Let's begin with a Stock Market trivia question: "What does the Zweig Breadth Thrust Indicator and the correlation of Global Money Supply to Bitcoin have in common?" We'll give you the answer in a minute, but what they have in common will shed some light on what happened last week in the market and where we might be going from here.

But first, let's unpack last week. What a turnaround a week can make! We entered last Monday, firmly in the bear camp. But then on last Tuesday, April 22nd after lunch, everything changed. Around 1pm, both our SPY and QQQ Net Options Scores suddenly jumped from the low 20's (bearish) to the high 40's (bullish). From the close on Tuesday until the Wednesday morning at market open, the S&P began to rally! It was a powerful rally; and we knew things were looking up when at the end of the rally day on Wednesday, our QQQ and SPY numbers were still extremely bullish. At 2pm on Wednesday afternoon we posted on our X account:

The answer was yes and we saw the rally continue for the rest of the week. Once again, we continue to be amazed with our Net Options Sentiment's ability to foresee these kinds of swings. I personally made a good amount of money last Wednesday after our tweet. I switched to Call Options on the Mag 7 (right before the market closed). The market rallied overnight and I woke up the next morning a happy man.

But that's not what we want to mainly talk about today. There are two important topics we want you to know about as we head into next week, because both shed light on a question everyone's asking: Was last week a typical "Bear Market rally" that will soon reverse and go to new lows? Or was last week the bottom and we're about to see a reversal to new highs? The answer is nobody knows for sure, especially in the current political climate, but there are two data points that provide for us some fascinating historical insight.

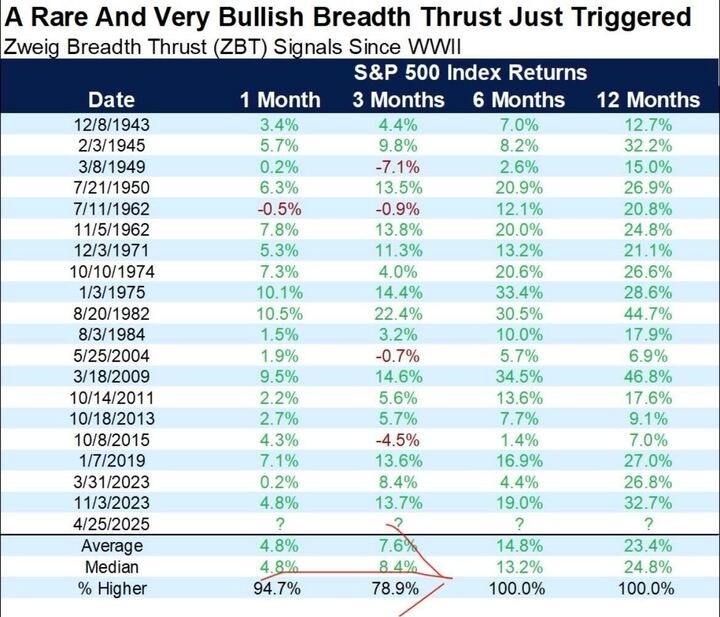

1. The Zweig Breadth Thrust Indicator triggered for only the 20th time since WWII: Prospero fam, this is a big deal! The Zweig Thrust indicator measures when 70% or more of the stocks on the NYSE advance on 6 out of 10 days. Friday it triggered for only the 20th time since 1943. Why does this matter? Each and every time the indicator has flashed since 1943, the 6 and 12 month S&P 500 returns were Bullish with an average return of +23%! The craziest part of the indicator is that it's been accurate 100% of the time in predicting the reversal of downtrends and positive forward movement. Take a second and check out the chart below (via Carson Investment Research) and look at the 6th and 12 month returns.

