When you get feedback like from our Discord, you have to write a letter about it:

“The app did well showing broadcomm ahead of the big move post earnings!! Guessing someone out in the market knew what was coming and positioned themselves before the move and the app picked that.”

If you haven't heard, AVGO, (Broadcom) had unbelievable earnings Thursday after the bell. They had a top and bottom line beat with increased guidance moving forward. But here's what really moved the needle for their earnings; they had a 220% year over year growth in A.I. driven revenue, to the tune of $12.2 Billion. After the earnings call, the stock went bananas and ended up skyrocketing a massive 21.3% just in the morning trading session alone. With this introduction, I want to share a quick story about how George and I (Matt) played AVGO's earnings call differently, and the results of those two choices were radically different. BUT, if you asked me which one of us made the right decision…I'd say both of us did. How is that possible? Let me explain.

You see, at heart, our CEO is a teacher. He loves seeing everyday retail investors learn the discipline of trading. When I came on board as one of the writers, George began to mentor me in everything from Prospero's signals, to macroeconomics, value investing and the ins-and outs of large institutional dynamics. It's been one of the greatest experiences of my life, learning from one of the best.

But now that he's been mentoring me for well over a year, I've begun to get more and more confident in my own ability as an investor. This week was a great example of how the principles I've learned, combined with Prospero's signals, made a huge difference in my choice to invest in AVGO before earnings. George and I played the AVGO (Broadcom's) earnings completely differently. George didn't invest in AVGO before earnings. I did. Yet both of us had solid fundamental reasons for why we chose the route we did. Here's how it played out.

