Welcome to the 27th edition of the Prospero weekly newsletter. In case you missed them, how Downside Breakout helped predict bank stocks and our SVB summary. You are receiving this if you downloaded our app or subscribed via Substack.

If you want early access to our free app alerts, sign up for an interview here to be a part of our pilot.

If you do not yet have the app:

Our CEO George Kailas did a YouTube stream last Friday to better explain how to get the most out of our app.

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

SPY and QQQ Net Options Sentiment attain key re-alignment signaling stability is returning

From our 03/19 letter:

“Bullish if: SPY Net Options Sentiment > 10 AND QQQ Net Options Sentiment > 30”

Our bull conditions were surprisingly met on 03/20 which is a great sign for the market. Diverging Net Options Sentiment for these two key indices makes any trade riskier but the converse is also true and has us optimistic about Bullish trades.

QQQ returned 2.10% this week vs. .5% for the SPY. Pre-Market 03/20 to After-Market 03/24. But this could have been a much bigger week if not for Deutsche Bank (DB) fears. We do have to keep watch for these events but Federal Reserve's balance sheet implies liquidity stress is stabilizing, UBS says.

We did see both of these important metrics dip towards the end of the week but especially if SPY Net Options Sentiment moves up tomorrow 03/27, we could be in for a great week.

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

Potential Bull Mover - BABA (Alibaba Group Holding Ltd)

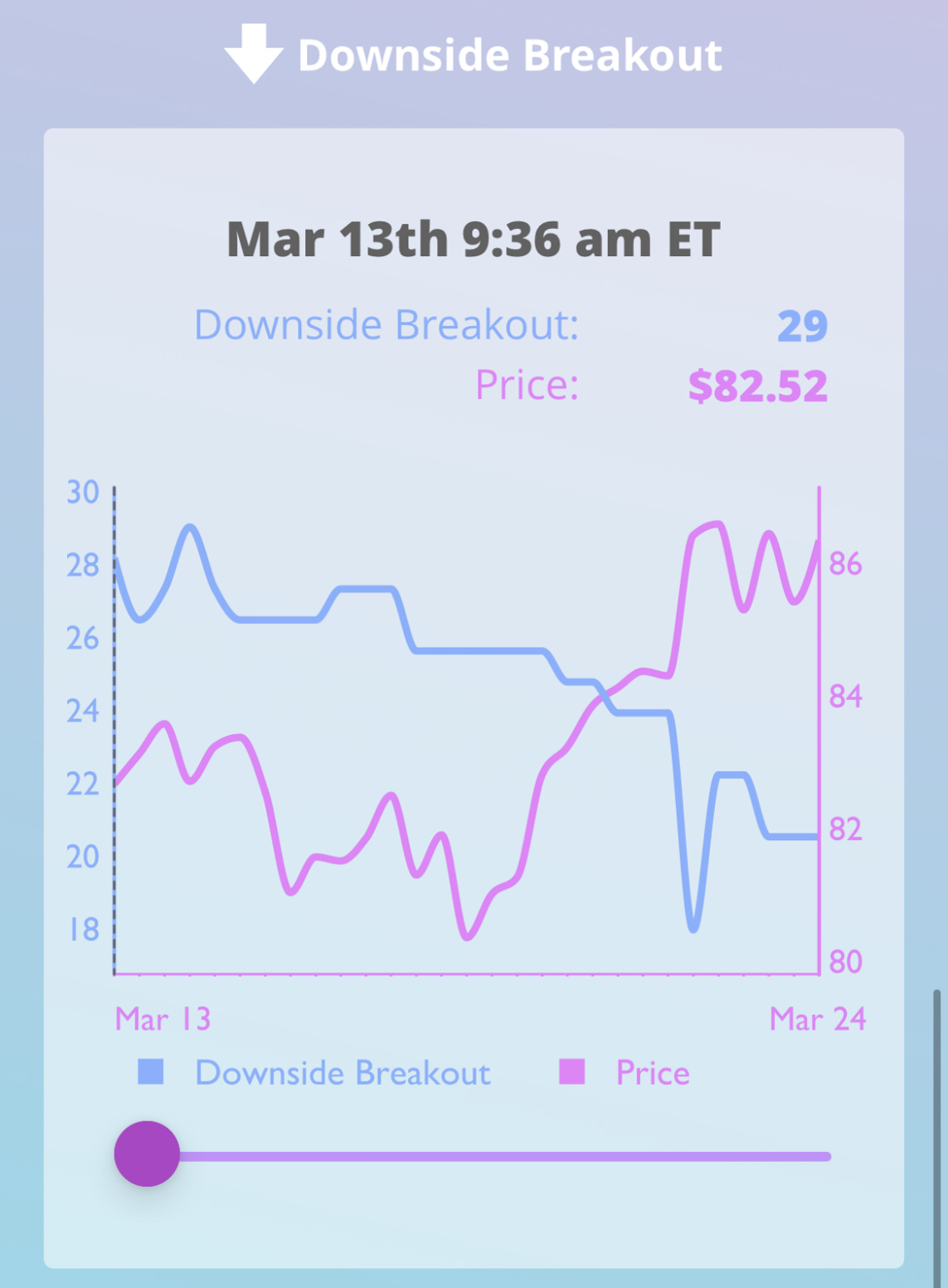

BABA looks strong all around. High Upside Breakout to Downside Breakout ratio. Profitability + Growth is well above average and Net Options Sentiment is trending in the direction of a big move. Also, Downside Breakout trending lower has been an interesting surprise as a Bull signal lately, and this trend looks good.

