We are officially bearish. Why? Because Wall Street made a powerful statement on Friday through the market, then on Friday afternoon at 2:39 PM one of Wall Street's most powerful men made a bigger one; and we heard it loud and clear. To explain, I need to tell you about a guy named Steve Cohen. If you aren't familiar, Cohen is the founder of the hedge fund, Point 72 Asset Management and S.A.C Capital Advisors. He's also the majority owner of the New York Mets. Interestingly, Cohen is the inspiration for the character "Bobby Axelrod" from Showtime's hit show "Billions." He's a genius and one of the most successful investors and hedge fund managers of all time. As a matter of fact, he's so good at what he does that investors were willing to pay upwards of 50 % of their gains to be a part of his hedge fund! Think about that for a second. That's insane. So why am I telling you about Steve Cohen? Because he's a Wall Street legend, and when Cohen talks, people listen. And more importantly, they respond. On Friday afternoon, after one of the worst market performances in quite some time, Steve Cohen started talking. As the market was reeling from a sharp decline, CNBC released an article where Cohen was interviewed. In the article, Cohen explained that he was deeply concerned about the current state of our economy and essentially predicted a recession. He made the statement that he was officially "Bearish" on the market. His reasoning was that President Trump's actions on tariffs and immigration are coming at a time when our economy is already on thin ice. We’ll explain more later, but we believe Cohen was sending a stern warning about who holds the real power in Market dynamics. Important side note/reminder: Here at Prospero, we have zero political allegiances. Period. OUR ONLY ALLEGIANCE IS TO YOU our Prospero family. As a matter of fact, we fight like hell to sift through all the partisan political noise and give you the most accurate information possible, regardless of which side of the political aisle it might benefit. So before you dismiss what Cohen is saying as a political hit-piece, you need to understand something really clearly; Cohen isn't speaking on behalf of Democrats, he's speaking on behalf of Wall Street. And unfortunately, we think what he's saying has teeth. Here's the reality. While there are many reasons a majority of Americans voted for Trump, one of the primary reasons he won the popular vote was because Americans were tired of inflation and felt he was the guy to get prices under control. This was a critical point of interest for many Americans, primarily because consumers already had the highest rate of credit card debt in the history of our country. And it's still growing at an alarming rate. Bottom line, people were already struggling over the last four years, and Cohen argued that cutting government spending and adding tariffs (while ultimately might be a good and necessary thing) would unmistakably cause short term economic pain. Why? Because any further increase in the cost of consumer goods would hit consumers at a time when they were already stretched to the absolute limits. Turns out he was right. The Consumer Data report was released last week. and Consumer Confidence plummeted to a 15 month low. Not good.

But here's the main point we want you to take away from today's article. Our CEO, George Kailas believes that Cohen wasn't talking about the economy for the heck of it, but was sending a very clear message to the current administration. And here's the message he was trying to send: "DON'T F' WITH OUR MONEY!" George believes that Cohen releasing his statements on Friday at 2:39 pm, after one of the worst market days in recent memory was no accident. He was sending a message that Wall Street doesn't appreciate the uncertainty and volatility caused by these policy changes; and they have the power to turn the market blood red, while lining their pockets in bright green. Cohen was essentially saying: “you want to mess with this market? We’ll tank it further, make a ton of money, and you’ll look bad in the process.” When George was explaining this to me, I asked him to elaborate. George said:"Look, there's something Wall Street cares more about than anything, and that’s their money. So when Cohen came out on Friday afternoon after a crappy day in the market and said: 'I'm bearish'. That was him signaling to Wall Street: 'I'm short this market!' And the harsh reality is that people are going to follow him…"

