Hope everyone had a wonderful start to the holiday season! For those that missed it, we added BURL mid-week and it turned out to be a nice snag!

We rose back up to a 61% beat of the S&P 500 on our 2023 picks, with a 61% win-rate per pick against S&P 500 benchmarks.

Our YouTube livestream is tomorrow 11/27 at 11 AM EST We will not be doing the Wednesday stream this week as I’m trying to get in my first few days off in over a year! To get calendar invites for them: sign-up link.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Bears not hibernating, Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Portfolio Macro Strategy - A Lesson on Risk

How we are approaching the number of longs/shorts and sectors

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> No Keeps —> Drops

Portfolio Summary

Market Update

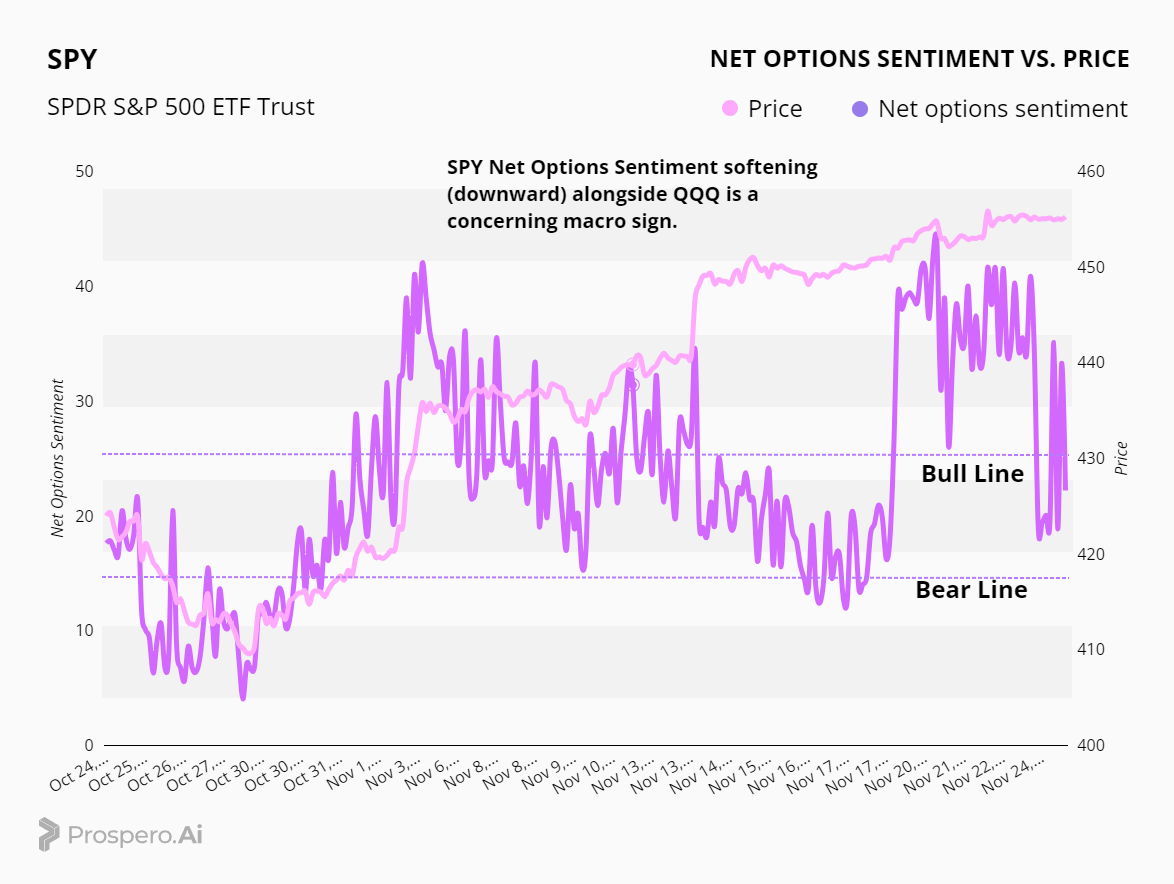

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned .9% this week vs 1.00% for SPY. So far, our levels have been excellent indicators of market direction. As they were ascending, we saw our biggest gains in SPY and QQQ (6+%, 2 weeks ago). In more consolidating/stable behavior, we saw 2.31% increase. And now, as we see softening/decline, we are at a 1% increase. We don’t like this trend, but we’re still Bullish overall. More on this strategy later.

