DON’T TRIM THE HEDGES

03/30/25 Prospero.ai Investing - 207th Edition (Weekend)

Something unprecedented happened last week at Prospero and it's not good! SPY and QQQ Net Options Sentiment ended the week with their lowest combined scores, EVER. (SPY at 0 and QQQ at 3). That's a lower combined score than at any point in the Bear Market of '22. What does that tell us? It tells us that Institutions and Hedge Funds are more bearish on US equities than at any time in Prospero's history. To explain WHY that's the case is not super straightforward. We could talk about Politics and Tariffs and GDP, but we'll leave that to the Wall Street pundits. The reality is that the markets are spooked. Big time.

So, more than the WHY of what's happening, it's much more important to discuss WHAT is happening and HOW we're going to deal with it moving forward. Let's unpack what happened last week, because frankly, it's not good. But before we get into the bad news, let's talk about what glimmer of hope we have moving forward. First of all, April is historically one of the most Bullish months of the year for equities. On top of that, we're in an extremely oversold market that's in desperate need of a relief bounce. When you add in the fact that April 2nd (Tariff Deadline) may already be priced into the recent decline, it's possible we'll get some sort of positive bounce.

BUT, here's the bad news. Check out the SPY (S&P 500) Daily Chart below (via @barchart):

That purple line is the 200 Day Moving Average for the S&P 500. Historically, the 200 DMA has been a very reliable place that the SPY will bounce off of and head back up. But as you see, it didn't bounce off the 200 DMA, but sliced through it like a hot knife through butter. Even worse, it rejected off the bottom of the moving average (blue circle) and is now heading lower. Rejections below 200 day moving averages are VERY bearish. The last few times that happened were in 2007 (global financial crisis), the 2020 Covid Crash and the 2022 Bear Market. One last point to consider. The monthly candle on the SPY chart just closed red and below the all time highs. Historically when that's been a sign of a larger drawdown in stocks. So from a technical perspective, things are looking fairly ominous.

That leads us to the all important question of HOW we're going to approach a market that from a technical analysis perspective is potentially heading into a bear market?

To answer that, we did some research after a user suggested that shorting the SPY when SPY Net Options Sentiment was at 0 would be a good strategy. We decided to look deeper.

First, we decided to look at some returns from SH (Inverse SPY ETF), SQQQ (Inverse QQQ etf ) and SCC (an inverse Consumer Discretionary ETF), from February 21st to March 21st. Why those dates? Those are the dates our SPY Net Options stayed in its “0 flatline.” Here are the results:

SH (inverse SPY) = +6.37%

SQQQ (3X inverse QQQ) = +27.99%

SCC (2X inverse consumer discretionary) = +22.69%

To answer our subscriber’s question, this would have been an outstanding strategy over that time frame, and as long as Net Options are at or near zero, it likely will be a good strategy going forward. This data clearly demonstrates that if you have conviction on the market going down you can make money without being an expert on shorting stocks or buying puts.

We also wanted to illustrate how hedging can affect a “buy and hold” or “set it and forget it approach”. We understand many of you don’t have the time to day trade. But if you’re a buy and hold kind of investor, hedging by purchasing inverse ETF’s can powerfully impact your bottom line.

To demonstrate this we put a table together showing 4 scenarios.

Scenario 1:

We chose our top 3 stocks in Upside + Net Options Sentiment + Profitability scores (as of open 01/02/25) PLUS a 6% SQQQ hedge. (Generally this year we’ve suggested between a 5%-7% SQQQ hedge)

Scenario 2:

Simply buying the SPY ETF with a 6% SQQQ hedge.

Scenario 3:

Our top 3 stocks with a 12% hedge (½ SQQQ & ½ SCC). SCC is the ETF we mention is our preferred one alongside SQQQ.

Scenario 4:

Simply buying the SPY ETF with a 12% SQQQ & SCC hedge.

We laid out this example to illustrate one primary point. You’ll notice that in a positive portfolio a hedging strategy is not moving the needle much. But for SPY alone it makes an increasingly big difference. At a 6% SQQQ hedge you are still experiencing 67% of the loss (-3.33%/-4.96%) but at the 12% hedge you are experiencing 31% of the total loss.

Expressed differently: Your loss is 149% bigger without the 6% hedge vs with it and 318% bigger without the 12% hedge vs. unhedged.

A WORD FROM OUR CEO

Thanks to everyone who joined our Reddit page last week. We now have more than 6X as many followers!

We feel that our approach has us well hedged as we look for upside with good risk/reward profiles. Our paper trading portfolio is beating the S&P 500 by 67% annualized, with a win rate of 63% against SPY benchmarks.

