Happy Sunday! You are receiving this if you downloaded our app or subscribed via Substack.

We are looking for a few more volunteers to help with feedback on our new interface. We are offering 3 months free of our 2X weekly paid letter and 3 months free of the bonus picks in this letter. We especially need people that are new to Prospero. Calendar link to schedule directly.

2023 picks had a very rough week as did a lot of tech oriented portfolios but still 79% annualized return above the S&P500 and increasing to a 73% win rate per pick against their S&P 500 benchmarks.

Weekly YouTube live is tomorrow 7/24 at 11 AM EST

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Bear correction coming?

The markets are so tough to read this week that for the first time ever we are reserving the right to adjust midweek. We will send out a 2nd letter if we decide to adjust our positions officially.

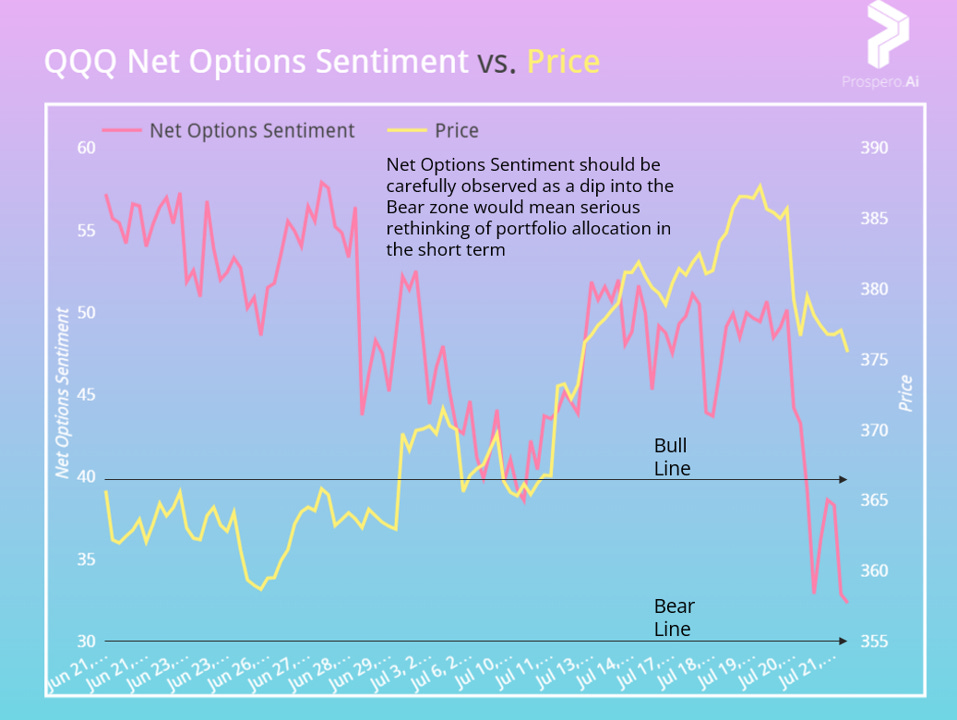

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

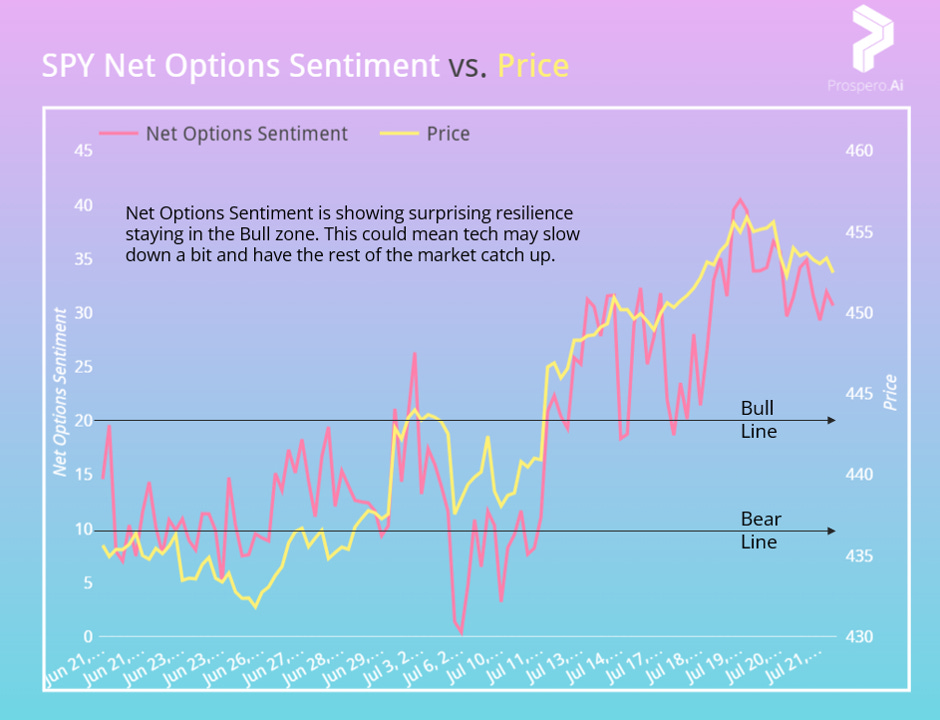

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned -.91% this week vs .65% for the SPY. This makes sense as for the first time in as long as we remember we saw QQQ Net Options Sentiment fall into our neutral zone and SPY stay in the Bull zone as they are astoundingly closing in on the same values.

