About two months ago, my wife and I started watching a show called "SEAL Team". It's been out since 2017 and is finishing its 7th and final season this year. It follows the Navy's most elite fighting unit "SEAL Team Six" or "Devgru". They and other units like Delta Force (Army) are the tip of the spear for the U.S. military. When the government needs something really difficult done, they call in these guys. Well, about 10 minutes into the show, I was hooked. I have a friend who is a Navy Seal, who said the show is ridiculously accurate to real life.

The main character is named Jason Hayes. He's a 20 year veteran of the Seal Teams and he's seen more combat than just about any soldier in history. As a result of his experience, he had a reputation for always being right. He was a ninja at making the right call in the middle of a firefight. If he had a gut instinct about not going into a certain situation, his team listened. If he ever showed hesitancy, it was because of DISCIPLINE.

But as he approached the twilight of his career, PTSD and other cognitive issues began to plague him. He starts forgetting important details that put him and his team members in danger. When he finally admitted he had a problem, he began to question himself on the battlefield. This hesitation caused him to make even more mistakes. When he found himself pausing, not wanting to go into a difficult situation, he no longer trusted his gut. He was afraid to get his guys hurt.

All of a sudden, what used to be discipline, now was just good old fashioned indecision. There's a fine line between the two. Here's the difference

Discipline is driven by self-control….Indecision is driven by doubt.

Discipline is driven by data….Indecision is driven by feelings.

Here at Prospero, we constantly remind ourselves to make our decisions based on discipline. Why? The market can be one of the most humbling environments in the world. There's a reason why over +80% of traders are unprofitable. And we currently find ourselves in one of the most challenging markets to navigate in quite awhile. As a result, we lean heavily on discipline. We pick our battles wisely and only when we have the highest convictions do we "pull the trigger". But that begs the question: "ARE WE MISSING OPPORTUNITIES IN THIS MARKET?" The answer is yes, we are. But that is purely out of discipline, not indecision.

Let me give you two examples that will help you understand how we make decisions here at Prospero: XRX and SMCI.

The last few weeks we saw XRX showed up REALLY strong in our Bear Screeners and had max (100) Downside Breakout. But at the same time of the week, small caps were showing bouts of strength. So we avoided Xerox. Well, it ended up going down -16.58% for the week. Did we miss an opportunity? Yes, but us sitting out that "battle" was purely based on discipline, not indecision.

The other example was SMCI. It was showing up as a Bear candidate on Momentum Score but event driven strategies around things like predicting the outcome of an accounting manipulation scandal is highly risky. And something institutions with deep expertise in these matters are far better suited to predict. So even though Net Options Sentiment was in the 40’s, well below SMCI’s typical levels we passed on making it a Bear pick. The stock dropped a WHOPPING -44.89% last week as some new news on the shady accounting came to light. Perhaps if the market wasn’t so volatile we would have put a green light on this move, but at the end of the day, regardless of the outcome, we still think we made the right call. Our call was that it was too risky. Just because it ended up going the way Momentum score and benchmarked Net Options Sentiment would have suggested doesn’t mean it wasn’t also a risky move.

Here's out point. One of the greatest gifts you will ever give yourself as an investor is to not feel the need to jump into every trade. The best ones over the years are always the most patient. They wait for the perfect opportunity. They look at the data. And then b/c of discipline, they get in the fight. If you'll do that. More often than not, you'll win.

A WORD FROM OUR CEO

As discussed, we will continue to exercise extreme caution until volatility concerns around the election go away. (Reflected in Net Options Sentiement QQQ/SPY divergence) The defensive strategy has us sitting in again almost the exact same place as last week beating the S&P 500 by 66% annualized, with a win rate of 60% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! Monday 11/4 at 11 AM EST and Wednesday 11/6 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

RED, BLUE OR GREEN?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Portfolio Strategy

For the Macro Update, I don't think there's anything more important to discuss than the election. On Tuesday, November 5th the next President of the United States will be elected (hopefully). As of the writing of this letter, Trump is ahead in the polls…but barely. Four years ago he was behind at this same point. But at the same time, the betting odds have been slowly moving toward VP Harris. So, once again, it's simply too hard to tell who's going to win. And even if there was a crystal clear picture of who would win, we still don't have a clear picture of what the market is going to do. THERE'S NO BETTER EXAMPLE OF THIS UNCERTAINTY THAN THE DIVERGENCE IN OUR QQQ AND SPY NET OPTIONS SENTIMENT.

