Have you ever wondered why we talk about Net Options Sentiment so much at Prospero? Net Options Sentiment is one of the foundational tools that makes Prospero unique. And today we want to take a minute to talk about "why" Net Options Sentiment is a game-changer in today's market. In a minute, I want to give you some examples of just how effective our Net Options Sentiment Numbers have been at predicting these volatile market cycles. But first, for those of you new to Prospero, let me give you a brief review of our Net Options Sentiment numbers and what they measure.

Net Options Sentiment is one of our short term signals that measure the extent and force by which institutions are paying more for "call options" vs "put options." Very simply put, call options or calls, are a bet that a stock will go up. Put options or puts are a bet that a stock will go down. Our Net Options Sentiment shows if institutions are, in aggregate, betting more that a stock will go up or down in the short term options markets. This updates every 3 minutes during trading hours. Higher Net Options Sentiment means higher prices are being paid for calls with strikes above the trading price. Lower Net Options Sentiment means higher prices are being paid for puts with strikes below the trading price.

Why does that matter? Because our signals don't focus on where BIG MONEY is putting their money on the riskiest shorter expiration options. More often than not, institutions have insight & data that the average retail investor doesn't. This was the thinking behind building Net Options sentiment, helping retail “use their weight against them.” Additionally, they have enough capital to actually influence the direction of a stock. As a result, whether institutions are heavy in Calls or heavy in Puts, is a very valuable piece of information, because it lets us know what direction institutions are betting a stock will go. Or the direction they might use their considerable capital to push it to go after buying the options. THAT is what our Net Options Sentiment measure.

With that in mind, let's talk for a second about our QQQ and SPY Net Options Sentiment. They are proving to be one of the most valuable tools that Prosero has to offer the retail investor. QQQ Net Option Sentiment measures the extent the market is bullish or bearish on QQQ Nasdaq (tech heavy) ETF. Every week in our newsletter, our team will let you know what we feel like the "Bull Line" is for each of those. Typically our Bullish number will be 40. In other words, if QQQ or SPY NOS is 40 or higher, that shows that institutions are generally bullish on the QQQ and SPY. If the NOS numbers are 30 and below, that is typically very bearish.

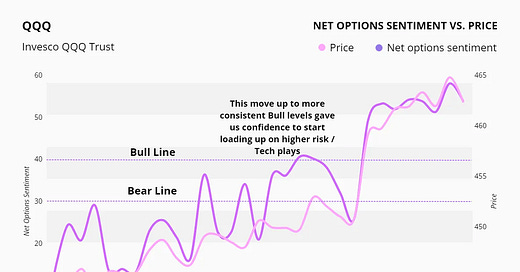

Here's a graph that shows you how QQQ Net Options Sentiment works. Look specifically at the NOS movement of August 12th.

As you can see, our Net Options Sentiment numbers were a bearish 25, then suddenly jumped to a very bullish 52. This move, along with the upward trend that followed, gave us the confidence to go heavier in tech and really boosted our returns.

