There are two types of people currently reading this newsletter. First are the active traders and investors that on Sunday evening, are just now feeling somewhat normal after a ROLLER COASTER of a week last week. The other kind of person reading this newsletter is the more passive trader and investor that might have glanced at their portfolio on Saturday morning and wondered what in the heck happened over last week!! Either way, there's one word that describes last week: volatility. The market was schizophrenic. It had multiple personalities. At the beginning of the week it was mixed. Then on Wednesday we swung wildly to the upside. Then on Thursday and Friday, we saw some of the biggest market declines since the Covid crash of 2020. If you forced us to explain WHY the market is seeing such crazy volatility, we'd use another word. Uncertainty. You see, the market HATES uncertainty. Nobody likes to lose money, especially institutions whose livelihood depends on them making money; and they can move the market more than anyone. So in an uncertain world, the result is that you have an uncertain market. And uncertain markets can change directions on a dime.

From what we can tell, there are 4 primary factors causing market uncertainty.

#1 The Economy: For many months, good economic news was bad for the stock market. Let me explain. Since the first rate hikes in 2022, we've been patiently waiting for the Fed to give us a rate cut. To the point that any time GOOD economic news came out, the market would drop! Why would the market drop on good economic news? Because the market is forward looking, and since the FED was waiting for the economy to slow down before cutting interest rates, a good jobs report meant an interest rate cut would be delayed. So, good news was bad news for the market. But after this last Fed meeting, questions began to arise as to whether the FED has waited too long to cut interest rates, because the economy teeters on the edge of a recession. Because of that sentiment, now, good news isn't bad news…but now, bad news is bad news! Well, Last week we got some bad news. The US jobs report came out; and the number of jobs missed estimates badly to the down side. Then on Wednesday, something pretty ominous happened. Japan raised interest rates by 15 basis points. The result? Japanese stocks suffered their largest 2-day decline since the Fukushima Nuclear Disaster of 2011. Historically, Japanese interest rate hikes are a pretty accurate forward indicator of Global Recession. That spooked the market big time on Thursday and Friday.

#2 Politics: We've talked about this quite a bit. But while election years traditionally provide stability in the markets (because candidates promise the moon and everyone feels optimistic), this year seems to be different. People aren't optimistic, they're fearful. Both Republicans and Democrats are convinced that if the other side wins, life as we know it will cease to exist and we'll enter into a period of unrecoverable darkness. In a tight race, that creates a scenario where people are uncertain of what tomorrow will look like. Markets hate uncertainty.

#3 Big Money is Selling: Right before the historic bear market of '22, there were signs that the end of the Bull run was near. Jeff Bezos and other CEO & Billionaire types started selling stock like crazy. People ignored it because the market was in a state of euphoria. Because there were a lot of people that lost a lot of money in '22; when Jeff Bezos started selling Billions of Amazon stock last quarter, that caused even more uncertainty. People began to wonder out loud: "Are we on the precipice of another bear market or some major economic disaster?"

If that were not enough, it was revealed on Saturday that Warren Buffett sold 75 BILLION dollars worth of Apple! Why does that matter? Because to disclose the sale, Buffett filed a 13F with the SEC. That means that Buffett sold the stock last quarter. Apple is Buffett's favorite stock that he's held forever. When the most famous investor in the world (Buffett) is selling 75 Billion in Tech stocks, that does NOT bode well for a bullish market future.

A.I Chips vs A.I Products:

Something that has made us hang in long perhaps more than we should with bad QQQ Net Options Sentiment trending is that we expect this A.I. trend to continue to cause Chipss makers to produce excellent earnings. The only thing the market seemed to love lately is AMD earnings. We would be more Bullish on this if we did not see some remarks by Trump send Chips into a tailspin two weeks ago. We are betting this is not the last time something like that happens before the election which makes these stocks tough to play. But we are still more Bullish here due to our earnings expectations than the rest of the market.

Even if A.I. products are overhyped there are very real orders for Chips to R&D these products that have increased at a torrid pace. It cannot be understated just how special NVDA’s last 3 quarters are. You have to be able to seperate out people overhyping unproven products from the very real Chip orders that are driving a seemingly limitless apetite to develop them. There seeems to be a joke at Y-Combinator, the most famous startup accelerator that all the graduating companies are A.I. companies.

