Last Thursday, our fearless leader and CEO George Kailas was quoted a number of times in a Fortune article "Cathie Wood Buys Falling Tech Stocks, Anticipating a Market Rebound". (Syndicated in Yahoo without paywall) For those of you who don't know who Cathie Wood is, she's the founder of Ark Invest, an investment fund worth around 60 Billion. Her rise to fame came in the Bull Market of '20-'21 where she made some great bets on innovation plays like Tesla. Recently her fund has fallen on hard times, with investors pulling out over $2.2 Billion during the last several months. One of her biggest mistakes was selling her entire stake in Nvidia, just months before its monolithic rise in '23.

The point of the article is that Aunt Cathie (as she is affectionately called by investors) is buying the recent dip in Tech Stocks. And when we say recent dip, we're talking about the one last monday when the market fell off a cliff. One example would be Nvidia that dropped from $117 on July 31, to a low of $92 just 3 trading days later. There were a lot of reasons for the sell off, from issues with Japan's interest rates, to slowing U.S. job numbers and fears of recession. But the question on everyone's mind is, "Is the current down trend in stocks, simply a much needed correction and the bull market will commence shortly…..Or is this the beginning of a larger downtrend that could potentially lead to a full-on Bear Market?" If the former is the case, Cathie Woods just made a great decision. But if the later scenario proves true, she just made another Nvidia 2023 kind of mistake and Ark Invest (that's already down 20% for the year) is going to lose a lot more money.

In the article, Gene Goldman the Chief Investment Officer at Cetera, is convinced that the upward movement after Monday's collapse is a "Dead Cat Bounce" and that we have about 5-6% more downside to go. That's a pretty bearish outlook. But our CEO George Kailas wasn't so gloomy. They asked him which direction he felt the market would go, he essentially said: "I'm a little bearish". I talked to George recently and let me translate what he means. He thinks we're dealing with a slight correction caused by overwrought fears, brought on by Political and Economic uncertainty about the future. But here's what's keeping George from being "Very Bearish" like the aforementioned Gene Goldman.

1. 78.5% of S&P 500 Companies are beating earnings forecasts. Tech is at 74%. That's an increase of 1.5% from the previous quarter. Some sectors like Financials and Healthcare have even higher % 's in the Mid 80's. That doesn't jive with an impending Bear Market. Typically in Bear Market's you see companies regularly underperforming expectations.

2. Company Valuations are still very reasonable. For example, Meta has a P/E ratio of 26. Google - 24. Even SMCI (that went on a CRAZY run this year) has a P/E of 24. You could make a pretty strong argument that those stocks (and many others) are undervalued. Especially when you look at the potential for future earnings of A.I. driven stocks.

3. Chart Technicals say we're due for a bounce. Look at the graphic below.

That’s a daily chart of the S&P 500. Look at the blue line at the bottom of the graphic. That's the RSI indicator. When the line is over 70, that means S&P stocks are "overbought". When that line hits 30, it means that stocks are "oversold". As you can see, each time that stocks in the S&P 500 hit the baseline of 30 (extremely oversold) there was a significant bounce to the upside. Interestingly, on the Prospero App, our SPY Net Options Sentiment ended the week on a very bullish score of 50. That tells us that institutions are pretty bullish on the S&P. QQQ is a different story, which we'll deal with later.

Bottom line, things are incredibly volatile, so unlike Cathie, we need to remain cautious and not go on a buying spree. Until the trend reverses, we remain (as George says): "A little bearish". Hopefully, this time next week we're talking about a face ripping rally that caught us all by surprise. But until our QQQ Net Options Sentiment gets out of the cellar, we're going to tread lightly.

A WORD FROM OUR CEO

On a tough week for many, we anticipated the volatility and played it well - gaining 10% annualized. Currently beating the S&P 500 by 66% annualized, with a win rate of 63% against SPY benchmarks.

For newer readers linking our short intro + learning videos.

