Part of what we’re doing today in this letter is singing the praises of Canada. Why? Because it’s been a great week here at Prospero, where we were able to make back a lot of the gains that we lost in a very tough week last week. Much of our success can be attributed to two things. One was that Canada became the first country in the G7 to cut interest rates last Wednesday. This caused a rally in the US Stock Market that saw some serious gains that Thursday. Thank you Canada! The second thing that contributed to our successful week, was an uptick in our QQQ Net Options Sentiment that gave us the confidence to go “risk on” with Tech BEFORE the rally started. When we saw the uptick in our QQQ numbers, we went much heavier into tech l and it paid off. There are times our Net Options Sentiment Numbers point with strength and clarity towards key decisions and this week was one of them. The behavior we witnessed points to some institutions anticipating the rate cut announcement and getting more aggressive with their tech bets before the news arrived. Prospero saw it coming as well! Our CEO George Kailas often says: “The retail investor can’t beat hedge funds, but you can walk in their shadows” We walked in a big one this week and reaped the benefits of it!

For those wondering why Canadian rate cuts would move our market, it is that it applies more pressure to all G7 countries to follow suit . Or risk heavy criticism if they were laggards on cuts and the economy faces a “harder landing” from inflation than others.

A WORD FROM OUR CEO

We recovered nicely on the back of clear signaling from QQQ Net Options Sentiment and ended the week beating the S&P 500 by 81% annualized, with a win rate of 62% against that benchmark.

For newer readers linking our short intro + learning videos. Only one stream this week - Wednesday at it’s normal 3 PM EST time.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Canadian Bull ‘eh?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

Last week’s Net Options Sentiment levels from the 6/2 letter:

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Last week was a crazy week with rate cuts from Canada and then a hot, unexpectedly positive jobs report that had the market activating in a highly volatile way. As we approach the coming trading week, let me take this part of the letter to give you the good, the bad and then the ugly. Here’s the good stuff. One, Apple has a marketing event that is supposed to highlight their advancements in A.I. That could be a strong catalyst for the market if something revolutionary gets announced. Two, the Bank of Canada’s move to cut interest rates puts pressure on Fed Chairman Powell to cut rates here in the U.S. The odds of a rate cut in September just got moved up to 50/50. Finally, our QQQ Net Options sentiment continues to show Bullish movement, even as markets dipped on Friday. Hopefully that is a sign of good things to come. Now here’s the bad stuff. Traditional, historic market indicators are sending mixed signals. For example: The McClellan Oscillator swung from an extreme low of -100 to +50 in a very short amount of time. In the last two years, we ‘ve only seen that happen twice. Oct 2022 & April 2023. Both times resulted in significant upside in the market. (via X @gameoftrades_). But at the same time, there are several indicators that demonstrate market breadth that are historically bearish. Which way will it go? Finally the ugly. U.S. existing home sales just fell below its 24 month simple moving average. Every time this has happened since the early 1970’s (50 years) it’s ended in a recession. We live in fascinating geo-political and macro economic times. Prospero will continue to move forward in a cautiously bullish way as we approach the coming week.

CAP/VALUE ANALYSIS

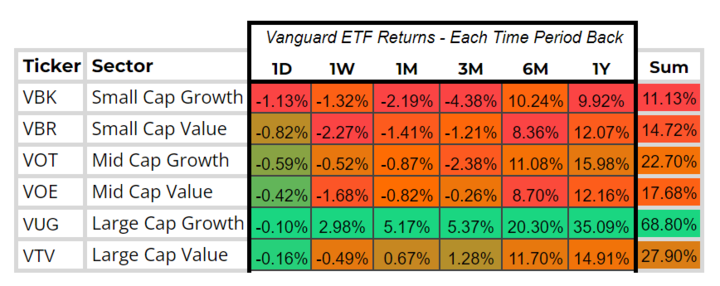

See the chart below. You can see why we had a great end to the week. Our decision to load up on Large Cap Growth (Tech) on Wednesday paid off. We hope that this chart has been helpful over the last few weeks, because it’s pretty obvious where the growth has been. It’s also been obvious to see who has struggled (Small Cap & Value). Interestingly, the Russell 2000 (small cap index) has been down by greater than 10% for more than 600 consecutive days. This is the 3rd longest stretch in history! (Via @SethCL). Rate cut easing has been historically bullish for Small Caps. Wouldn’t surprise us to see a rally after a cut in the fall. But until then, we’ll be keeping our eyes open for shorting opportunities.

