All filled up on chips?

3/10/24 Prospero.Ai Investing (104th) Edition (Weekend)

Happy Sunday! Prospero continues to have superior performance for the year. We are currently beating the S&P 500 by 308% with a win rate of 73% against that benchmark.

For newer readers linking our short intro + learning videos. If you have questions the best place to ask is in our discord.

Demand for chips can reach a fever pitch. Whether it be at your Super Bowl party or of the AI / stock variety. Now, is the market bloated and ready to go home because their team is losing or is it hungry for more chips? We collaborated on a video to simplify this main story.

To expound in a different way, let me ask a straightforward question. Are we at the top for the AI market, as some are saying? Here at Prospero, we don’t think so. But what is the right valuation is an important question people too often ignore. When you look at it from that perspective, is AI in a bubble? Hell no! In my 20+ years of analyzing stocks, starting as a professional buy side value investor and now working in AI, I’ve never seen anything remotely like this environment. The status quo for public companies, is they’re are afraid to spend on unproven revenue streams because of headline risk. Now, every public company is literally allocating money to AI in many cases without knowing what they will build. That is because the headline risk is NOT investing in AI. Companies are validly afraid they will fall behind if they don’t spend and their competitors find value in AI they don’t. There are very real and massive chip orders resulting from this unprecedented unabashed spending. Never forget: fear moves the markets up and down!

For those wondering about what our paid letters look like during the week (in addition to getting live entries and exits) we are linking our 3/8/24 letter we also introduce one of the 3 people now helping us write! Running a 25% discount on monthly subscriptions (normally we do only yearly for discounts) for those that want to try it! Even if you don’t trade very often the paid upgrade to this letter gets more looks at our approach which can help any strategy irrespective of if all our moves make sense for you.

Regular livestream times this week! Tomorrow 3/11 at 11 AM EST and Wednesday 3/13 at 3 PM EST. Simulcast from our X/Twitter page. Also you can listen / watch after we air because we are now on Spotify!

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

ALL FILLED UP ON CHIPS? Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Last week’s Net Options Sentiment levels from the 3/3 letter:

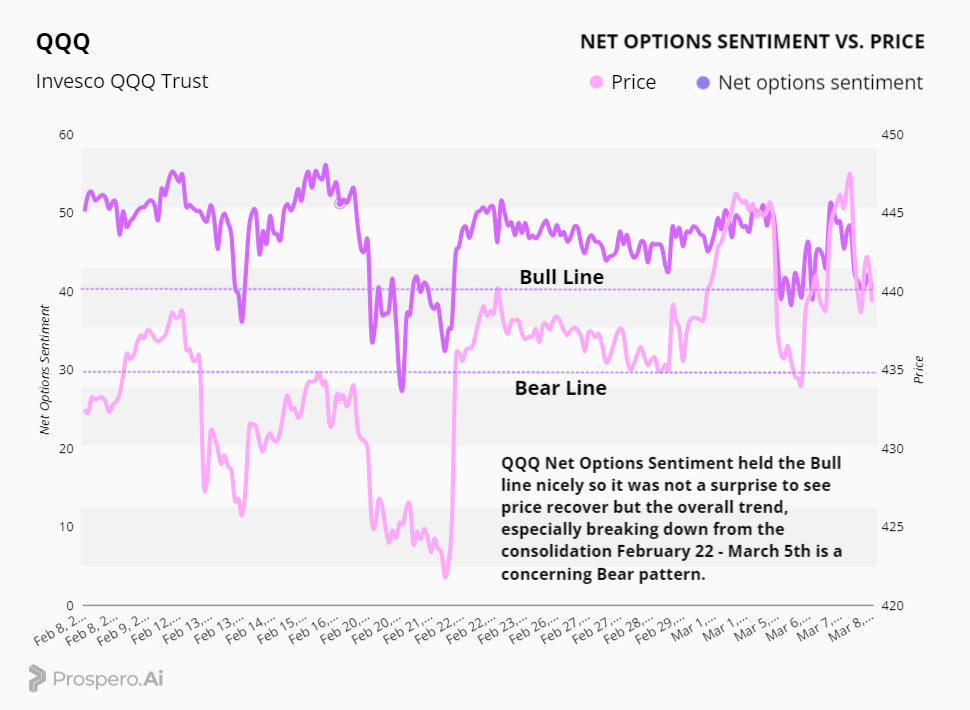

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

QQQ returned -1.48% this week vs - .22% for SPY.

Market Update:

One of the remarkable aspects of Prospero’s analysis is its “Net Social Sentiment”. Prospero regularly ingests data from social media sites like Reddit, Facebook and X to understand overall market sentiment, as well as how consumers and investors might be viewing a company. When you look at QQQ and SPY’s Net Social Sentiment on the Prospero app, you see a 69 and 71, respectively. We typically consider a Net Social Sentiment of 80 or above as a “highly positive” rating. So a QQQ Net Social Sentiment of 69 means folks are positive, but not highly positive. As I personally look at X, that’s exactly how I would describe what I’m seeing. Optimism, mixed with a healthy dose of caution. Why? The market made another set of highs this week. One would think that with all this success that people would be exuberant. But while people are excited, they are approaching the market with caution, and certainly aren’t at the euphoric stage. What’s keeping people from being “highly optimistic?” I believe the answer is found in the mixed messages that people are receiving from the overall macroeconomic picture. For example, while the market continues to rise, the 10 largest S&P 500 companies account for a whopping 33% of the total index. That’s the highest level of concentration in the last 40 years! Here’s another example, while tech stocks continue to drive market growth, @winfieldsmart reports that tech funds just experienced their largest outflow of money in HISTORY, to the tune of $4.4 Billion Dollars. On top of that, investment grade bonds saw a weekly inflow of $13.3 billion dollars. (For the newer investors more money in bonds means less for stocks)