Normal streams this week! Monday 8/12 at 11 AM EST and Wednesday 8/14 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

BEARS ROAR - CATHIE BUYS

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

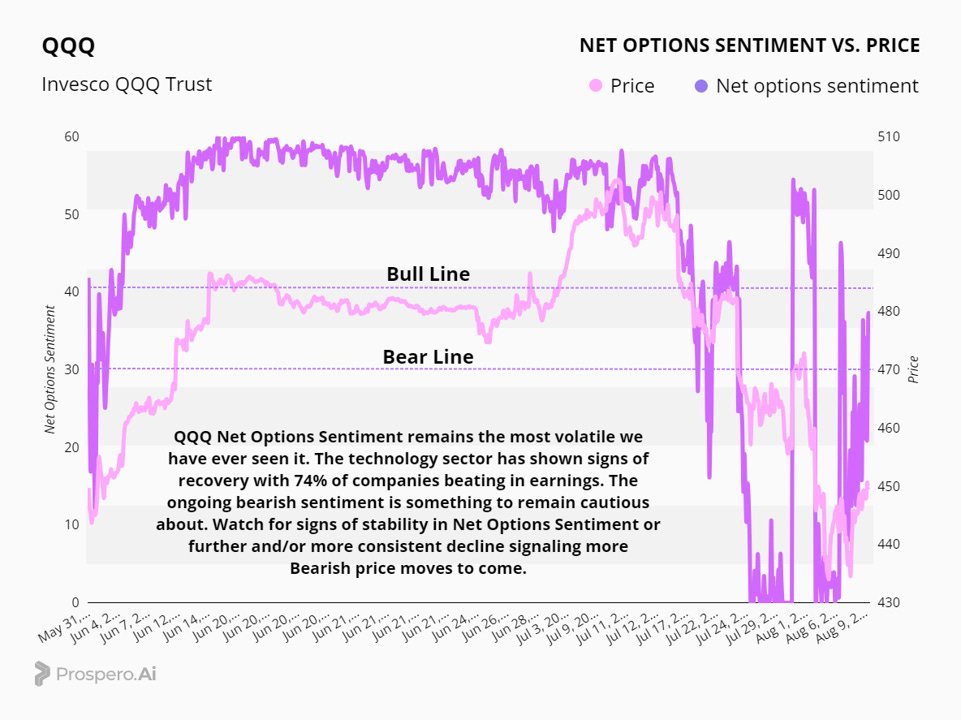

Last week’s Net Options Sentiment levels from the 7/28 letter: SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

The state of the Market is still in flux, with a perpetual mixture of good and bad news. As we talked about in last week's article, uncertainty fuels volatility and when you add political craziness and an economy teetering on recession; we're dealing with a significant amount of uncertainty. For example, the VIX is the S&P 500's volatility index.

On August 5th, the VIX spiked to levels not seen for over a year. That essentially means that people are scared and are expecting a significant amount of further volatility. The good news is that VIX leveled down significantly toward the end of the week. This is a sign that people aren't quite as fearful as they were at the beginning of the week.

Besides uncertainty, you can blame the recent downturn on unrealistic growth expectations placed on the Magnificent 7. Investors are currently asking the question: "Did the A.I. driven rally get ahead of itself?" The reason for the question is that two of the Magnificent 7 stocks failed to create euphoria when they reported their 2nd Quarter results. But last week, one of the A.I. pure-play stocks PLTR had stellar quarterly earnings. Dan Ives @DivesTech (Wedbush Analyst) said in a quote on X that Palatir's recent earnings are "proof that A.I. global demand is exploding and Palatir's success is proof of A.I. monetization". Nvidia's earnings that are coming in a couple of weeks will also be telling about the future of A.I. But right now, it's still too early to know whether we're going to see an upward trend reversal in the coming days, or there's more downside to come.