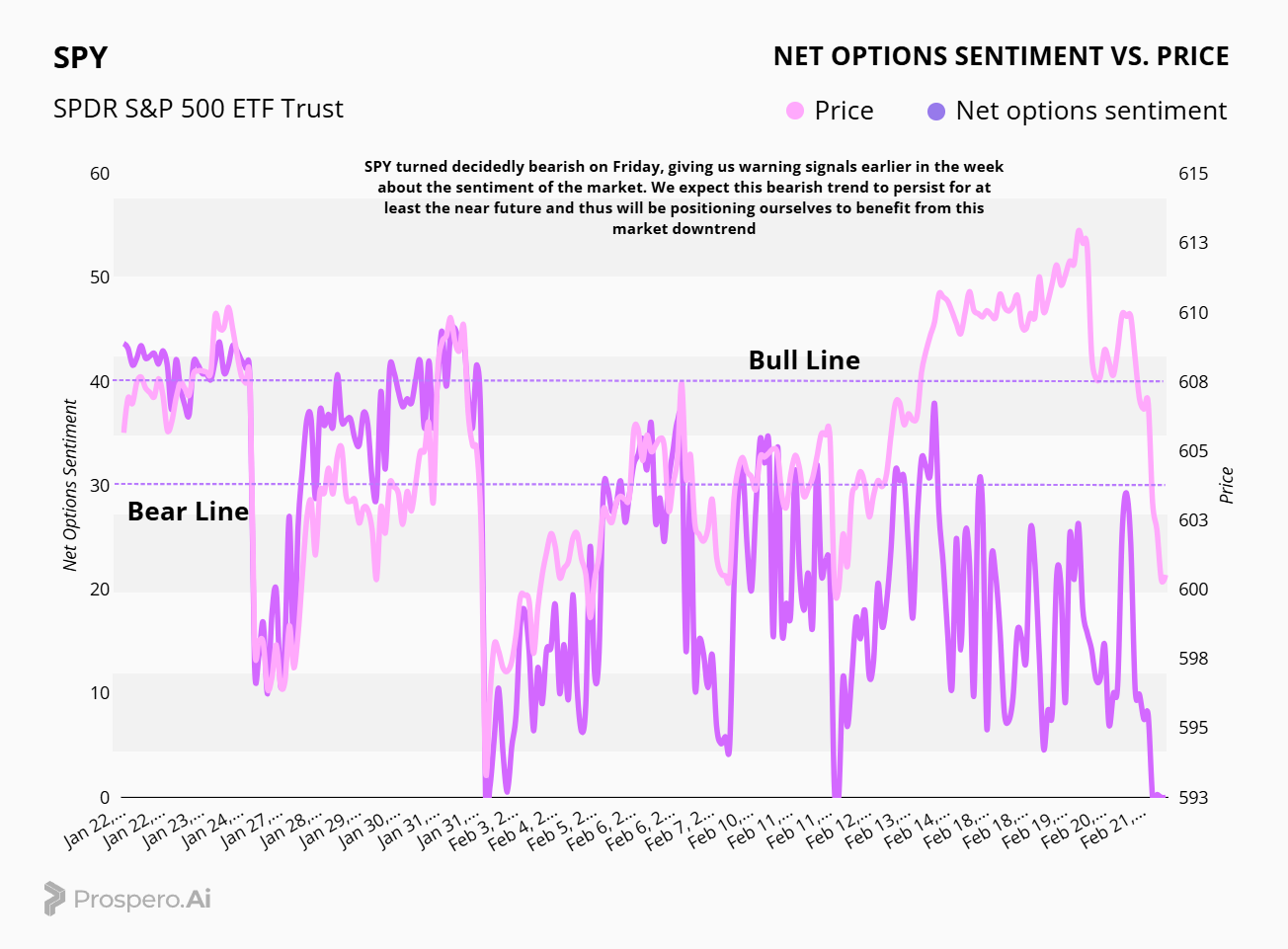

Turns out George was dead right. On Friday afternoon about the time of the release of the article, SPY Net Options Sentiment plummeted to ZERO. Wall Street got the message loud and clear.

Where do we go from here? Over the last several weeks, we have been approaching market volatility by playing defense; being super careful and riding the fence. But in light of Cohen's statements, we are no longer playing defense. Unless there is a very clear directional change, we are entering the week playing offense. And our team has a name. The Bears.

A WORD FROM OUR CEO

We updated our short intro + learning videos to include our new full app tour as well as advice on how to use this letter.

The hard part about the strategy we pursue is that on major events our winners can take sharp turns, and we should have acted faster. We would have if we realized as we do now that Wall St. was likely sending a message. But we are taking it seriously now. A very tough day on Friday but still a great start to the year. Our paper trading portfolio is beating the S&P 500 by 79% annualized, with a win rate of 67% against SPY benchmarks.

Regular streams this week - Monday 2/24 at 11 AM ET and Wednesday 2/26 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

DON'T F' WITH OUR MONEY!

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

It was a rough week for every style box, with small caps taking the hardest hit. However, Mid Cap value had a decent week as its undemanding valuations don't require extraordinary market conditions to perform well. Large Cap growth didn't fare well either, as optimism about future economic growth subsided on Friday. Overall, value is likely to perform best in this market downturn, as there is far less room for low-valuation companies to fall.