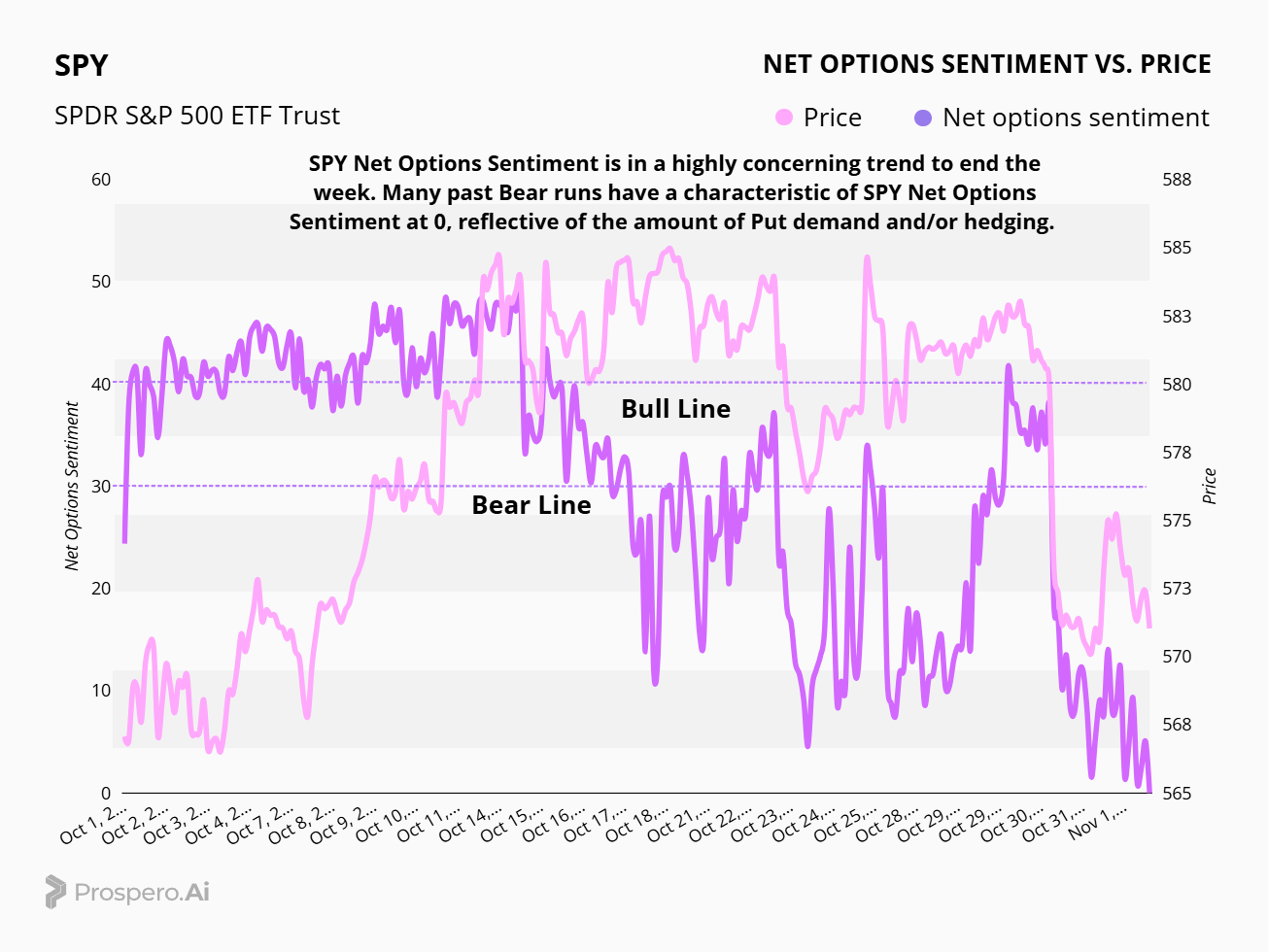

At the end of the week, QQQ Net Options Sentiment (tech) was firmly in our bullish zone and heading on an upward trend. So that means that Institutions are betting that the market will go up after the election? Not so fast. At the end of the week, our SPY Net Options Sentiment was sitting at (get ready for it)......ZERO. Zilch. Nada. What does that tell you? That means that institutions are hedging HEAVILY heading into this election. They are betting that tech will go up and hedging by betting that the S&P 500 will go down. That tells us that there is not much certainty heading into Tuesday. At Prospero, we are going to play some hard core defense until it's clear what we're dealing with.

