One of our primary values at Prospero is to teach and train retail investors. So, let's start off this letter with a pop quiz! Here's your question:

1. What are some of the best ways to hedge against downside in a Tech Bull Market?

In other words, when we're long in several stocks in one sector (in today's example it was Large Cap Growth), how do we protect ourselves if something happens that affects that sector negatively? First, we often suggest a position in SQQQ, which is an "Inverse" QQQ ETF. If QQQ (Tech) goes down, SQQQ goes up and it limits losses. But another way we like to hedge, is to find clear opportunities to short certain stocks showing weakness in our signals. Here's a real life example of how we've done that over the last few weeks through TXN. Texas Instruments is a semiconductor company that specializes in Analog Microchips. Despite the A.I. chip boom, there is still massive demand for analog chips and they're used in everything from washing machines to ballistic missiles. To understand the context of the last several weeks, at different times, George (our CEO) had a lot of exposure to Large Cap Growth (META, TLSA, PLTR, etc). But when he's long in that many stocks in a particular sector, he looks for ways to hedge against some unforeseen occurrence that could impact that sector negatively. George found that opportunity through TXN. While we are in an environment where Large Cap Growth has been showing strength in our signals, TXN wasn't. With their quarterly earnings approaching, they were showing significant weakness in Net Options Sentiment that had dropped as low as 10! George saw that as a shorting opportunity in an otherwise strong sector. Here's a graphic of TXN's Net Options Sentiment from January 13th until last Friday the 24th. The dark purple line is the Net Options Score and the pink line is the price. Interestingly, on Jan 16th (one week before earnings) TXN's stock price started going up and ran upwards of 5% into earnings. At the same time, TXN's Net Options Sentiment began to increase and jumped up from 13-14 to almost 50 during the same period. While a 50 Net Options Sentiment is not Bullish, that upward swing caused George to exit his short position (he was being careful because of the market's uncertainty). Earnings were set to be announced after the market closed on Thursday, Jan 23rd. As earnings approached that Thursday, at 12:36 PM, something fascinating happened. TXN's Net Options Sentiment (as shown near the perforated line) began to drop and drop quickly. That Thursday afternoon, the Net Options Score dropped while the price was still increasing. By market close, NOS had plunged from 49 to 22. Soon we'd find out why. TXN announced earnings and gave weak guidance for the upcoming quarter. The reason for their weak guidance was concern over international demand for their analog chips. The stock plummeted almost 8% by Friday's close. What's the takeaway from all of this?

1. Net Options scores continue to be an incredible predictor of future price action.

Even though the Large Cap Growth sector had been showing real strength in our Net Options signals, TXN was showing significant weakness. And it started showing that weakness weeks before earnings. Because of our signals, George was able to identify that weakness and capitalize on it.

2. Price can be deceiving, Prospero's gives us insight into what hedge funds and institutions are really thinking.

The reality was that TXN was going to give weak guidance and as we always say, "somebody always knows something". Right or wrong, the word obviously got out and institutions were betting heavily that the price would drop after earnings. But without Prospero's signals, all you'd see is that TXN's price was climbing into earnings. How many retail investors saw that price increase and got sucked into going long, only to be left holding the bag?

3. Things change quickly, you can never check enough.

We got out of TXN the last time because Net Options Sentiment was heading up near 50. But had we seen it had gone down to 22 again we very well might have gotten back in.

4. Always benchmark.

Compared to other Large Cap Tech stocks in the Chip Sector, even a 50 Net Options Sentiment isn’t very high. We could have very well stayed in the position based on the relative value of Net Options Sentiment for TXN’s peer group.

The reality is that we still find ourselves in an uncertain and volatile market. SPY just hit all time high's AGAIN, and while we're currently bullish, that upward momentum won't go on forever without a correction. Lastly, with the inauguration of a new president, love him or hate him, there's a new sheriff in town and he's making changes. How those changes will impact stocks is anything but crystal clear. In market's like this one, wisdom would say be selective with your picks, be sure and hedge against downside and keep focused on QQQ and SPY Net Options Sentiment for signs of a downturn.

A WORD FROM OUR CEO

We apologize for the turbulance but our active and defensive strategy this year has done well with many struggling. Our paper trading potfolio is beating the S&P 500 by 70% annualized with a win rate of 71%!