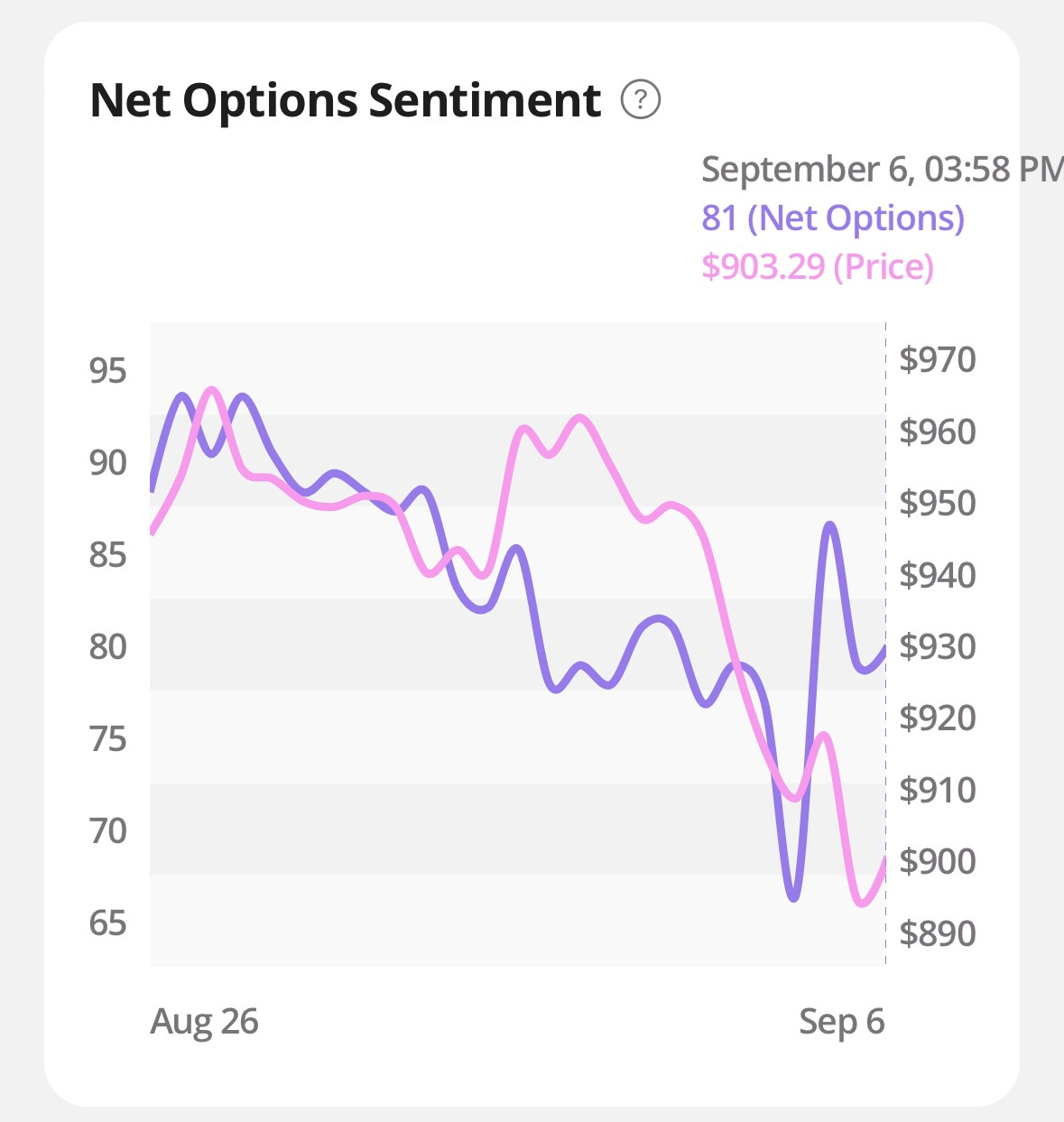

Over the last week, when our Options sentiment numbers began to drop dramatically, it gave us the confidence to be more aggressive with shorts, and to exit positions that we’d previously had confidence in. Let me give you one example. Below is the Net Options Numbers for LLY (Eli Lilly). LLY has been on a tear for the last several months. But notice that at the end of August, their Net Options Numbers began to decline. The price began to decline too. But look at the beginning of September. The price began going UP…but the net options sentiment kept going down. Our bullish number for LLY has been at 80. On September 4th, LLY's NOS fell to 78. That was all we needed to see, and we exited the stock. After that, the stock FELL OFF A CLIFF and dropped below $900 for the first time in weeks. Net Options Sentiment saved us from a dramatic decline. It is important to look at one more thing here. You can see that Net Options Sentiment started going down when the stock was still going up, giving that clear warning sign. It isn’t magic but it can get you out ahead of market movements. It did start heading up to end last week and if it continues that trend it might be an add for us.

One of the reasons we decided to write the letter this way, is we wanted to make our reasons for exiting picks in the middle of the week clearer to those that do not pay for our premium service. Over the last week, when the market was dropping, we targeted more shorts with Net Options Sentiment numbers (below 50) like CGNX, BDC, JACK, VSH, CRI and BCH. But some of them, shortly after, went over 50. This isn’t an infrequent occurence for stocks that have gone down, the market decides they’ve gone down far enough and bets flip. Sometimes people ask us why we make moves quickly in an investing letter? Or exactly what our hold time will be? Any of the things we add, long or short, we’d love to hold as long as possible, especially when Net Options Sentiment looks good. So the easy answer as to why we drop something, not too long after we’d added it, is that as a general rule we don’t like to bet against institutions. That has gotten us excellent performance for 3 years. If you're not studying and utilizing Net Options Numbers in your investing, you're missing out on one of the best market "cheat codes" available to the everyday retail investor! Now, a word from our CEO, George Kailas.