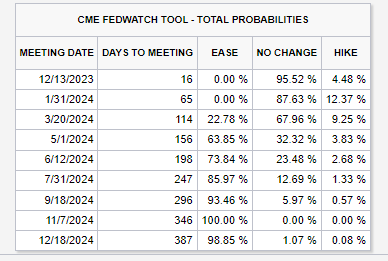

First things first: Not so fast on the inflation victory lap! After seeing bets of a hike go to zero; and then last week, the highest bet at a little over 2%. We’ve now seen the highest, creep up to over 12%.

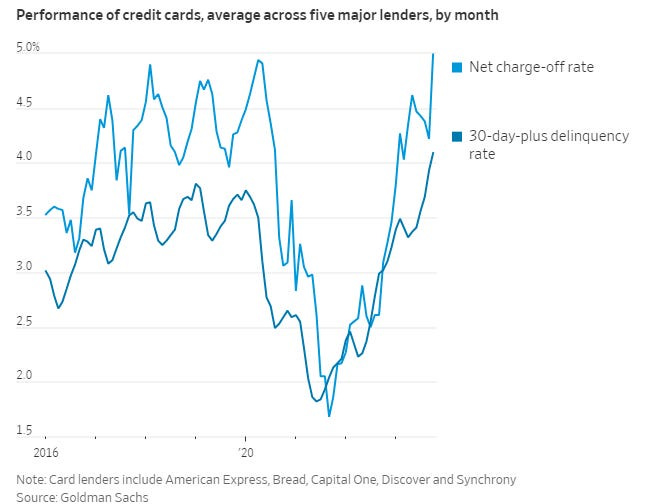

So…there’s the troubling development of increasing chances of inflation. But we’re also seeing this as well: American Borrowers Are Getting Closer to Maxing Out

But as we have been warning, this “soft-landing” may be one of haves and have-nots:

The silver lining from a macroeconomic perspective is that challenges could be fairly concentrated within certain subsets of consumers, such as those with lower incomes and student-loan debts. American Express, which tends to have wealthier and more creditworthy borrowers, reported a 30-day-plus delinquency rate as of October of 1.3%, versus over 4% on average across the five lenders, according to Goldman’s tracking.

This is playing out very closely to the “most likely” scenario we expressed earlier. We discussed how AI will create more top-line profits, without necessarily creating more jobs that leads to money trickling down to lower income brackets. In those lower tiers, we could see consumers seeing a lot of pain, as well as not spending. But at the very same time, the market might still perform well as a whole. We have been guiding towards this end, and our strategy to deal with it is ready to go!

Levels stay the same, to hold our sensitivity to what looks like a Bear move that might be incoming. But as the market opens tomorrow, let’s keep an eye out for a reversal of these Net Options Sentiment numbers.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish < 15 = Bearish.

Portfolio Macro Strategy

This week is going to be way more straightforward. The additional Bear risk (in what we still view as an overall Bull trend) will have us leaning Bullish, but we will have a close eye on QQQ and SPY Net Options Sentiment during our livestream tomorrow morning at 11 AM.

This week we’re choosing 3 Bulls and 2 Bears, as well as our long-term Bull index IWM. We chose this index because mid-caps have recently gotten beat up way too much, and we expect mid-cap stocks to outperform large caps over the next year.