Here’s one final one. The S&P 500 VIX did something it rarely does. We saw a divergence where the VIX was rising at the same time the market keeps going up. Let me explain. Because the VIX tracks the number of Put Options (Big Money betting the market will go down) in comparison to how many people are long on stocks…the VIX almost always moves in the opposite direction of the market. Market increasing…VIX goes down. Market goes down, VIX goes up. Well, last week, both the market and the VIX began to rise simultaneously. Hedge funds and institutions are starting to hedge by increasing put options. Somebody is getting a little antsy! Sounds pretty ominous right? But at the same time, Bloomberg reported last week that NVDA could announce a stock split as the stock approaches $1,000. In one sense we could be approaching a financial cliff, but at the same time, we could easily see a buying of Friday's dip and continue to break records. In light of these data points, we’re approaching the coming week with caution, and will continue to diversify our portfolio in case of a market pullback.

See the graph below. SPY Net Options Sentiment is holding up better than QQQ so no surprise that it did better this week. But it’s still in a slight downswing from its highs in Mid February. While we’re always be ready to quickly pivot back into the Technology Sector, should the uptrend continue, we’ll begin the week by diversifying into some safer sectors.

See the above graph. Our QQQ Net Options sentiment dipped dramatically during the early part of the week. It held the Bull line and had a nice recovery, only to see it begin to break down again by the end of the week. After a pullback on Friday, we finished the week with a QQQ Net Options Sentiment of 40, right back down at the base of the Bull line. We will be paying close attention to these movements at the beginning of the week.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30= Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Sector Analysis

Take a look at our Sector analysis chart. One thing that stands out like a sore thumb, is the month that Technology and Communications had. Definitely lower numbers than we’ve seen over the last year. This is a concerning trend that has us taking a long look at our portfolio’s balance that’s been so successful for several months. The good news is that Materials and Utilities continue to strengthen after a long period of weakness. Both of these are evidence that people are drifting towards sectors that are more defensive in nature. As a result, Gold hit an all time high last week and the price of copper is finally creeping upwards.

If you missed last week’s letter, we have started a new diversified portfolio that includes one of our favorite stock picks from each sector. This is a great way to diversify and minimize your risk in a potentially volatile market. Unfortunately it’s not free, so linking the 25% off sign up again:

Portfolio Strategy

This is a unique week because many stocks moved so much after-market that we wouldn’t feel right about exiting them at market close prices as we normally would. There was one instance where we actually took a bigger loss on ABNB because we were shorting it and it was announced that it would be added to the S&P 500 and used the after-market price for that. But generally, we use close prices because those are the most accurate “market” prices for a Sunday letter. That is actually why it says “latest date” on our investing picks vs. exit date on our model portfolio, that is shared with our trading letter. We exit the model portfolio picks with live prices, but since this letter gets written on Sunday (because it is so much work) we use the best Sunday prices we have, which most weeks is Friday close.

So hold onto your hats! Since we are holding so much tech risk (NVDA, SMCI) we doubled up on our tech shorts. (LPL, XRX) And we will go into Monday with our largest portfolio ever. 9 longs and 8 shorts + our REMX index long.

Long / Bull Adds - Link to Below Picture

BLK is a screaming add because it offers diversification for our tech heavy portfolio. It’s also the best looking stock in our Screener / Technicals combo.

Long / Bull Keeps

We’re doing all the keeps in one place today. Why? Because we’d probably have dropped a lot of these stocks if they didn’t move so much after-market. So, tomorrow morning, we will watch for live pre-market prices to determine if we want to exit on any of them.

Long / Bull Drops

ETN because screener performance is underwhelming. The oscillators say Sell and the Industrials Sector doesn’t seem exciting. Covered 2/11-3/8 and it finished +7.03% and a Win, Beating the SPY benchmark by 3.86%.

Short / Bear Adds - Link to Below Picture

No big mysteries here. We’re adding our highest ranked shorts, to balance out our heavy long portfolio that we’re holding because of after-market volatility.

Short / Bear Keeps

Similar story as above. There was so much after-market movement that we’re holding tight to the whole portfolio to be as fair/accurate as possible. The ones we dropped didn’t move as much, and in the case of OGE, it moved in our favor, but we will still use the close price, because that is our standard methodology.

Short / Bear Drops

FRHC is a drop due to poor Screener performance. Covered 3/3 - 3/8 and it finished -2.27% and a Win, Beating the SPY benchmark by 2.05%.

OGE is a drop because the Utilities Sector is on fire! Covered 3/3 - 3/8 and it finished 3.08% and a Loss, Losing to the SPY benchmark by 3.30%.

Portfolio Allocation

10 Longs: META, LLY, BLK, DASH, COST, TRGP, NEE, SMCI, NVDA, REMX (ETF)

8 Shorts: KW, SBGI, HSBC, LEG, LPL, XRX, GO, WISH

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.