DID WE DISCOVER THAT INSTITUTIONAL RISK APPETITE IS FALLING OFF A CLIFF!?

02/09/25 Prospero.ai Investing (193rd) Edition (Weekend)

Does the reality that Billionaires are building underground bunkers and Warren Buffett is sitting on a historic pile of cash concern you? I'm not a big worrier and I'm starting to worry. I've been paying attention to politics and world events since the early 90's, and I personally have this subtle, uneasy feeling that the world is about to explode. Can you relate? Well, if you've been a bit uneasy about the state of the world, put your seatbelt on, because what we're about to tell you is likely going to make things worse. Here's why…

On Friday, our CEO George Kailas and I had a zoom call to talk about how Prospero is beginning another investment round (stay tuned, we're going to eventually open this investment round up to YOU). But when I opened up the zoom call, George was clearly excited and didn't want to talk about investors. Why? He discovered something that he described with words like CRAZY, SCARY AND UNPRECEDENTED. Got your attention yet? Here's what happened. A couple of days ago, George was doing a deep dive on some of Prospero's signals- Upside and Downside - based on some user alerts to these normally stable signals moving 50+ points on various stocks. He ran a filter of Large Cap Companies to see their Call and Put Open Interest that was farther out than 320 days (end of this year). In other words, George was doing some research on companies long term call and put options for 2026. But when he ran the filter, what he found STUNNED HIM. Here's an abbreviated version of what popped up….

Let me translate what you're looking at. See that column with all the zeros? To get straight to the point, here's what that means. Every one of those companies HAS ZERO LONG TERM OPTIONS CONTRACTS PAST 2025. At first, George thought it might be a glitch, but he kept digging; and what he discovered shocked him. He found that 11% of Large Cap Companies, currently have NO OPTIONS CONTRACTS past December of 2025! George explained that he's never seen this before in all his years of research. I think the best way to explain what might be going on is to give you a summation of mine and George's conversation after he dropped the news.

My Question: "What is actually happening here?"

George's Answer: "Banks and Financial Institutions have risk metrics they use to originate Options Contracts (Calls and Puts). They usually do this years in advance. For example, TSLA and NVDA already have option contracts for 2026 and 2027. But many company’s options contacts aren't released that far in advance. But by now, most of the companies on that list would typically have new long term options originated to replace the expiring ones. That's really, really strange because the financial institution's goal is to sell as many contracts as they possibly can, and so it's absolutely crazy they haven't released new long expirations yet. There seems to be a concerted effort by banks and institutions to NOT originate long term options contracts on a suprisingly large population of stocks."

My Question: "Does that mean they know something bad is going to happen and they don't want to put any contracts out?"

George's answer: "No. For example, if they knew World War 3 was about to start, they would simply make calls really cheap and puts really expensive. There's a way to profit from every event. What's crazy is that there are NO OPTIONS BEING ORIGINATED. And it's not just one institution not releasing them. NONE OF THEM ARE, FOR ALL THOSE LARGE CAPS! It's as if, completely independent of each other, all these banks and financial institutions came to the exact same conclusion."

My Question: "Could this be a glitch in Prospero's numbers? Have you verified this outside of our data?"

George's Answer (in an offended tone): "Matt, you know me better than that! I've verified this from multiple places outside of our data. This is really happening and I'm concerned."

My Question: "Then what in the world does all this mean and what worries you the most?

George's Answer: "Again, you can price your way through ANYTHING the market throws at you. The only plausible reason why they haven't released the long term contracts for those companies, is when they ran the numbers through their risk metrics and their computer models either couldn't or wouldn't come up with reliable, consistent predictions! That worries me because institutions have spent billions in making these models to accurately predict the future direction of the market. This tells us that the world is so volatile and unpredictable, the banks' Billion dollar systems could be saying 'it's just too risky to release long term options for many stocks we normally would!' The last question I asked George was: "What in the world would cause such uncertainty that it would cause the long term future options contracts to suddenly not exist?" He talked about Tariffs and uncertainty in the government. He talked about the potential for crypto to disrupt stocks. He talked about rapidly changing advances in technology that could upend everything. He finally added: "Then throw in a few comments by President Trump about making Canada the 51st state and turning the Gaza Strip a shopping mall and it could be overwhelming the system". I didn't know whether to laugh or cry. The bottom line is that you and I are living in a time where the cliche, "Unprecedented times" are truly and actually…unprecedented. Trump's ascendency to the White House is potentially so genuinely disruptive to the status quo, that the old metrics no longer work. Maybe this is a really good thing. Maybe Trump has a plan for all this craziness and is actually saving the world. Or, this could mean that we're all screwed. If you believe the former, sit back and enjoy the ride. But if you believe the latter scenario, according to our data, you have about 10 months to finish building your bunker.