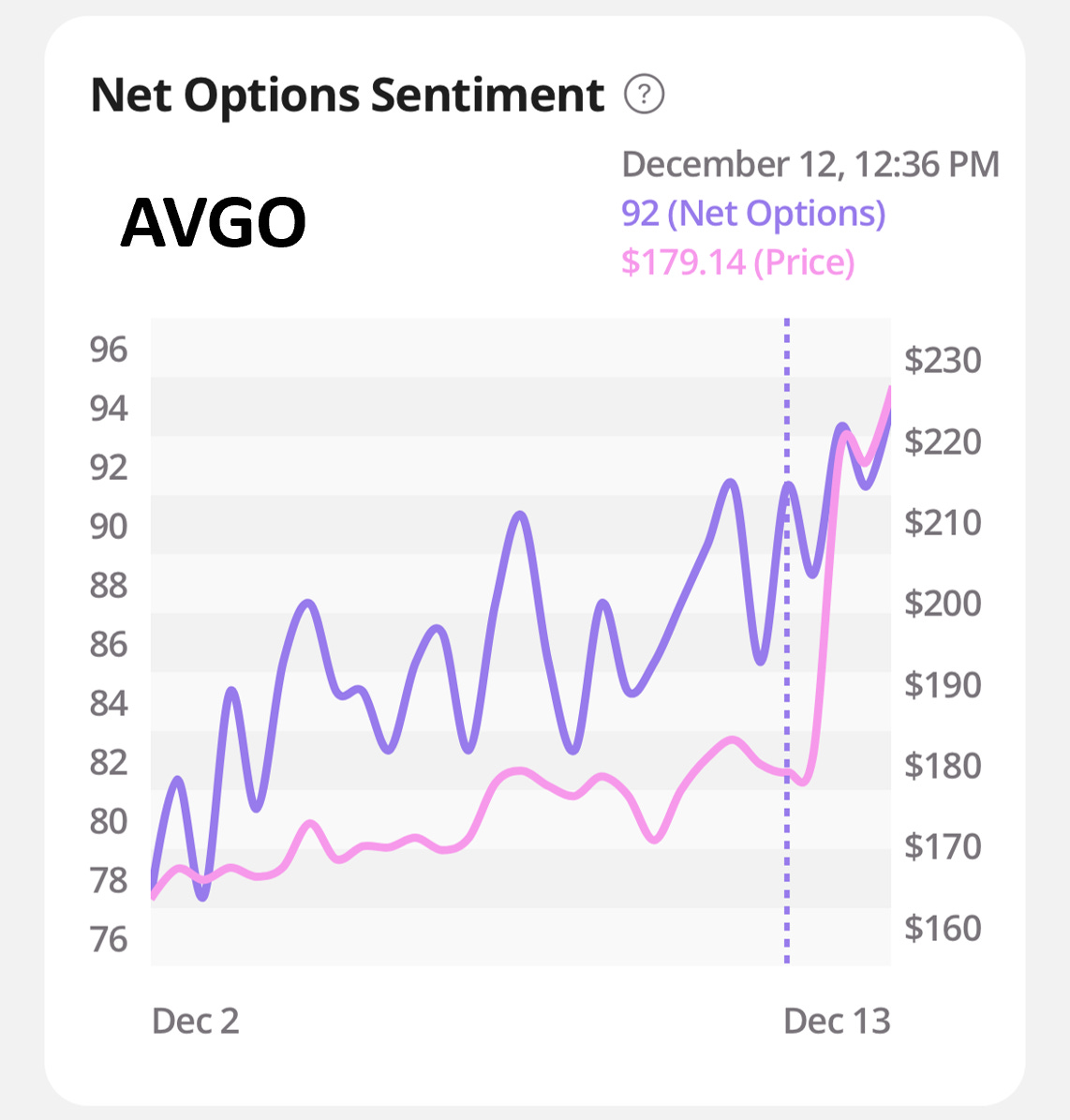

Heading into earnings, AVGO started showing STRONG Net Options and Upside numbers. In addition, Net Options Sentiment showed reduced volatility and a much higher low right before earnings.

The company showed up in the "our picks" list on the app a couple of days before the earnings were released. I knew the earnings were coming up, and that got my attention. Here are a few things I noticed. One, its Net Options Numbers were not only strong, but had been on an uptrend since early December. On December 2nd it's Net Options sentiment was in the 70's. By the morning of earnings, it had slowly moved into the 90's. It's always important to not only watch Prospero's numbers, but watch their trends as well. Additionally, AVGO's short pressure was relatively low and their Net Social Sentiment was pretty high. Despite all that goodness, George chose not to enter the trade. And there were actually REALLY good reasons why he chose not to. Here are the two primary ones….

1. George is by nature, a defensive investor.

Under George's leadership, Prospero has had incredible gains this year, blowing the S&P benchmark out of the water, even on a year where the S&P has reached new heights. Part of why he has done so well is his disciplined approach to investing. Bottom line is that earnings are a volatile and risky time to invest. We've seen companies do really well, only to see their stock tank because of one off-handed comment from the CEO.

2. Despite AVGO looking good in our screeners, other stocks had stronger stories in the larger Macroeconomic environment.

TSLA and COIN were great examples. Both have had strong results the last few weeks and we were already heavily invested in those areas. With Trump entering the White House, he's made it very clear he's pro Bitcoin. Additionally, Elon Musk and Trump are besties now, which bodes well for Tesla. Lastly, AVGO is in the chip sector and has macro concerns b/c of the US and China's relations. Why put yourself in such a risky earnings play with that much uncertainty? George decided it made more sense to stay in stocks that had just as much (or more) upside as AVGO, with less downside risk. This is despite the fact that he was impressed by the Net Options Sentiment run AVGO went on, sometimes there are a lot of good options and you have to eliminate a highly promising one. With SPY Net Options Sentiment having a tough week he wasn’t willing to weigh too heavily long.

It actually makes A LOT of sense. But despite his conviction, AVGO did really well on earnings and exploded. Someone on Tiktok made a comment to the effect of "You missed that one" or "I bet you wish you'd done that differently". The reality is that George would make the same decision every single time. Why? Because of his fundamental process of investing and his sound principles of risk management. When you stray from that, you get in trouble. I guess George's track record speaks for itself.

