Matt is off today so this is George writing the intro! The Prospero signals were built to cover what I viewed as knowledge gaps. To explain market “phenomena” unexplained by my value investing training. One of the shortcomings of our key options driven signals are that they do not refresh outside of market hours. And sometimes, when the market is really moving, I need to make defensive moves pre-market.

In this tough market, I’m turning over all the stones. And integrating information from the bond markets more into my pre-market decisions. It helped me properly add risk pre-market yesterday and dictated risk reduction today.

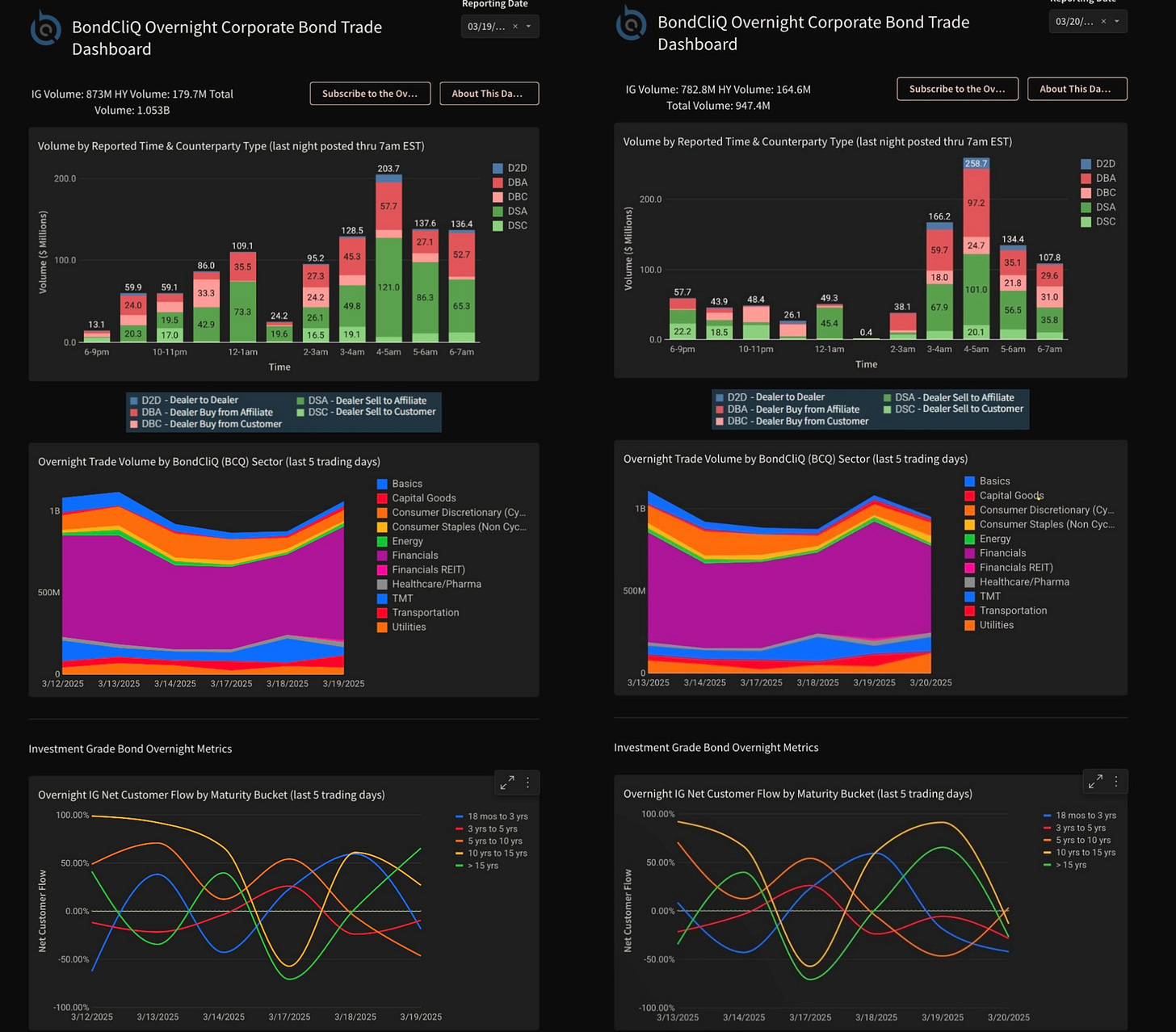

See the picture below. The left is yesterday and the right is today. Yesterday we saw much more buying in Asia. (Green is buys) And a little more buying in Europe. Perhaps the bigger signal is the third graph. Yesterday we saw bond duration increaing (green >15 year line going up aggressively) and today we are seeing that green line reverse, as well as the yellow line (10-15 years). Duration lengthening is increasing risk and shortening is decreasing. Hence our risk off/bearish interpretation today.

The team at BondCliQ are doing a great job consolidating corporate bond data and produce plenty of helpful images to measure (get your hands around) that risk.

John Brown-Christenson who was generous enough with his time to really get me up to speed on getting the most out of the platform said this morning:

“It seems like this credit market can’t figure out its direction just like the stock market.”

I wanted to include this because you shouldn’t feel bad if you are struggling with this market, it is a hard one to interpret. But hopefully this additional bond market signaling integrated pre-market, will help us all increase our wins.

SOME MORE WORDS FROM ME

A great bounce back midweek and hopefully bullish momentum favors our portfolio, beating the S&P 500 by 67% annualized, with a win rate of 64% against SPY benchmarks.

We updated our short intro + learning videos to include our new full app tour as well as advice on how to use this letter.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Bonding

Cap Analysis

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.