To help newer readers get up to speed linking our short intro + learning videos.

Normal stream times! Monday 1/27 at 11 AM ET and Wednesday 1/29 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

HOW TO HEDGE A BULLISH MARKET

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

There's a clear shift in investor focus, particularly towards mid and small caps. Over the past month, Value has also performed well this past month, potentially signaling the start of a trend as the market seeks potential earnings surprises. While nothing has appeared in our screeners yet, we will stay vigilant as this trend continues to develop.

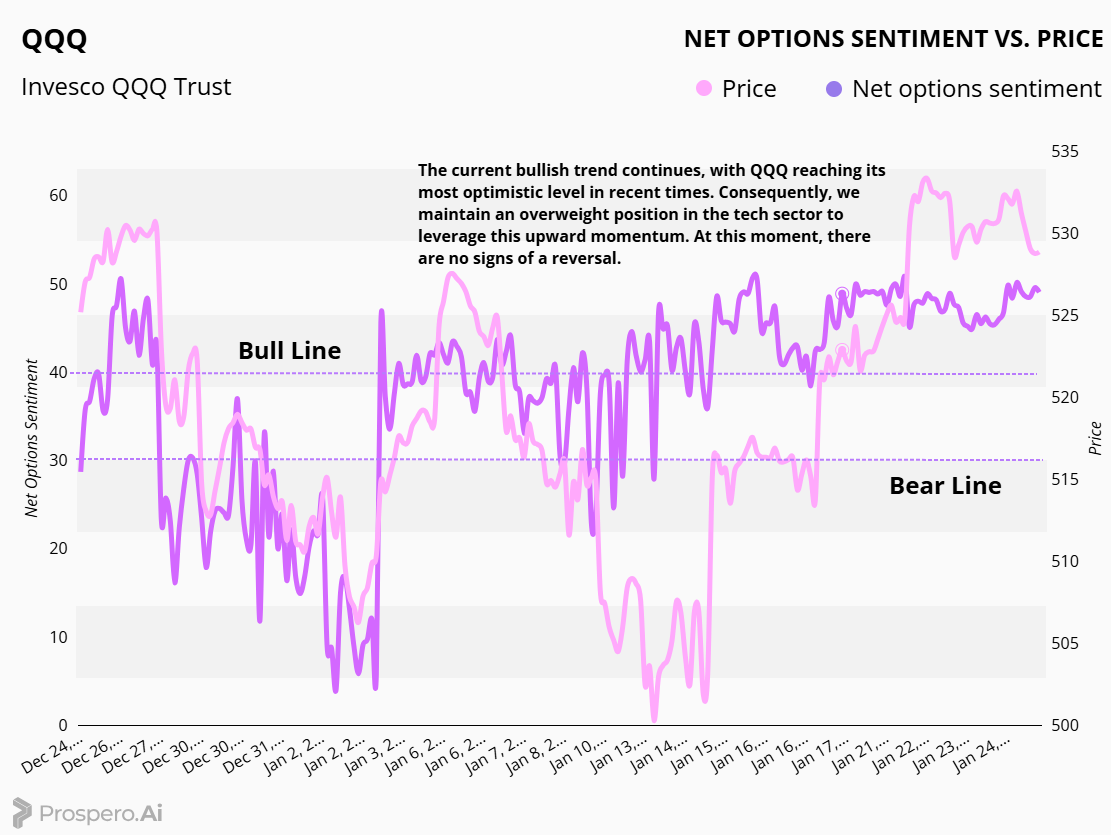

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS discovered a new lifeline this week, consistently exhibiting bullish signals. Although there were slight indications of a pullback late on Friday, we remain above the Bear Line. This small signal isn’t enough to alter our bullish stance. However, we'll maintain a slightly underweight position in the rest of the market relative to tech, as stronger signals are present in QQQ.

QQQ continues its strong bullish trend, gaining even more momentum since last week following significant announcements regarding Project Stargate and increased investments in tech driven by the new administration's policies towards China. We will, of course, closely monitor the situation for any changes. However, the sector still holds significant potential for upside surprises, as exemplified by Netflix's performance earlier this week.

