Hey Prospero Family, hope you are well this Sunday! We know our nation has experienced a crazy weekend, and our CEO George Kailas will briefly address it in the next section, but we decided to continue with the normal format of our newsletter.

One of the things I have grown to appreciate about our CEO is he faces losses as head on as wins. That takes humility and a commitment to excellence. I’ve been a part of organizations in the past that only focus on the positive. That feels warm and fuzzy in the moment, but the problem is you never learn from losses and take that difficult step of growing from good to great! THAT is why we titled this newsletter “Good Losses”. We took some losses last week and we’re going to tell you what we learned from them. It is a contrast from a ~month ago where we felt we did some things wrong. Here at Prospero, we refuse to settle for good; and will do whatever it takes to achieve greatness. I’ll address our “Good Losses” in the Macro Section of this newsletter. But now, a word from our CEO George Kailas.

A WORD FROM OUR CEO

Do not want to get too far down this rabbit hole but just wanted to say I’m happy that voters will decide the election. That is the way it should be.

As we will discuss more we took some licks but still beating the S&P 500 by 80% annualized, with a win rate of 62% against SPY benchmarks.

For newer readers linking our short intro + learning videos.

Normal streams this week! Monday 7/15 at 11 AM EST and Wednesday 7/17 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Good Losses

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

In the introduction I talked about how we took some losses last week, but they ended up being good losses because we put our decision through the right process. One of our goals at Prospero, is to not only help you make money, but to teach you how to become a better trader and investor yourself. So let’s take a minute to discuss our thought process.

In the middle of last week, our QQQ Net Options Sentiment took a pretty substantive dip from its trend of being in the high 50’s. Our QQQ NOS has been pegged around 57-58 (very bullish) for days. Then on Tuesday afternoon it dropped to 54. Then Wednesday morning it dropped again to 51. By 12:36 PM on Wednesday, it dropped again to 48.

Here’s a graphic that illustrates last Wednesday’s dip in QQQ Net Options Sentiment.

It’s important to stop and clarify something. When the QQQ number dropped to 48, that is still well above our bullish line. But we need to always remember that the TREND MATTERS; and for 24 hours it had been trending downward. Typically in those situations, we would get very defensive, but we didn’t. Because QQQ had been elevated for quite some time, we were beginning to take a few risks. We entered into longs that were a little more risky, Tech/AI-plays like PLTR with lower Net Options Sentiment < 80 than we typically go for.

I asked George (our CEO) why he chose not to be more defensive. He said he saw the drop on Wednesday and considered exiting from our heavy Tech bet. And added candidly “I kept the bet on due to macroeconomic data. Increasing market confidence in rate cutes from Jerome Powell’s words combined with the fact that QQ Net Options sentiment, even with the drop was comfortably in in our Bull zone” In other words, he focused on the odds of Core Inflation Numbers coming in soft, which would then lead to a probable interest rate cut. He focused on this being an election year, which has historically good returns, and even though a drop in QQQ Net Options Sentiment is something to be taken seriously and so it was still a tough call. He had made significant returns betting on Tech/AI and could have pulled the plug on that at various points, but timing things perfectly is tough to impossible. Some losses are losses and some losses come at the other end of significant gains; and in his mind those are always acceptable vs giving up too early on an investment strategy you have conviction in. Holding onto AI had worked in the past, so he held and took the acceptable loss.

It was then that George told me the “origin story” of our Net Options Sentiment. He said:

“I created Net Options Sentiment, because in my younger days, I kept making the same mistake of picking stocks based on typical value metrics and macro economic data; and over and over again I got it wrong. I realized there was this group of people out there (hedge funds) that were making bets on things that I didn’t even know about yet. So I created Net Options Sentiment to help me see what the big boys were betting on, BEFORE it became public knowledge.”

Finally I asked George what the takeaway for us should be. He said that it never hurts to be defensive when you see a decline in Net Options Sentiment in QQQ or any investment. You hedge or get out of risky bets, to minimize losses. Then, when QQQ suddenly turned the corner and began trending upward on Thursday, bought back in and capitalized on Friday’s rally.

