Have you ever heard someone say, "I learned that lesson the hard way?" They're referring to some valuable life lesson they learned by failure. Me? I'm a big fan of learning lessons the easy way. When I say "the easy way", I'm talking about connecting yourself to people that are smarter and more experienced than you and learning from them, before you make the mistake. And that is one of the many things I love about Prospero.ai and specifically working with our CEO George Kailas. George is a teacher at heart and he loves helping the everyday, retail investor learn the nuances of high level trading and investing. How cool is that by the way? Well today, we're going to talk about a subject that ought to help just about everyone reading this letter, and that is getting your mind around a risk vs. reward profile before entering a trade. I don't know about you, but for me, learning when to get in and out of a trade has been one of the most difficult aspects of trading for me. And at the same time, learning the discipline of thinking through a stock's risk vs reward profile has radically changed my personal performance (for the better) over the last year or so.

For our lesson on risk vs. reward, let's talk about a company that just went public in late March and has gone on a parabolic run since then (up 268%). The company I'm referring to is CRWV (Coreweave). When you learn about what they do as a company, their crazy price increase actually starts making more sense. In simple layman's terms, Core Weave rents high powered GPUs (like NVDA's Blackwell) to companies at a fraction of the cost of the company purchasing them. It's a brilliant business model. Many companies have a need for massive computing power, but they don't want to spend the money to buy, manage and build the infrastructure to support those super expensive GPUs. In light of that amazing business model, they saw a CRAZY amount of revenue growth over their first quarter as a public company.

But here's the question we want to address today. After its parabolic run, is now a good time to invest in CRWV? It's growing revenue at an incredible rate. Its momentum has been on an upward trajectory for almost the entire first quarter. And on top of that, its short borrow rate is high, making it a possible candidate for a "short squeeze." A short squeeze occurs when a stock is being shorted at a high level (people are expecting betting it will go down in price). When a stock's short borrow rate is exceptionally high; if that stock continues to rise in price, as the stock increases in price, those that are shorting the stock, start losing exponentially more money. If that continues to happen, there comes a point where holders of shorts will "cover" or buy back their positions. If enough people cover their shares at the same time, this can cause a parabolic upward increase in the stock. If you happen to be long in a stock when it "squeezes", you can make a ridiculous amount of money. But here's the question George wants us to discuss today…

Is now a good time to buy CRWV? Let's take a minute to evaluate the risk vs reward profile of going long on CRWV. Here are some things to consider:

1. How does CRWV's valuation compare to other similar companies? For example, when considering whether to buy a stock, you need to compare things like the company's revenue growth and P/E ratio, to similar companies. In this case, let's compare CRWV, SMCI and NVDA.

Let’s start by comparing P/E ratios (price per earnings) for 2024/25 and projections through 2027/28.

CRWV: Next year: -68.78, +2 Years: -262.84. +3 Years: 105.14

SMCI: Next year: 24.02, +2 Years: 17.61. +3 Years: 11.45

NVDA: Next year: 35.4, +2 Years: 26.89. +3 Years: 22.43

It is pretty clear that you are paying a hefty premium on the growth of CRWV. And sometimes that is definitely the smart move. But that is often the case when incumbents are not growing fast, which isn’t the case for SMCI or NVDA especially.

Now here’s a snapshot of the 3 year revenue projections for CRWV, SMCI and NVDA.

CRWV: projecting $16 B in revenue by + 3 years.

SMCI: potentially reaching $35–40 B by + 3 years.

NVDA: Continues to dominate with nearly 20% annual growth, heading toward $288 B in revenue by + 3 years.

Now you have to ask yourself is it worth paying that P/E premium when even in 3 years the projections are 42% of SMCI’s revenue and only 5.5% of NVDAs. Throw in the fact that NVDA owns 7% of CRWV, that price to risk ratio seems even heftier. Especially when you factor in that CRWV could grow faster but as a relatively younger business doesn’t it also risk new competition? Not to mention NVDA and SMCI could beat their growth projections as well.

2. It's important to remember that stocks don't keep going up forever. CRWV is up for 7 weeks STRAIGHT!! When you see a rise like that it's important to remember a principle called "Mean Reversion." Mean Reversion teaches us that stocks will eventually level out and come back to a median level of price action. This bad boy is way overdue for some mean reversion. Do you really think Institutions that got in at the beginning of CRWV's run are going to keep holding after a 281% increase? As we speak there is still some potential for a squeeze, but if the shorts do overpower, institutions that are long often take profit quickly which could cause an even faster and sharper decline. Retail tends to hang on too long waiting for further price increase that probably won’t come. If shorts don’t win out and it does squeeze, the reality is that since the stock has already gone up that much, the upside is limited. In the event CRVW does squeeze, smart money will take profit quickly and often leave retail holding the bag. One last thought. If it squeezes and you time the exit well you could put in an exit order or have a limit that gets blown past because most brokerages (especially ones like Robinhood) allow institutions to jump out before you.