After a Zweig Thrust, the lowest 12 month S&P returns were in 2015 when the market only advanced 7%. But under the current conditions, most of us would take it! Bottom line, if the market doesn't end green twelve months from now, it will be the first time that's happened since your grandad was preparing to storm the beaches of Normandy. One side note, (i'm not going to post it) I saw a chart that showed the one week returns after a Zweig Thrust, and we are due for some red days. But the good news is that QQQ and SPY Net Options Sentiment ended the week firmly bullish. We will be watching closely to see if that changes. If you're heavy long after last week, hedging with some SQQQ as the 24 hour market opens tonight might not be a bad idea. To be clear, we're not calling a bottom here, but this is a strong glimmer of hope in what's been a two month long bloodbath. Now, here's the second historical data point that's important for you to know.

2. The Correlation Between Bitcoin and the Global Money Supply: So what is the Global Money Supply (Global M2) you ask? It's simply a way of measuring all the money that's liquid (easily available) around the world. We're talking about money that's in cash, checking and savings accounts and other areas where money can be quickly accessed. Well, it turns out that there's a shockingly strong correlation between the Global Money Supply and the price of Bitcoin.

When the Global Money Supply increases, usually within 2 to 6 months, the price of Bitcoin follows it. There is strong precedence for this occurrence. The first time we saw it was in 2017. The Global Supply of money was steadily increasing, especially in China, who was pouring cheap money into the economy. Bitcoin skyrocketed from $1000 to $20,000 over the course of that year. Same was true for 2020. As Covid hit, the US alone increased Global M2 by 20%. Bitcoin soared to $60,000 within several months.

But why does this matter? There are a couple of reasons. One, with the economy on unsure footing, Central Banks are poised to start pouring liquidity into the economy. Interest rates will likely be cut in the coming months and the reality is that in the U.S., M2 has recently seen its fastest growth since 2022! And that explains a lot. If you're a Net Options junkie like me, you've probably noticed that stocks like MSTR and COIN (Bitcoin proxies) have maintained really strong Net Options Sentiment scores through this whole downturn. As a matter of fact, on Friday, both of those stocks had Net Options Scores of 100 and Upside Scores in the high 80's-low 90's. This tells us that institutions are currently bullish for both the short and the long term, for Bitcoin.

In light of this data, now might be a good time to gain some exposure to Bitcoin. If you're old and technically challenged like me, cryptocurrency can be a little intimidating. But there are simple ways to gain exposure through stocks like COIN, MSTR or IBIT (Bitcoin ETF). To close things out, we are entering into the coming week cautiously bullish, but cautious about a pullback after such a strong Bull turn. Stay hedged and let's watch those Net Options Numbers to give us insight into market direction. Now a word from our CEO:

A WORD FROM OUR CEO

We closed the week out well with our revised double dip avoidance strategy. Our paper trading portfolio beating the S&P 500 by 77% annualized, with a win rate of 61% against SPY benchmarks.

We updated our short intro + learning videos to include our new full app tour as well as advice on how to use this letter.

Regular stream times this week. Monday 4/28 at 11 AM ET and Wednesday 4/30 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

