Happy father’s day! Especially my Dad Leo who I found out reads this whole letter! You are receiving this if you downloaded our app or subscribed via Substack.

2023 picks now show returns in real time. As of 06/16 they are beating the SPY 70% of the time for a yearly annualized beat of 124%.

We will be conducting interviews and giving some people a first look at our 2.0 app design. Sign up here, anyone that is interviewed will get 1 month free of our paid newsletter.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Big Bull Signals All Around. More detail tomorrow on YouTube live 06/19 at 11AM EST

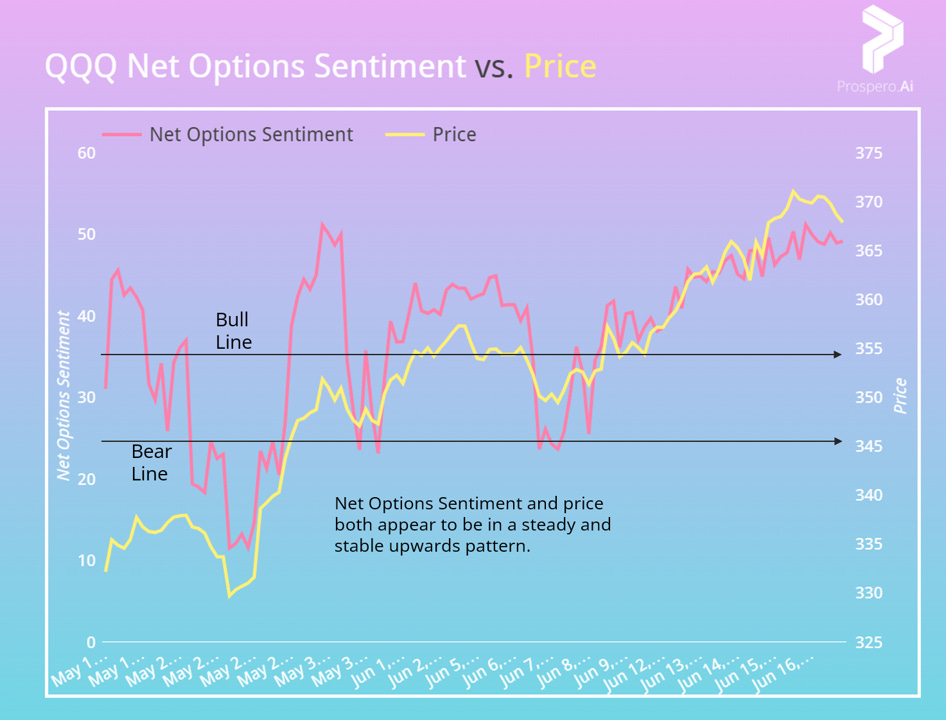

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned 3.79% this week vs. 2.22% for the SPY. QQQ Net Options Sentiment has been Bullish and SPY finally has caught up, creating our most Bullish outlook in a while.

One of our favorite Substacks, Cubic Analytics, posted about a highly Bullish signal that is on the verge of triggering. He goes into much greater detail at this link, even similar signaling on SPY!

With SPY Net Options Sentiment finally capitulating and moving well into our Bull zone that is a pretty clear sign that some major players are swinging their bets around. Definitely keep an eye on it to see if it goes back down, it is still only one day of this very Bullish signaling. And keep a few other things in mind:

There will be corrections in any Bull market don’t overextend on short term bets or let your “Bear market trauma” scare you off of trades.

There are very real macro risks to the economy but there are always Bears in any Bull market. Make sure you understand the risks well enough to see signs they are manifesting but Bull markets tend to be long so remember that too.

Even if we see see a consumer credit crunch or persistent inflation it appears the businesses that have run up already, did so because the larger market is not worried about those forces affecting them. Don’t completely toss out value metrics like forward P/E or let the value obsessed talk you out of conviction on a company you think will continue to produce new game-changing innovations. (TSLA is this example for me)

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

In Review - Bull Potential - TSLA (Tesla Inc)

TSLA Net Options Sentiment > 75

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

TSLA returned 6.60% this week vs. 2.22% for the SPY. It is up 22% since we first recommended it a few weeks ago. The 2nd 20%+ newsletter run in 2023, it is quite clear that Net Options Sentiment at the top of our scale is a clear sign TSLA will run up. Linking both 2023 examples side by side.

Not overthinking this one. Unless you see Net Options Sentiment break from the top of our scale we are Bullish.

Bullish this week if:

TSLA Net Options Sentiment > 85

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Keeps - to prioritize new information we added this section to summarize Bull/Bear holds whose signals haven’t moved materially

Bull review - CFLT (Confluent Inc) from 6/11 letter and Bullish this week if:

CFLT Net Options Sentiment > 70

CFLT Net Social Sentiment > 25

QQQ Net Options Sentiment > 30

CFLT returned -4.65% this week vs. 2.22% for the SPY. It still has 88 Net Options Sentiment but if that continues to drop we will likely drop it as a pick. Some management teams are more conservative in their forecasts than others but CFLT seems to be one of the only stocks so close to AI that didn’t report guidance revisions that excited the market. Even a company that most consider to be a dinosaur, Oracle (ORCL) had a big week around that.

Bull review - META (Meta Platforms Inc) from 6/11 letter and Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

After one bad week META humming along again, returning 6.06% this week vs. 2.22% for the SPY. Just like last week, our two most important Bull signals, Net Options Sentiment and Upside Breakout combine to 196/200. 4 off from perfect. Anything over 180 is a pretty simple buy and hold from our perspective.

Bear review - FRHC (Freedom Holding) from 6/11 letter and Bearish this week if:

FRHC Net Options Sentiment < 40

FRHC Net Social Sentiment < 60

SPY Net Options Sentiment < 10

FRHC returned .45% this week vs. 2.22% for the SPY. This may be the kind of week that we get for a typical Bear now, despite being up it underperformed by 1.77%. This continues to be driven by minimum, 0, Net Options Sentiment and Profitability (37) + Growth (28) = 65.

Bonus Picks - 2 New Bulls and 1 New Bear Below. (3/3 closed out this week are wins!)

Running a 20% discount on both monthly and yearly Bonus pick subscriptions this week.

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.