Bottom line, the risk vs reward for CRWV right now would state that it's not a good time to go long. Full transparency, Prospero has recommended shorts to people close to us (0 Net Options Sentiment) and they have acted. But it is important to remember that institutions can be heavily betting against something and still get overpowered by retail and other opportunistic institutions. (Remember GME anyone?!)

Of course we think that CRWV has a great story for the future, but they are way overdue for a pullback on price action alone. Even with a squeeze we think it is only a matter of time before it reverts to a more reasonable valuation. Even with its fantastic long term potential. Not to mention with the market near it's all time high and concerns in the Middle East, that adds to the bear pressure.. Next week, I might tell you the story about the "argument" George and I got into about whether he should have bought ASTS last week. I told him that he should and he walked me through the risk vs reward profile and explained why we shouldn't. He made a fascinating point. He said: "Matt, even if ASTS goes up, the risk vs reward profile right now would tell you to not buy in…always trust the process". It was a pretty funny story I hope to write about. Regardless, this coming week should be really informative about what happens with both stocks. And by the way, be careful out there. Net Options sentiment is looking pretty bearish. But now a word from the man himself.

A WORD FROM OUR CEO

Last week was highly volatile but we still had some great picks and our paper trading portfolio is 100% above the market annualized with a win rate of 61% against SPY benchmarks.

Our short intro + learning videos get you up to speed on how best use our letters and app to increase your wins.

George will be traveling the next few weeks and the stream times will be reduced. Just one this week: Monday 6/16 at 11:00 AM ET

Track all of your investments in real time with our app. Prospero’s proprietary AI tech updates key options signals like Net Options Sentiment, Upside and Downside every 3 minutes.

CoreSqeeze

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Growth remains in charge, though the broad rally took a pause Friday amid ongoing global tensions. Mid-cap and large-cap growth were down 1.14% and 1.37% respectively, but still boast strong 3‑month returns (13.77% and 13.34%). Small-cap growth is still digging itself out of a deep slump (‑9.33% over six months), while value continues to lag—even small-cap value reversed earlier intraday gains and closed negative. Despite that, broader YTD momentum remains tilted toward growth, as investors continue to chase rate-sensitive sectors ahead of a likely Fed hold next week. Rallying sentiment around growth and energy earlier in the week has been wrestled back by rising geopolitical risks, with uncertainty suggesting that investors are waiting for any trade or conflict updates before deciding their next move.