Regular streams this week - Monday 3/31 at 11 AM ET and Wednesday 4/2 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

DON’T TRIM THE HEDGES

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

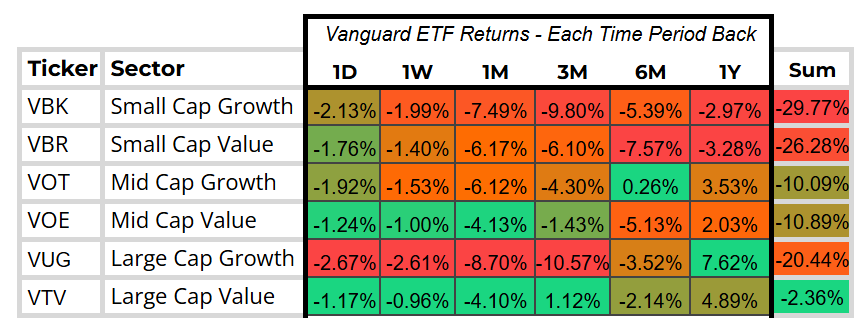

CAP/ ANALYSIS

Large Cap growth keeps getting beat as multiples further contract. There are no singular bright spots in this market as all styles are compromised to various degrees, but Large and Mid Cap value seem like the way to go if you want to minimize your downside and protect your capital with solid franchise businesses. If we see any sharp mean reversion in growth we’ll definitely be on the lookout.

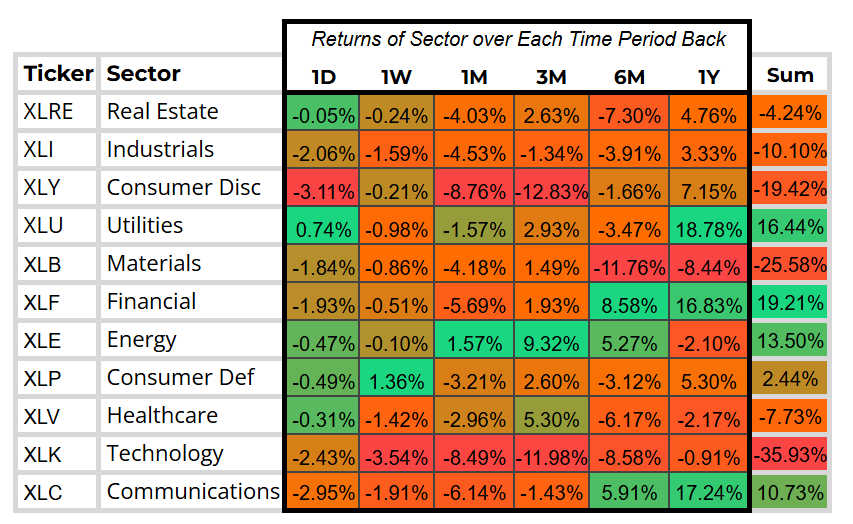

SECTOR ANALYSIS

As consumer confidence keeps weakening we still see that Consumer Defensive stocks are largely more in favor than the rest of the sectors available, as they’re able to capitalize on the marginal discretionary income that consumers have left. Energy remains strong, although still susceptible to broader weakening of consumer demand, as increased geopolitical uncertainty remains favorable for the sector domestically in the short term. Tech and Communication Services remain out of favor and will continue to be so until certainty materializes in one way or another.

