Happy mother’s day to all the mother’s out there! You are receiving this if you downloaded our app or subscribed via Substack.

Did you buy CELH, FSLR or AMR in part because you saw it in our long term “safest” picks? We were recommending all 3 before big recent gains and we are looking for testimonials. Please @prospero_ai on Twitter or comment here if we helped get you into those stocks.

If you do not yet have the app:

We are sorry but had issues with going live last week. Our CEO George Kailas will go live at 11 AM EST tomorrow (5/15) on our YouTube channel this week. We did share clips from what we shot on TikTok and Instagram.

Educational Videos: The basics of how to use Prospero and how to use our app to track institutions and stay ahead.

Newer to investing? Confused by any terms? Click our glossary help file.

Bearish signs mounting again

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned .66% this week vs. -.28% for the SPY. SPY Net Options Sentiment spent all it’s time in Bear territory so the down week isn’t surprising vs. QQQ Net Options Sentiment which spent most in Neutral territory with some Bull time. That matches with a small increase for the week.

We are seeing behavior that is displayed in Bear runs we have tracked since we started producing high frequency Net Options Sentiment almost a year ago. The dreaded “zero flatline.” See examples.

Our bi-weekly newsletter was out in front of this bad end to the week, pointing to this pattern.

For Tech this week: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech this week: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

In Review - Bull Potential - AMZN (Amazon.com, Inc.)

From 05/07 letter, Bullish if:

AMZN Net Options Sentiment > 70

AMZN Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

AMZN returned 4.35% this week vs. -.28% for the SPY. As we said last week we debated dropping AMZN due to some negative sentiment around AWS but it looks like we were right to stick with it.

We still like AMZN for all the same reasons. Long term options markets are betting on it (high Upside and Low Downside Breakout) and short term (high Net Options Sentiment) combined with excellent Net Institutional Flow and our strong support of their long term business strengths.

In addition, Net Social Sentiment can be a tough signal to harness because of its volatility. But the graph above shows how it can be a strong indicator, as volatility drops and it stays consistently at higher values we see a steady price climb. If we see it stay up we would expect this trend to continue.

Bullish this week if:

AMZN Net Options Sentiment > 60

AMZN Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Bear Potential - SJW (SJW Group)

We see the trends lining up as we’d want for a Bear pick. SJW is either right near average or below average in all 10 metrics which is something that gives us conviction for a Bear.

Bearish this week if:

SJW Net Options Sentiment < 50

SJW Net Social Sentiment < 50

SPY Net Options Sentiment < 10

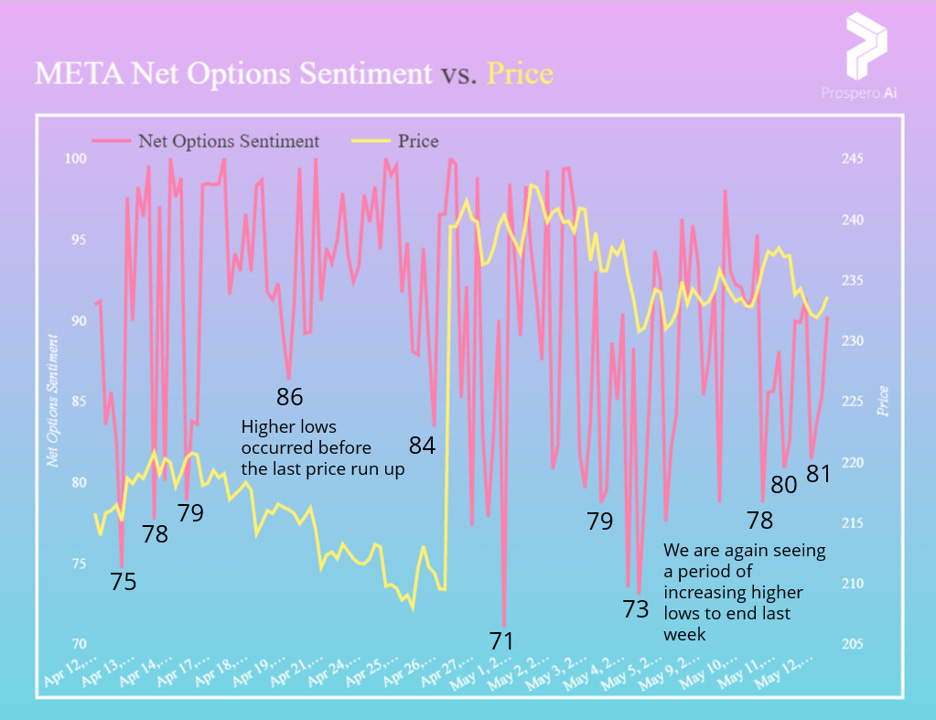

In Review - Bull Potential - META (Meta Platforms Inc)

From 05/07 letter, Bullish if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

META returned .44% this week vs. -.28% for the SPY. We expected META to move more Bullish this week and it is nice to see it get back above the SPY.

Both short and long term signals continue to look excellent for META. Although keep an eye on that declining Net Social Sentiment as it could be a sign of Bear times ahead if the trend continues.

The trend of higher lows in Net Options Sentiment is potentially very exciting for META stock. We saw before the last big run up that it settled into lows of 84-86 and we did get back into the low 80’s for the first time in a month to end last week. If those lows keep climbing it could mean it is set up for another price run up.

For this week we are Bullish if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Bear Potential - CACC (Credit Acceptance Corp)

This is higher Profitability than we normally like for a Bear pick but one of the things we look for when we see this is a potential overvalue of Profitability and a trading price of $429 above it’s AVG Price Target of $426 supports this theory. Average Net Institutional Flow alongside this high Profitability forecast we also see as a support of this thesis. As institutions typically love to load up on the most profitable companies.

For this week we are Bearish if:

CACC Net Options Sentiment < 50

CACC Net Social Sentiment < 50

SPY Net Options Sentiment < 10

Coverage Drops

PKG is dropped as a Bear because it flashed above our 50 Net Options Sentiment warning and currently is sitting too close to that key level. PKG closed out as a Win losing -2.18%, beating SPY by 1.90% 05/07/23 (1st and last covered) to end of week.

SAH is dropping because despite starting the week as an excellent Bear pick, down 2.59% by close 05/09 after a prolonged period of declines, used car and truck prices ticked higher on 05/10 which caused it to end the week up .20% narrowly closing out the week as a loss to the SPY by -.48% 05/07/23 (1st and last covered) to end of week.