SPECIAL ALERT: This letter was almost completed, when on Saturday evening we learned that the U.S. had bombed Iran's Nuclear facilities. Bitcoin has dropped on the news but as of the writing of this letter is not collapsing. This is a good sign that investors aren't panicking (yet). BUT word just came out that Iran's parliament approved the closure of the Straits of Hormuz, which could send gas prices skyrocketing. Events are fluid and changing rapidly, so be on alert as futures come out this afternoon. One last thing to note, QQQ and SPY Net Options Sentiment dropped noticeably on Friday. At one point in the afternoon, QQQ was at 13 and SPY at 0. They ended the day slightly higher, but those are, historically speaking, pretty low combined scores. Bottom line, we need to be on the alert as we move into the coming week. And this year especially we’ve seen Net Options Sentiment getting out in FRONT of geopolitical events.

With the rest of our letter, we want to talk about an interesting anomaly we're seeing in this current market; and that's a divergence in the sentiment of so-called Smart money (Institutions) and Dumb money (Retail). Over the last couple of weeks, Retail investors and other, more powerful forces in the market are staring each other down and one of them is about to blink. The question is which will it be? The reality is that two things are occurring simultaneously. Retail is having a bigger impact on market movement than maybe at any time in history; and since April, they have been aggressively "buying the dip" read more in: Retail Short Squeeze

At the same time, corporate insiders' sales are telling a shockingly different story (We'll show you the data in a minute). The question at hand today is this: Which side of this historic divergence should we be on at Prospero? To start, let's unpack some data about retail investor involvement (total trading daily volume).

Pre 2020 (typical baseline): 10-15% (daily volume)

2020 Pandemic: 20-25%

2021 Meme Stock Mania: 30-32%

2022 Bear Market: 18-22% (dropped slightly)

2024-25: Stabilized around 20-25%

The data shows that retail now makes up 1 out of every 4 trades on a daily basis (up to 50% of penny stocks w/o institutional involvement). That's not noise, that's a huge percentage of a daily narrative. While retail trading used to be a footnote that smart money ignored, today retail is shaping price action in a way that's impossible to ignore. Because of this, firms like Citadel and Virtu are actually monitoring retail order flow. Why? Retail sentiment is moving the needle in ways that were once thought impossible. Retail has traditionally been called "dumb money" because they are usually blind toward what truly moves the market, which are institutions and hedge funds and their Billions of dollars. But now because of Social Media and platforms like Prospero.ai, retail has insight into the market in ways that were completely impossible a decade ago. Now make no mistake, institutions still dominate the landscape, but retail engagement isn't a fleeting trend but a structural shift that's only going to grow with time. That brings us to today. As of the writing of this letter, despite historic market valuations, retail is bullish on this market. The crazy part is that they just might just be right. A.I. is in the early innings of changing our world as we know it. The U.S. economy (thus far) has avoided recession and inflation has stabilized. And lastly, interest rates look to have peaked and although the Fed didn't lower interest rates this month, rumors are swirling that a .25 interest rate cut is coming soon. Retail has a reputation of being ruled by emotion, but it's entirely possible they're optimism could be right.

Now let's talk about corporate insiders. The latest data shows that while retail is buying the dip, corporate insiders are selling shares at their highest rate in history. Check out this chart from VerifyData.

Those vertical pink lines show the ratio of buyers to sellers. This chart doesn't show it, but in 2025, Q2 corporate insider sales have only increased compared to Q1. Take a second and look at the chart. What stands out to you? To us, there are three things to point out. First thing to note is that the current rate of corporate insider sales is even higher than before the historic bear market of '22. That alone should get our attention. But here's another one. Go back and look at every time corporate insider sales spiked. They're usually pretty darn accurate at predicting a pullback. Why? Insiders have a level of information that's more accurate than even the most informed institutions and hedge funds. They're the ones seeing the data for their quarterly guidance before anyone else. So when we hear that insiders are selling at the highest rate in history; that's something we simply can't ignore. Here's one last data point we'd like to point out. As I studied the chart, I noticed something interesting. When you see a spike in insider sales, the drop in the S&P 500 doesn't happen simultaneously, but usually occurs a few months later. In other words, corporate insider sales is a lagging indicator. The problem is that insiders have been net sellers now for several months. With international tensions high, valuations on the market at historic levels and tariffs still looming, this market seems to be on thin ice. Let's be careful as we move forward into this week, but regardless, it will be fascinating to see if retail engagement has grown to such a level that it can overcome some pretty daunting market headwinds. Now a word from our CEO.

A WORD FROM OUR CEO

Well sometimes we have good strategic reasons for ups or downs and sometimes we can just reflect on the reality of life and trade execution. I got engaged this week and in a normal week I would have cycled the positions more. It wasn’t a great week and I apologize to anyone on the wrong end of that but that is why we always encourage our readers to make their own choices. To be able to “fish” on their own. Even in a tough week our year remains excellent with our paper trading portfolio 79% above the market annualized with a win rate of 60% against SPY benchmarks.

