Happy Memorial Day and a special thanks to anyone that has served. You are receiving this if you downloaded our app or subscribed via Substack.

Thanks to all the voters in our Crowdfund poll. We got enough votes to move forward in less than 48 hours. We can now keep the letter as you know it free.

We also want to be responsive to demand for more picks by offering an upgraded version with at least 2 extra per week. To kick it off we have 4 extra picks (2 Bull + 2 Bear) and as a special offer until 06/03, 40% off a full year of the extra picks < $5 a month ($59.98 total, many of our polled users said this was their preferred price).

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

How long can the AI rally keep up? We will go into more detail on YouTube live 05/30 at 12PM EST and in a star-studded FinTwit live 05/30 at 7:10PM EST “AI in investing”

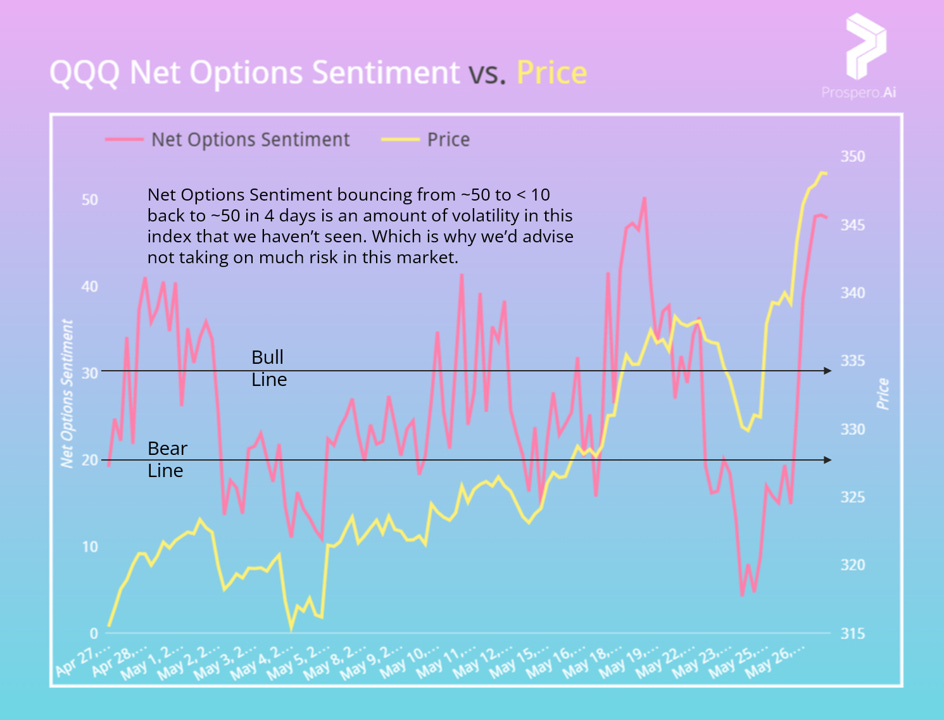

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

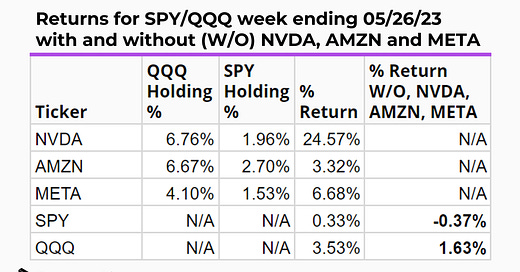

QQQ returned 3.53% this week vs. .33% for the SPY. These numbers make even more sense with the below visual:

We have been touting 2 of the 3 names in that list but we shared this to show the impact of big moves from large cap stocks to an index. It is not a huge surprise to see our SPY Net Options Sentiment stay in Bear territory in this context as it was a down week for the index using 497 of its 500 stocks.

We recommend caution as AMD and NVDA are now two of the most overbought stocks. That being said, we did see BTC get a nice bounce this weekend after the debt ceiling resolution and typically this means tech gets a good bounce to follow at the opening of the week.

The flip side however is an enticing setup for institutions to open up new short positions on tech if they close out what appeared to be a copious amount of SPY Put options to hedge against debt ceiling risks.