A WORD FROM OUR CEO

We hedged well on a tough week and are beating the S&P 500 by 68% annualized, with a win rate of 60% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

We are adjusting our stream schedule this week only one - Monday 9/8 at 11 AM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

How do we beat the market?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

Last week was one of the worst weeks in the market in over two years. I want to share with you a part of why we saw so much red last week. Check out the graphic below:

This is a chart of the S&P 500 (in white) with an overlay of U.S. Non Farm Payroll (in red). I want you to notice a couple of things. First go back to 2002 and then look at the two lines up until 2022. What do you notice? They follow each other really closely. But then, about 2023 you see a radical divergence. Job numbers have been falling off a cliff, but the stock market is continuing to go to all time highs. We've shared many times here at Prospero that we believe that divergence is likely due to A.I. and its impact on companies profitability. We truly are at the beginning of what is likely another industrial revolution. BUT, despite the profitability of companies, it's not showing an increase in private sector jobs. One of the reasons that the market has cooled dramatically over the last couple of weeks is that it's becoming harder and harder to ignore the signs of economic slowdown. When you combine that with the reality that September and October are seasonally a slow time in the market, you see the kind of market performance that just happened. That's the bad news. Now, is there any good news? Yes. Pretty much every time we've seen the SPY and QQQ get to this level of being "oversold", it bounces. Check out the chart below. (Via: @Banana3Stocks) This chart shows a spike in the number of Puts Options on QQQ and SPY. As you can see, it's spiked to a very high level of puts. (This is why our QQQ and SPY Net Options Sentiment is so low). But notice that every time it's gotten to this level of puts, there is a reversal. Hopefully we'll see that play out soon.

(just for fun)

MULTIPLE CHOICE TEST QUESTION FOR THE NEW FOLKS AT PROSPERO:

Question: How will you know when institutions have changed direction and there's more demand for long term higher strike price, calls than puts, indicating a bullish market momentum?

a. Donald Trump and Kamala Harris hug and become friends?

b. Nvidia misses their earnings estimates and decide to stop selling Blackwell GPU's.

c. QQQ and Net Options Sentiment change direction and head above 40?

Answer: C

Hopefully you got that right! THAT is the beauty of our Net Options Sentiment numbers. We will KNOW, when that momentum changes. Until that changes though, we need to put ourselves in a VERY defensive position of increasing hedges, going net short, and keep some cash on the sidelines for a bottom to be confirmed.

CAP/VALUE ANALYSIS (link to the table)

Check out the Cap/Value table link. Look at the numbers for the week. You can see that everything got hammered. And so much for the Small Cap rotation! Small Caps got destroyed last week. Even Value stocks which had strong week before, took it on the chin. Hopefully we'll find the bottom soon and see a rally, but there doesn't currently seem to be a harbor in the storm.