Our short intro + learning videos get you up to speed on how best use our letters and app to increase your wins.

I am still traveling so only one stream this week. Wednesday at 1030 AM.

Track all of your investments in real time with our app. Prospero’s proprietary AI tech updates key options signals like Net Options Sentiment, Upside and Downside every 3 minutes.

Dumb Money?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS: (Link to live, it will be different after market open)

Both Growth and Value have managed to hold fairly steady on Friday and across the week, with monthly returns remaining within 1.5% of zero on either end. While Large Cap Growth did see some losses on the week, it still stands out as the strongest in the past month and quarter year. The lack of movement across the Cap space was most likely due to the natural dampening effect of these diversified ETFs, protecting them from any sector-specific slowdowns, and that geopolitical tensions may have already been priced in before the rapid escalation this week.

SECTOR ANALYSIS

The rotation into Energy, Tech, and Communications we’ve been seeing the past couple weeks has met resistance to close off the week due to very poor market outlook. While Energy led the way intraday on rising crude— Tech, Healthcare and Communications all dropped below zero on Friday with Healthcare approaching -3% for the month. Industrials and Real Estate managed to hold steady for both the week and month, meanwhile defensive corners like Consumer Defensive and Utilities saw a bit of a rebound as the market s that flight-to-safety trade briefly evaporated amid uncertainty .