NET OPTIONS SENTIMENT

See the chart below. Look specifically at the dotted line with an arrow. That is the moment we realized our QQQ Net Options numbers were skyrocketing higher, even though the price action stayed below it. That kind of divergence tells us something is coming. We loaded up on Tech and reaped the benefit of it. If you’re an active trader, but not taking the time to watch our alerts and read the trading letters, you’re missing out on plays just like this. QQQ ended the week showing continued strength but we will be watching for a continuation tomorrow. We are going to stay aggressive on tech accordingly, but remain cautious and watchful because of all the macroeconomic craziness.

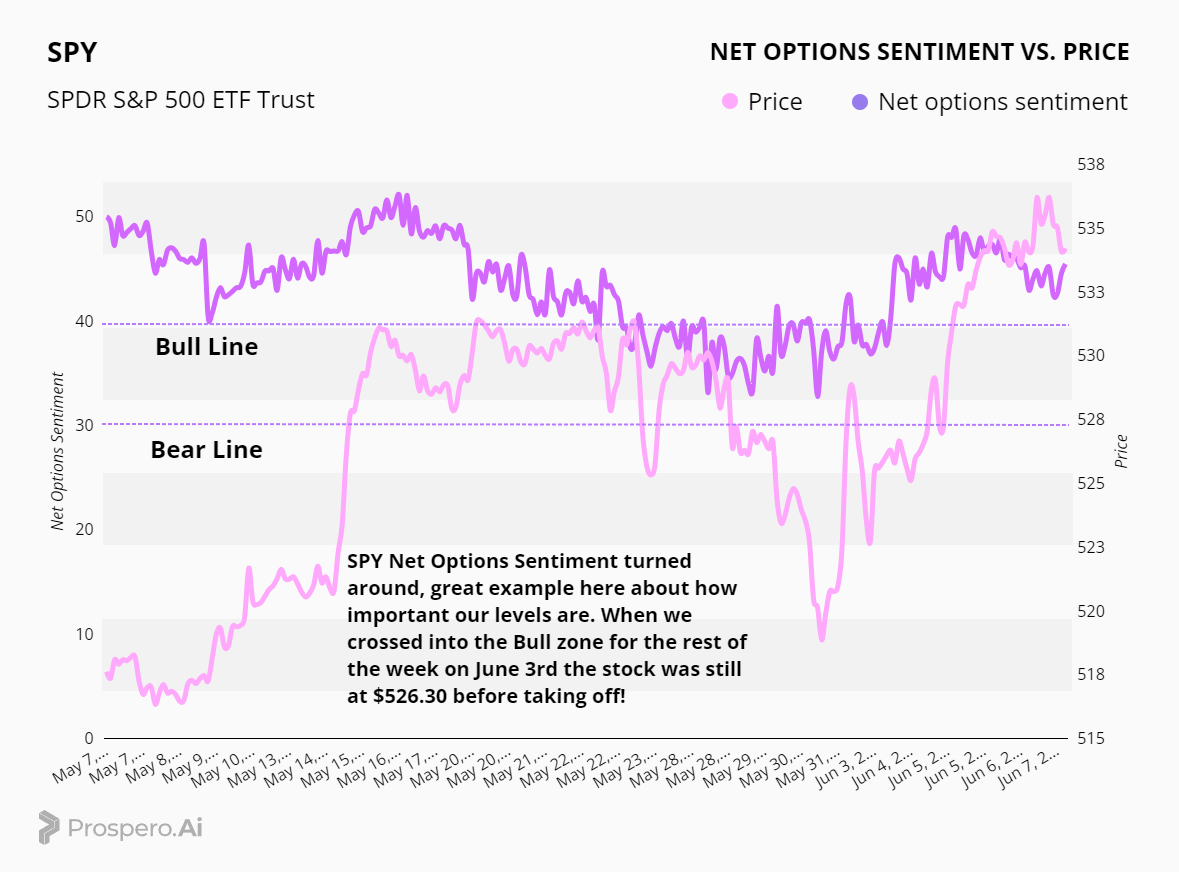

See the chart above. I’m hearing more and more stories of some of the top traders on X utilizing Prospero’s Net Options Sentiment Numbers, and this week is a great example of why. On June 3rd, our Spy Numbers crossed into the Bull Zone while its price action was still lagging. This, when added to the huge uptick in QQQ Options Sentiment Numbers gave us the confidence to swing bullish in our portfolio and we had a fantastic week as a result. We saw a small downward trajectory toward the end of the week, but our SPY numbers are still solidly in the Bull Zone. Levels were spot on last week so we will leave them there.

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

SECTOR ANALYSIS

Over the last couple of weeks we have looked for short opportunities in Utilities and we were right to make that decision. We saw Utilities begin to soften and adjusted our portfolio accordingly. They were down a whopping -3.44% for the week! Tech has had an amazing month, Communications is back to showing strength alongside and Healthcare is beginning to look strong too. We will emphasize those strength Sectors and target others on the short side until we see a shift away from that strength.

PORTFOLIO STRATEGY

We are doing cautiously Bullish a little different this week with QQQ Net Options Sentiment looking stronger than SPY. We will lean more heavily on higher risk tech longs and balance that out by going even long / short (7 each) and diversify our shorts to balance that risk. The way the signals ended the week point to Tech being the catalyst for on going Bull movement.

