Let me explain our newsletter title today by telling you a quick story. Over the past few months, I’ve had the privilege of spending time with three personal friends who are private wealth managers. All three are very successful, oversee portfolio’s of hundreds of millions, and have a track record of beating the S&P Benchmark by double digits. As I spoke to them about their strategies in approaching the current market, they all had one thing in common. Huge portions of their portfolio are currently in cash, and have been for months. I never asked them to tell me the specific percentages, but one of them (the oldest of the 3) volunteered this: “The largest % of our portfolio is currently in cash”.

In response, I asked: “Forgive me if this is a stupid thing to ask, but why would the largest percentage of your portfolio be in cash while we’re in the middle of a historic Bull Market?”

He replied : “Bull Market?? BULL SH#T!!.....If anything, we're in a historic Bull bubble.”

We both laughed as he began to explain his meaning. He was referring to the current A.I. craze and was comparing it to the Dot.com bubble of the early 2000’s (which we’ve written on at length). He’s structured his portfolio in preparation for the A.I. bubble to burst. If/when the collapse comes, they’ll be prepared and pour in with cash. But that brings us to what we want to discuss today. Are these guys, and so many other seasoned Wall Street veterans correct in their “fearful” stance toward this market? Or is there something else driving this market that makes everything we’ve learned in the past difficult to rely on for predicting the future? The reality of it all, is that WE ARE in a historic Bull Market, that isn’t (currently) showing signs of slowing down. Will it eventually? Of course it will. But one thing that makes this Bull run stand out in comparison to ones in recent memory...is that people are scared; and that fear is causing many to miss out on the potential gains of this historic market. Last Friday, The Wall Street Journal published an article titled: “Why Your Fund Manager Can’t Beat Today’s Stock Market”

The article states that only 18.2% of actively managed funds that compare themselves to the S&P 500 are currently beating it. Yet at the writing of this letter, Prospero is beating the S&P 500 by 90%. We don’t say that to brag, but to demonstrate that this market is different, and it’s going to take new tools and a new framework to succeed. Prospero’s unique system gives us those tools and that framework. The proof is in the numbers. In the Macro Update of this letter, we’ll go into more detail on why we think this fear-driven boom cycle is occurring, and how Prospero is uniquely positioned to take advantage.

A WORD FROM OUR CEO

Had a good week betting on Tech as our signals dictated and we sit beating the S&P 500 by 90% annualized, with a win rate of 62% against SPY benchmarks.

For newer readers linking our short intro + learning videos.

Back to normal streams this week! Monday 7/8 at 11 AM EST and Wednesday 7/10 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Bull Sh#t?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

In the intro to our letter we talked about how two things are occurring simultaneously. First, we’re experiencing a bull market that has made historic gains. Second, many people, (including hedge fund managers) remain fearful.

Let’s look at this data a little more scientifically. CNN created what’s called the “Fear and Greed” index. It’s an index that gauges market sentiment. Fear meaning people are assuming a market collapse. Greed, people are assuming the market will continue to rise. For example, at the height of the 2021 Bull Market, the index was pegged on EXTREME GREED. We were in a state of market euphoria. Everyone and their grandmother was buying stocks and leveraged to the hilt. Pre-Revenue Companies that had no earnings would skyrocket on pure speculation. Market Breadth was expanding into just about every sector. But sure enough, it all came crashing down. The Bear Market of ‘22 followed and it was a bad one. But check out the chart below (CNN’s Fear and Greed Index Chart). Something is VERY different about this Bull Market.

Through much of September and October, as well as the beginning of April until last week, the Fear and Greed Index has been pegged on FEAR. In early April it was resting close to EXTREME FEAR. All the while, the market keeps going up and breaking new all-time highs. Last week we hit even more all time highs and the index slightly increased to Neutral.

We believe that one of the reasons for all the fear is that several reliably historic indicators of market decline keep popping up. Market breadth stinks. Most sectors are negative. Small Caps just had the single worst six month start (compared to S&P) in history. Economic confidence is weakening. Geo-Political Tensions are high. The Fed hasn’t lowered interest rates in forever. I could keep going. But THAT is why hedge funds are piling into cash.

But here’s my question: With this market’s meteoric rise, shouldn’t we be pegged at Extreme Greed by now? Remember the old phrase that EVERYONE uses: “Buy when others are fearful. Sell when others are greedy?” According to that statement alone, shouldn’t we be buying, not stock piling cash?

