How long can tech stay hot?

1/21/24 Prospero.Ai Investing (90th) Edition (Weekend)

We asked about tech because it will be key to get right to keep up our absolutely scalding pace to start 2024. 223% above the S&P 500 on an annualized basis and 90% win rate (19/21) and 100%! (10/10 on shorts) vs their S&P 500 benchmarks.

We did a full writeup on our amazing SMCI timing buy. But below, is about as far as I go to “tell” anyone what to do. Below is an excerpt from the paid section of 1/15/24 letter:

We obviously talk about SMCI all the time (and we have definitely been right about it so far) but it continues its climb to the top of our rankings. Sorry to be a broken record, but if you have a long portfolio of any size, and do not own it…my question is why? It has a .34 2026 P/E .34!!

Not only did our paid readers get that strong push, but they got the alert that we added SMCI about 12 hours before it started to blow up. (36% in 1 day!) For another reason to try our paid letter, we’re running our first ever 1 week free trial; and our trading letter (which goes out every day) has 3 days left on its 1 week trial offer.

Normal stream times. YouTube stream links: 1st tomorrow 1/22 at 11 AM EST and 2nd Wednesday 1/24 at 3 PM EST. Simulcast from our X/Twitter page. We’re doing another space with@WOLF_financial, on X spaces Tuesday 1/23 at 2 PM EST. This one will feature some of our power users and you don’t want to miss it! On that note, we released a new video with a full tour of “best practices” for how to use our app to support your strategy.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

How long can tech stay hot? Outline:

Market/Macro Update

QQQ and SPY Net Options Sentiment

Sector Update / Portfolio Strategy

Now the Sector analysis will be roped into our allocation!

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> No Keeps —> Drops

Portfolio Summary

Market Update

From 01/15 letter:

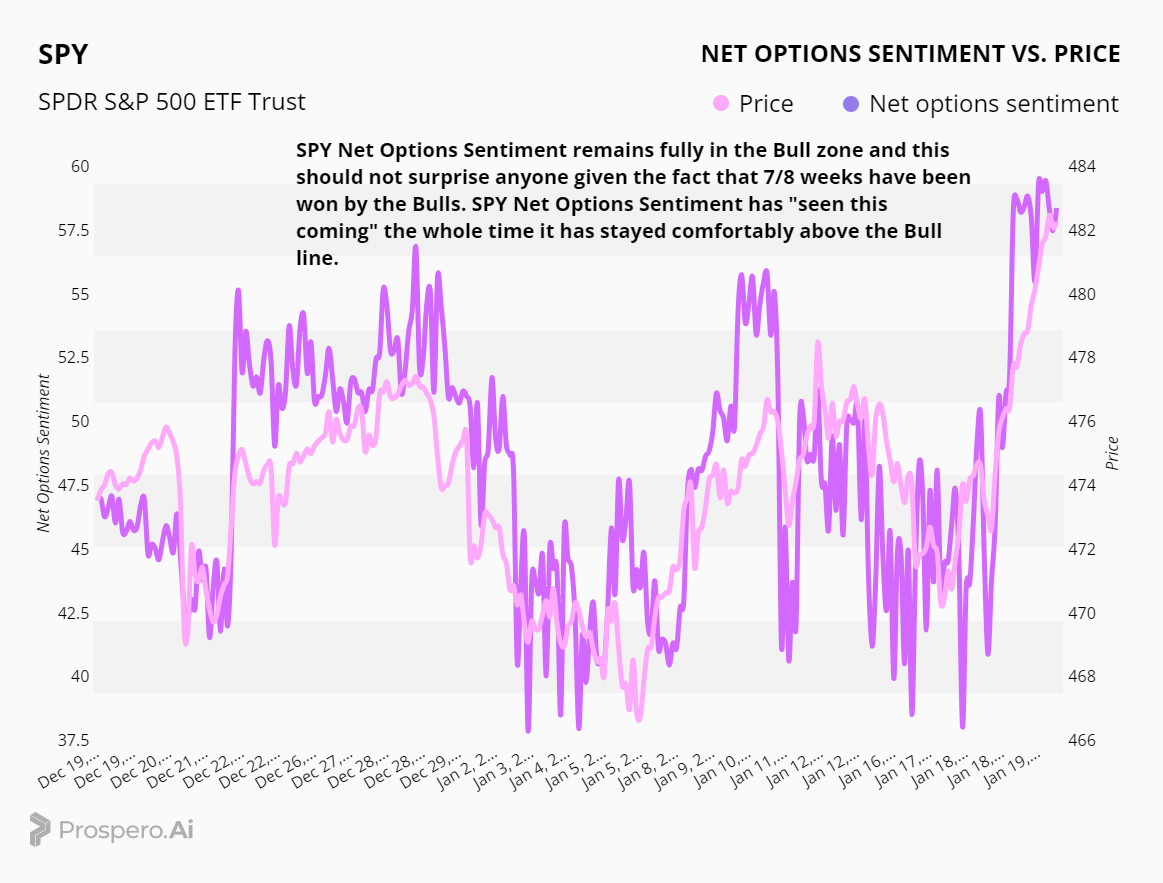

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

QQQ returned 2.84% this week vs 1.21% for SPY. Our QQQ Net Options Sentiment is one of the primary reasons we’ve been on such a tear with our portfolio. Stock picking becomes so much easier if you have a good read on the market!