SPY/QQQ NET OPTIONS SENTIMENT

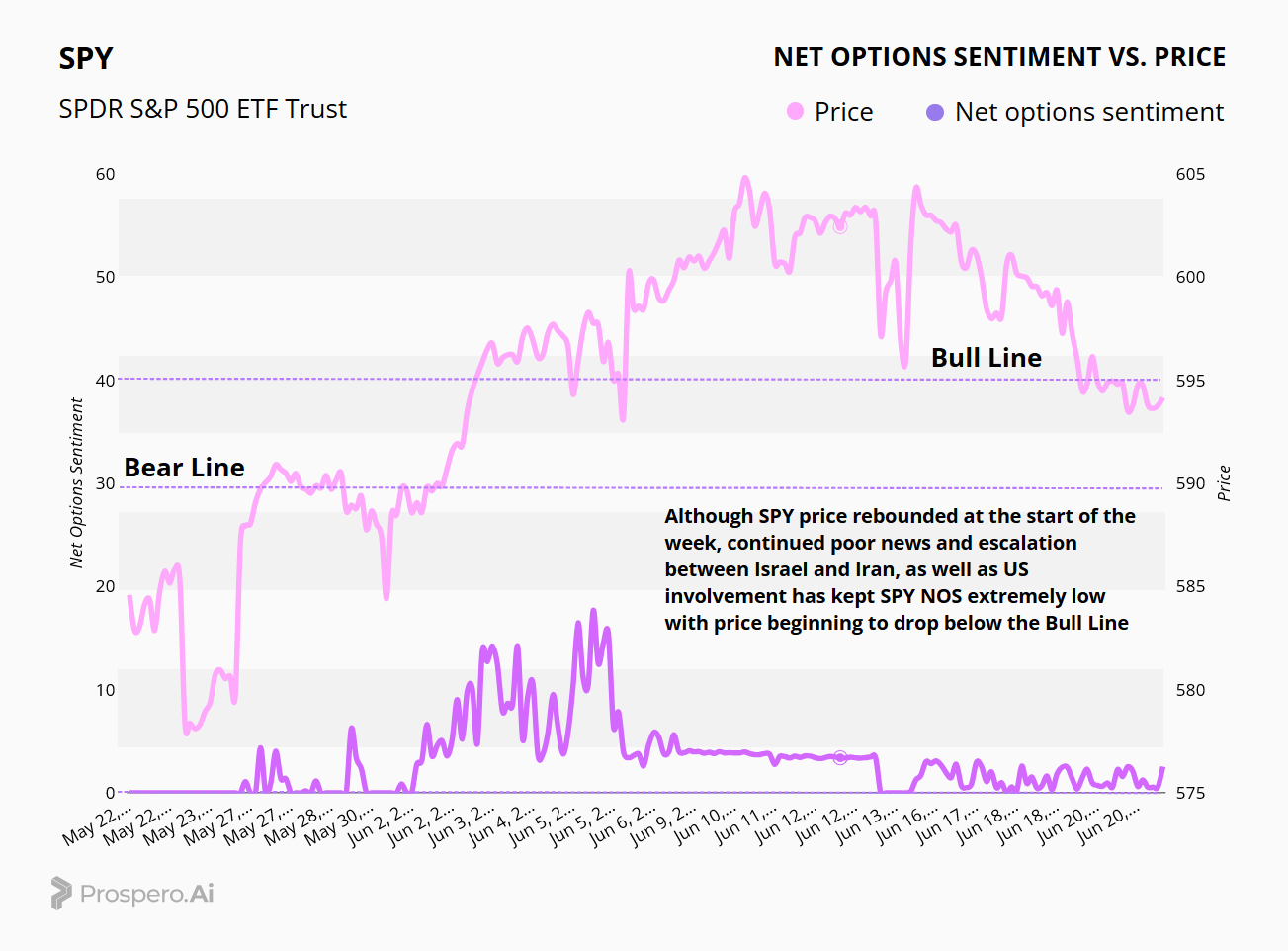

SPY NOS, after managing to tread water for a couple of weeks after flatlining in late May, returned to zero on Friday as conflict arose between Israel and Iran, with institutions favoring risk-off positioning as they prepare for the worst. While less sensitive to QQQ due to its broader exposure, SPY NOS was already struggling before being dealt yet another blow. As markets adjust to rapidly developing news, NOS has been jagged yet still incredibly low, with price beginning to approach market sentiment, dropping below the Bull Line.

While QQQ NOS and price rebounded to start the week after an especially rocky Friday the 13th, continued poor news this week has hit the entire market, sending QQQ NOS and price down without any clear hope of another rebound. This looks like an ominous sign perhaps reflecting an understanding that conflict was about to escalate again.

PORTFOLIO STRATEGY

The combination of already weak market sentiment bundled with added uncertainty and bearish sentiment across the board amid developments in the Israel-Iran conflict and the US’s participation in it has led us to hold all our existing positions. This is what we always do if there is significant market news over the weekend to be honest and transparent with our portfolio. IE we could add a bunch of defense stocks right now to see gains on Monday but that would not be the ethical thing to do. We have done this before. We will look at the numbers Monday morning to see if we expect a return to stability or clearer signs to guide future moves. We do think the low Net Options Sentiment readings were helpful positioning for us heading into this weekend. We are holding a net short positioning, with 9 shorts and 8 longs.

Long / Bull Moves

Long / Bull Moves - No new adds / META, FANG, LLY, CASY, HOOD, PLTR, QBTS holds / No drops

Adds

There were no new long adds this week, as markets entered a holding pattern following geopolitical tension and ahead of macro catalysts like CPI revisions and FOMC commentary.

Holds

META remains a top performer in Communications with strong Upside, Tech Flow, and institutional Options Sentiment, continuing to ride momentum from AI exposure and robust ad spend. FANG stays in as a high-conviction Energy pick, outperforming peers with elevated sentiment and a stable setup. LLY continues to rank near the top of our screener in Healthcare, buoyed by nearly perfect Options Sentiment and technical resilience. CASY holds in Consumer Cyclical, maintaining strength in Tech Flow and stability post-earnings. HOOD and PLTR remain strong speculative holds, with HOOD seeing consistent retail participation and PLTR positioned to benefit from further public sector contracts. QBTS rounds out the group as a high-beta tech name with solid sentiment and a breakout structure still in play.

Drops

No long picks were dropped this week, as all prior names remain technically intact and sentiment has held up across the board.

Short / Bear Moves

Short / Bear Moves - No new adds / SSYS, NAVI, DBX, LEVI, PECO, IR, ROP, CRWV, HSIC holds / No drops

Adds

No new short adds this week as downside setups were held rather than expanded, with broader weakness being more sector-specific and not yet fully confirmed across the board.

Holds

SSYS and DBX continue to underperform in Tech, both posting weak Tech Flow and Options Sentiment, and showing no signs of reversal. NAVI remains a firm Financials short with a strong Downside Breakout score and poor profitability/growth positioning. LEVI continues to face cyclical pressure, holding its short status as discretionary trends weaken. PECO lags in Real Estate with little upside and stalled flow, while IR stays in Industrials with unimpressive sentiment despite sector strength. ROP and HSIC all remain bottom-ranked with extremely weak Tech Flow and poor institutional interest, holding steady as low-conviction names with bearish setups. CRWV is an interesting case it has a 0 Tech flow because it doesn’t qualify for some of our metrics like our longer EMAs. We may choose to double up on that short or exit it entirely. The key variable we will be watching for here is the short borrow rate. Which at 147% is the lowest it has been since 5/30. It topped out at 343% on 6/11.

Drops

No shorts were dropped this week, with existing names continuing to meet downside criteria or failing to recover sufficiently to warrant removal.

Portfolio Summary

Long / Bull Moves - No new adds / META, FANG, LLY, CASY, HOOD, PLTR, QBTS holds / No drops

Short / Bear Moves - No new adds / SSYS, NAVI, DBX, LEVI, PECO, IR, ROP, CRWV, HSIC holds / No drops

8 Longs: META, FANG, LLY, CASY, HOOD, PLTR 2X, QBTS

9 Shorts: SSYS, NAVI, DBX, LEVI, PECO, IR, ROP, CRWV, HSIC

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.