I, on the other hand, chose to invest pretty heavily into AVGO right before earnings. Why did I choose to take the risk? One, I saw AVGO's Net Options growing and trending higher over the week. Two, its upside was doing the same. Interestingly, I noticed that AVGO's downside had decreased RAPIDLY on December 10th. But there was one more reason. I only invested my profits I had made from TSLA and COIN over the last several weeks. So even though it was a risky play, the worst case scenario is that I would lose money that was pure profit. I bought 2, deep in the money calls right before earnings. I made a great profit on those two calls the following day.

Was I right and George wrong? Absolutely not. Every single aspect of George's thesis was perfectly sound and was a healthy way to approach earnings at the end of the year. But man, I'm glad George taught me how to read those signals for myself!

There is one more important story on this front. One of my personal favorite stocks is ASTS (AST Spacemobile). I first told George about ASTS months before Prospero added it to their portfolio. It’s a company bringing 5G connectivity to unmodified cell phones. AT&T, Verizon and Google are all partners. George informed me that although it was a compelling growth story, its Net Options Sentiment and Upside were not high enough for a Small Cap stock. Sure enough, ASTS went up. I made my triumphant return to him a few months later to point out how I saw something he didn’t; but he said he still wouldn’t have invested in it. That surprised me a bit. He said he shouldn’t have invested because it didn’t meet his criteria. Later on in the months that followed, its Net Options and upside met George’s criteria and he added it. His first 4 positions had annualized gains of 34, 45, 71 and 71 percent! George told me later that once I brought it up to him, he was intrigued by the growth story, but he doesn’t concern himself with trying to get in a stock before everyone else, because there’s usually plenty of time to jump into a company's growth cycle. He’d rather get in during the right risk profile than be the first to discover something.

Here’s the final question we want to answer. Why is it often better to wait for an appropriate risk profile, even if there will be times you miss out on huge returns? The answer is simple. Because of all the times the risk outweighs the reward and you’re left holding losses you can’t afford to realize. A final example would be the people online had been giving him a hard time about Soundhound AI. For the exact same reasons, he chose not to enter SOUN earlier in the year. It’s a great company, but at the time it was trading at a really elevated valuation and the risk profile was too high. He chose to pick other stocks. SOUN eventually took off, but it took months. If Prospero would have jumped in the trade when many in the crowd wanted to, we would have seen a loss, or ended up even after 9 months as our picks far outperformed that. It’s really easy to get attached to a name we love and ignore what’s called “time value of money”. It's a process that doesn’t think about rights and wrongs or I told you so’s, just simply what is the best investment today. Picking a stock you love, or have feelings about, loses out to process time and time again.

A WORD FROM OUR CEO

We had a bit of a tough week but the year is still looking incredible we are beating the S&P 500 by 80% annualized, with a win rate of 59% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Back to normal streams! Monday 12/16 at 11AM EST and Wednesday 12/18 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

HAVING "AV-GO" AT IT

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Check out the Cap/Value Analysis Table above. Growth stocks, across the board have had a stellar month. Later in the week, we're likely to write about the possibility that the Santa Rally has already happened. Look at the 3 months numbers for Small, Mid and Large Cap Growth. Pretty impressive. Will that continue? It's hard to know, but interestingly, there was one sector that was positive on the daily numbers. Large Cap Value. That is often a sign of "risk off" behavior. It will be interesting to see if Large Cap Growth continues its run heading into the holidays.