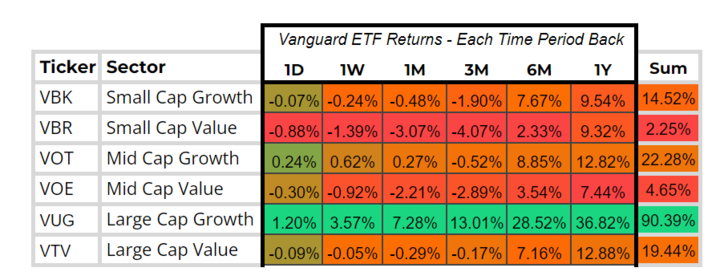

In the cap analysis below, you’re going to see a physical picture of WHY hedge funds are fearful and underperforming this Bull Market. Because there’s only one Cap that is performing consistently well. Large Cap Growth. (A.I) According to the Wall Street Journal, we’re in a stock pickers market, but there's only a handful of stocks worth picking. We’re in uncharted waters and people are fearful and making mistakes based on old metrics.

We think it is important to take a step back here and ask ourselves what fair expectations are. We were told last year that 2024 would be a tough one if we didn’t get rate cuts. Well they haven’t come yet and it hasn’t been tough. AI is showing us it can help the market break more rules - such as market breadth is needed for a Bull market. So why bet against this existing trend that AI can carry a Bull market? When all we have seen is that it can - in what might be a permanant shift.

The bottom line reason for why Prospero is beating the S&P by over 90%, is because we have an amazing new tool that helps us see past the noise and clamor and fear of the outside world, and calmly points us to what works and what doesn’t. What we’re not saying is to pile into the market and be greedy. There are certainly economic headwinds. That’s why we hedge here at Prospero. But at the same time, while our numbers are Bullish, we’ll remain bullish and put our money where the new tools tell us!

CAP/VALUE ANALYSIS

As you’ve heard us say many times, Large Cap Growth is a “Proxy for A.I”., meaning Large Cap Growth is the main driver behind this historic bull run. The table below is a stunning picture of WHY we are experiencing a historic bull run, while at the same time the “Fear and Greed” index spends a good amount of time on the “Fear” side. Check out the table below.

Large Cap Growth is 7.28% up over a 3 month period. Everything else is negative or barely positive. That spooks a lot of people. But it doesn’t spook us, because Prospero’s indicators have kept us focused on where the growth is.

On a positive note, we’ve seen some strength in Consumer Discretionary. That should begin to impact Large Cap Value, which is exactly what we see happening above. As I mentioned earlier, Small Cap Growth continues its historic lag in comparison to its Large Cap older brother. As a matter of fact, the Russell 2000 just had its worst first half to a year in HISTORY. (via @WinfieldSmart) At some point (historically speaking) there will be a mean reversion in that sector. When it starts to move, it will likely move FAST.

But the important question is will AI correct down eventually or will Bull breadth come up? Hard to say, especially with an important election looming but we do know our indicators, especially QQQ Net Options Sentiment have helped us stay ahead of the curve and we expect that to continue.

NET OPTIONS SENTIMENT

See the graph below. As you can see, our QQQ Net Options Sentiment Numbers have come back up (after dropping in late June), into the mid-50’s. This is SOLIDLY in our Bull Zone. We remain bullish until we see those numbers begin to drop. In light of QQQ’s ETF reaching all time high’s over the last week, a corrective pullback could happen at any time. But as of right now, the market is buying any and all dips. Keep in mind that any time you’re this far into a bull run, wisdom is merited. But simply based on our Net Option Sentiment numbers, it’s likely we haven’t seen the end of our growth.