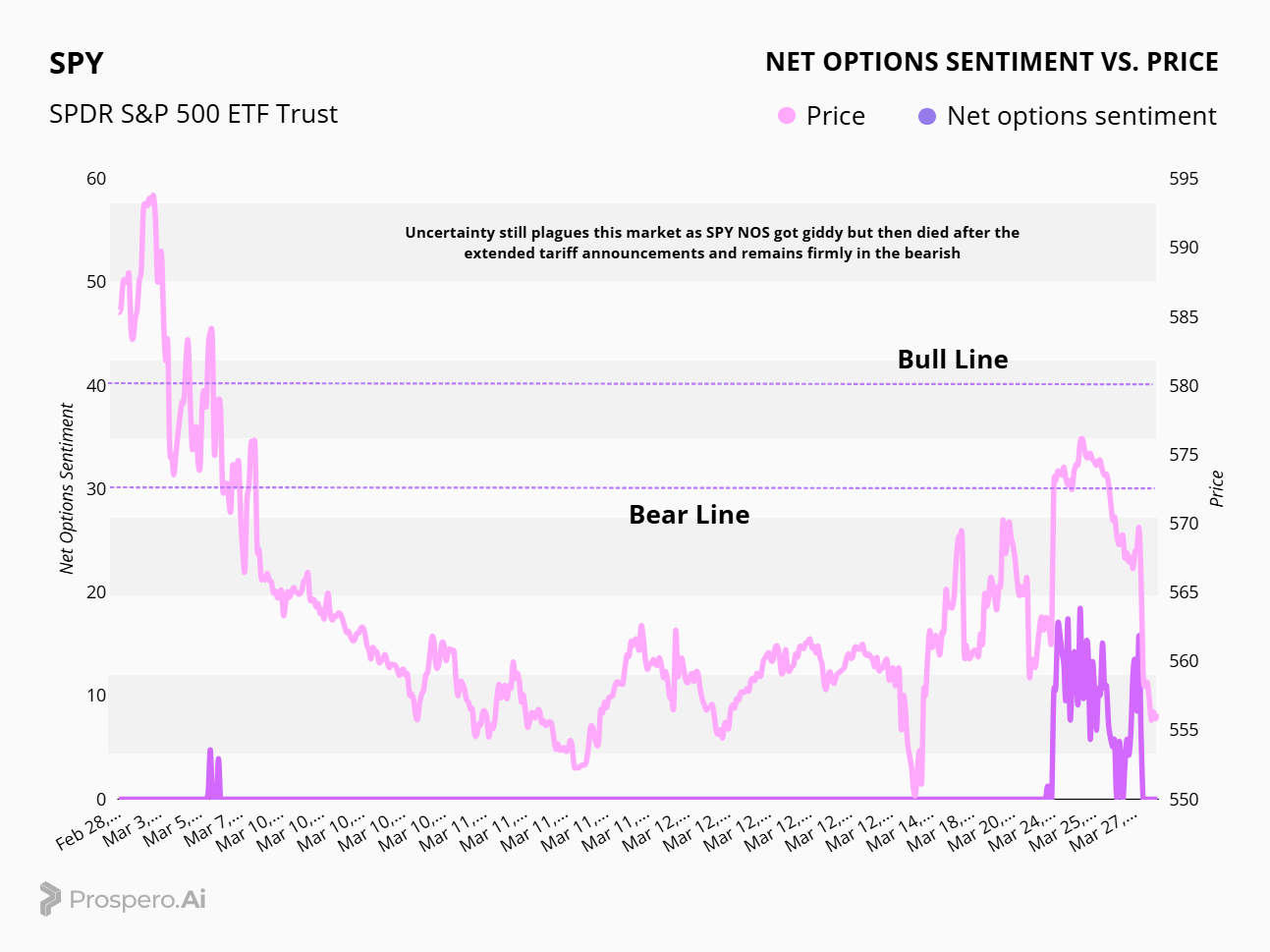

SPY/QQQ NET OPTIONS SENTIMENT

Check out the SPY Net Options Sentiment Chart below. We remain bearish as institutions clearly don’t favor the additional uncertainty. Although there was slight renewed optimism earlier in the week, it reversed quickly. The trend remains bearish for the foreseeable future and we remain positioned to capitalize on that bearishness.

Now Check out the QQQ Net Options Sentiment Chart. It took also took a sharp turn, and remains bearish as even tech can’t escape the pain in the markets at the moment. We’re reducing our Tech/Communication Services exposure accordingly to make sure we don’t get caught on the wrong side of a market regime change.