CAP/VALUE ANALYSIS

Check out the table above. Overall it was a pretty bearish week. One thing that we can learn from this info that I hope brings some comfort. After that crazy, scary, volatile week, most caps were barely down. What a roller coaster. It felt like more than that to me, so it's good to see that while a correction has happened. The sky is not falling. At least not yet. Interestingly, Small Caps continue their poor performance. The sector rotation many hoped for has yet to emerge. Bottom line, we're dealing with some serious choppiness and we urge caution as we enter into the week. When and if a trend emerges, we can be more agressive.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Check out the Spy Net Options Sentiment below. For the folks new to Prospero, Net Options Sentiment can tell us in real time (during market hours) whether institutions are bullish or bearish. A number over 4o is generally bullish. A number less than 30 is bearish. Well, as you can see, SPY Net Options Sentiment ended the week at a very bullish 50! After all that volatility, that's a good sign. But as you can see with the chart, things in this environment can change in a hurry. That's especially true considering that QQQ (Tech) Net Options Sentiment ended the week in very bearish territory. I know that the first thing I'm going to do when the market opens tomorrow is check the Prospero App and look at SPY and QQQ Net Options Sentiment. That will 100% determine whether I'm more aggressive, or take a defensive stance.

As you can see from the chart above, QQQ Net Options Sentiment is the most volatile we have ever seen it. While SPY numbers ended the week in Bullish territory, QQQ is continued with erratic, unsure readings. In many ways, this week is vitally important for QQQ. It has dropped below the 100 Day Moving Average. That's the first time it's dropped that far in a LONG time. While it's bounced off the average, and is trending slightly upward, this week will tell us if it's a "dead cat bounce" or if a genuine trend reversal has started.

SECTOR ANALYSIS

Check out the table above. Energy and Industrials had a strong week last week. Energy has been in the doghouse now for 3 months and is due for a move upward. Real Estate is cooling off for the month, but had a strong day on Friday. Finally, check out Tech on the one month! They took it on the chin. Hopefully we'll see that downward trajectory turn as we head into NVDA's earnings at the end of August. If their earnings come in less than expected, things are going to get very interesting for Tech. One final though. Healthcare had a strong 3 month showing. LLY performed really well in their latest earnings; and as of last Friday was showing strength in Prospero's numbers. We'll be looking at the Healthcare sector as a possible harbor in the storm if volatility continues.

PORTFOLIO STRATEGY

With the extreme volatility QQQ is experiencing we are taking a balanced approach to the portfolio picks this week. The strategy this week is focused on diversification to weather the fluctuating market trends. Therefore we are going with an even balance between the Short and Long picks with 7 Longs and 7 Shorts.

Long / Bull Moves - Link to Below Picture

*NOTE after finishing this letter we noticed ASTS did not get included in the Bull picture, we are holding it.

Long / Bull Moves - LLY, PDD, and AXON adds / META, TSM, CCJ, ASTS (not pictured) holds / GWW drops

Adds

LLY and PDD are adds because they ranked highly in the screener with overall very strong metrics. AXON is an add also due to strong technicals. AXON won over GWW with a better in a very close call due to the excellent Technical Flow.

Holds

META and TSM are holds with high ranking in the screener and strong metrics. CCJ is a hold because of a strong Net Options Sentiment trend, appearing in our best movers for that metric multiple times to end the week. (As a result of 2 strong moves) We also liked the movement for the Energy Sector as a clincher for this hold. ASTS is a hold, even with some lost momentum we still like the metrics trend.

Drops

GWW is a drop because it lost out to AXON as an industrial long-pick.