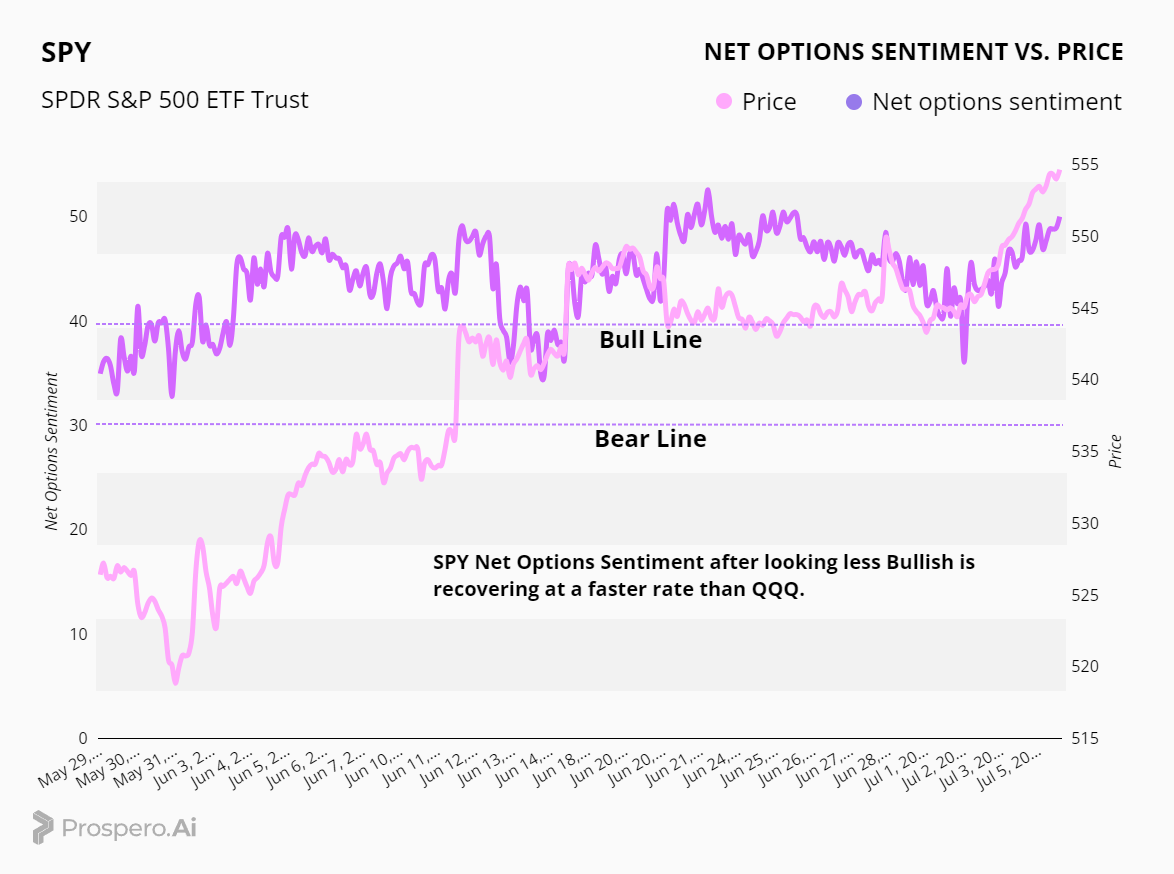

See the graph above. Our SPY Net Options Sentiment numbers showed encouraging signs this week. After dipping for most of the month of June, they’ve turned a corner and are on a strong upswing. Stocks in the S&P 500 like Apple, Microsoft, Amazon and Tesla, (plus Consumer Discretionary stocks like Costco and Walmart) which previously have lagged stocks like Nvidia and Super Micro Computer are catching up and showing strength.

Keeping at these Bullish levels.

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

SECTOR ANALYSIS

See the sector analysis table above. Two things to pay attention to here. First, Consumer Discretionary came real close to matching Tech’s success over the last month. Interestingly, stocks like McDonalds and Coca Cola have been showing up on our “Short Term Bull” picks over the last week or so. This shows signs people are thinking there might be value in Consumer Discretionary but leaning towards more comfortable names at first. Second, Communications is showing signs of a comeback with a very strong week. We may eye a re-entry on an old favite META. Growth in both of these sectors are positive signs of market breadth expansion and bode well for continued growth.

PORTFOLIO STRATEGY

This week QQQ remains stronger than SPY but we see more growth potential in SPY while QQQ remains stagnant. Therefore, this week will require focus on diversification and a healthy balance within our long / short ratio to hedge our continued Bullish position on tech. The overall strong performance of QQQ and SPY Net Options Sentiment nets us a Bullish stance - 6 longs and 4 shorts.

Long / Bull Moves - Link to Below Picture

Long / Bull Moves - META add / AVGO, MSFT, BKNG, SMCI, and LLY holds / CELH, GOOG drops

Adds

META fell off our list for a few weeks due to high Short Pressure / Dark Pool but it is back to the top of our Screener now and an obvious add.

Holds

Lots of Holds this week because we are confident about our position in the market right now. AVGO, MSFT, and BKNG were obvious picks due to strong signals and high position in the screener ranking. Their sectors are also doing well and fit our portfolio strategy with regards to the strong tech position and diversification by holding a consumer cyclical stock. META won over GOOG due to better Screener performance. Despite being filtered out, we continue to feel bullish on SMCI as tech continues to do well. The same goes for LLY which is pretty consistently performing well.

Drops

CELH is a drop due to low position in the screener. GOOG is a tougher drop but we are not as happy with its trend in Net Options Sentiment especially contrasted with META.

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - NEU, DEI, CRI adds / AVT holds / KSS, BOH, and AMED drops

Adds

NEU and DEI are strong adds with good technicals and a strong position in the screener. CRI has strong technicals and is a good hedge against our Consumer Cyclical hold. We aren’t convinced Consumer Cyclical can hold this run.

Holds

AVT is high up in our screener with good technicals and maintains balance in our tech-heavy portfolio.

Drops

KSS was dropped due to poor performance in our screener. BOH and AMED were filtered out and are ranked very low therefore we feel confident about dropping them.

Portfolio Allocation

6 Longs: AVGO, MSFT, BKNG, META, SMCI, LLY

4 Shorts: NEU, DEI, AVT, CRI

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.