QQQ/SPY NET OPTIONS SENTIMENT

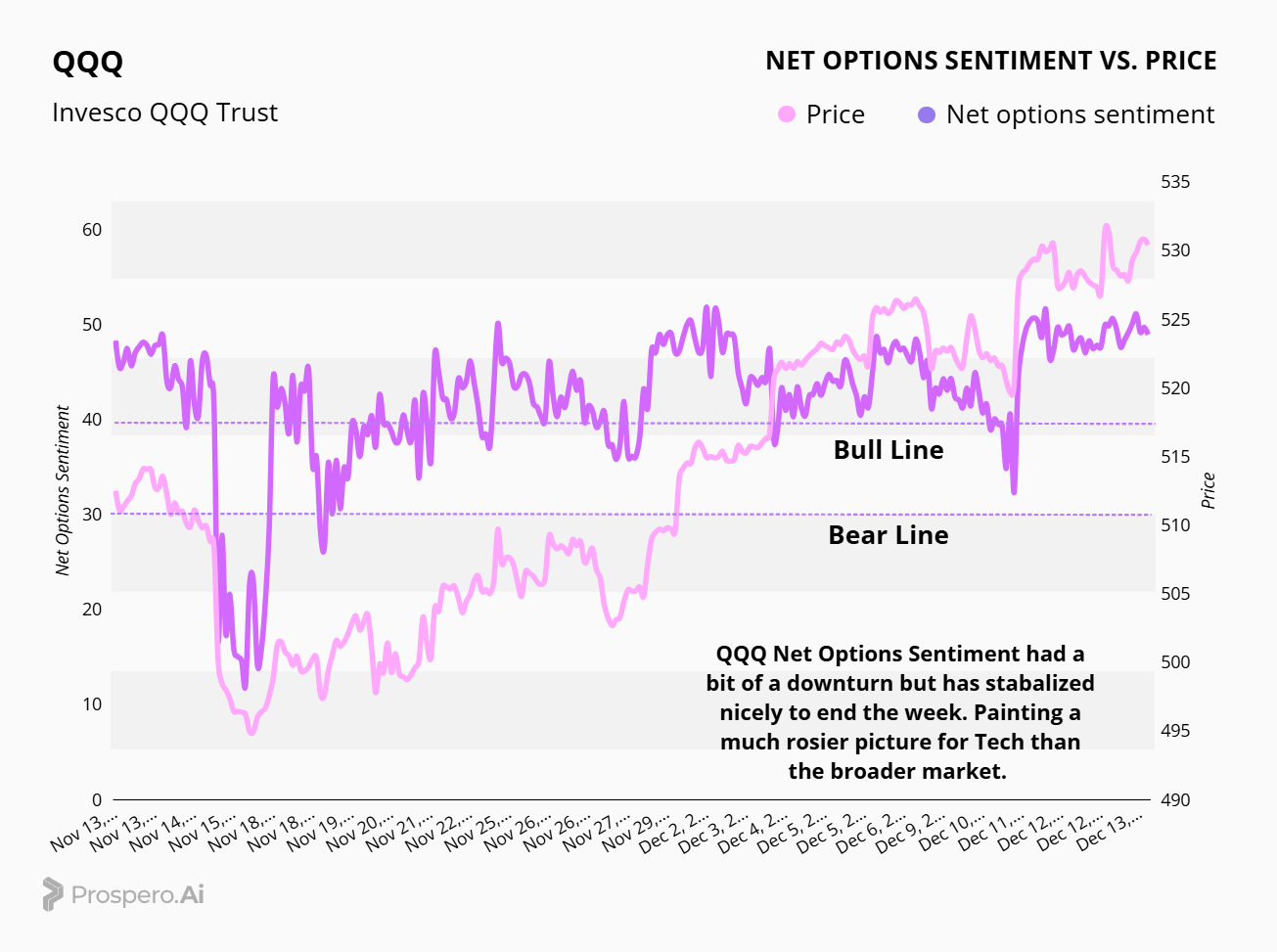

Let's look at our QQQ Net Options Sentiment chart below. QQQ Net Options has been on a bit of a slight downward trend since early December, but is still firmly in our bullish zone and remained stable all last week. It's definitely painting a rosier picture than our SPY numbers, which you're about to see have fallen off a cliff.