The A.I. chipmakers and other A.I. product producers like NVDA. Just the other day, famed investor James Anderson (early investor in Amazon and Nvidia) stated that if Chipmaker Nvidia keeps its dominance in that market, it's not outside of the realm of possibility for them to have a 50 Trillion Dollar valuation over the next decade. Yes, you read that right. 50 Trillion. I can't even comprehend that kind of money. If that's the case, we really are on the verge of the next Industrial Revolution and we could just be scratching the surface of the upside to come. The reality is likely someone in the middle. But until we know the answer, things will continue to be…..UNCERTAIN.

A WORD FROM OUR CEO

We are beating the S&P 500 by 56% annualized, with a win rate of 62% against SPY benchmarks. On a very difficult week we were able to keep our return vs SPY almost equal while managing to increase our win rate by 2%!

For newer readers linking our short intro + learning videos.

Normal streams this week! Monday 8/5 at 11 AM EST and Wednesday 8/7 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Bad News Bears

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

Last week’s Net Options Sentiment levels from the 7/28 letter: SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

We covered a great deal of this in the introduction, but despite the market uncertainty caused by numerous macro economic and global forces, there is still hope to be had for better days. For example, look at the QQQ weekly chart below (via @barchart):

Those circles represent a 4 week, consecutive decline for the QQQ. The Nasdaq has only posted a 4 consecutive week decline a couple of times since 2002. One of those was the last 4 weeks. Each time that's happened, it resulted in a strong upswing. Will that happen next week? We hope so.

One more glimmer of hope for you. Historically speaking, August has been Green for the month, 100% of the time on election years, since Ronald Reagan was finishing his last term. For this August to be different, it would have to be a massive historical outlier. The reality of all of this is that nobody knows the future. At Prospero, we're going to continue our defensive stance until a clear direction emerges.

CAP/VALUE ANALYSIS

The Cap Table is a perfect example of how uncertain things have become. Look at Small Cap Growth and Value for last week. A week ago, Small Cap Value was one of the two best performers for the month. Coming into last Monday, if you would have asked us (based on the data), what cap we were most certain of, we would have told you Small Caps. But oh, how things can change in 7 days! Small Cap Growth and Value were actually the WORST performing caps for the week. It could be the growing fears of recession. And it's entirely possible that big money is flushing out the little guy to buy at a lower price before the long awaited sector reversal, but it's impossible to tell. Again, we'll remain defensive until there is more certainty.