This is why we think co-movement is especially important this week as a bounce in SPY Net Options Sentiment could mean these short SPY hedging positions will be closed to short individual stocks. We are only Bullish if you see both of these indexes in their Bull zones and Bearish if the opposite is true. QQQ Net Options Sentiment volatility is another reason we are concerned. Either way, be careful this week. We encourage risk-off behavior (no options buys, only increase positions with a hedge the other way IE buying META along with 5-10% of the deployed capital buying SQQQ )

For Tech this week: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech this week: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

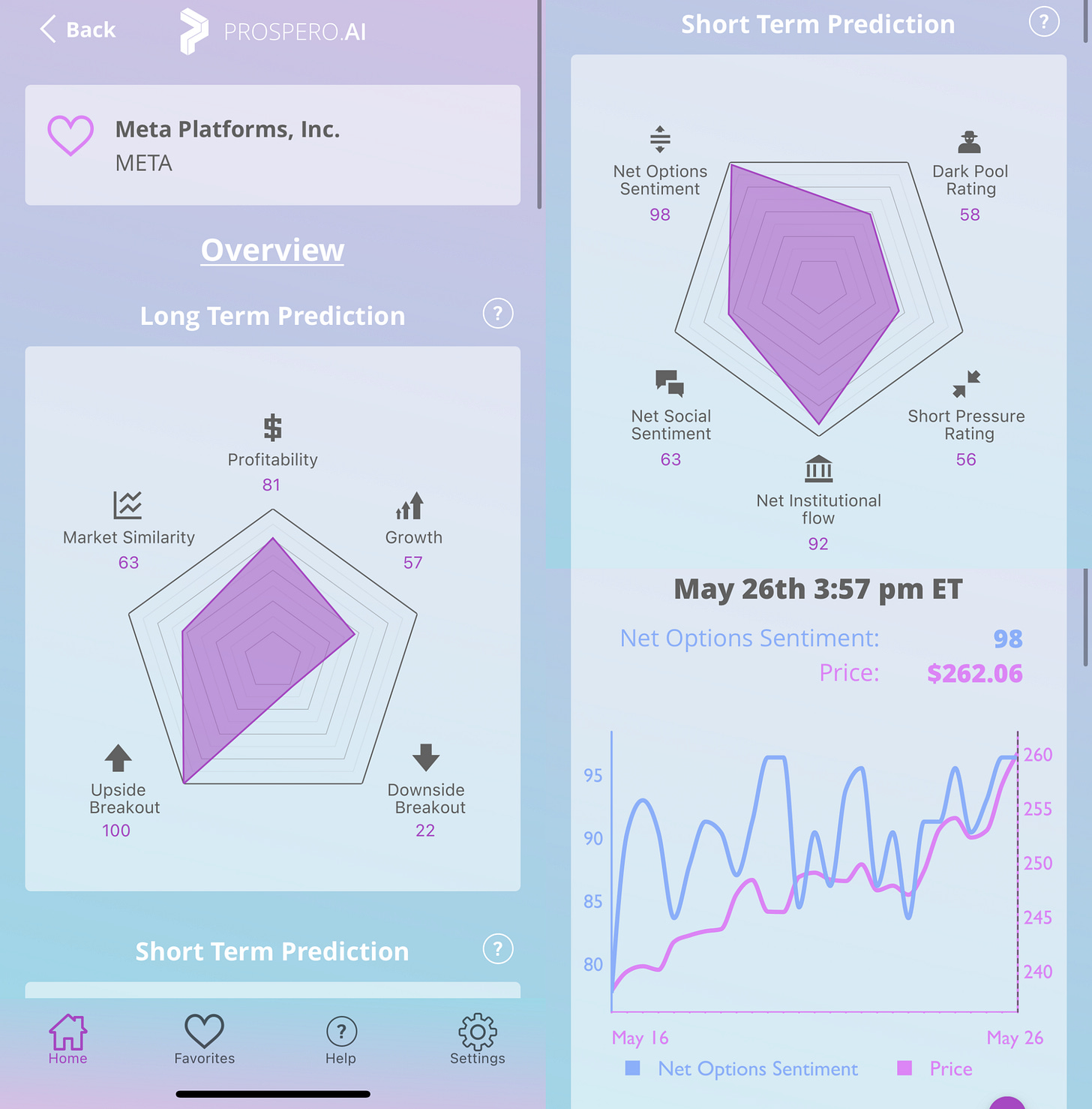

In Review - Bull Potential - META (Meta Platforms Inc)

From 05/21 letter:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

META returned 6.68% this week vs. .33% for the SPY. Our continued faith in META looks to be well founded. META is up 9% since our letter recommendation a month ago and since it maxed out (100) Upside Breakout rating on 02/16/23 (which it still has) it has gained 52%.

