We are working on an exciting new project! We will train an AI to answer questions as close to how our CEO, George Kailas would as posslible in our app. We’d love your help. Ask us anything here - it will not only make our AI smarter but he will personally answer all the questions we get. Hope everyone has a happy holiday, we are running one more sale this week 33% off but anyone answering a question at a link above we will email a 50% off link again!

We're going to take a minute and talk about why Quantum Computing Stocks have increased a jaw-dropping 2000% over the last few weeks and how Prospero's Net Options Sentiment helped us find a particular stock that allowed us to capitalize on that run up. Later in the Net Options section of the letter, we're going to show you how SPY Net Options Sentiment currently being at 0 ought to get everyone's undivided attention moving forward. But let's start with Quantum computers. Most of you have heard the term before, but many have no idea what it means. For those of you (including myself) that aren't versed in computer technology, here's one of the most basic and simplified explanations I've found regarding Quantum Computing.

Normal Computers: Imagine normal computers are like a really awesome librarian. If you ask it to go get a book for you, it can go into the Library and retrieve one book at a time. Why? Because regular computers use what are called "bits". They're like tiny light switches that can either be off (0) or on (1). In the same way that your librarian can only retrieve one book at time, regular computers can only handle one bit of information at a time. They can accomplish that task with a ton of speed and accuracy, but there are definite limitations.

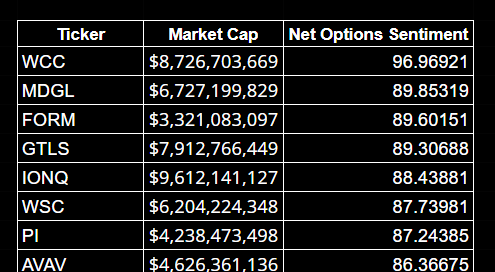

Quantum Computers: On the other hand, Quantum Computers don't use bits, they use what are called "Qubits". A qubit doesn't have to be "on" (0) or "off" (1), but they can be off, on, or "off and on" at the same time. Which honestly makes no sense, but hang with me. Because these qubits can be on and off at the same time, they're not like your librarian. They're like a Superman Librarian, which is not only ridiculously fast, but can check out and retrieve millions and millions of books all at one time! Insert your cliche here. It's game changing. It's paradigm-shifting. Bottom line…It's a REALLY REALLY big deal. One example is Google's Quantum Computer Chip "Willow", that just solved a computation that experts estimate would have taken a normal computer more than a Trillion years to solve! The real world implications of Quantum Computing are impossible for us to get our minds around. In the same way that a person in the 1930's couldn't have comprehended the implications of the current computer/internet age, it's similarly difficult for us to understand the seismic shift in technology that's occurring during our lifetimes. As a result of the hype around Google's Willow, any stock remotely related to Quantum Computers has gone ballistic. QUBT rose 2140% over the last couple of weeks! (thus the title, 'Got a (Qu)bit Carried Away'). But one particular stock that we capitalized on here at Prospero is a company called IONQ. IONQ is arguably the most advanced Quantum Computer company and is the closest to commercialization and monetization of their product in the whole industry. Side note, IONQ is actually one of the greatest regrets of my career. Back in May, I owned around 3000 IONQ stocks with an average price of around $6. Friday, it ended the week at $44.42. Do the math…and don't tell my wife. But despite IONQ's recent run up, on Dec 17, our CEO, George Kailas, entered IONQ long. The reason he chose to buy IONQ, was because their Net Options Sentiment made a pretty substantial jump from 76 to 88 in a single day which helped it stand out on our Momentum score. Now, you may be saying, "88 seems pretty low compared to META, who is currently at 99-100". And you'd be right. But it's so important to understand something about Net Options Sentiment. Small & Mid Cap stocks have a lower average Net Options Sentiment than Large and Mega Caps. So, what matters most, is not the score, but how much the score moves relative to its average. Here's a quick table to demonstrate the different averages by Market Cap:

Small: 55.43

Mid: 55.14

Large: 57.56

Mega: 58.81

On average, Mid Caps have a Net Options number 3.7 points smaller than Mega Caps. The next table shows some specific examples of smaller cap scores and their Net Options:

Check out ROOT at the bottom of the table. Its Market Cap is only 1.1 Billion. But its Net Options is at 85.4. That would be considered a BETTER Net Options Score than if META (whose Market Cap is at 1.4 Trillion), was at the same score of 85.4. By the way, that's why George chose to hold onto IONQ through the market dumping after the Fed speech. Even though IONQ's price was plummeting, its Net Options remained bullish and George decided to hold. Sure enough, the next day, the stock came roaring back. Good call George! It's important to note that Quantum Computing Stocks valuations are currently through the roof. While there are some really smart people claiming that buying them at these valuations are the equivalent of buying Apple in the early 90's, it's impossible to know. If you're trying to make money off the Quantum Computer sector in the short term, watch Net Options Sentiment on a regular basis and if you see the moment rapidly shift lower, that's a good sign to get out. There's almost certainly going to be a pullback in these stocks at some point in the very near future.

