I'm starting to hear two words being thrown around more and more recently on Social Media: "Market Euphoria". It's a phrase that ought to strike a healthy amount of fear in your trader/investor soul. It comes from an often used Market Cycles Chart that graphically illustrates the emotions felt by traders and investors during different stages of a Bull and Bear Cycle. Check out the graphic below.

When the market starts to go up and enters into a bonafide Bull Market, there is one emotion that, more often than not, signals a market top. Euphoria. Webster's Dictionary defines Euphoria like this…

Euphoria ~ A state of intense happiness, excitement, or sense of well being.

Are we truly in a state of market euphoria? It's not as easy to determine as you might think. Let's take for example, the Fall of 2021. For those of you that were trading back in November of 2021, THAT was Euphoria. Everything was green. EVERY. SINGLE. DAY. The market made you feel like a genius. It didn't matter what trade you were in, you made money. The "Fear and Greed" index was pegged on Extreme Greed. Money from Covid -stimulus checks poured into the market from retail investors. Stock valuations and P/E ratios were absurd and it didn't matter; everyone was still in a state of "euphoria" and kept on buying. When the new year rolled around, we entered a Bear Market that created a lot of Bag Holders that are just now getting back to even.

Here's the question. Are we at the same place as November 2021? Is the market in a state of euphoria that will quickly roll over into a massive correction or worse? Well, as the old saying goes: "History doesn't repeat itself, but it certainly rhymes"

Here are a few examples of the similarities between then and now.

First, the Market is at all-time highs. As a matter of fact, the U.S. equity market has outpaced the international equity market at an absurd level. Check out this fascinating chart from BofA Global Investment Strategy:

As you can see, US stocks are at a 75 year high compared to the rest of the world. On top of that, just like in 2021, the "Fear and Greed" index is pegged at "Extreme Greed". Also, similarly to 2021, there are some areas of the Market that are experiencing euphoria, especially in the Crypto/Bitcoin space. If you don't believe me, get on X and type in #Bitcoin in the search bar and start reading. It's EXTREMELY Bullish. Everyone is thrilled and flush with cash from the massive upswing.

And Maybe the biggest concern of all? Just like in Nov 2021, we're starting to see some signs that typically coincide with a market top. Let me give you one example.

My 80 year old father just asked me if I would help him set up a wallet to buy "cheap criptos". Not Cryptos. But Criptos. LOL! When he sent me that text, I literally spit my coffee all over my computer screen. That's either a sign of a market top, or maybe the end of the world. We shall see.

Now, let's take a minute and talk about the differences in today's market vs. 2021. While there are some companies whose valuations have gone off the rails in this bull market (MSTR for example), overall stock valuations aren't near as crazy as they were in late 2021. Here are a few examples of P/E ratios from today, compared to November of 2021.