A WORD FROM OUR CEO

We made a new video to help people understand how All 10 Signals in the Prospero.Ai App Work. We also recently updated How do I use the Prospero.ai investing letter?

With our flexible positioning we have been able to maintain our edge and have maintained our outperformance beating the S&P 500 by 144% annualized, with a win rate of 71% against SPY benchmarks in our paper trading portfolio.

Normal stream times! Monday 2/10 at 11 AM ET and Wednesday 2/12 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

DID WE DISCOVER THAT INSTITUTIONAL RISK APPETITE IS FALLING OFF A CLIFF!?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

This week has proven challenging for all style categories, although growth remains favored, particularly in the Mid Cap space. Our app currently has a mid cap growth Screener on if you are looking for more long ideas. Value, as defined by the indexes, continues to struggle. The disparity in quality within the small cap space is exerting significant pressure on that sector. Additionally, large cap value is underperforming due to a lack of macroeconomic catalysts to drive positive surprises.

SPY/QQQ NET OPTIONS SENTIMENT

The SPY NOS continues to exhibit bearish trends as macroeconomic volatility impacts earnings calls. Since late January, we have not observed significant and sustained bullishness, and we anticipate potential disruptions ahead as earnings fail to meet market expectations. SPY had been looking stronger than QQQ but that has reversed which is a sign of just how uncertain/volatile of a time we are in. We are closely monitoring the situation and will remain vigilant for any catalysts that may alter the current outlook.

The QQQ shows a slightly more positive outlook but remains uncertain in its trajectory from a week ago, as big tech earnings were met with apprehension amid significant capital expenditure plans. We continue to observe bullish trends in select stocks within the sector and will proceed cautiously, staying true to our process.

SECTOR ANALYSIS

This week was challenging across all sectors, with no major wins. Energy experienced some upside as oil remains a strong play in volatile times, particularly with difficulties in Russian petroleum exports coming online. Technology had a slightly better week, with positive earnings from companies like Broadcom earlier in the week. Real Estate has been performing well for the better part of a month, as eased yields have provided meaningful relief to this already constrained sector. Consumer Discretionary and Industrials faced difficulties due to potential tariff and retaliatory tariff pressures, which are expected to loom large in the near future, coupled with the challenging foreign exchange situation.

PORTFOLIO STRATEGY

Both SPY NOS and QQQ NOS remain undecided and mildly bearish following last week's volatility, but we believe the worst is behind us and are therefore going net long this week. We maintain a similar outlook from a top-down sector exposure and market cap exposure perspective, aiming for diversification across both axes. On the long side, we plan to retain some of our positions and exit those that lack standout characteristics and fail to meet our diversification criteria. On the short side, we will seek to add downside protection through diversified shorts that balance our long exposure. 11 longs, 11 shorts.

Long / Bull Moves

Long / Bull Moves - PM add/ XYZ, META, APP, LLY, CAVA, AVAV, ROOT, ASTS, TMDX and COIN holds/ SNOW, PLTR, TSLA, VST and CRWD drops

Adds

PM was added for its high Tech Flow and sector diversification.

Holds

META was retained due to its standout Net Options, Tech Flow, and Upside Breakout. APP remained in our portfolio for its excellent Net Options and strong Upside Breakout. LLY was kept for its excellent Tech Flow and Net Options. CAVA was retained for it good metrics and market cap diversification. AVAV and ROOT were kept for their good Net Options, and sector and market cap diversification. ASTS was kept for its good Momentum, Upside Breakout, Sector and Market Cap diversification. COIN was kept for its excellent Net Options Sentiment and Upside Breakout. TMDX was kept for its Market Cap diversification and good Net Options Sentiment. XYZ was held but not in our Screener as we are updating the ticker. But we are long term Bullish on the new Goose release.

Drops

PLTR was dropped for its mediocre Net Options Sentiment. VST, CRWD and TSLA was dropped for their low Momentum.

