Welcome to the 21st edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

We rolled out a highly requested feature this week, historical line graphs for some metrics. We do a quick overview in this TikTok. If you do not see the graphs, update your app or download with these links:

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

SPY Net Options Sentiment Approaching Big Bear Danger Zone. We advise against new longs this week.

“We were able see signs of this Bull run by identifying higher lows in SPY Net Options Sentiment, as a result, lower highs makes sense as a Bear signal and if this trend continues we think we will move into a Bear run this week or next week.

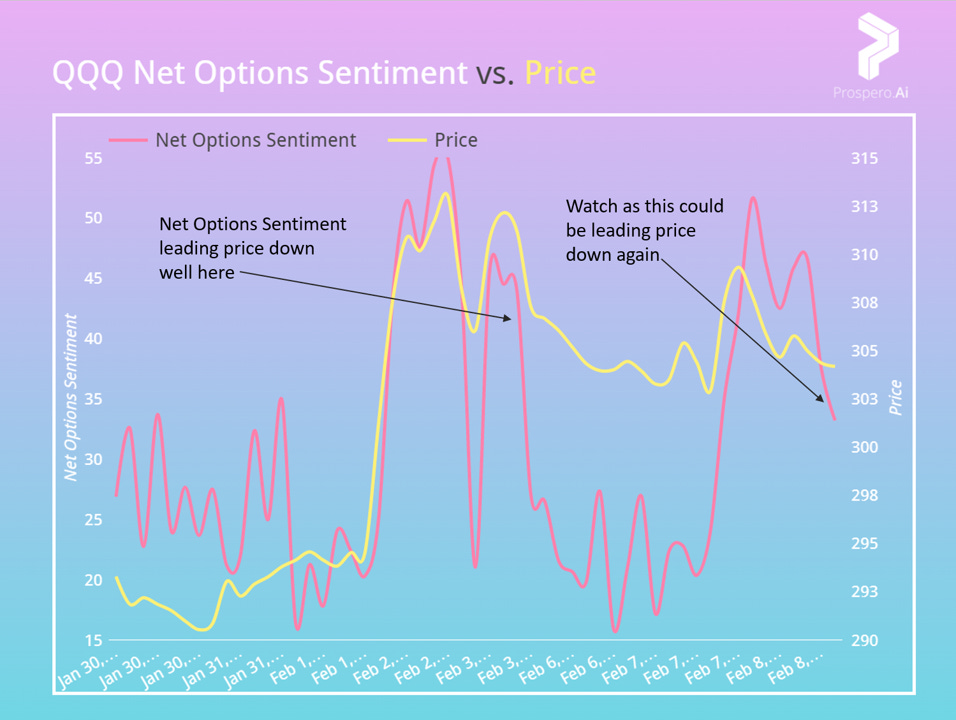

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.”

Our expectations of a Bear run were well placed, QQQ returned -1.87% vs. -.83% for the SPY, Pre-Market Open 02/06 to After-Market Close 02/10.

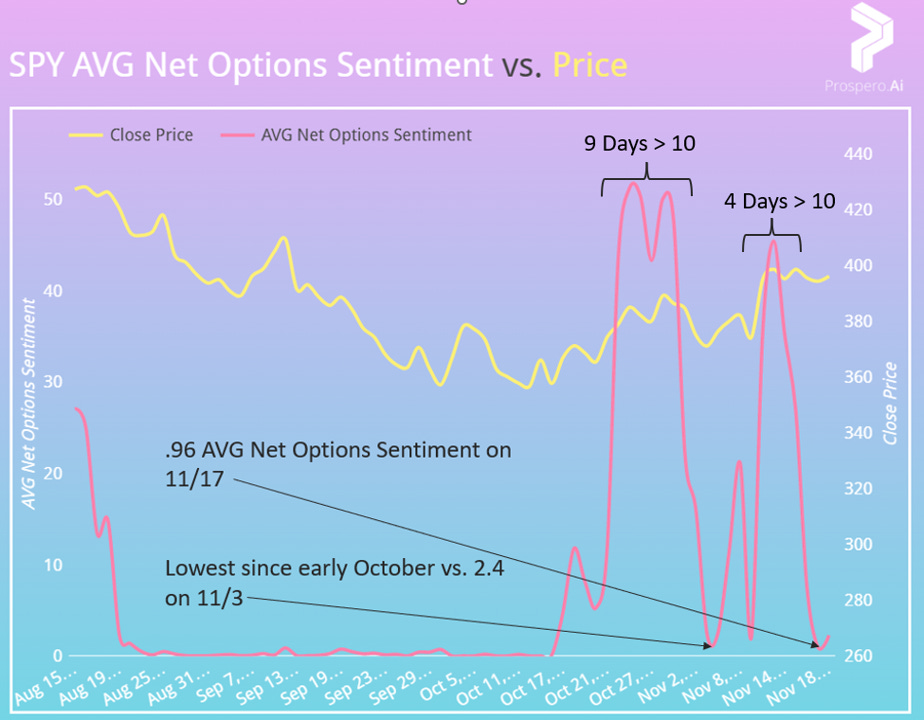

The march towards 0 SPY Net Options Sentiment is important to watch, we discussed in our Premium Newsletter on 02/09/23 how we’ve seen this play out in the past:

SPY Net Options Sentiment stayed right around 0 as we saw the SPY descend from $428 to $357 over 2 months from 08/15. That 02/09 letter was sent pre-market open, after pointing to an increasingly Bearish trend: QQQ opened at $308.88 and post-market close on 2/10 was $299.99 a return of -2.88% since we ramped up our concern and saw this clear pattern:

We think the Bearish trend last week is an indication that the market is expecting to be disappointed with the CPI reading this week. But watch Net Options Sentiment and treasury yields (up is bad) heading into the announcement 830AM on 02/14. We could see a run up if they surprise on the good side but we think that would result in only short term gains.