NET OPTIONS SENTIMENT

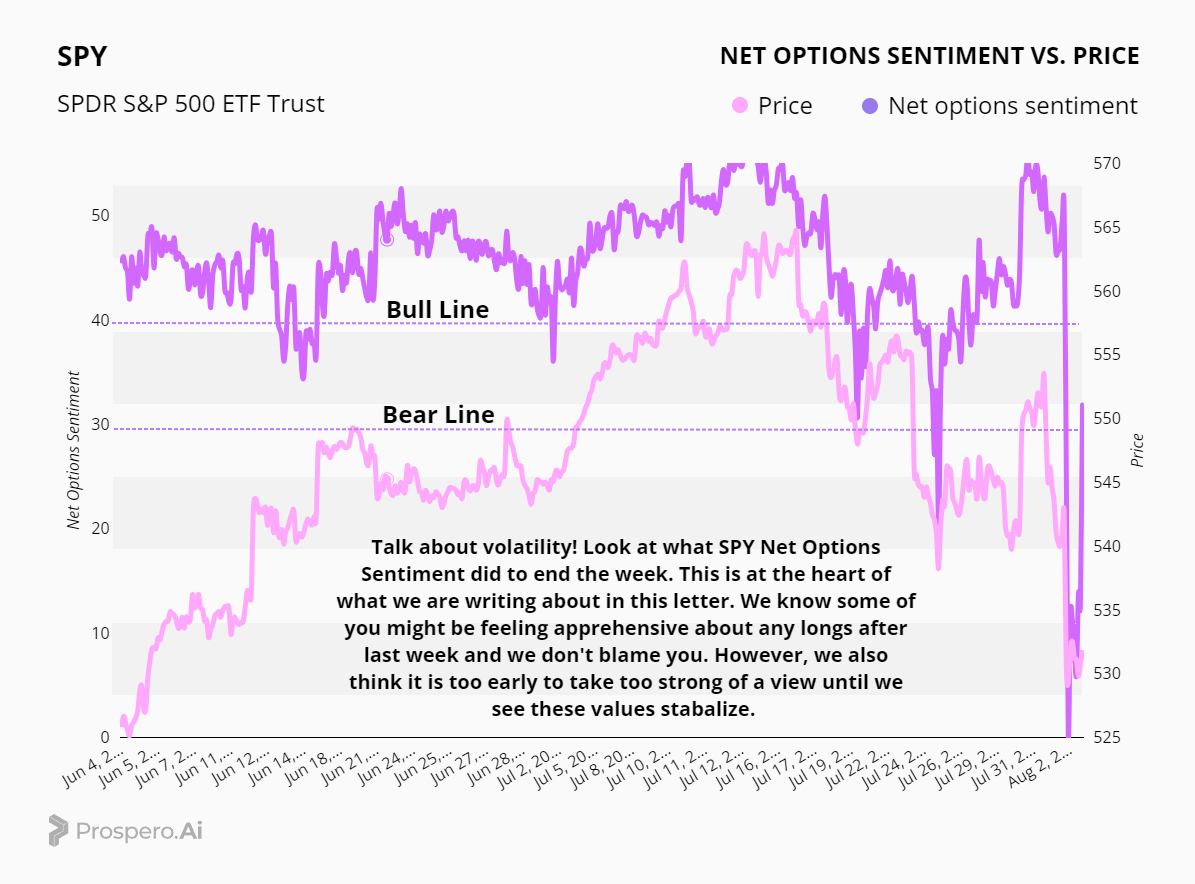

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

See the SPY Net Options Sentiment below. This is a physical picture of EXACTLY what we've been talking about in this letter, regarding volatility and uncertainty. Those are some wild swings in the course of just a few days! While we are LESS bearish about SPY than we are QQQ, it's still too early to be confident if the market has decided a direction.

Check out the QQQ Net Options Sentiment Chart below. As you can tell at the end of the week, just like with SPY NOS, things were swinging wildly up and down. Again, that's a great physical picture of the volatility we've been talking about. Within the course of a week and a half, we saw our QQQ numbers swing from a high in the 50's, all the way down to zero, back to the 50's…then back down to zero on Friday. The good news is that by the end of the day on Friday we saw some buying pressure and QQQ NOS started sneaking up into the 20's by market close. Are we confident that this is a bullish momentum change? No. QQQ is definitely leaning more bearish than bullish in regards to trends. But are we confident this is a long term bearish trend? No. The volatility has to settle down before we can be confident either way.

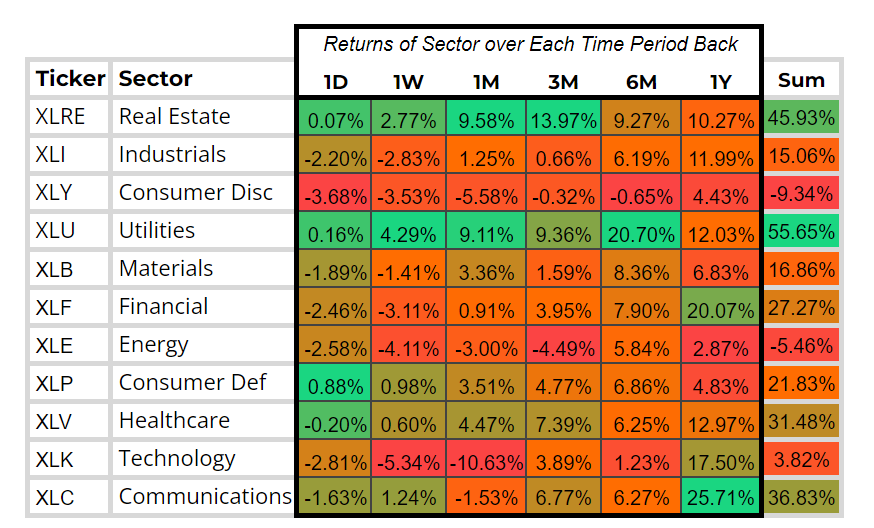

SECTOR ANALYSIS

Look at the sector analysis graph . Check out Tech for the month. It got obliterated! Hopefully we'll see some corrections in that sector next week. But the next major Tech earnings (NVDA) isn't until the end of August, so there could be more downside to come. In light of the Nasdaq chart we showed you above, we’re due for a bounce. Interestingly, Real Estate and Utilities continue to be the bright spots for the month. Bottom line, it's difficult to place any faith in a long term play at this point.