Short / Bear Moves

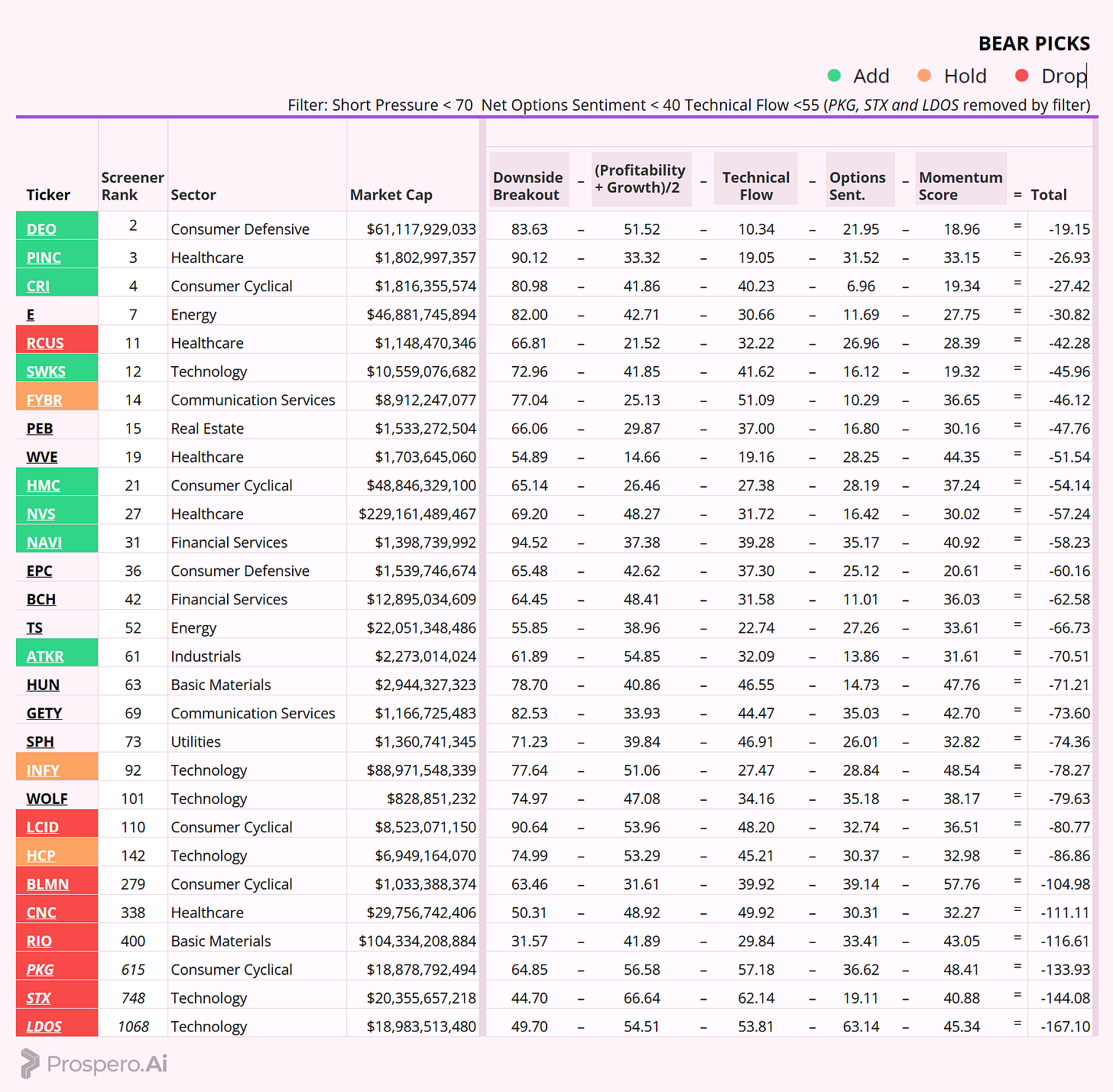

Short / Bear Moves - DEO, PINC, CRI, SWKS, HMC, NVS, NAVI and ATKR adds/ RCUS, FYBR, INFY and HCP holds/ RCUS, LCID, BLMN, CNC, RIO, PKG, STX and LDOS drops

Adds

DEO, PINC and CRI were added as top picks in our screener. SWKS was added for its large market cap and sector diversification, with low Net Options Sentiment. HMC was added for sector and market cap diversification. NVS was added for its low Net Options and Healthcare exposure. NAVI was added for its Financial Services exposure. ATKR was added for its low Net Options Sentiment.

Holds

FYBR was kept for its low Net Options Sentiment. INFY was kept for its large cap Technology exposure. HCP was kept for its mid cap Technology exposure.

Drops

LCID, BLMN, CNC, RIO, PKG, STX and LDOS were all dropped for their poor performance in our screener with no outstanding metrics. RCUS was dropped because PINC looked better as a Healthcare pick.

Portfolio Summary

11 Longs: XYZ, META, APP, LLY, CAVA, PM, AVAV, ROOT, ASTS, TMDX and COIN

11 Shorts: DEO, PINC, CRI, SWKS, HMC, NVS, NAVI, ATKR, FYBR, INFY and HCP

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.