The week we were expecting has played out. Volatility, like any kind of market can play to your benefit if you inform a strategy around the proper market expectations. A few general tips:

Don’t be afraid to stay on the sidelines with cash - As we will discuss below, this can mean being quick with an exit or not allocating the cash from incoming funds into the market as you typically would. As we discussed last Sunday - Warren Buffet is leaving cash on the sideslines, so why not you? At the bottom of this letter in the paid section we always put forth strategies to diversify all long, as well as an allocation to hedge a long portfolio with a single ETF. So there are different ways to handle risk management in this market type, the above is just the least advanced one that may be the best suited for most.

You do not want to make rash decisions but it is ok to be quick to escape, even a new position, as long as it is informed by a process. Take PG:

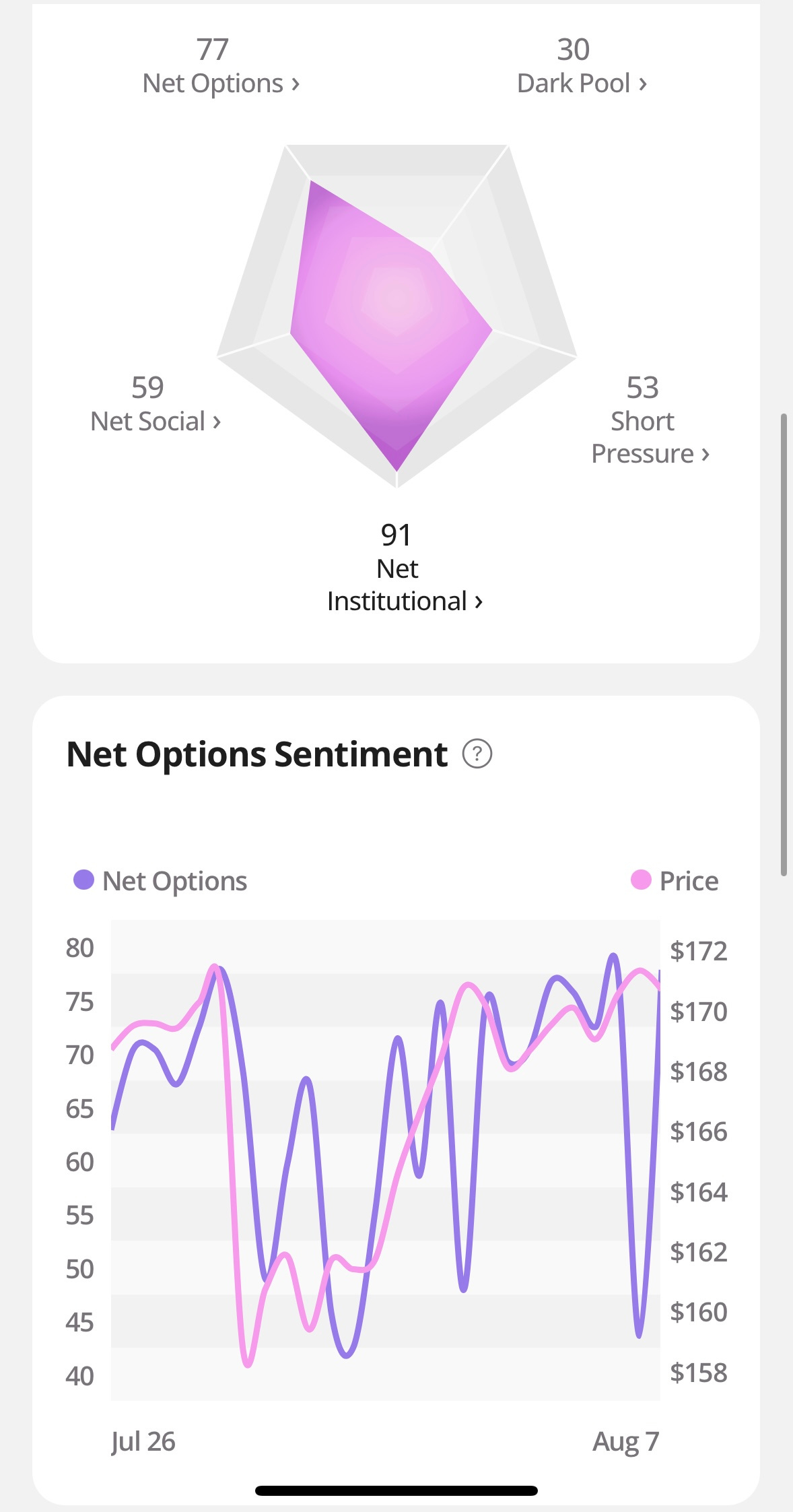

That is a lot more volatility in Net Options Sentiment than we would normally expect from PG. We got in on the 6th because you can see that volatility stabalized and we were seeing consistent higher lows. This was identified by a higher average Net Options Sentiment from our new “movers” trade alert signal.

We were also quick to recognize that the thesis was no longer in tact when Net Options Sentiment fell quickly into the 40’s. But this is why we always emphasize personal risk levels and time constraints. PG did well relative to the market after we exited. Nonetheless we are happy we applied our processs to the decision. That is all that matters and what we preach, if your process had involved more patience to see if the number recovered that would have worked well. The important part is you have a process and you stick with it, do not just sell because the price of a stock is going down.

A WORD FROM OUR CEO

Our conservative, market neutral strategy towards this volatility is paying off and we are beating the S&P 500 by 62% annualized, with a win rate of 63% against SPY benchmarks.

For newer readers linking our short intro + learning videos.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Deling with Persistent Volatility

Market Overview

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.