A WORD FROM OUR CEO

It was a challenging week but we were well hedged and had some big wins to mostly offset the losses. We are currently S&P 500 by 79% annualized, with a win rate of 59% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Only one stream this week our normal Monday time - 12/23 at 11AM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

GOT A (QU)BIT CARRIED AWAY…

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Check out the Cap Table above. There are two areas of interest to me. The first is Small Caps. Small Cap Growth and Value had the largest pullback of all the sectors. This is after seeing a monumental run over the last month. That pullback is most likely because Small Caps are more sensitive to interest rate hikes and inflation. When Fed Chairman Powell stoked fears of rising inflation at this last meeting, the bloodbath began. The other area of interest is Value Stocks. Look at the "Sum" numbers at the end of the table. Value stocks are by far, the poorest performing group. What makes that interesting, is that Value stocks are actually at their lowest historical performance relative to their Growth counterpart. The implications of this are hard to know, but it's worth noting that there will be some really good companies for sale if we continue to see that sector decline.

QQQ/SPY NET OPTIONS SENTIMENT

Look at the SPY Net Options chart below. There's one data point that is very important to focus on. The SPY Numbers ended last week at ZERO. That is deeply concerning to us. Historically, when Net Options Sentiment drops to zero, it's been a strong indicator of a coming Bearish run. For example, in August of '23, Spy Net Options hit zero and stayed on, or near it, for two months. During that two month period, SPY's price declined from $428 to $357 dollars! So far, SPY Net Options numbers have been on or near zero since Wednesday of last week. That is a major red flag. If Monday opens at Zero and stays there, we need to proceed this week with the utmost of caution.

Check out the SPY Net Options Chart above. As you can see, QQQ also saw a dramatic drop at the end of the week. One particular data point that has us concerned, is that we saw a slight rally in Tech stocks on Friday, and QQQ started creeping back up into the high teens/low 20's. But by the end of Friday, it had declined again and ended the week at 10. Not good. That combined with the Spy Numbers gives us a pretty bearish outlook heading into the week. The good news is that stock historically performed well over the next two weeks, but the SPY Numbers are (currently) telling a different story.

SECTOR ANALYSIS

The negative numbers for the sectors last week are indicative of what we're seeing in the Net Options Sentiment. Bearishness. Honestly, there's not much here that gives us any positive hope. Ideally, last week was a healthy pullback, and the Santa Clause rally will commence shortly. But until the Net Options Numbers turn Bullish, it looks as if any bounce might be short lived.

PORTFOLIO STRATEGY

Building on last week's underperformance and with SPY Net Options Sentiment in bearish territory, we aim to overweight tech, given that QQQ Net Options remain bullish. This week, we'll meticulously allocate our portfolio, emphasizing sector diversification and the downside protection it offers. We'll also hedge our market cap exposure with larger market cap shorts. Consequently, we'll adopt a much more risk averse stance, maintaining our winning positions and cautiously seeking incremental upside. 7 longs, 7 shorts.

Long / Bull Moves

Long / Bull Moves - BKNG, AXON and AXP adds/ GOOGL, META, IONQ and COIN holds/ AVGO, BA, AZO, APO and TSLA drops

Adds

We decided to add BKNG for sector diversification as well as it being a good all around pick with a good Upside Breakout. We added AXON for market cap and sector diversification with good Tech Flow and Net Options Sentiment. AXP was added for more sector diversification with great Upside Breakout and Tech Flow.

Holds

GOOGL remained high on our screener with great Tech Flow and Momentum. META was kept as it had standout Upside Breakout, Tech Flow and Momentum metrics making it an easy pick. We still like IONQ for market cap diversification with good Tech Flow and Net Options with standout Momentum. COIN was kept for its excellent Upside Breakout and Net Options.

Drops

AVGO was dropped as we didn’t like our overexposure to mega-caps, especially with its muted Net Options signal. We dropped BA as AXON looked like a better way to get Industrials exposure. AZO was dropped as BKNG stood out as a better Consumer Cyclical play. APO was dropped because it performed poorly in our screener. Although we have favored Trump picks in the past, TSLA didn’t excite us this week with lackluster Tech Flow, Net Options and Momentum.

Short / Bear Moves

Short / Bear Moves - IIPR, PBR, HSBC, CAR and WEN adds/ FYBR and ALB holds/ PPBI, CUBE, KBH, AMED, MAC, KEX and CVS drops

Adds

IIPR looked like a great pick with low Tech Flow and Momentum. PBR was chosen for its larger market cap and favorable Net Options Sentiment for a short pick. HSBC was also chosen for market cap reasons with decently low Tech Flow and Net Options. CAR was a great Industrials pick with low Tech Flow and Net Options. We liked WEN for its Consumer Cyclicals exposure to balance out our long picks.

Holds

FYBR was kept for its mid-sized market cap with good Net Options Sentiment. ALB was kept for its low Momentum and Net Options.

Drops

PPBI was dropped as we liked HSBC more as a Financial Services play. CUBE, KBH, AMED, MAC, KEX and CVS were removed due to their poor performance in our screener.

Portfolio Summary

Long / Bull Moves - BKNG, AXON and AXP adds/ GOOGL, META, IONQ and COIN holds/ AVGO, BA, AZO, APO and TSLA drops

Short / Bear Moves - IIPR, PBR, HSBC, CAR and WEN adds/ FYBR and ALB holds/ PPBI, CUBE, KBH, AMED, MAC, KEX and CVS drops

7 Longs: BKNG, AXON, AXP, GOOGL, META, IONQ and COIN

7 Shorts: IIPR, PBR, HSBC, CAR, WEN, FYBR and ALB

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.