Nov 2024 P/E Ratio Nov 2021 (approx) P/E Ratio

Google 22.10 Google 30

TSLA 96.67 TSLA 325

NVDA 55.93 NVDA 95

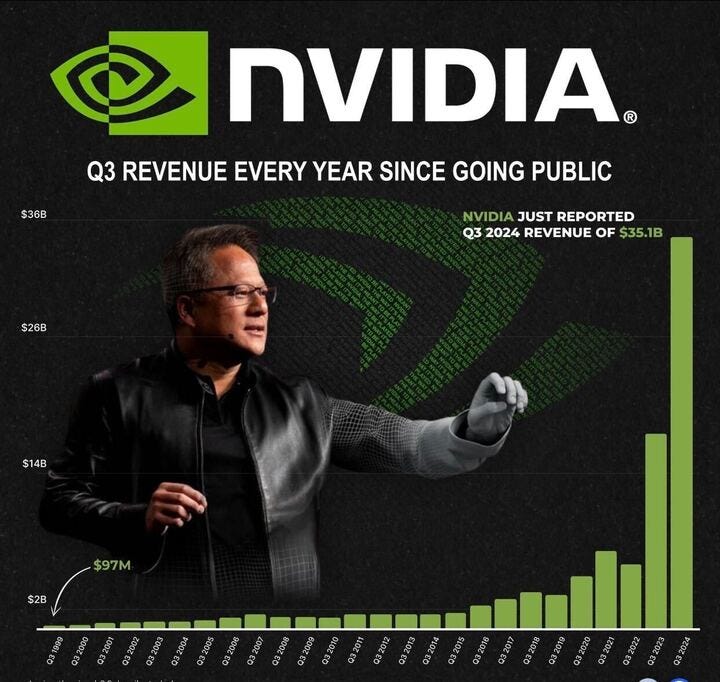

As you can see from the table above, valuations are currently pricey, but you could make the argument they are CHEAP compared to the same time in 2021. As a matter of fact, NVDA just had another BLOW OUT earnings and many analysts are saying their valuation is completely justified, if not cheap. I found a graphic yesterday via @stockMKTNewz that gives us a striking picture of just how insane this company's growth really is.

Take a second and let that graphic sink it. Every one of those green bars represents Nvidia's Quarter 3 Revenue from each year since their inception. Since quarter 3 of 2022….in just TWO YEARS…they have grown their revenue from 7.10 Billion to a staggering 35.1 Billion. In two years their quarterly revenue has grown by the equivalent of 4 times the entire market cap of Celsius Energy drinks!! It's mind boggling. So they've quadrupled their revenue, but cut their PE ratio in half since 2022. So while the market has reached new highs, that growth is largely based on earnings.

One final thought before we move into Cap/Value Analysis. In this latest stretch of growth, we've seen a significant market breadth expansion. Small Caps especially have been the beneficiaries of this expansion. Another example would be different sectors such as Financials and Utilities have seen significant growth over the last 3 months. In 2023, it was Tech and Communications carrying the market. If you remember, not that long ago, one of our biggest concerns was that the Mag 7 was holding the market on its shoulders. That's no longer the case.

The conclusion to all this? The reality is that the market is STILL sending mixed signals. QQQ Net Options Sentiment is Bullish but volatile. SPY Net Options Sentiment is mildly Bearish. Euphoria is growing, but pessimism and Bear Porn still abound. I think our CEO said it well in our paid Trading Letter on Friday. He said: "The market is getting more decisive, but don't get too comfortable". Doesn't sound euphoric to me. But, at the same time, things certainly aren't falling apart either. There just might be some more upside to go.

One final thought. Thanksgiving is coming this Thursday and we have a lot to be thankful for here at Prospero. We're thankful for the success we've experienced and the partnerships we've formed. We're thankful for the fun we've had as a team. But most of all, we're thankful for you, our Prospero Family. None of this would be possible without you. Happy Thanksgiving everybody! Thank you for joining the journey with us. Now a word from our CEO, George Kailas.

A WORD FROM OUR CEO

It was another interesting, volatile week but we made the right calls and used it to our advantage. We are now beating the S&P 500 by 90% annualized, with a win rate of 60% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Only one stream this week for the holiday Tuesday 11/26 at 12PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

EUPHORIA: FACTS OR FEELINGS?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Check out the Cap/Value Analysis Table above. This chart is a fantastic picture of what we just talked about in the Intro/Macro Section of this letter. Take a look at the 3 month numbers. Small and Mid Cap growth and Small Cap Value are the three highest sectors. This is a clear signal that it's no longer just Large Cap Growth carrying the market. The market has expanded and money is entering into more than the Mag 7. That is why we've continued to see the market go up longer than many expected.

QQQ/SPY NET OPTIONS SENTIMENT

Check out the QQQ Net Options Sentiment Chart below. The bad news is that most of the week, QQQ Net Options stayed below the bullish line. The good news is that by Friday, it settled above our Bullish zone at 44. This makes us feel a little better and will allow us to lean "Slightly" bullish heading into this week. But as you can see when you look at the chart as a whole, we've had at least 5 drops below our bullish line of 40. We're still dealing with volatility and we will plan accordingly.

