Welcome to the 25th edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Our thoughts on SVB.

If you do not yet have the app:

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

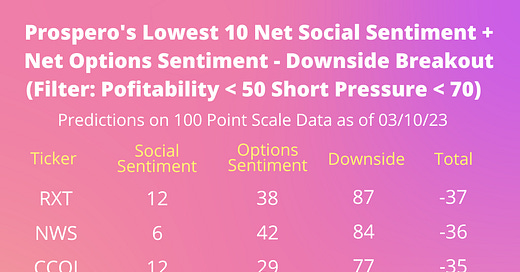

We get into index level Bear signals below but since being Bearish now isn’t unique we are bringing our favorite Bear filter to the top.

Last shared this filter in 02/20/23 letter (filter at the bottom with a description of why we like it) 8/10 beat the market as shorts since then:

Bearish trends for SPY and QQQ Net Options Sentiment accelerate

From 03/05/23 letter: “For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.”

You will see below how Net Options Sentiment was again helpful to get you ahead of a market turn. QQQ returned -3.66% this week vs. -4.36% for the SPY. Pre-Market Open 03/06 to After-Market Close 03/10.

Our premium 03/07 letter: Key SPY Indicator Back in Bear Zone predicted this Bear turn well:

Also from that letter “Until we can get a more reliable read on what is going on with QQQ and Net Options Sentiment we will lean on SPY for the whole market in our guidance. SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.” That proved very helpful in the short term but let’s zoom out:

Our premium 03/10 letter: Red alert for risk today highlights another way Net Options Sentiment can be helpful. Big spikes in this metric caused by anomalous trading behavior turned out to be quite prescient as 3/10 was a highly volatile day which also included a major news event. Prospero was built as a variety of new ways to visualize risk so it is always interesting to see new ways it can prove to be useful in this way.

We’ve warned against a “zero flatline” for SPY Net Options Sentiment before but we can also see how helpful descending towards that value into our “Bear guidance” (< 10 for the week) can be:

As we did in our bi-weekly newsletter with all the volatility we will use SPY Net Options Sentiment as our market level indicator until further notice.

SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

Bear Review - FHN (First Horizon Corp)

From 03/05/23 letter: “Expect a down week if: FHN Net Options Sentiment < 30 and SPY Net Options Sentiment < 10. (Risk Factor - Net Social Sentiment > 60)”

FHN delivered as a Bear returning -5.90% this week vs. -4.36% for the SPY. Pre-Market Open 03/06 to After-Market Close 03/10.