Now, we understand that not everyone can sit in front of a computer everyday and pay attention to the ups and downs of Net Option Sentiment. But it’s a lesson all of us should remind ourselves; while those numbers are not a crystal ball into the future, they are a crystal ball into what big money is betting on. In today’s market, it more often than not pays to be on their side.

CAP/VALUE ANALYSIS

Check out the table below. One of the biggest stories of the week was the Small Cap Rally that happened on Thursday and Friday. As you can see, Small Cap Growth and Value had a strong showing. There seems to be some evidence of market breadth expansion over the last week. I saw one chart on X, that showed that Thursday’s rally was the 4th biggest thrust into Non Mag 7 stocks since 2021. We’ll watch the numbers over the next weeks, some are more certain than us but we are unsure if this is a rotation or just profit taking. But we always look at probabilities, and there is not enough data to know which. So we will do something we haven’t done since we began writing this letter, and that’s look for Small and Mid Cap, long opportunities.

NET OPTIONS SENTIMENT

If you read the Macro Update section, we discussed a missed opportunity in regards to Wednesday’s dip of QQQ Net Options Sentiment. See the graph below. Last Wednesday you can see the dip from what had been a pretty sustained run of QQQ numbers in the high 50’s. We didn’t react to that dip, and that is where we took our losses. But notice that the dip got bought pretty quickly and QQQ numbers finished the week, back in the very bullish, high 50’s. As you can imagine, we’ll be watching pretty closely for what those numbers do at the beginning of this week.

See the graph above. SPY Net Options Sentiment has made a STRONG comeback since its downtrend that lasted through the last two weeks of June. As a matter of fact, July 1st until Friday, we’ve seen SPY NOS improve from the high 30’s to well above our bullish line into the mid 50’s (approaching historical highs). This is a sign of strong market optimism for increased breadth away from Tech/AI. And if our numbers stay in the 50’s that could be a strong signal for us of a bullish continuation. Again, in light of the events of this weekend, we’ll be watching SPY and QQQ Net Options Sentiment very closely before the opening bell Monday morning. Due to the hard data we saw we are actually moving our levels:

SPY and QQQ Net Options Sentiment > 50 = Bullish < 40 = Bearish.

SECTOR ANALYSIS

See the table above. Look at the one month numbers. One thing that stands out to me is that several sectors that have been weak are beginning to show some strength. Real Estate and Consumer Discretionary actually beat out Tech for the month. Financials were right behind Tech as well. Now, look at the numbers for last week. Utilities, Materials and Healthcare had great weeks. These are all positive signs for market expansion and overall market health. Interestingly, Communications had a poor showing for the week and didn’t participate in the rally like the rest of the sectors. We’ll be watching that closely in the days to come.

PORTFOLIO STRATEGY

For the first time in a long time we are tweaking our strategy to account for inclusion of more Smaller Cap Longs. For each Sector we will have our top pick > $10B market cap and below. We are Bullish overall still due to Net Options Sentiment levels on QQQ and SPY so we will expand our strategy but we also want to see more data so we are going with a smaller portfolio - 4 longs and 2 shorts.

Long / Bull Moves - Link to Below Picture

Long / Bull Moves - AMR, ASPN add / AVGO, and BKNG holds / META, GE, SMCI and PLTR drops

Adds

We wanted to make sure our portfolio was at least 50/50 larger cap and smaller cap. and AMR and ASPN were the best smaller cap stocks combined technical / signals. WCC vs ASPN was a close call but we liked the trend on Net Options Sentiment for ASPN after adding it to our trading portfolio on 7/12.

Holds

AVGO and BKNG were easy holds as despite the hard week for larger cap stocks they maintained good technicals. Far better than META above.

Drops

META and GE were easy drops due to technicals. SMCI was the toughest call but with the added risk to larger caps we didn’t want to take anything that was filtered out of the Screener. Meaning PLTR was an easy drop both filtered out and lower in the Screener.