Take a look at the graphic above. One of things that I love about Prospero's signals, is that it gives not only hard data through our signals, but tangible, visible proof of what we're seeing in the market. While our QQQ Net Options Sentiment is Bullish. SPY is still a pretty darn Bearish. We saw a slight uptrend at the end of the week as it crept its way up to 22 to finish on Friday. But it's still solidly below the bullish line. Seeing QQQ Bullish, while SPY is Bearish is reflective of Institutions hedging this market. They're being more "risk-on" with QQQ, but hedging for downside risk by betting against the SPY. If institutions are sure of the direction of this market. We shouldn't be either.

SECTOR ANALYSIS

Check out the Sector Analysis Chart above. Once again, this is a great picture of the market breadth expansion I was referring to earlier. One year ago, Tech and Communications (Large Cap Growth) were bright green and everything else was pretty lackluster. Now, fast forward a year. Consumer Discretionary, Financials and Industrials are all showing incredible strength. The only sector that is showing real weakness is Healthcare, and you would think we'd see a mean reversion on that some time soon. There might be value to be found there but the other side is there could be more pain with concern about what will happen with the Trump administration and RFK perhaps making major changes.

PORTFOLIO STRATEGY

Following a mixed performance last week, we remain bullish on the market, with a particular focus on QQQ, which continues to demonstrate robust net options sentiment. Additionally, certain Trump-aligned picks appear favorable post-election, though we still exercise caution. For the week ahead, we plan to be overweight tech, while also increasing exposure to energy and utilities—both well-positioned to capitalize on ongoing secular trends. To enhance diversification, we will balance our large-cap long positions by introducing selective short positions in similarly weighted large-cap names within these sectors. 8 longs, 5 shorts

Long / Bull Moves (traveling this week so linking for easier view)

Long / Bull Moves - DDOG, APO, TRGP and DOCN adds / VST, TSLA and COIN holds/ APP, CYBR and LLY drops

Adds

We added DDOG to the portfolio due to its exceptional overall metrics, particularly its strong momentum and high net options sentiment score. APO was selected to increase exposure to financial services, supported by its favorable net options sentiment. TRGP was chosen for its market cap diversity, energy sector exposure, and strong Net Options Sentiment, while DOCN was added to enhance small-cap exposure, backed by solid Net Options Sentiment for its size.

Holds

We retained VST due to its consistently strong overall metrics. TSLA and COIN were also maintained for their high scores in Net Options Sentiment, Upside Breakout potential, and robust tech flow metrics.

Drops

We decided to drop APP to balance the portfolio and reduce overexposure to the /tech sector plus Momentum score was headed in the wrong direction. CYBR and LLY were also removed following their lackluster performance on our screener.

Short / Bear Moves (traveling this week so linking for easier view)

Short / Bear Moves - HSBC, BTI, RRR and AES adds / TXN hold / ESGR, LCID and CTLT drops

Adds

We added HSBC to the portfolio for its high market capitalization, financial services exposure, and strong ranking on our screener, providing a solid counterweight to other holdings. BTI was included for its higher market cap, despite its low Net Options Sentiment and Momentum scores, as a strategic addition. RRR was selected primarily due to its low Net Options Sentiment, which aligned with our diversification.

Holds

We chose to hold TXN to maintain large-cap tech exposure as a counterweight to our long positions.

Drops

ESGR was dropped as we liked HSBC as a pick more in the financial services sector. LCID and CTLT were dropped due to poor screener performance.

Portfolio Summary

Long / Bull Moves - DDOG, APO, TRGP and DOCN adds / VST, TSLA and COIN holds/ APP, CYBR and LLY drops

Short / Bear Moves - HSBC, BTI, RRR and AES adds / TXN holds / ESGR, LCID and CTLT drops

8 Longs: DDOG, APO, TRGP, DOCN, VST, TSLA and 2XCOIN

5 Shorts: HSBC, BTI, RRR, AES and TXN

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.