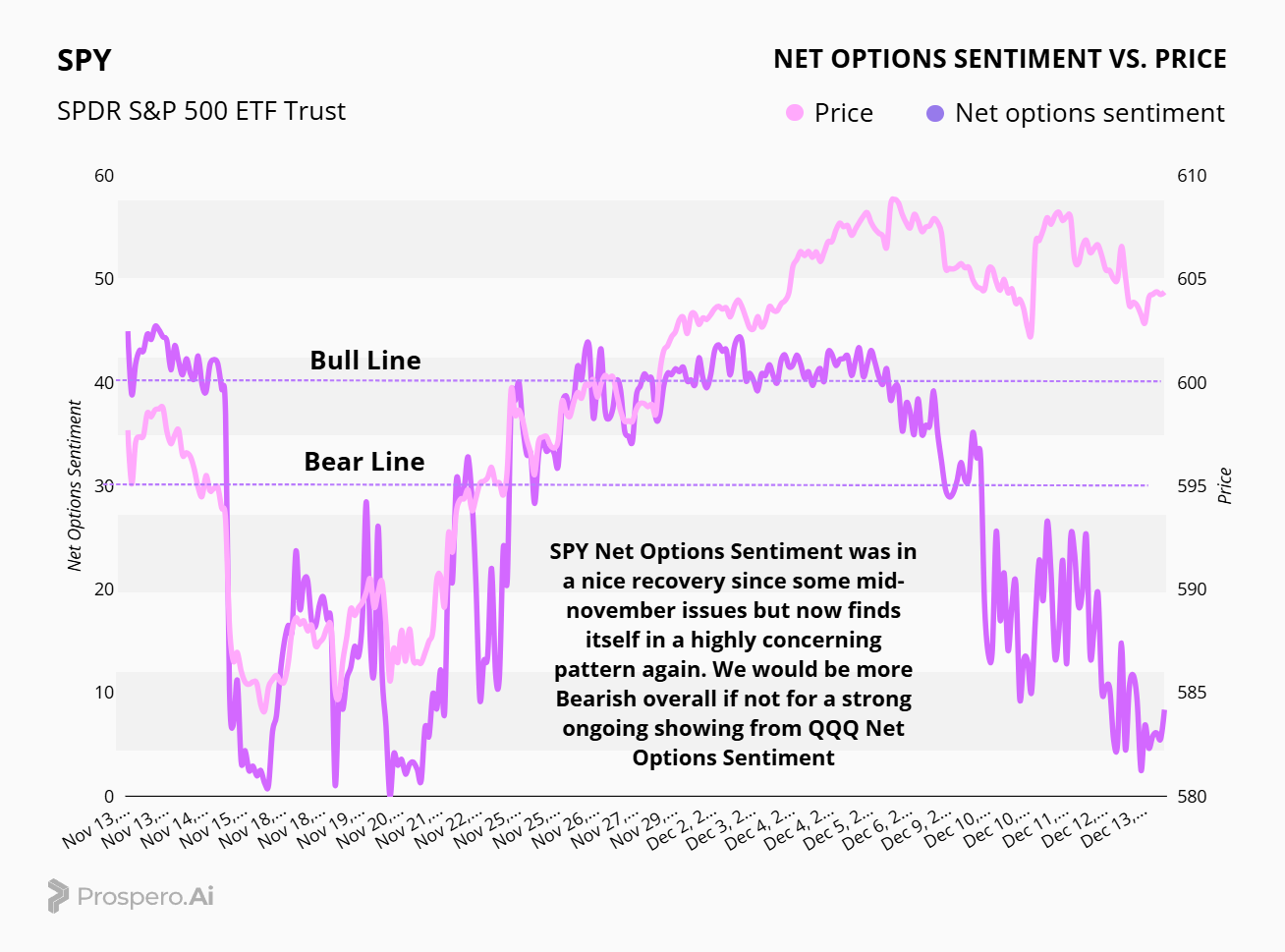

Look at the SPY Net Options graph above. As you can see, SPY Numbers are deeply below our Bullish levels. This is a complete divergence from QQQ Net Options and has us pretty concerned. Those numbers are LOW. But the only reason we aren't bearish overall, is that QQQ is showing such relative strength. One of two things is likely to happen as we move toward the new year. We'll have a Santa Rally and the SPY will likely trend upward….OR….QQQ will begin to trend downward and things could get interesting.