Seeing the acceleration of Consumer Discretionary downside on Friday makes us especially scared that we are seeing signs the the stock market is aknowleging a high chance of recession that hits/is driven by Consumer Spending. It is why we are leaning into some Consumer Discretionary shorts and will even drop our best Consumer Discrationary long below.

PORTFOLIO STRATEGY

Being Bearish right now is unavoidable. However, due to the QQQ price chart above as well as positive Net Options Sentiment moves for SMCI and even a few of our shorts like WOLF and ON to end Friday has us feeling like we want to target other areas on the Bear / short side. As we’ve been promising we really wanted to slim things down and simplify but we were waiting for what we felt was a better read on the market. 6 Longs and 9 Shorts this week.

Long / Bull Moves - Link to Below Picture

Long / Bull Moves - GWW and IRM add / META, UNH, SMCI, ASTS holds / AZO, SNPS, JLL, NEE, TSLA, AVGO, and AMSC drops

Adds

GWW is an add because it ranked high in the screener with strong technicals. IRM is an add this week because we are feeling Bullish about the Real Estate sector, and we like its Net Options Sentiment trend. Our paid letter will get into it more below but we are moving to roll out our trade alerts product and IRM is a stock we found based on an impressive move up in its 1 Day Average Net Options Sentiment vs its 7 Day Trailing Average.

Holds

META and UNH are strong holds right now as evidenced by their high ranking in the screener and good technicals. SMCI is a hold due to a strong, positive Net Options Sentiment trend. Additionally, ASTS is a hold for a similarly strong Net Options Sentiment and Upside Breakout trend.

Drops

TSLA, AVGO, and AMSC are all drops having been both filtered out of our screener with poor technical performance. AZO is a drop because we are not feeling Bullish on Consumer Cyclical in light of the sector’s performance as well as concerns about consumer spending. SNPS is dropped due to poor technicals. JLL lost to IRM as our Real Estate pick mostly because of JLLs lower Upside. NEE has been dropped due to concerns for volatility in Utilities and Energy. We do not like these Sectors either way right now.

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - LAMR, AIN, LCII, WMG, and COF adds / NAVI, RXT, CRNC, and ASND holds / WOLF, JNPR, ARKO, DEO, VLY, STX, DDOG, ON, LCID, AVT, PTEN, SWI, RAMP and DDS (not in this Screener but still a drop) Drops

Adds

LAMR had the most attractive move down in Net Options Sentiment averages. AIN and LCII were similarly identified and are adds confirming our Bearish position on consumer spending. WMG has strong technicals and we want a Bearish position on Communication Services to balance out some Sector concerns on our META hold. COF is added due to both the Financial Services sector performance alongside its good technical performance and large market cap balancing against some of our smaller cap holds.

Holds

NAVI is a hold due to its high ranking in the screener, our strong Bearish position on the Financial Services sector and decent technicals. We are holding RXT and CRNC for our Bearish position on Tech considering its monthly performance. They were chosen over WOLF due to better Net Options Sentiment trends. ASND will be held to hedge our long healthcare pick and we like its technical performance.

Drops

DEO, VLY, STX, DDOG, and ON are all drops because of their poor performance in the screener. LCID, AVT, PTEN, SWI, and RAMP are drops due to being filtered out with no overly attractive metric trends. WOLF lost to RXT and CRNC without an enticing net options trend. JNPR is a drop because of poor technical performance. ARKO is a drop, losing to AIN and LCII also due to less attractive metric trends.

Portfolio Allocation

6 Longs: META, UNH, GWW, IRM, SMCI, ASTS

9 Shorts: NAVI, RXT, CRNC, LAMR, ASND, AIN, LCII, WMG, COF

Paid Investing Letter Bonus - This Section is going to have even more content starting this week. Our trade alerts are getting closer to roll out and we have some bonus picks below that show our best Bull/Bear picks according to moving average changes in Net Options Sentiment!

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.