CAP/VALUE ANALYSIS

Check out the Cap/Value Analysis Table above. If you take some time to study this table, it's a great example of the volatility in this market. Start by looking at Large Cap Growth for the month. It's up the most over every other cap. Now look at Large Cap Growth for the week. It was DOWN the most over every other cap. How do you trade that? It's simply too hard to make a call. So remain disciplined and pick your battles.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

If you read our Macro Update, check out the visual below. QQQ Net Options is showing strength after tech earnings and it is still firmly in our bullish zone. But before you get too excited, check out the SPY Net Options Sentiment Chart. There is a crazy divergence happening.

Look at the SPY Net Options Sentiment above. Ya'll, it's at ZERO. In the past when this has happened, it was often the beginning of a fairly significant bear run. Why? Because it was reflective of a huge amount of bearish hedging by institutions. This divergence in the QQQ and SPY has us concerned and we will remain extremely careful until this thing plays out. If you are long only in your portfolio, we strongly recommend hedging, heading into the election.

SECTOR ANALYSIS

If you're looking for a Bearish Sector to run with, based on this table, Utilities seems to be (thus far) the only reliable one. Despite the negative reaction to META's earnings, Communications is looking to be the most solid on the Bullish side. As of the end of the day last Friday, META and GOOGLE were both showing up on our Bullish Short Term list. TSLA and COIN, although they also got hammered last week, are showing very high Upside and Net Options Sentiment. But those are not recommendations, simply giving you the data. Anything can happen on Tuesday. If you choose to go long on Tech or Communications, it would be wise to hedge with some SQQQ.

PORTFOLIO STRATEGY

We keep our tactical positioning from last week, weary that we’re heading into an election cycle and want to reduce our exposure to key sectors, as low SPY Net Options Sentiment and increased market volatility. Still focused on Market Cap diversity and downside protection, we will run a smaller book: 4 longs 4 shorts

Long / Bull Moves

This week, as we head into election week, we're adjusting our tactical positioning from last week. Our focus remains on sectors with strong secular trends, but we’re cautious due to the notably low SPY Net Options Sentiment. With so much uncertainty we will continue to de-risk by avoiding small cap shorts and overconcentration of Mega Caps. The divergence of QQQ and SPY Net Options Sentiment dictates an even approach again 5 longs 5 shorts

Long / Bull Moves

Long / Bull Moves - BKNG, MCK, and TTWO adds / NVDA and FSLR holds/ META, APP LII drops

Adds

BKNG was an excellent pick, taking the top spot in our screener thanks to its strong momentum, robust tech flow, and favorable net options sentiment. We added MCK for similar reasons giving us some sector and market cap diversity. TTWO was included to enhance market cap diversity away from mega caps.

Holds

NVDA was kept due to it being recently added to the Dow Jones index with a stronger momentum score than APP. FSLR was kept due to its high ranking, market cap diversity, supported by high momentum and net options sentiment

Drops

We decided to drop META to reduce our exposure to tech mega-caps, and that it had weaker tech flow and momentum. APP was dropped for sector diversity reasons as well as that it had a lower momentum score and tech flow than its peers. LII was dropped due to low Screener performance.

Short / Bear Moves

Short / Bear Moves - EL, TGNA, PRU and SNX adds / GPK hold / FTV, STX, CTLT, SWKS drops

Adds

We added EL for its larger market cap, exposure to consumer defensive sector and low tech flow. TGNA joined the lineup due to its impressive net options sentiment and to balance out sector exposure on the long side. PRU was included because of its low net options sentiment and larger market cap to balance out the long side of the portfolio. Lastly, SNX was added to balance our tech exposure on the long side.

Holds

GPK was held due to good net options sentiment score and consumer cyclical exposure balancing our picks on the long side.

Drops

FTV, STX, CTLT and SWKS were all dropped due to their low placement in our tracker.

Portfolio Summary

Long / Bull Moves - BKNG, MCK, and TTWO adds / NVDA and FSLR holds/ META, LII and APP drops

Short / Bear Moves - EL, TGNA, PRU and SNX adds / GPK hold / FTV, STX, CTLT, SWKS drops

5 Longs: BKNG, MCK, TTWO, NVDA and FSLR

5 Shorts: EL, TGNA, PRU, SNX and GPK

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.