Long / Bull Moves - Link to Below Picture

Long / Bull Moves - MSFT, NVDA adds / AVGO, LLY, META holds / PDD, TDG, FANG, APO, ARCH, SMCI drops

Adds

Overall lack of strong technicals this week, but we have two adds: MSFT and NVDA. MSFT is ranked highly in our screener and has strong technicals. Additionally, the Tech sector has been doing well this past month solidifying our Bullish position on this pick. NVDA was chosen for similar reasons despite being filtered out and a dip in its net options sentiment trend. It continues to show strength but due to elevated Short Pressure and Dark pool we will potentially exit fast if the week starts slow.

Holds

AVGO continues to hold the edge over MSFT as it ranks higher on our screener. Its net options sentiment trend reinforces this pick as a hold. LLY presents with strong technicals and a high ranking. Healthcare overall has been doing well and we want to ride that wave. Lastly, META, while filtered out, has been doing very well alongside its sector allowing us to remain Bullish on it.

Drops

PDD, TDG, FANG, APO, ARCH all experienced poor technicals, were ranked lower on our screener this week, and are in sectors who are not exhibiting a Bullish trend. SMCI also presented with poor technicals and with two Tech adds we decided to limit our exposure to Tech by dropping it.

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - CALM, CCOI adds / WEN, PBR, BXMT, LPL, WEN, POR hold / FLO, MSM, KW, APT, AVA, CGNX drops

Adds

Before looking at the shorts we weren’t even sure we wanted to hold this many but CCOI and CALM were doing too well as Bears in these Screener with great technical setups to match and they were too good to pass up.

Holds

BXMT, PBR and LPL all were obvious keeps. WEN and POR were closer to drops because of screener performance but as they were in two sectors we wanted to target that tipped the scales to keep them.

Drops

MSM, KW, APT, AVA and CGNX did not perform well enough in the screener to hold, especially with all the other short picks being held. FLO could have been held if CALM didn’t have a better setup in Consumer Defensive.

Portfolio Allocation

7 Longs: AVGO (2X), LLY (2X), META, NVDA, MSFT

7 Shorts: BXMT, WEN, CALM, CCOI, PBR, LPL, POR

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.