Bullish if: BABA Net Options Sentiment > 70, BABA Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

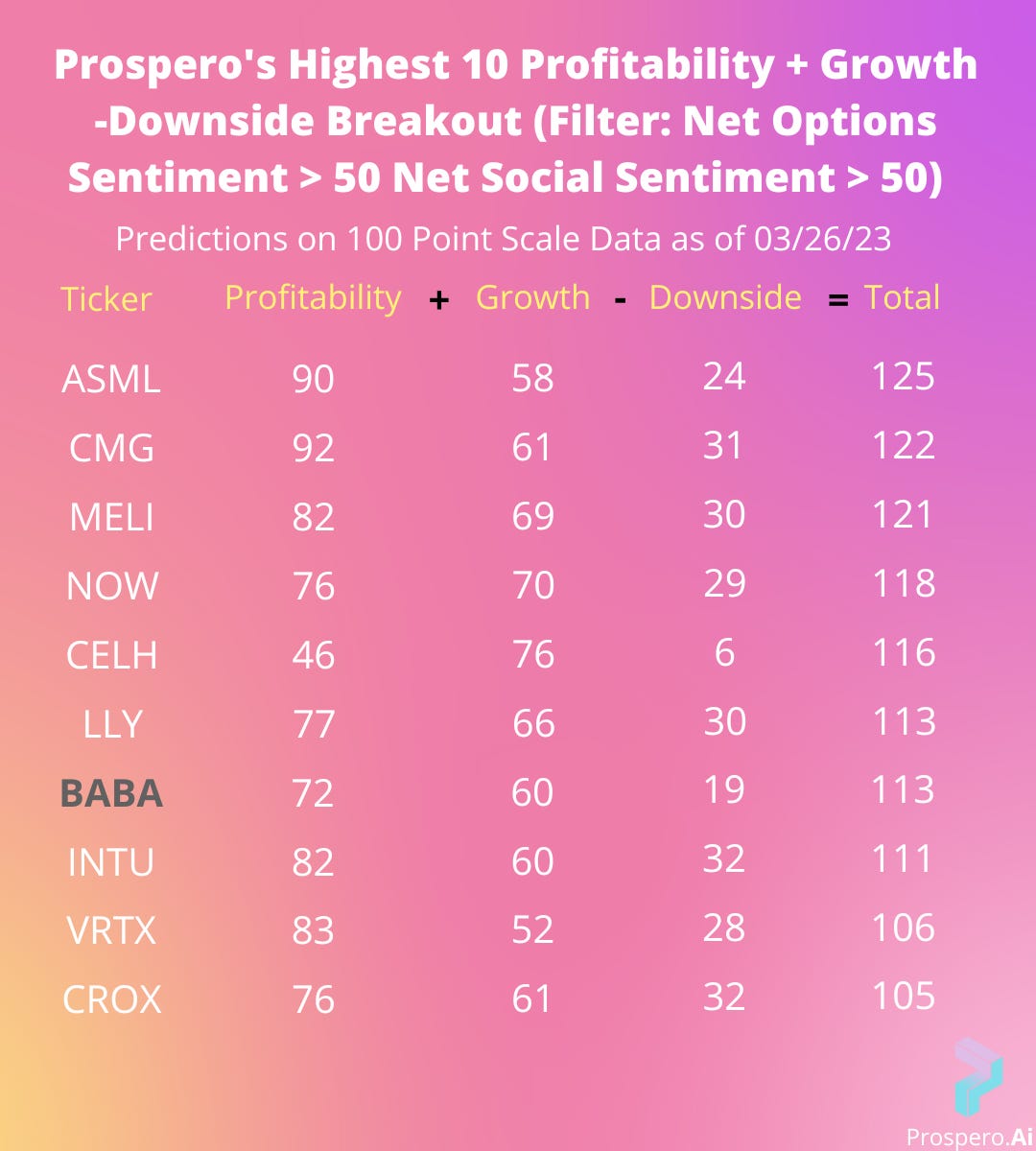

Reviewing the Bull/Bear Filters

It was a successful week for both of our filters, the Bear filter gained +1.88% on SPY and the Bull Filter +.02%. Keeping track of all of these stocks made it apparent that especially for a short term filter it is vital to have stocks refresh, otherwise it is too much app checking and math to total the scores to be useful. This is the next feature we are now working on. A filter of the day that updates live.

Without a live update these filters work best with a long-term focus. Below filters above average Net Options and Social Sentiment to raise chances of appreciation this week. In case of more bank turmoil there is downside protection with high Profitability and Low Downside Breakout. Add in high Growth to get stocks that could move up a lot when the market rebounds.

Potential Bear Mover - SLG (SL Green Realty Corp)

This was at the top of our Bear filter last week and it continues to profile well as a Bear.

This is about as good of a Bear set up as you can get. Each of the metrics is where you would want it to be. And the combination of very low Options and Social Sentiment as well as low Profitability and Growth is especially good.