Same guidance as last week: For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

If you are using Net Options Sentiment to time any of in-week trades this information is invaluable:

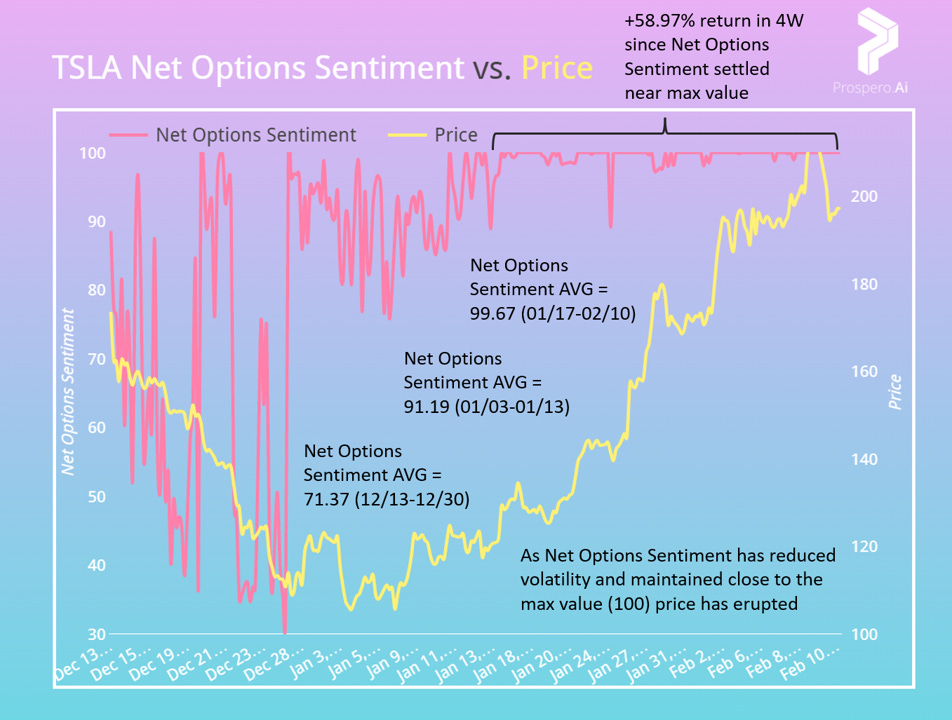

Our signals predicted this breakout from TSLA (Tesla Inc) but concerns are developing

From 02/05/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 85 and QQQ Net Options Sentiment > 40. (Risk factor - Rising 1 Year Treasury Yields)”

TSLA beat the market again but may be slowing down, +.97% Pre-Market Open 02/06 to After-Market Close 02/10 vs. -.83% for the SPY. QQQ Net Options Sentiment again proved essential to help this play. From 9:30 AM 02/08 to 11:30 AM 02/09 QQQ Net Options Sentiment AVG was 42.29 (25.18 rest of last week) and in that time TSLA was up 8.07% ($196.10 to $211/92)

Since we called out TSLA in our 01/02 letter for “close to max Upside Breakout (99) and Net Options Sentiment (99). As well as excellent Net Institutional Flow (92)” it has been up 80.17%.

TSLA still has extremely strong Upside Breakout (97) Net Options Sentiment (100) and Institutional Flow (92). The above Short Pressure trend has us concerned that it could be reversing downward soon though.

Expect an up week if: TSLA Net Options Sentiment > 90 and QQQ Net Options Sentiment > 40. (Risk Factor - Short Pressure > 80)

In Review - Bear Potential - GPS (Gap Inc)

From 02/05/23 letter: “Expect a down week if: Net Options Sentiment < 50 and Net Social Sentiment < 50. (Risk Factor - SPY Net Options Sentiment > 15)”

Seeing as the high for SPY Net Options Sentiment this week was 7.59 and GPS Net Options Sentiment < 50, the Bear set up was ideal for GPS. GPS returned -13.11% Pre-Market Open 02/06 to After-Market Close 02/10 vs. -.83% for the SPY.

Net Options Sentiment is up from last week 42 vs. 36 as is Net Social Sentiment 42 vs. 30 but still in our comfort zone. Continued Bear confidence from average Profitability (44) and worse Growth (36) forecasts which are exponentially Bearish when both < 50. Adjusting guidance vs. last week a bit to allow for more Bearish view overall.

Expect a down week if: Net Options Sentiment < 60 and Net Social Sentiment < 60. (Risk Factor - SPY Net Options Sentiment > 13)

New Longer Term Bear Potential - EPR (EPR Properties)

This trade has a 6-12 month OR 25% decline timeline on it. We formed it with a value thesis backed by our metrics, ideal. 41% of their revenue comes from AMC whose debt rating was just downgraded again. AMC stock is down 72% in the past year and they continue to dilute the stock, it’s wearing on retail investors who are saving the company. Movie theaters are specialty Real Estate. The likely event of some kind of debt restructuring would create heavy losses as those buildings can’t be used for other purposes without massive costs. Not to mention, many think REITs and Real Estate without this concentration risk could be in for a tough year. We love this Bear setup.

None the 10 metrics are Bullish, which increases our conviction. All that would change our short thesis is Net Options Sentiment > 75 (institutions turning short term Bullish in the options markets) or Upside Breakout rising above Downside Breakout because that would indicate institutions in the long-term options markets turned Bullish.