Short / Bear Moves - Link to Below Picture

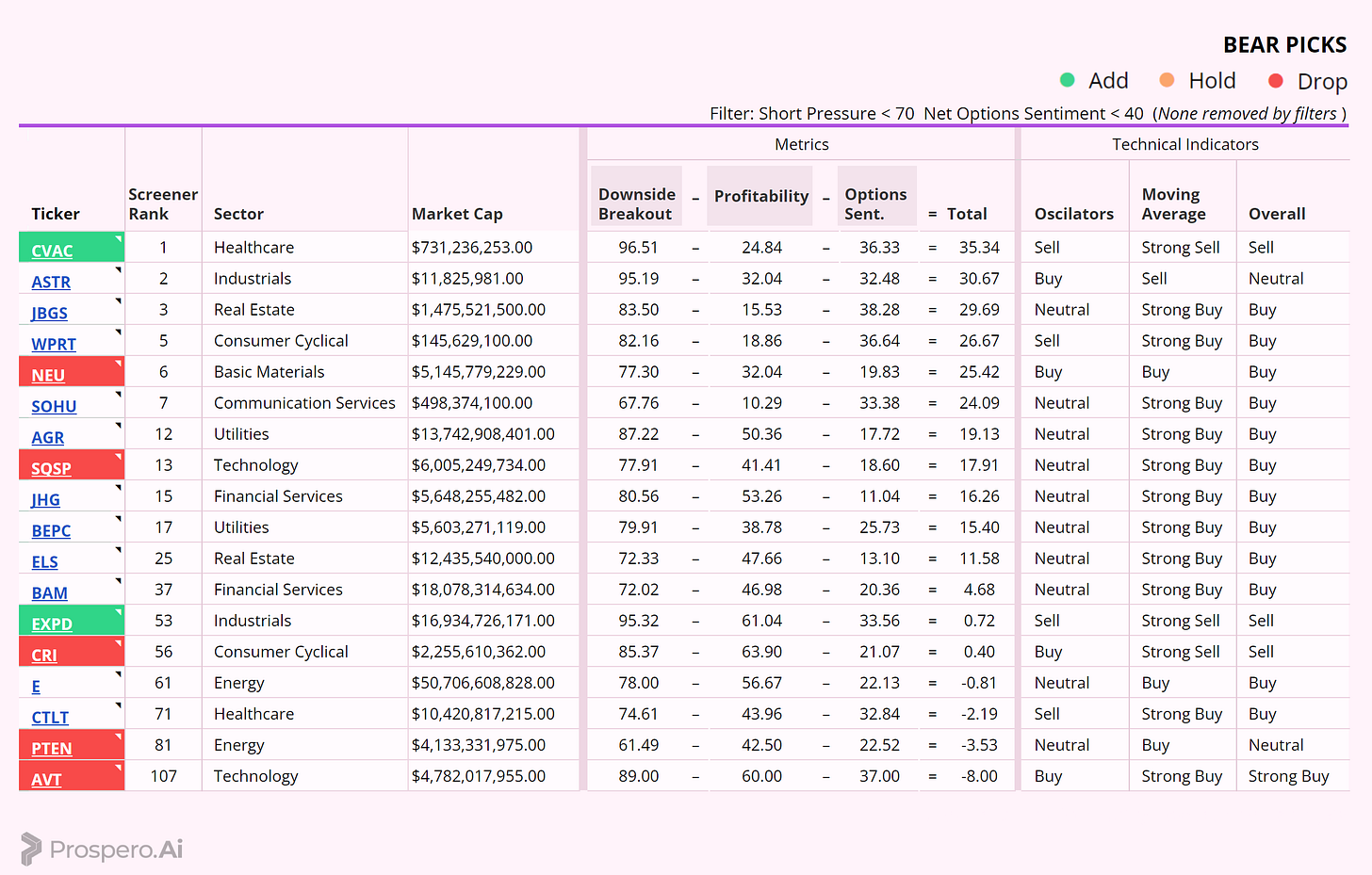

Short / Bear Moves - CVAC, EXPD adds / No holds / NEU, SQSP, CRI, PTEN and AVT drops

Adds

CVAC and EXPD were the only two stocks on this Screener that had good technical setups so they were the easy picks.

Holds

None

Drops

None of the drops had the technicals to be holds but only NEU and SQSP were even potential holds given the Screener performance.

Portfolio Allocation

4 Longs: AVGO, BKNG, ASPN, AMR

2 Shorts: CVAC, EXPD

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.