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS signaled significant turmoil earlier this week and demonstrated marked bearishness on Friday. We interpret this as a potential prolonged downturn in the market, not just a one-time blip. Therefore, we will position ourselves accordingly from a top-down perspective to capitalize on the opportunity to ride the wave downward. However, it is important to note we have seen a lot of volatilty and we are open to revising again quickly if these Net Options Sentiment numbers reverse.

QQQ didn't fare any better as its growth-oriented profile came under scrutiny due to poor economic data combined with the Deepseek events from a couple of weeks ago. We are on the precipice of shifting to an environment where growth may not be as abundant. Consequently, we will be reducing our overweight stance on tech as a whole and will focus significantly more on sector diversification.

SECTOR ANALYSIS

What a reversal this week! Traditional and inflation-protected sectors like Utilities, Energy, and Consumer Defensive outperformed the recent strong gains in Tech and Communication Services. Market sentiment shifted from rewarding recession-resistant sectors to moving away from pure growth plays. Consumer Discretionary continues to suffer as tariffs, coupled with weakening consumer sentiment since the new administration took office, have left it with no choice but to decline.

PORTFOLIO STRATEGY

Following the recent swift shift in sentiment for both SPY and QQQ NOS, we are promptly adjusting our positioning to align with the current market conditions. As previously mentioned, there are potential upside opportunities in select sectors; however, our primary strategy now involves adopting a Net Short position to capitalize on anticipated near-term downturns. We also added a column 52 Week High / Price because in our opinions a lot of the stocks that got hit were stocks that were running well so we added that as a filter to increase the odds that we were getting value. Our ongoing emphasis remains on market capitalization and sector diversification to hedge against any significant style or sector declines. 5 longs, 8 shorts.

Long / Bull Moves

Long / Bull Moves - ABT, META and BABA adds/ COIN and XYZ holds/ APP, GME, CYBR, BKNG and TSLA drops

Adds

We decdided to add ABT as it placed at the top of our screener with good Tech Flow and 52 Week High/Price. META still remains one of our favorites with high Upside Breakout and Net Options. BABA was added for its perfect Net Options Sentiment and Upside Breakout.

Holds

COIN was held for its high Upside Breakout and Net Options Sentiment, still keeping one of our Trump trade picks. XYZ was held due to our ongoing longer term view that the Goose release will be beneficial. But if XYZ and the market struggles again tomorrow we will likely look to exit.

Drops

APP was dropped after a preciptuous drop after a short report was released about the company sparking a mass sell-off. GME didn’t look good enough in our signals to warrant a hold. CYBR and BKNG were dropped as they had not standout metrics for us to justify keeping them. TSLA was dropped as Tech Flow and Momentum were too low.

Short / Bear Moves

Short / Bear Moves - BCH, AMED, FYBR, DBX, BMBL and H adds/ INFY and CRESY holds/ TOWN, ICFI, ANF, IRM, NVS, AZPN, SXT, SWKS, TRMB, SAIC, AIZ and AMAT drops

Adds

BCH was added for its favorable Net Options Sentiment and 52 Week High/Price. AMED and FYBR were added for their favorable Downside Breakout and low 52 Week High/Price. DBX was added for its larger cap Technology exposure and Net Options Sentiment. BMBL was added for its micro cap tech exposure and low Net Options Sentiment. Finally H was a good add to play the ongoing downtrend in Consumer Cyclical stocks.

Holds

INFY was kept for its Large Cap Tech exposure with favorable 52 Week High/Price. CRESY was kept for its low Tech Flow and Momentum.

Drops

TOWN, ICFI, ANF, IRM, NVS, AZPN, SXT, SWKS, TRMB, SAIC, AIZ and AMAT were dropped as they performed poorly in our screener with no standout characterisitcs.

Portfolio Summary

Long / Bull Moves - ABT, META and BABA adds/ COIN and XYZ holds/ APP, GME, CYBR, BKNG and TSLA drops

Short / Bear Moves - BCH, AMED, FYBR, DBX, BMBL and H adds/ INFY and CRESY holds/ TOWN, ICFI, ANF, IRM, NVS, AZPN, SXT, SWKS, TRMB, SAIC, AIZ and AMAT drops

5 Longs: ABT, META, BABA, COIN and XYZ

8 Shorts: BCH, AMED, FYBR, DBX, BMBL, H, CRESY and INFY

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.