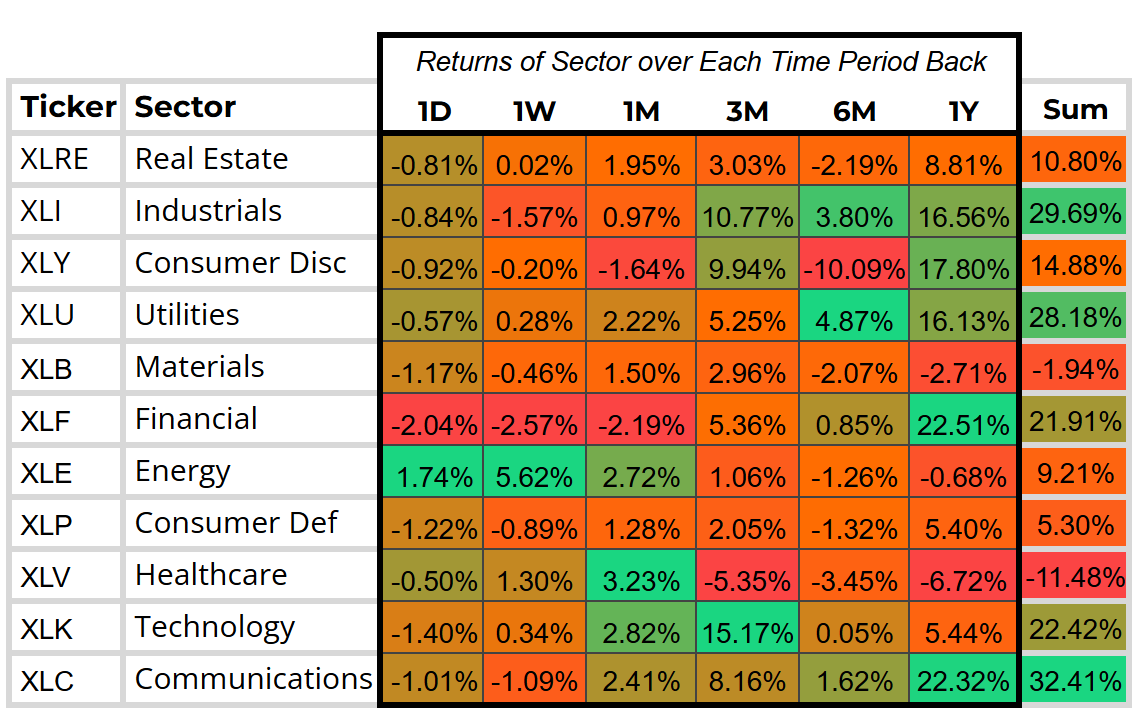

SECTOR ANALYSIS

The rotation into Energy, Tech, and Communications earlier this week met resistance today due to rattled markets. Energy led the way intraday on rising crude— but sector returns faded heading into the close. Tech, Healthcare and Communications still post monthly gains ranging from 2.41% in Communications to a respectable 3.23% in Healthcare, but they too pulled back on today’s risk aversion. Industrials and Real Estate saw a modest downtick but still hold steady for the month, meanwhile defensive corners like Consumer Defensive and Utilities saw fresh weakness as that flight-to-safety trade briefly evaporated amid uncertainty .