Although the week didn’t begin this way, it was our QQQ Net Options Sentiment that gave us a strong hint that we should turn our portfolio more Bullish. That decision ended up paying some nice dividends. But it’s that same exuberance in Net Options Sentiment for QQQ and SPY, that leaves us a bit worried about a correction.

This WSJ article makes a lot of the same points that we often do: Stocks Are at Record Highs, but Things Will Only Get Harder From Here. We often talk about the “cap” on the market until we reach the 2% inflation target, but Fed Chair Powell might choose to delay rate cuts if the market is too strong. And boy, is it looking strong! So the picture below especially resonates with us.

We think the “market” needs to catch up to the reality that this Bull run, means Powell will be slower to bring about those highly anticipated rate cuts. How do we know that? Because at the very least, that is EXACTLY what the fed is saying. This means we will remain cautious and keep both Bull and Bear levels higher.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30= Bearish.

For Non-Tech: SPY Net Options Sentiment > 40 = Bullish < 30 = Bearish.

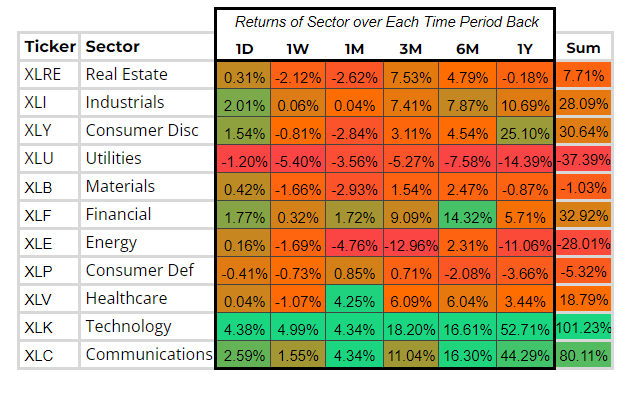

Sector Analysis / Portfolio Macro Strategy

Nothing stands out to us on the Bear side, except that it may be the week to finally back off our very Bearish stance on Consumer Discretionary a bit (strong day on 1/19)

On the Bull side, we already shifted ahead of this strong finish to Tech and Communications. So, there’s not much to move around given these Sectors have been the strongest throughout the last year, and are finding more strength on an ongoing basis. Honestly, It would be silly of us to ignore that.

7 Longs and 4 Shorts this week. Although the market is dictating more of a Bullish stance, we are still concerned. While the Financials Sector can be very turbulent, after identifying a short in PKBK, we actually went back and added BLK as a long. We feel good about that given the strong finish to the week in Financials. Getting BLK, the best Financials Bull in our portfolio, is a move we are happy to make.

Long / Bull Adds - Link to Below Picture

Not only is BLK strong in our signals for a Financials stock, but sometimes you have to zoom out and look at broader trends. Blackrock is a financial behemoth that just keeps growing. Size is always on your side in Finance. BLK is never a bad bed for exposure to the Financials Sector.

Long / Bull Keeps

META is a keep, and returned 2.39% vs 1.21% for the SPY. META is again at the top of our Bull Screener, it continues to show it has more room to go up.

FICO is a keep, and returned 2.37% vs 1.21% SPY benchmark. Stays strong in our screener and technicals, no reason to drop.

TDG is a keep, and returned 2.35% vs 1.21% SPY benchmark. Stays strong in our screener and technicals. No reason to drop.

GOOGL is a keep, and returned 2.61% vs 1.21% SPY benchmark. GOOGL got even stronger in the technicals this week.

TDW is a keep, and returned 4.48% vs 1.21% SPY benchmark. It had the best week of any of our longs, from our picks on 1/15. It’s nice to see it finally recover! We considered cutting out with a small loss on the position, but we like the reduced volatility (and more upwards stability) of its Net Options Sentiment.

SMCI was a midweek add, and wow was it a hell of one! Up 27.95% since we added it pre-market Wednesday vs. 1.65% for SPY over the same period! After being up almost 36%, as well as its high Dark Pool rating (89), we thought about taking it out. But that high Dark Pool rating could actually mean institutions were shorting it, trying their best to stop the bleeding. We believe there is more upward movement coming tomorrow.

Long / Bull Drops

CI is a drop because it doesn’t wow us in the Screener or with its technicals. Covered 1/7-1/19, and it finished -3.68% and a Loss, Losing to the SPY benchmark by 6.78%.