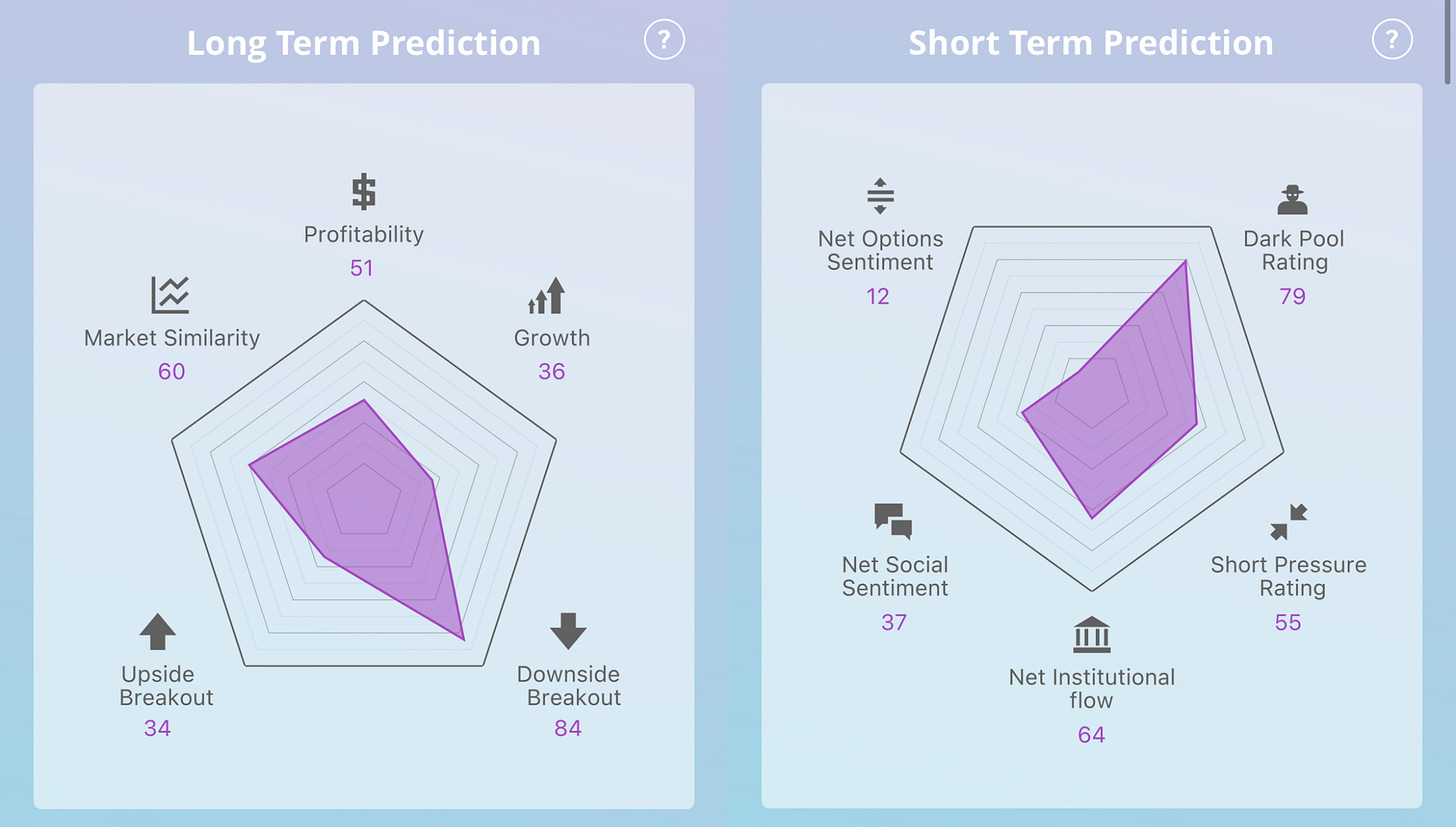

FHN would have been #4 on the filter above had it not had > 50 Profitability so obviously we continue to like it as a Bear for the same reasons as last week.

Expect a down week if: FHN Net Options Sentiment < 30 and SPY Net Options Sentiment < 10. (Risk Factor - Net Social Sentiment > 60)

