Happy Sunday! You are receiving this if you downloaded our app or subscribed via Substack.

Sorry for link issues last week, fixed now to sign up for user feedback interviews and a first look at our 2.0 app design. Sign up link, anyone that is interviewed will get 1 month free of our paid newsletter.

2023 picks at 70% win rate vs SPY for a yearly annualized beat of 128%.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Beware the Matador. Never get so caught up in good feelings that you forget the ebbs and flows of the market. It is why our model portfolio is long/short. And while we started it out with 33% shorts, it is now 47%.

More detail tomorrow on YouTube live 06/26 at 11AM EST

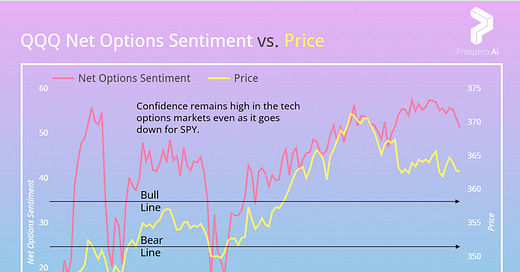

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned -1.46% this week vs -1.42% for the SPY. This breaks a 5 week winning streak for SPY. It was going to happen eventually and as we have discussed, we could easily see SPY red and QQQ green over the next year.

Given our expectations there is value in that can help it weather a recession, it is increasingly important to look at these index signals for different informational value. We expect both indices to hold up fairly well from a big drop as long as QQQ Net Options Sentiment stays above the Bull line.

From Grit Capital: “JPMorgan says household excess savings gone by October”

We are now pretty concerned about a dip (without breaking from what we’ve said recently) we still like stocks with big growth potential as long term holds but these evolving rate bets have changed the picture a bit for us.

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

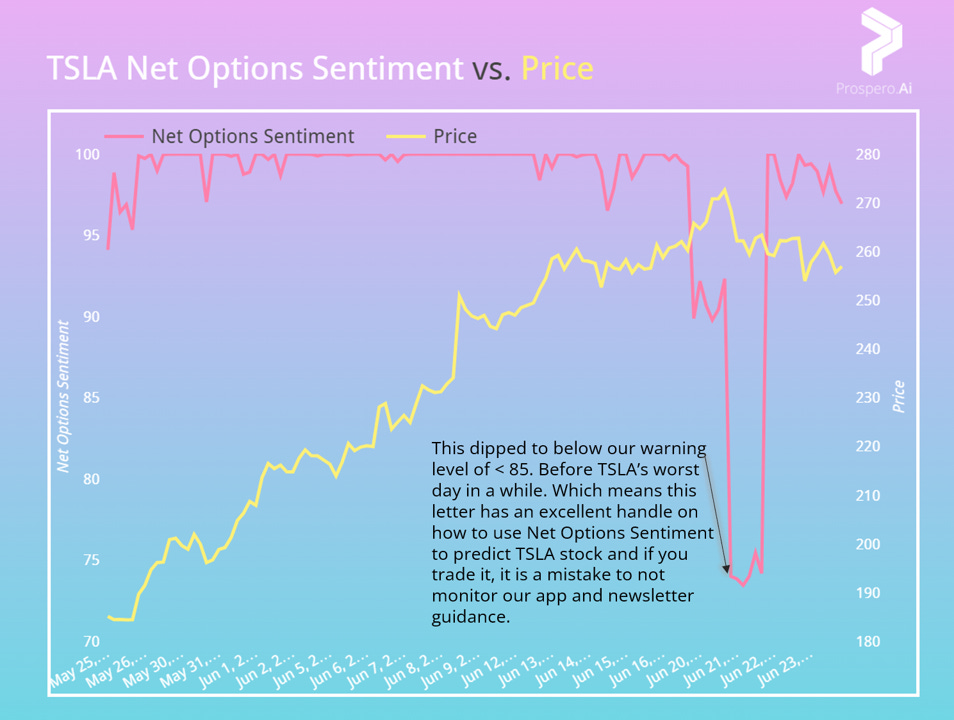

In Review - Bull Potential - TSLA (Tesla Inc)

TSLA Net Options Sentiment > 85

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

TSLA returned -1.51% close to the benchmark vs -1.42% for the SPY. Even in a bad week, it is hovering around the SPY return. It is up 20% since we first recommended it a few weeks ago. Perhaps the best case study for Net Options Sentiment continues to be made here, a full review linked here.

Definitely a concerning development here especially Upside Breakout trending down before this latest price drop. We will have our eyes on this and may regret not dropping it this week.

Bullish this week if:

TSLA Net Options Sentiment > 85

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Despite a Bearish week last week we are still long term Bullish on Growth stocks. But this Screener is helpful right now to find Growth potential that is protected by high Profitability. Increasing the chances of success we add our two most important Bull signals: Upside Breakout (reflecting more Bull vs. Bear bets in the long term options markets) and Net Options Sentiment (reflecting more Bull vs. Bear bets in the short term options markets)

Bear Potential - BOH (Bank of Hawaii)

We have had our eye on BOH for a bit but wanted to let a bit of the banking industry volatility die down. Extremely poor to poor in Net Options and Net Social Sentiment and increasing Upside Breakout combined with low Growth forecasts means we may have it as a Bear for a bit.

Bearish this week if:

BOH Net Options Sentiment < 50

BOH Net Social Sentiment < 60

SPY Net Options Sentiment < 10

Keeps - Staying as a pick but unchanged guidance

Bull review - META (Meta Platforms Inc) from 6/18 letter and Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

After one bad week META humming along again, returning 2.75% this week vs -1.42% for the SPY. Since we started covering META 04/30/23 it is up 20% vs. 4% for the SPY. Our signals continue to like META more than any investment we’ve seen. Notice how the distance between #1 META and #2 TSLA in the Screener above is 36 points and #2 to #3 is just 1 point? That says just how Bullish we are on META as Net Options Sentiment and Upside Breakout combine to a perfect 200/200. Anything over 180 is a pretty simple buy and hold from our perspective.

Bear review - FRHC (Freedom Holding) from 6/18 letter and Bearish this week if:

FRHC Net Options Sentiment < 40

FRHC Net Social Sentiment < 60

SPY Net Options Sentiment < 10

FRHC returned -3.69% this week vs -1.42% for the SPY. This is the kind of performance we expect to continue for this stock and why we’ve been hanging onto it. This continues to be extremely low, 3, Net Options Sentiment and Profitability (37) + Growth (28) = 65.

Bull review - CFLT (Confluent Inc) from 6/18 letter and Bullish this week if:

CFLT Net Options Sentiment > 70

CFLT Net Social Sentiment > 25

QQQ Net Options Sentiment > 30

CFLT returned -4.50% this week vs -1.42% for the SPY. It still has 74 Net Options Sentiment and is inching towards our drop level. For now we hold it even as Upside Breakout has gone from 70 when we first started covering to 54. We still like the long term potential here due to 72 growth. This is a good example of why we have the “keeps” section. Even with it down we let it hang around so long as we like the upside better than the downside.

Bonus Picks

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.