If you like our signals one reason we do recommend getting our 2X weekly letter is right here:

From our 7/18 letter: “We can only climb so high before we dip a bit so watch Net Options Sentiment as it could absolutely get you out of trouble if the market turns suddenly. But the general trend is clearly and decisively Bullish.”

That seems pretty prophetic now, you can even see QQQ Net Options Sentiment start to fall before the market a little after this was published.

This is an interesting development as for much of the year QQQ Net Options Sentiment has been far more Bullish than SPY. We see this as a sign we need to hedge our tech portfolio more in the form of more shorts as signals on TSLA and META remain high. A long time ago we committed to go with what our signals said, even if macro concerns weighed heavy so that is what we will do. Instead of clearly out the longs that feel like they may be ripe for a deeper correction from a macro and technical standpoint we will manage that risk by adding some Bear picks in tech to offset that risk.

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

Bear Potential - AVT (Avnet)

AVT is on a price downswing and is a stock that is not expected to grow much which is an attractive Bear characteristic for a tech company. And Net Options Sentiment finished the week at it’s lowest value since July 14th so it could be ready for a deeper run down. Especially with all the long term options bets against it (Downside Breakout)

Bearish this week if:

AVT Net Options Sentiment < 50

AVT Net Social Sentiment < 60

QQQ Net Options Sentiment < 40

Bear Potential - INFY (Infosys)

INFY is a company that touches technology pretty broadly so we think that and the fact that it has very low profitability for such a mature company and low Net Options Sentiment / Net Social Sentiment makes it an excellent Bear candidate and broad technology hedge.

Bearish this week if:

INFY Net Options Sentiment < 50

INFY Net Social Sentiment < 60

QQQ Net Options Sentiment < 35

Bear Potential - KXIN (Kaixin Auto Holdings)

KXIN has a lot of great things going for it as a long term Bear. Including extremely low Growth and P + G < 50 which is great. Net Options Sentiment is higher than you’d want ideally but it is on the way down and Net Institutional Flow is also very low.

Bearish this week if:

KXIN Net Options Sentiment < 50

KXIN Net Social Sentiment < 60

QQQ Net Options Sentiment < 35

Keeps - Staying as a pick but unchanged guidance

Bull review - META (Meta Platforms Inc) from 7/16 letter and Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

META returned -4.73% this week vs .65% for the SPY. Our signals continue to like META more than any other stock. META Net Options Sentiment + Upside Breakout combine to a near perfect 197/200. Anything over 180 is a pretty simple buy and hold from our perspective. However META reports this week and this is one of the stocks we will be keeping a close eye on potentially adjusting if the signals change tangibly after earnings or leading in.

Bull review - TSLA (Tesla Inc) from 7/16 letter and Bullish this week if:

TSLA Net Options Sentiment > 75

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

TSLA returned -7.39% this week vs .65% for the SPY. TSLA is right behind META which are above the rest of the stocks in probably our two most important signals. TSLA Net Options Sentiment + Upside Breakout combine to a near perfect 195/200. Anything over 180 is a pretty simple buy and hold from our perspective.

Bear review - SR (Spire INC) from 7/16 letter and Bullish this week if:

SR Net Options Sentiment < 50

SR Net Social Sentiment < 60

SPY Net Options Sentiment < 15

SR returned 3.49% this week vs .65% for the SPY. Even though Upside Breakout is on the upswing it is still 38 and Downside Breakout is on the way down it is still 81. Net Options Sentiment at 18 means even thought we don’t love the price action we are holding.

Bull review - CFLT (Confluent Inc) from 7/16 letter and Bullish this week if:

CFLT Net Options Sentiment > 70

CFLT Net Social Sentiment > 25

QQQ Net Options Sentiment > 30

CFLT returned 1.43% this week vs .65% for the SPY. Net Options Sentiment has gotten healthier at 81 and we still like it long term with Growth (72) story.

Bull review - ELF (elf Beauty Inc) from 7/16 letter and Bullish this week if:

ELF Net Options Sentiment > 70

ELF Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

ELF returned -3.44% this week vs .65% for the SPY. Net Options Sentiment (82) and Upside (76) to Downside Breakout (44) remain strong so we hold.

Bull review - PYPL (Paypal Inc) from 7/16 letter and Bullish this week if:

PYPL Net Options Sentiment > 80

PYPL Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

PYPL returned 1.23% this week vs .65% for the SPY. PYPL continues to do well in both Net Options Sentiment (84) and Net Social Sentiment (87) and with earnings coming soon we think could do well even if the tech market overall struggles.

Drops

GLPG is dropped as a Bear as Net Options Sentiment ended the week at 60. It is up 5.71% since first covered and a Loss, losing to SPY by -7.22%.

Bonus Picks

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.