NET OPTIONS SENTIMENT

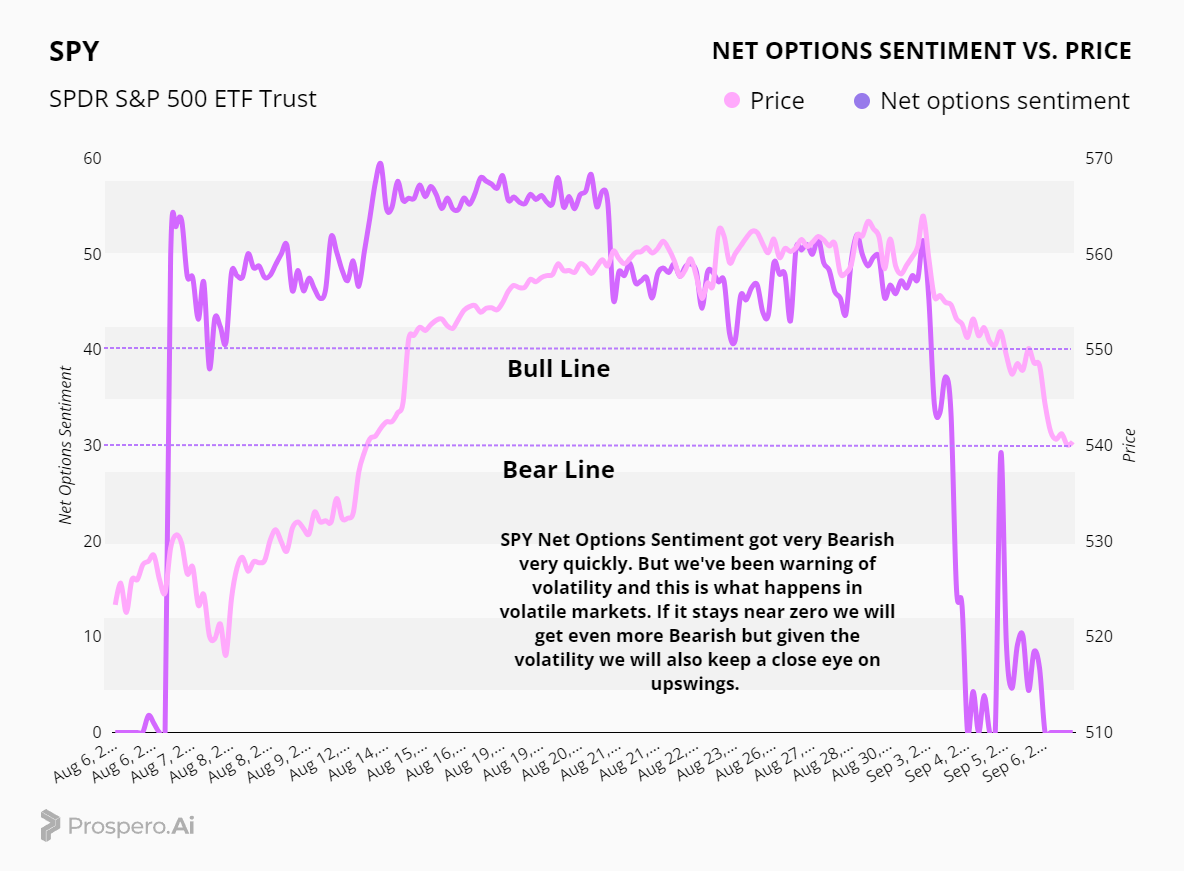

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Look at the QQQ Net Options Sentiment Chart below. What a CRAZY week it was! Once again we saw a strong amount of volatility, but the only thing you need to know is that QQQ Net Options ended the week with a grand total of 6. That is extremely bearish. When you combine these numbers with the Cap Analysis table, we are entering into the week with our guard up. Don't be afraid to sit it out until a better/clearer trend emerges. If you're following Prospero's picks closely, we will only pick long stocks that we have the utmost confidence in.

Check out the SPY Net Options Chart below. That's a pretty ugly chart there at the end of last week. Those kind of bearish numbers are there for only one reason. Institutions are HEAVY into puts against SPY. As we shared earlier in the Macro section of the letter, this is typically where we see bounce. But that remains to be seen. This is an important week for the direction of the market. In light of the volatility, we will certainly be on the lookout for an upswing.

SECTOR ANALYSIS (link to the table)

See the linked Sector Analysis Table. Look at the numbers for the week. Technology got obliterated. That's pretty interesting considering the strong earnings by Nvidia (and the solid earnings by Broadcom). Financials showed strong signs of softening, which could be further proof of concerns of a recession. One bright spot would be Consumer Defensive and Utilities. But in light of the schizophrenic, ever changing, nature of the market, it's next to impossible to see a clear trend. This further confirms our thesis we talked about last week, that we are going to look for a few top stocks, regardless of sector and trust our numbers.

PORTFOLIO STRATEGY

Pretty simple here. The Bearish signals are fairly severe so we will emphasize that while also trying to keep the portfolio as a whole small. 3 longs and 6 shorts.

Long / Bull Moves

Long / Bull Moves - UNH, DOCN adds / LMT hold / META, TDG, PCVX, SLAB, TSLA drops

Adds

UNH and DOCN were the top stock and top smaller cap stock respectively so they were the easy choices.

UNH we will look to exit if Net Options Sentiment goes below 80 or Net Social Sentiment goes below 40.

DOCN we will look to exit if Net Options Sentiment goes below 75 or Dark Pool goes above 75.

Holds

LMT was held because it has an overall strong Momentum Score and we are leading on momentum.

LMT we will look to exit if Net Options Senitment goes below 70 or Short Pressure goes above 65.

Drops

META and TSLA were dropped because of a bad Momentum Score. TDG because of declining Momentum Score and Technical Flow. PCVX and SLAB were dropped due to poor Screener performance.

Short / Bear Moves

Short / Bear Moves - HLF, FL, BATRA, MUFG adds / ON and VRNT holds / PXRX, SWKS, ITW, OZK, BBWI, GGG, and EQH drops

Adds

HLF, FL and BATRA we liked for combined low Momentum Score and Technical Flow. And MUFG was the best large cap.

HLF, FL and BATRA we will look to exit if Net Options Sentiment goes above 40 and MUFG 50.

We will also look to exit if Short Pressure goes above 70.

Holds

ON and VRNT were the best Large and Small cap Tech picks and that has been heading south.

We will look to drop both if Net Options Sentiment goes above 50 or Dark Pool goes above 70.

Drops

PCRX, SWKS, ITW, OZK, BBWI, GGG and EQH were all dropped due to poor performance in the Screener.

Portfolio Summary

Long / Bull Moves - UNH, DOCN adds / LMT hold / META, TDG, PCVX, SLAB, TSLA drops

Short / Bear Moves - HLF, FL, BATRA, MUFG adds / ON and VRNT holds / PXRX, SWKS, ITW, OZK, BBWI, GGG, and EQH drops

3 Longs: UNH, DOCN and LMT

6 Shorts: HLF, FL, BATRA, MUFG, ON and VRNT

Paid Investing Letter Bonus - With Momentum Score Screener!

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.