BITCOIN AND BREADTH THRUSTS

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

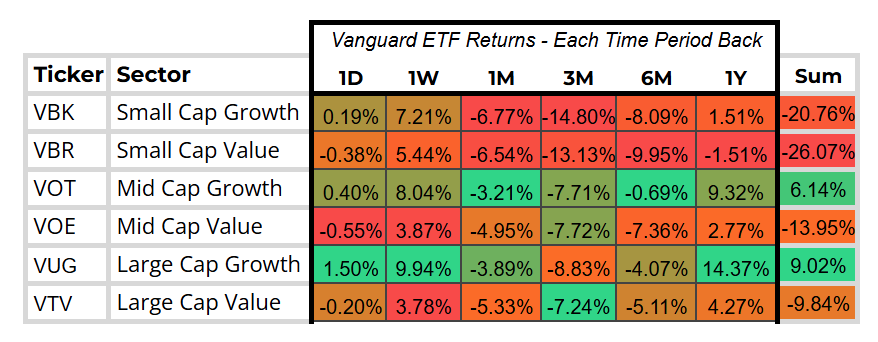

CAP/ ANALYSIS

A clear shift is underway, with Growth outperforming Value once again. Large Cap Growth has experienced the most notable rebound, driven by earnings exceeding expectations and a slight cooling in tariff rhetoric, even though no final decisions have been reached. However, it's evident that institutional investors remain cautious and bearish, hesitant to re-enter the market. In contrast, retail investors have emerged as the primary drivers of this rebound, fueling the renewed momentum in Growth sectors.

SECTOR ANALYSIS

Tech and Consumer Discretionary sectors have seen strong rebounds this week, buoyed by expectations of exemptions and carve-outs favoring large-cap players. Communication Services also performed exceptionally well, driven by standout earnings from major players like Google, alongside sustained advertising spend. In contrast, other sectors struggled slightly, as a rotation back into higher-risk sectors dampened their momentum.

SPY/QQQ NET OPTIONS SENTIMENT

As shown above, SPY NOS experienced a significant rebound following Treasury Secretary Scott Bessent's remarks in a closed-door meeting with institutional investors, where he acknowledged that the current tariff strategy and trade war were unsustainable in the long term. Unsurprisingly, retail investors were excluded from these critical policy insights. Notably, there appears to be a disconnect between Bessent and Trump regarding their messaging, further adding to the uncertainty.

QQQ NOS extended its bullish momentum from Wednesday, maintaining a strong position above the Bull Line. This sustained upward trajectory signals continued investor confidence in the sector. We remain steadfast in our commitment to staying agile and responsive should any tensions escalate.

PORTFOLIO STRATEGY

With the rebound in both QQQ and SPY NOS we’re shifting our positioning to be net long but still weary about conviction and will shift our positioning if things turn south. We’ll be focusing our exposure on sectors with positive momentum from last week. 4 longs, 3 shorts.

One quick note on the Bull / Bear ratio. It is fair to view our desired ratio as 5 Bulls and 3 Bears. Given the data we shared above we intend to add COIN or MSTR tomorrow. But as a rule we do not add or drop cryptocurrency related stocks in the weekend letter because of the live price action over the weekend. That is why we have left room for an extra Bull pick tomorrow morning.

Long / Bull Moves

Long / Bull Moves - META, MPWR and ULTA adds / VRT hold / PDD, AMZN, KR, APP and PLTR drops

Adds

META was an easy add as it was at the top of our screener with excellent Net Options Sentiment and Upside Breakout. MPWR was a good smaller cap Tech pick with great Tech Flow. ULTA was also chosen for smaller cap Consumer Cyclical exposure with solid metrics all around.

Holds

VRT was kept for excellent Tech Flow and Net Options with Industrial exposure in mind. (We had a Industrials short we liked we edged it out against APP and PLTR which was a tough call)

Drops

PDD and AMZN were dropped as they had no real standout metrics. KR, APP and PLTR were all dropped as they were screened out and as we said with VRT we are limiting our downside risk to start the week.

Short / Bear Moves

Short / Bear Moves - DCI and FOX adds / WHR hold / ST, XRX and KMB drops

Adds

DCI was added as a good Industrials counterweight to VRT on the long side. FOX was added as a larger cap Communcation Services with poor earnings power.

Holds

WHR was kept for favorable Net Options Sentiment and poor earnings power.

Drops

ST, XRX and KMB were all dropped as they performed poorly in our screener

Portfolio Summary

Long / Bull Moves - META, MPWR and ULTA adds / VRT hold / PDD, AMZN, KR, APP and PLTR drops

Short / Bear Moves - DCI and FOX adds / WHR hold / ST, XRX and KMB drops

4 Longs: META, MPWR, ULTA and VRT

3 Shorts: DCI, FOX and WHR

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.