PORTFOLIO STRATEGY

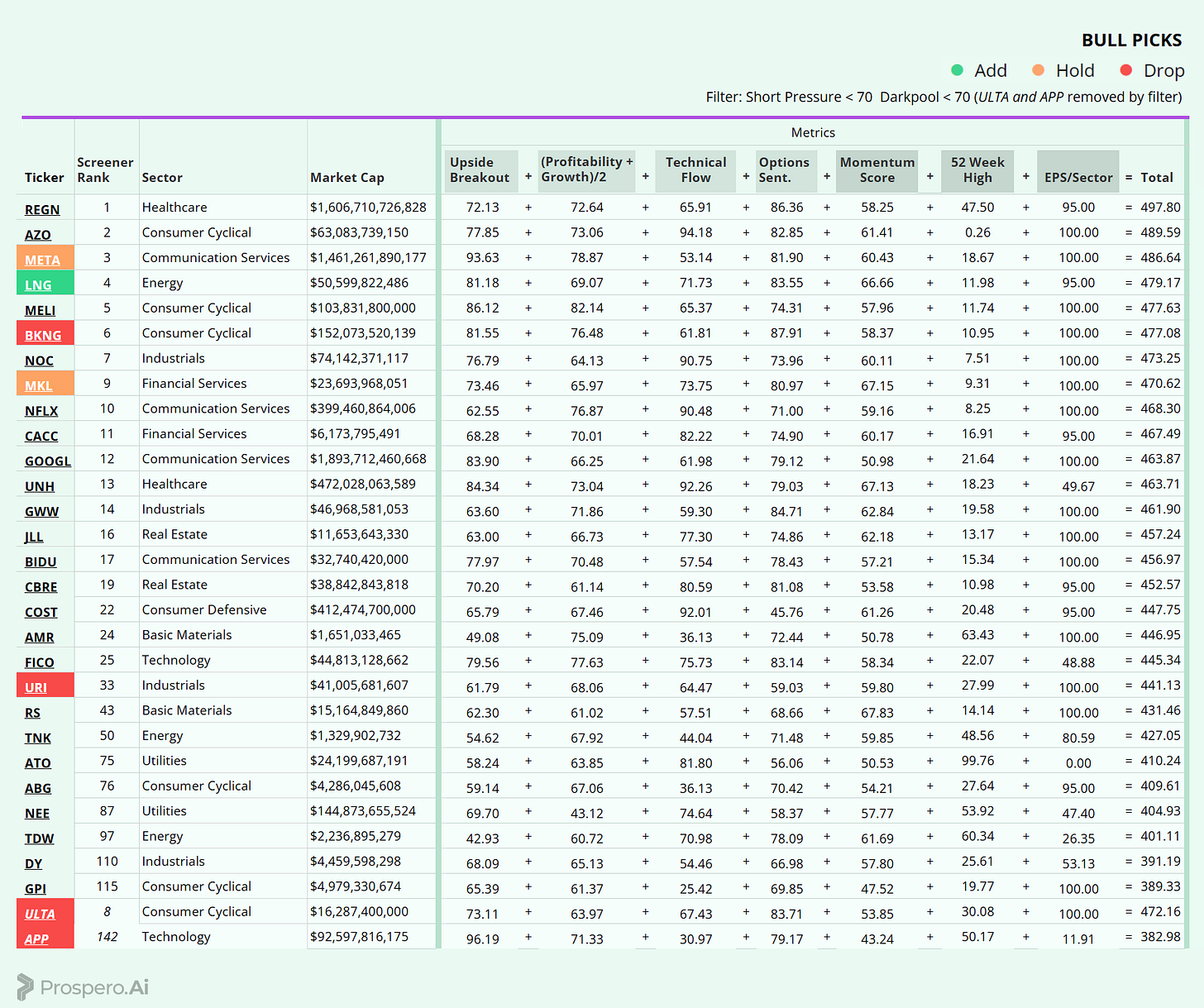

With the April 2nd tariff date looming and such apprehension with SPY/QQQ Net Options Sentiment we are again reducing the portfolio size and leaning Bearish. 3 Longs and 5 Shorts.

Long / Bull Moves

Long / Bull Moves - LNG add / META and MKL holds / BKNG, URI, ULTA and APP drops

Adds

LNG was added as a high Screener score for the Energy sector featuring great Net Options, Momentum and EPS sector scores.

Holds

META was held as a key holding with good Net Options and excellent EPS Sector. MKL was kept for Financial Services exposure, decent Net Options and excellent EPS Sector.

Drops

BKNG was dropped as Tech Flow was weak. URI was dropped as it had no promising technical indicators. ULTA and APP were both dropped as they got screened out this week.

Short / Bear Moves

*52 Week Mid is done differently. We realized we did not want to add shorts too close to the 52 Week High or Low. So the lower the number the closer to the midpoint it is.

Short / Bear Moves - SABR, CCOI, ADI and BX adds / CTSH hold / HUYA, GLPG, BC, MDB, MDT, LCID, IVR, F, WEC

Adds

SABR was added because of its low Tech Flow and Net Options. CCOI was added because it had decent Downside Breakout and balances out our Communication Services exposure on our long side. ADI was a good addition because of its large cap Tech exposure with favorable EPS Sector. BX was added for large cap Financial Services exposure.

Holds

CTSH was kept for its favorable Momentum and EPS Sector.

Drops

MDB, MDT, LCID, IVR, F and WEC were all dropped because they performed poorly in our screener.

Portfolio Summary

Long / Bull Moves - LNG add / META and MKL holds / BKNG, URI, ULTA and APP drops

Short / Bear Moves - SABR, CCOI, ADI and BX adds / CTSH hold / HUYA, GLPG, BC, MDB, MDT, LCID, IVR, F, WEC

3 Longs: LNG, META, MKL

5 Shorts: SABR, CCOI, ADI, BX, CTSH

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.