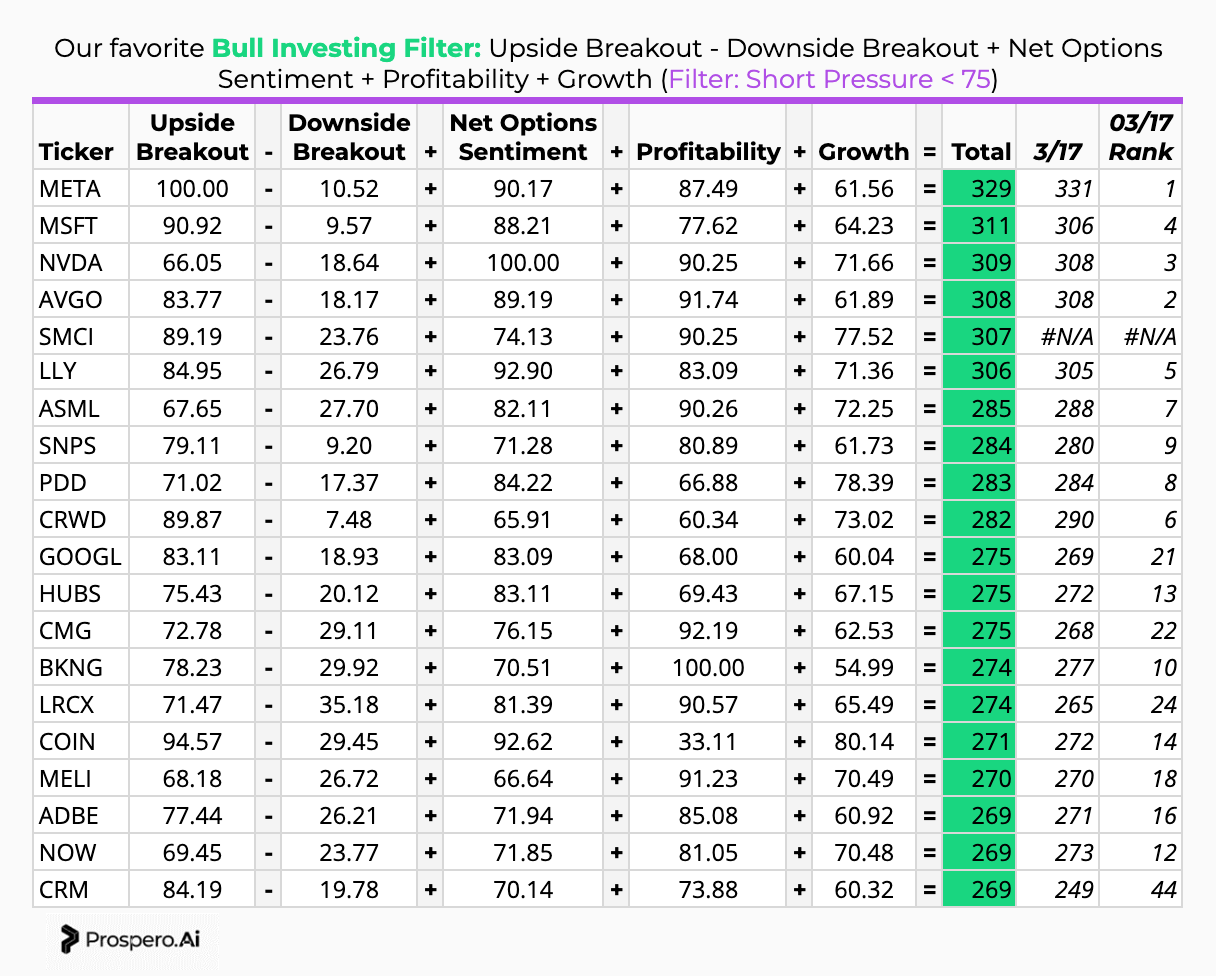

Hard to ignore ALL those chips at the top. 7/8 of the top stocks are Chips and AI. I know I never say this but might be time to increase tech exposure this morning. For the safest pick go MSFT. For a the biggest risk/reward SNPS.

Market Risk Update: QQQ: 5.5 (out of 10) SPY: 5.5 (out of 10). The lower the rating the more downside risk.

If you’re 100% long in this market, we would suggest 5% of your portfolio be in SQQQ to hedge downside risk.

Great song, awesome description of your play-by-play

Thanks for sharing