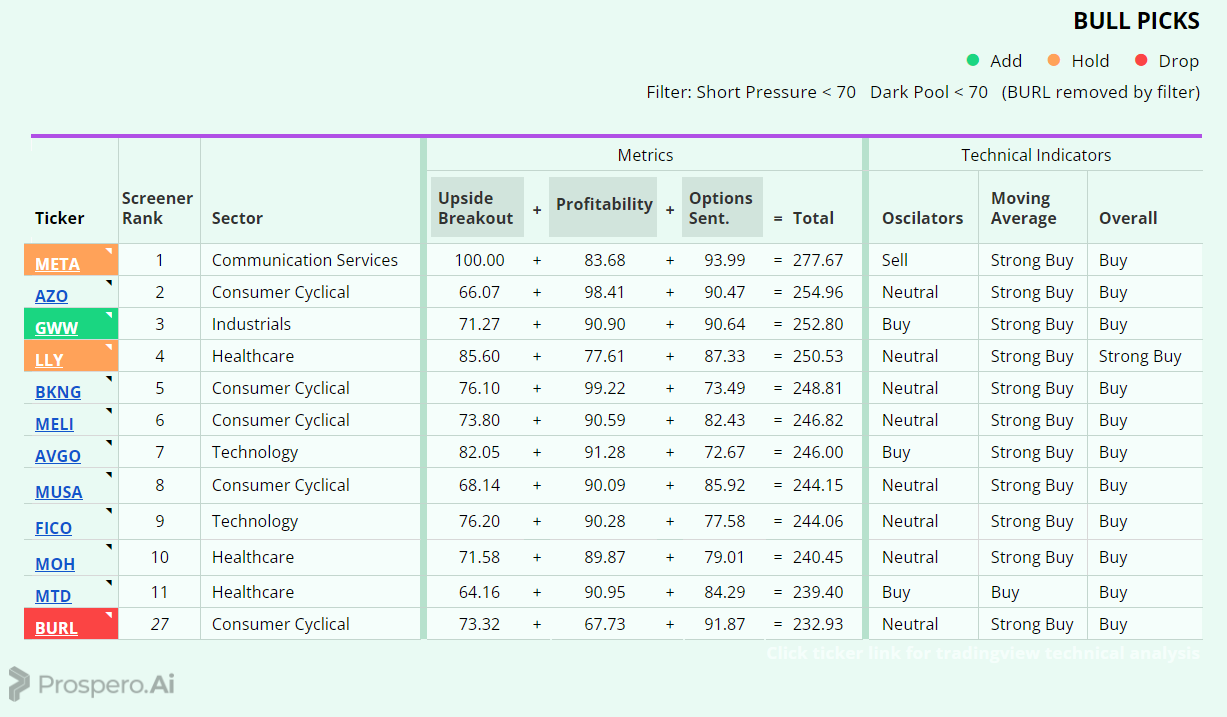

Long / Bull Adds - Link to Below Picture

GWW is an easy add. Not only do we like the Industrials Sector right now, but it’s the strongest stock on technical + Prospero combined analysis.

Long / Bull Keeps

LLY is a keep, and returned 1.59% vs 1% for the SPY. Screener rank is still great, as are technical indicators. This was an easy hold decision, especially considering it beat the SPY this week.

META as a keep was a tougher call. It returned .95% vs 1% for the SPY. Its screener rank is still tops, but the oscillators have turned. Despite this being a tough call we’ve decided to hold, primarily because we want to be able to keep a position in META for a while into 2024.

Long / Bull Drops

BURL was added on 11/22 via chat to our paid subscribers. It’s now dropped due to being filtered out in our Screener. Covered 11/22-11/24 and it finished +3.36% and a Win, Beating the SPY benchmark by 3.29%.

Short / Bear Adds - Link to Below Picture

We have gone back and forth on the Real Estate Sector. But when we realized DEI is the worst stock in our signals + technicals, we made the tougher call to add it.

We like LEG even better as a Bear, because with the consumer spending trends we addressed above, it’s in an industry (Consumer Cyclical) we see having a clear negative outlook.

Short / Bear Drops

LXG was dropped as a Bear, as it performed poorly in the above Screener. Covered 11/19-11/24, it finished +3.53% and a Loss, Losing to the SPY benchmark by 2.53%.

Portfolio Allocation

4 Longs: META, LLY, GWW, IWM

2 Shorts: DEI, LEG

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.