SECTOR ANALYSIS

Check out the Sector Analysis Chart above. Lots of green on Friday with Tech and Consumer Discretionary leading the way. Communications and Financials seems to have cooled a little from their 3 and 1 month numbers. Communications especially had a rough end to the week. Energy, Real Estate and Healthcare continue to be the losers with very little sign of a turnaround.

PORTFOLIO STRATEGY

Building on last week's underperformance and with SPY Net Options Sentiment in bearish territory, we aim to overweight tech, given that QQQ Net Options remain bullish. This week, we'll meticulously allocate our portfolio, emphasizing sector diversification and the downside protection it offers. We'll also hedge our market cap exposure with larger market cap shorts. Consequently, we'll adopt a much more risk averse stance, maintaining our winning positions and cautiously seeking incremental upside. 9 longs, 8 shorts.

Long / Bull Moves

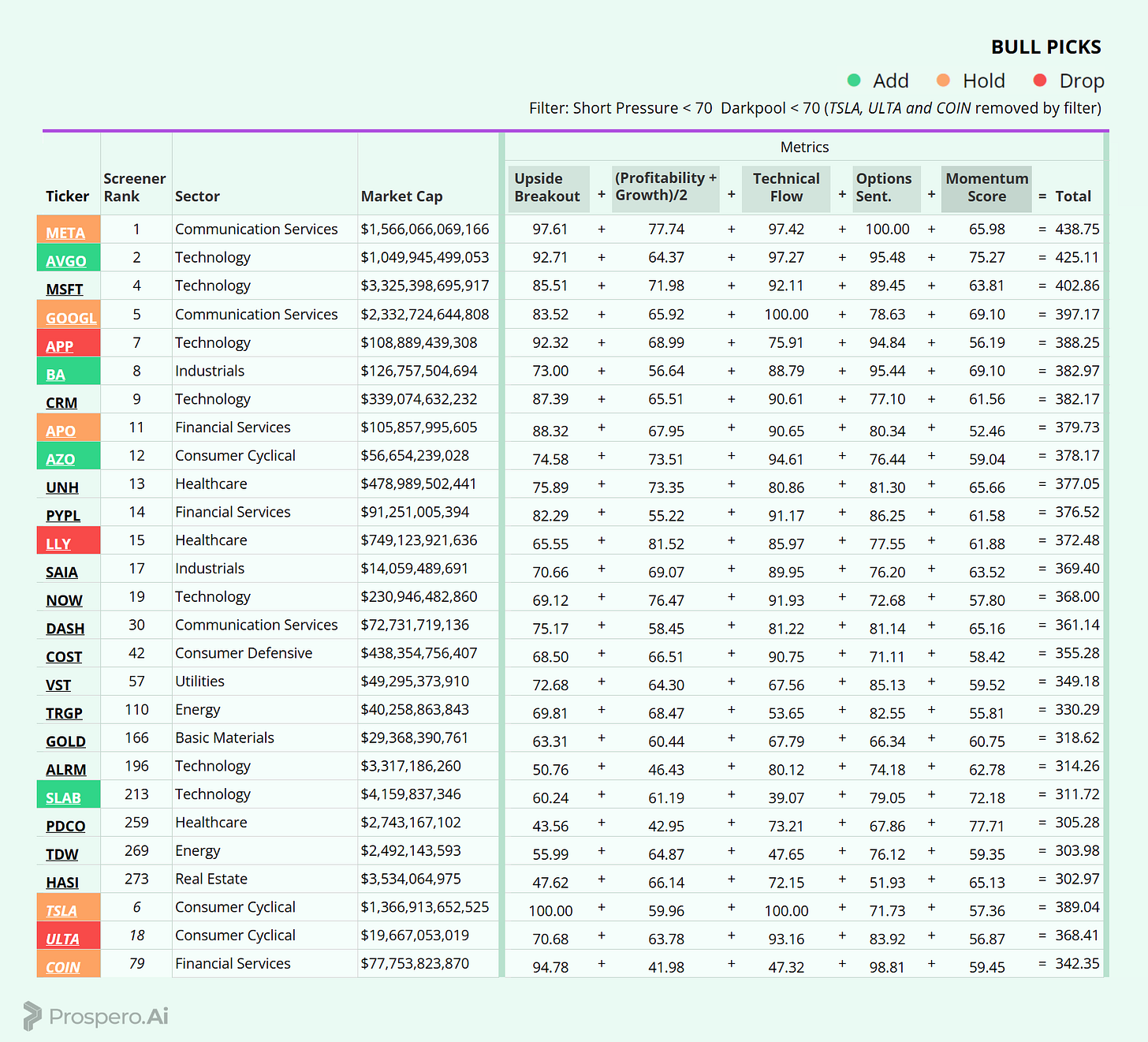

Long / Bull Moves - AVGO, BA, AZO and SLAB adds/ META, GOOGL, APO, TSLA and COIN holds/ APP, LLY and ULTA drops

Adds

AVGO was added as it was the second best performer on our screener with high marks across all of our metrics. BA was added for sector diversification with great Net Options and good Tech Flow. AZO was picked as a great mid cap consumer cyclical name with solid metrics all around. SLAB was added as a smaller tech name with promising Net Options Sentiment and excellent Momentum.

Holds

META is a hold as it was the top performer in our screener. GOOGL is a hold from earlier last week with standout Tech Flow. We continue to hold APO with its mid size market cap, with great sector diversification and good Tech Flow and Net Options. We keep our Trump trade picks with TSLA and COIN with top marks in Upside Breakout this week.

Drops

APP was dropped due to overexposure in large cap tech names that we found more appealing. LLY was dropped in favor of different sector exposure. ULTA was dropped as it was screener out with no standout metric.