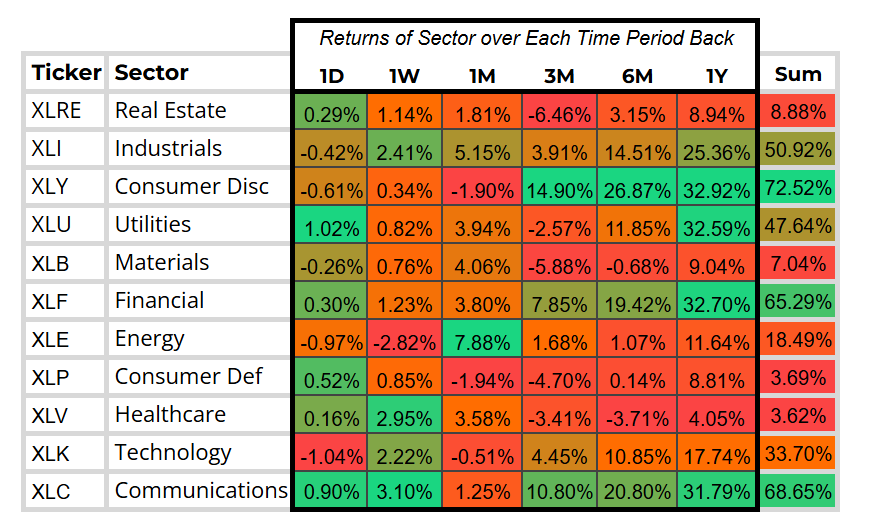

SECTOR ANALYSIS

Take a look at the Sector Analysis table above. Technology and Communications outperformed this week, driven by headline catalysts, as expected. Interestingly, Healthcare had a strong showing, possibly due to mean reversion after a tough year for the sector (excluding GLP1 players). Outside of the usual suspects, Industrials also had a good performance, bolstered by a slew of announcements positioning it alongside tech in the development of the American industrial plant. We'll be looking to increase exposure to these names selectively, as while there are significant winners, some are still affected by tariff tensions.

PORTFOLIO STRATEGY

With both SPY and QQQ Net Options Sentiment well above the Bear Line and in bullish territory, we are maintaining the same positioning as last week. Our strategy remains largely overweight on large-cap tech, with sector diversification to balance the rest of our exposure. On the short side, we are closely monitoring our market cap diversification to ensure we are not overexposed if the market moves against our interests. 8 longs, 6 shorts.

Long / Bull Moves

Long / Bull Moves - META, EQIX and CAPR adds/ APP, TSLA, COIN and PLTR holds/ MELI and GEO drops

Adds

META was added as it topped our screener with stellar metrics across the board, including an excellent Upside Breakout and Net Options Sentiment. EQIX was included due to its robust Momentum for a Real Estate stock. CAPR was selected for its unusually high Net Options Sentiment and Momentum, especially for a micro-cap.

Holds

APP remained in our portfolio due to its high Net Options Sentiment and significant Upside Breakout. TSLA and COIN were retained for their perfect Upside Breakouts and impressive Net Options Sentiments. PLTR was kept for its notable Upside Breakout.

Drops

MELI and GEO were dropped as they had no outstanding characteristics.

Short / Bear Moves

Short / Bear Moves - RCUS, HSBC, PBR, WEN, INVH and ON adds/ BG, JXN, MGA, DLB and ENPH drops

Adds

RCUS was added to our portfolio as it topped our screener with consistently low metrics. HSBC and PBR were included due to their larger market capitalizations and low Net Options and Tech Flow. WEN made the cut for its low Net Options Sentiment coupled with a high Downside Breakout. INVH was selected for its large market cap and Net Options Sentiment <10. Lastly, ON was added to balance our long side exposure with a large-cap tech name.

Drops

BG, JXN, MGA, DLB and ENPH were all dropped as they didn’t perform well in our screener.

Portfolio Summary

Long / Bull Moves - META, EQIX and CAPR adds/ APP, TSLA, COIN and PLTR holds/ MELI and GEO drops

Short / Bear Moves - RCUS, HSBC, PBR, WEN, INVH and ON adds/ BG, JXN, MGA, DLB and ENPH drops

8 Longs: META, EQIX, CAPR, APP, TSLA, PLTR and 2XCOIN

6 Shorts: RCUS, HSBC, PBR, WEN, INVH and ON

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.