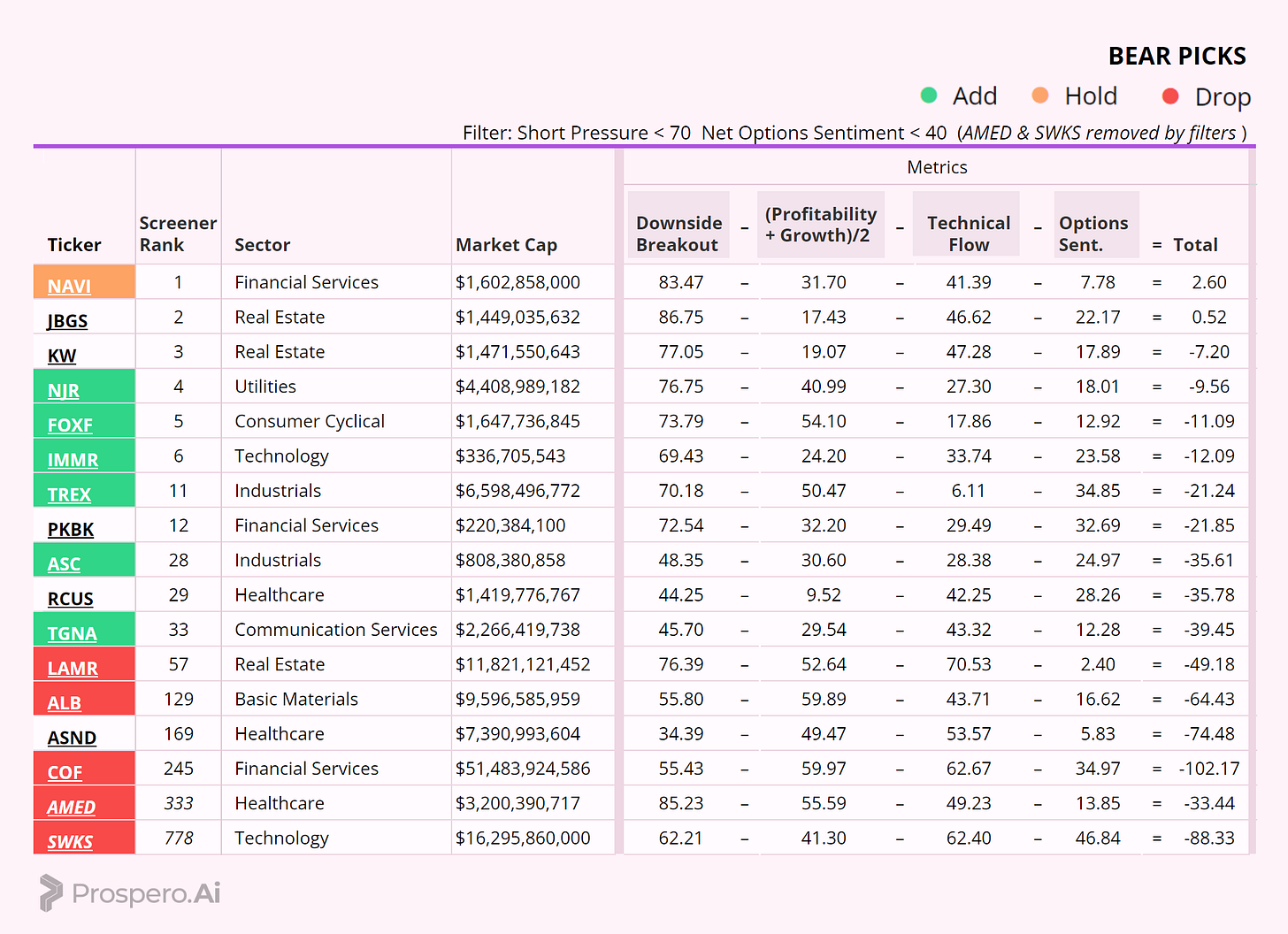

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - NJR, FOXF, IMMR, TREX, ASC and TGNA adds / NAVI hold / LAMR, ALB, COF, AMED, and SWKS drops

Adds

NJR, FOXF, IMMR, TREX and ASC are adds due to strong metric performance and diverse set of sectors. 2 Industrials to balance out 2 Industrial long picks (ASTS and AXON) TGNA is an add because of its strong Net Option Sentiment trend.

Holds

NAVI is a hold due to very strong metrics performance and high ranking in the screener.

Drops

COF, and ALB were dropped due to poor performance in the screener. LAMR was dropped due to a bad score in Technical Flow. AMD and SWKS are drops due to their being filtered out and poor metrics.

Portfolio Summary

Long / Bull Moves - LLY, PDD, and AXON adds / META, TSM, CCJ, ASTS holds / GWW drops

Short / Bear Moves - NJR, FOXF, IMMR, TREX, ASC and TGNA adds / NAVI hold / LAMR, ALB, COF, AMED, and SWKS drops

7 Longs: META, LLY, PDD, AXON, TSM, CCJ, ASTS

7 Shorts: NAVI, NJR, FOXF, IMMR, TGNA, TREX, ASC

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.