Nothing too complicated here. META continues to be our best stock because of extremely strong short and long term signals. Higher lows for Net Options Sentiment is a reason to be even more excited going into this week after back to back +5% weekly gains.

Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Macro Bear Warning - Retail / Theft

TGT reported $500M loss due to theft and ULTA is lowered it’s earnings outlook due to shoplifting. We have our eyes on retail stocks as Bear picks because of this and while none stood out this week we wanted to bring up this Macro trend. We think between the credit crisis we’ve been mentioning (shoplifting an early sign of that impact) and more job market strain potentially on the way, we could easily see a slightly Bullish market the next 6 months carried by AI with highly Bearish performance in retail alongside.

Bear Potential - MGEE (MGE Energy, Inc.)

MGEE has a highly desirable Bear setup. Fast decreasing Net Options Sentiment and increasing Downside Breakout both with poor absolute values in their scales. None of the 10 metrics look good here.

Bearish this week if:

MGEE Net Options Sentiment < 50

MGEE Net Social Sentiment < 60

SPY Net Options Sentiment < 10

In Review - Bull Potential - AMZN (Amazon.com, Inc.)

From 05/21 letter:

AMZN Net Options Sentiment > 70

AMZN Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

AMZN returned 3.32% this week vs. .33% for the SPY. We have been touting AMZN as our favorite for a bit and it is up 12.29% vs. 1.90% for SPY since we first recommended it 04/23. It is making our case well, when blue chips are offering returns like this, why chase riskier smaller caps?

AMZN’s metrics continue to be highly stable as the stock price performs well which is exactly what we want to see.

Bullish for this week if:

AMZN Net Options Sentiment > 70

AMZN Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Bear Potential - NSA (National Storage Affiliates Trust)

We have seen NSA as a Bear pick before this year and we are seeing it in a similar trend to what we called out for MGEE. It has lower Net Social Sentiment and we do also think there is a Macro threat as storage makes sense to cut if you are feeling a pinch on your budget. Clearing out storage both lowers your monthly expenses and puts some cash in your pocket if you sell items.

Bearish this week if:

NSA Net Options Sentiment < 50

NSA Net Social Sentiment < 50

SPY Net Options Sentiment < 10

Coverage Drops

CHRW is dropped as a Bear because it is went above our 50 Net Options Sentiment warning level and closed the week close to it. CHRW closed out as a Win losing -2.88%, beating SPY by 3.21% 05/21/23 (1st and last covered) to end of week.

DLR is dropped as a Bear due to a corporate action. We make the picks to last a week for a more honest retail investor experience where you can’t watch a stock constantly. DLR was started the week out exactly as expected -4.69% through 05/24. But declared a dividend, sending the stock up 13.66% the next 2 days. A struggling stock is a big for higher dividends so this is a case where analysis could be directionally correct but corporate actions can change circumstances quickly. DLR closed out as a Loss gaining 8.97%, losing to SPY by 8.64% 05/21/23 (1st and last covered) to end of week.

2 Bonus Bull and Bear Picks

As we have continued to put META and AMZN in our Bull picks every week, we’ve actually missed some big potential gainers, one you will see below that we still love. (Up 65% since we tweeted about it earlier this month)

Philosophically we felt a requirement to recommend blue chip stocks with our signals reflecting so positively, as these present by far the best risk/reward. Instead of moving from that philosophy we decided to paywall some picks that were higher risk/reward. Our goal is to increase the odds of sound risk management for retail investors. This added paywall hurdle increases the odds readers can afford to make moves with more risk in our view.

In addition to sharing picks we will also pass along more trading indicators we use to form our watchlists.

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.