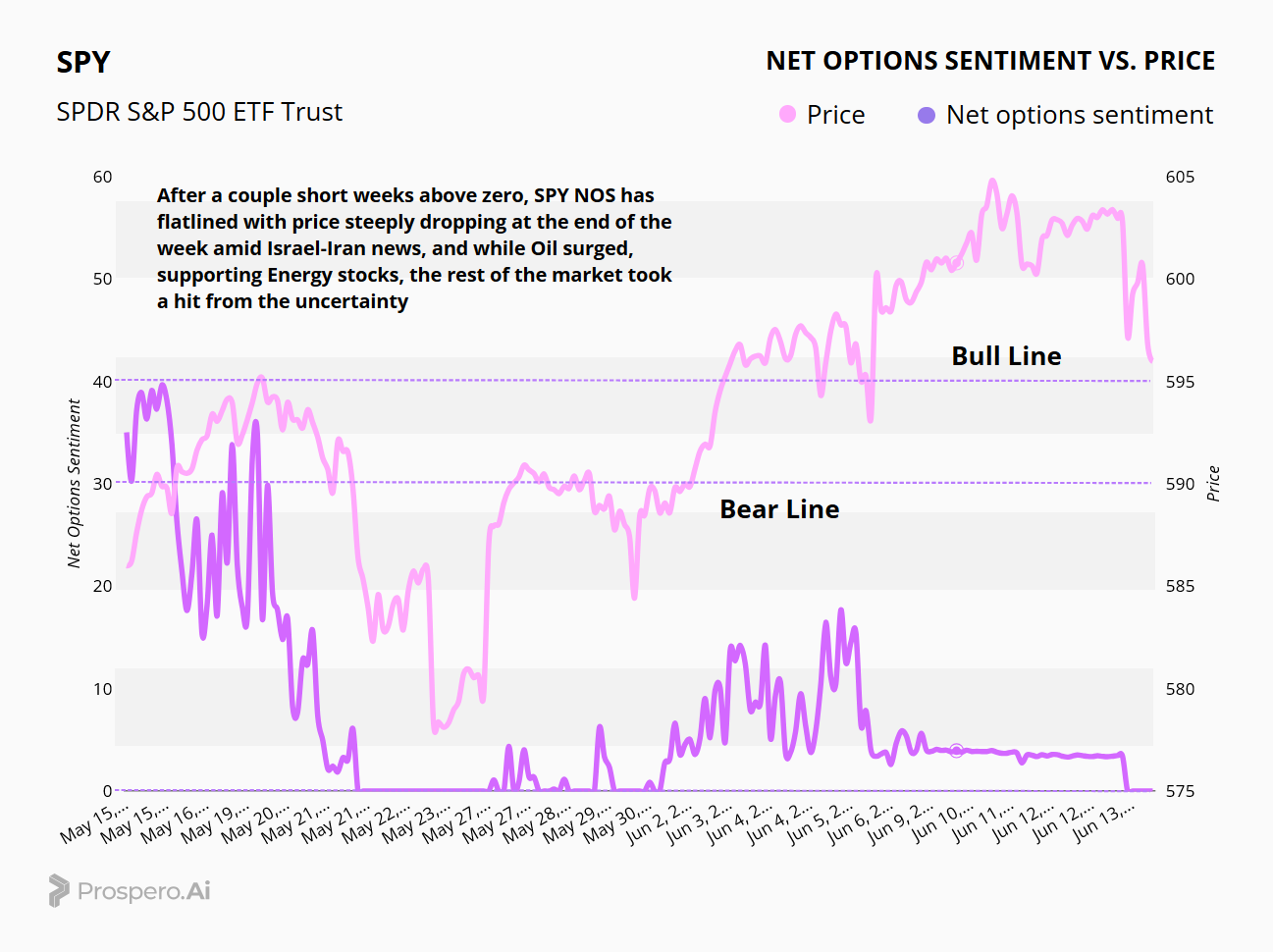

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS, after managing to tread water for a couple of weeks after flatlining in late May, returned to zero on Friday as conflict arose between Israel and Iran, with institutions favoring risk-off positioning as they prepare for the worst. While less sensitive to QQQ due to its broader exposure, SPY NOS was already struggling before being dealt yet another blow.

While QQQ NOS surged during the week amid hope surrounding a US-China trade agreement, both price and NOS saw a significant tumble amid fears over inflation and central bank tightening significantly affecting risk-averse Tech stocks. While QQQ NOS could see a rebound if tensions cool next week, it’s best to remain cautious when faced with this much uncertainty.

PORTFOLIO STRATEGY

As both SPY NOS and QQQ NOS abruptly dropped at the end of the week, we’ll be keeping a net short positioning as market sentiment continues to drop amid rising geopolitical tensions, which have fuelled inflation and yield concerns. Most of our moves were simple, replacing poor performers, especially in Tech, with stronger picks, though we did drop to one tech stock for our bulls due to QQQ NOS’s recent hit and continuing risk-averse sentiment.

Long / Bull Moves

Long / Bull Moves - FANG, CASY, PLTR adds / LLY and META holds / LNG, EQIX, KNSL, VRT, CORZ drops

Adds

Although PLTR ranked a bit lower on the screener, it was added for its perfect upside, with news that the company seems poised to win more government business supporting our move. CASY is a strong Cyclical pick, boasting solid Upside and near 90 Tech Flow, while FANG replaced LNG in Energy, offering stronger Tech Flow, Options Sentiment and Momentum.

Holds

LLY was a clear hold due to its incredibly strong perfomance on our screener, as it boasted almost perfect Options Sentiment. META was seen as another good hold in Communications, boasting +90 Upside, as well Tech Flow and Options Sentiment above 80, with it staying at the top of our screener for a few weeks now.

Drops

Dropping KNSL, VRT and CORZ were fairly clear choices as they dropped well out of our screener. LNG was dropped in favour of FANG in energy, while EQIX was dropped in Real Estate amid middling performance stretching as far back as six months ago.

Short / Bear Moves

Short / Bear Moves - NAVI, DBX, SSYS, PECO, IR adds / CRWV, HSIC, LEVI holds / JNPR, PERI, SJM, LUV, APPN, TSM drops

Adds

DBX and SSYS were fairly clear adds to replace APPN, TSM and JNPR in Technology, with both adds ranking in our top 10 and two of the drops ranking well out of the top 500. NAVI is an excellent pick in financials with +90 Downside, as well as being seen as a clear short as it has ranked top 5 in our screener the previous two weeks. PECO stood out in momentum score. And IR made the most sense as a larger cap stock ranked relatively high in the screener.

Holds

CRWV was seen as a very strong hold due to its strong Downside and our perception that it is overvalued, while HSIC was held to cover Healthcare as it ranked strongly this week. LEVI was kept in Consumer Cyclicals due to generally worse market outlook.

Drops

All 5 drops, PERI, SJM, LUV, APPN and TSM were pretty clear drops as they dropped out of our screener, with TSM dropping well out of the top 1000. JNPR was dropped in Tech in favour of higher performing tech picks DBX and SSYS.

Portfolio Summary

Long / Bull Moves - FANG, CASY, PLTR adds / LLY and META holds / LNG, EQIX, KNSL, VRT, CORZ drops

Short / Bear Moves - NAVI, DBX, SSYS, PECO, and IR adds / CRWV, HSIC, LEVI holds / JNPR, PERI, SJM, LUV, APPN, TSM drops

5 Longs: FANG, CASY, PLTR, LLY, META

8 Shorts: NAVI, DBX, SSYS, CRWV, HSIC, LEVI, PECO, IR

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.