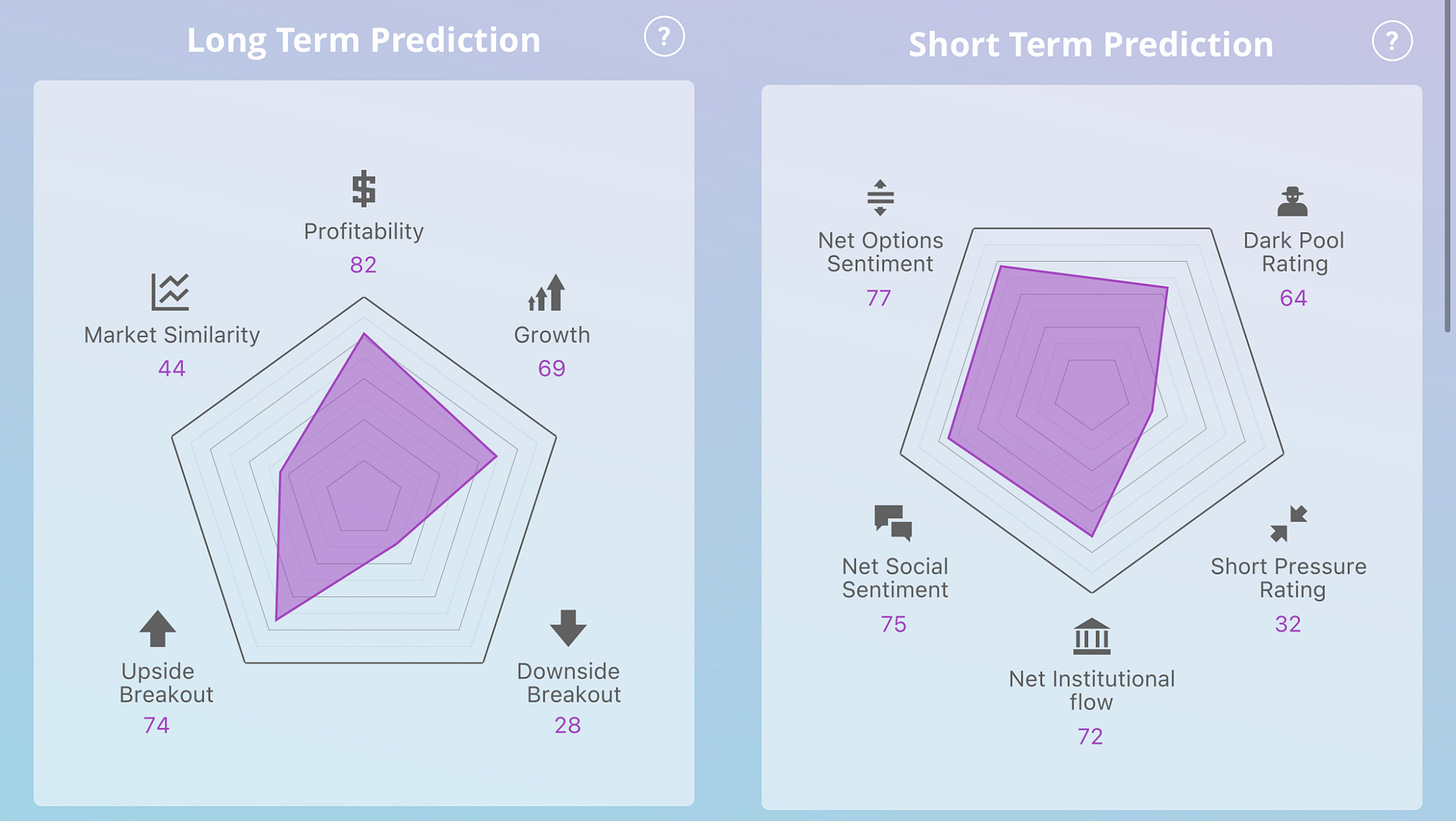

Bull Review - MELI (MercadoLibre Inc) some call the “Latin American Amazon” (Case study review linked here)

From 03/05/23 letter: “Expect an up week if: MELI Net Options Sentiment > 75 and QQQ Net Options Sentiment > 35. (Risk Factor - Net Social Sentiment < 50)”

MELI returned similarly to the overall market -4.49% this week vs. -4.36% for the SPY. Pre-Market Open 03/06 to After-Market Close 03/10.

This is the only Bull pick we are recommending, especially if you’d like a non-index to Hedge bets on the short side. However, we are not Bullish at all unless the market changes. This is why we are using SPY Net Options Sentiment for guidance despite this being a tech stock.

Expect an up week if: MELI Net Options Sentiment > 75 and SPY Net Options Sentiment > 10. (Risk Factor - Downside Breakout > 30)

Our signals were completely on top of the TSLA (Tesla Inc) run up but increasingly we’ve pointed to signs of concern which came to fruition

From 03/05/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 90 and QQQ Net Options Sentiment > 35. (Risk Factor - Short Pressure Rating > 80)”

We’ve been warning about the end of the run for TSLA and we did spend plenty of time with both QQQ Net Options Sentiment < 35 and TSLA Net Options Sentiment < 90. No surprise it had a bad week -12.03% this week vs. -4.36% for the SPY. Pre-Market Open 03/06 to After-Market Close 03/10.

Due to this movement we are removing TSLA from our watch list after a great run.