Short / Bear Moves

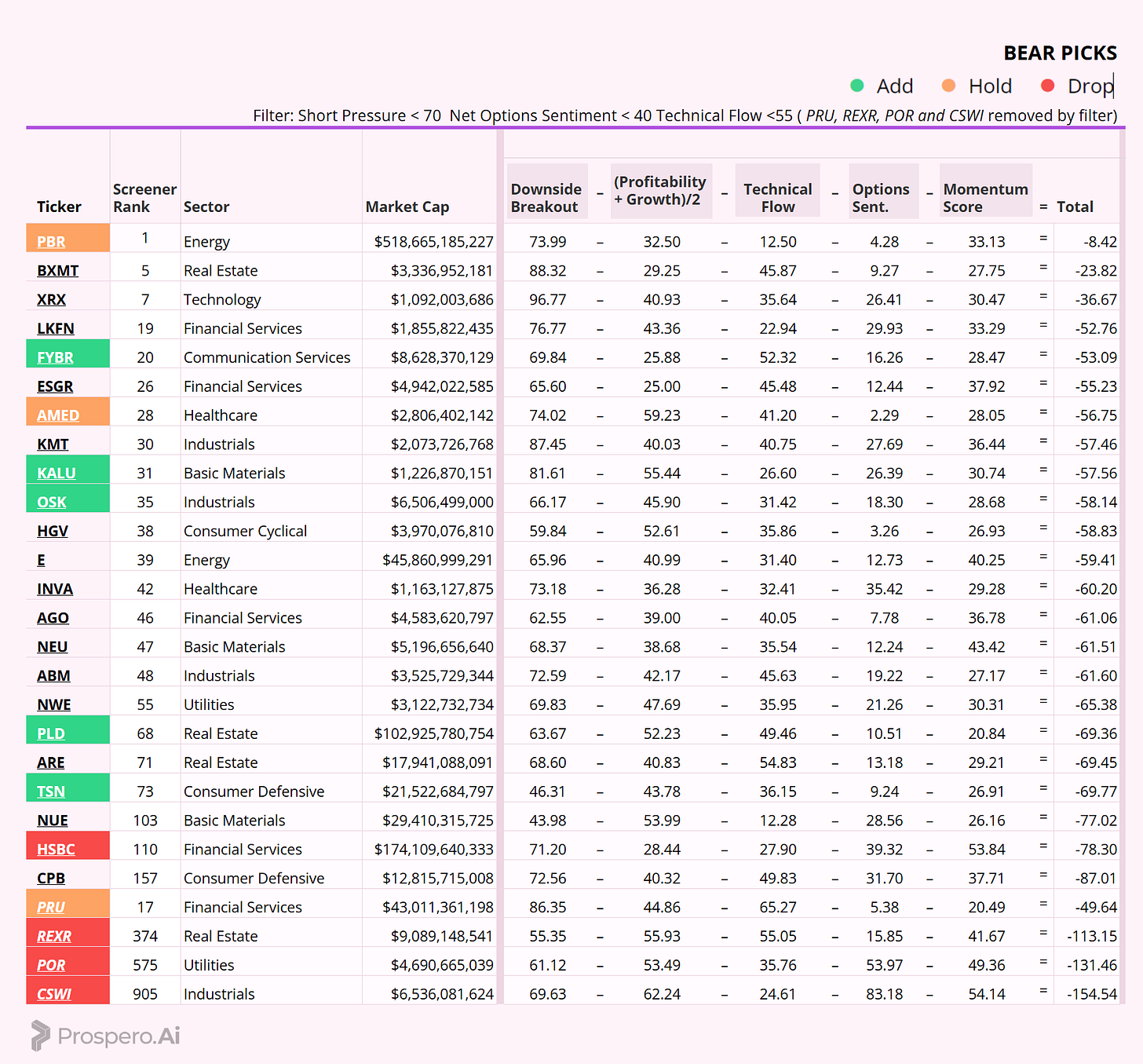

Short / Bear Moves - FYBR, KALU, OSK, PLD and TSN adds/ PBR, AMED and PRU holds/ HSBC, REXR, POR and CSWI drops

Adds

FYBR was added with great sector counter-exposure with favorable Net Options Sentiment and a larger market cap. KALU was added for sector diversification with a great Downside Breakout. OSK was added as a counterweight to BA on the long side, with favorable Net Options Sentiment. PLD and TSN were added for market cap diversification and favorable Net Options Sentiment for a short.

Holds

We’re keeping PBR as it ranked at the top of our screener for the second week in a row. AMED was kept for sector diversification, having great placement in our screener. We keep PRU for its larger market cap with extremely low Net Options Sentiment.

Drops

HSBC, REXR, POR and CSWI were removed due to their poor standing in on our screener.

Portfolio Summary

Long / Bull Moves - AVGO, BA, AZO and SLAB adds/ META, GOOGL, APO, TSLA and COIN holds/ APP, LLY and ULTA drops

Short / Bear Moves - FYBR, KALU, OSK, PLD and TSN adds/ PBR, AMED and PRU holds/ HSBC, REXR, POR and CSWI drops

9 Longs: AVGO, BA, AZO, SLAB, META, GOOGL, APO, TSLA and COIN

8 Shorts: FYBR, KALU, OSK, PLD, TSN, PBR, AMED and PRU

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.