ANET is a drop, because the performance in the screener (24) is not enough to overcome it getting filtered out. Covered 1/16-1/19. It finished +3.81% and a Win, Beating the SPY benchmark by 2.08%.

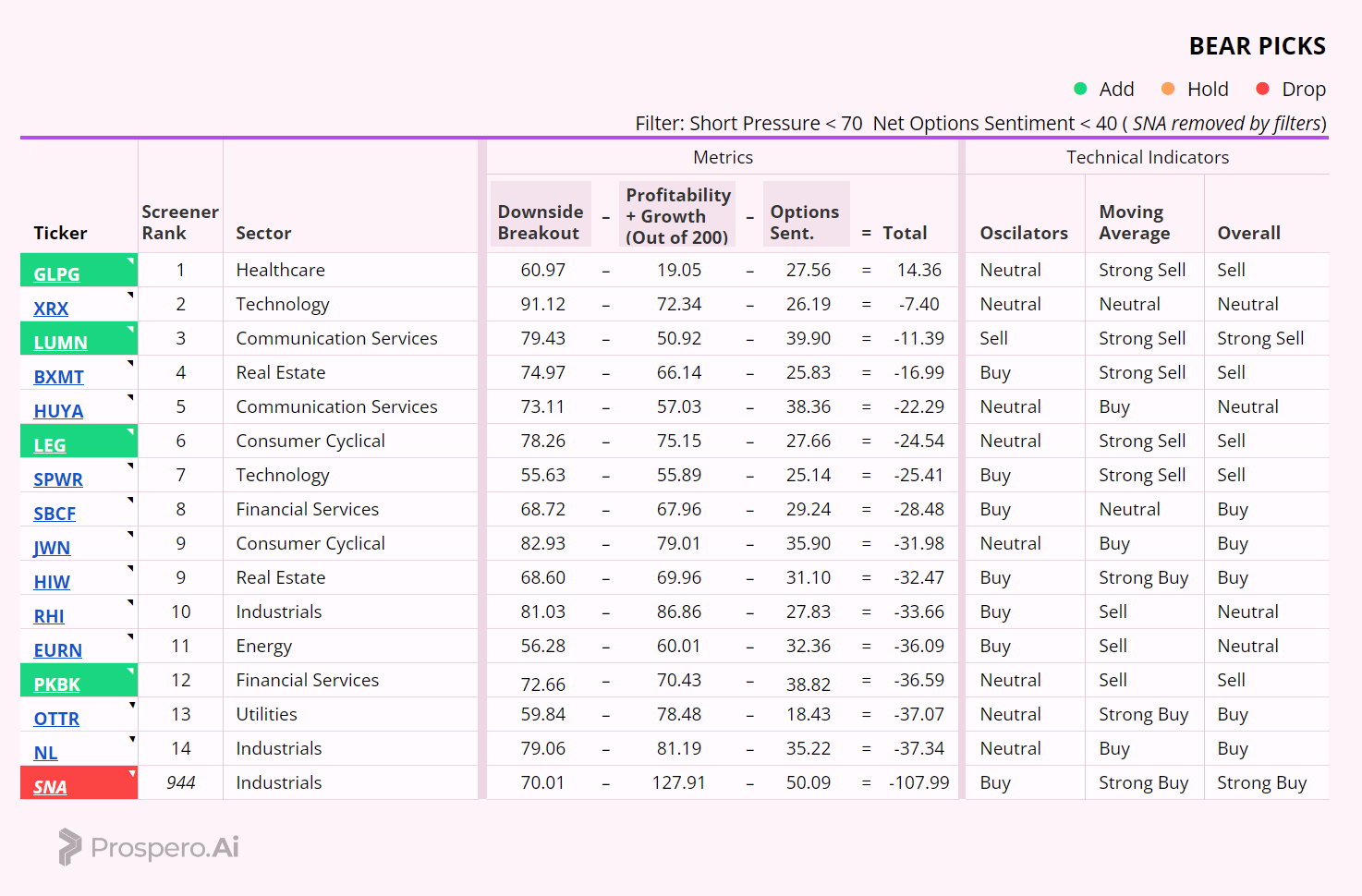

Short / Bear Adds - Link to Below Picture

As we said above, this week we actually wanted to go with 6 Bears and 3 Bulls, but adding PKBK (and also BLK) made too much sense as a pair trade. The rest of the Bears (and really our overall Bear strategy) was that we grabbed anything in this Screener that didn’t have a “Buy” rating anywhere in the technicals.

Short / Bear Drops

SNA is a drop because it is simultaneously bad in the Screener, and horrible in technicals. Covered 1/17-1/19. It finished +1.36% and a Win, Beating the SPY benchmark by .82%.

Portfolio Allocation

7 Longs: META, TDG, TDW, FICO, GOOGL, SMCI, BLK

4 Shorts: GLPG, LUMN, LEG, PKBK

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.