Happy Bull market everyone! We made it! You are receiving this if you downloaded our app or subscribed via Substack.

Updated our 2023 picks and doing even better nearing the half way point: 27/37 and beating the SPY 137% on an annualized basis.

Not to worry if you missed out, our Model Portfolio in its 1st week is pacing similarly vs. SPY beating by 128% annualized.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

How to play official Bull market. More detail tomorrow on YouTube live 06/12 at 11AM EST

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

QQQ returned -.04% this week vs. .46% for the SPY. These are results that can be expected on what was overall a fairly neutral week for both key Net Options Sentiment indexes.

We are officially out of the Bear and into a Bull market. This post links to an article about previous ends. Well worth it to review to see the broad mix of what to expect but this summarizes nicely:

It is more than fair to expect the next few weeks to be mixed as there will always be hesitation from some institutions when we hit milestones. As they look over their shoulders and wonder who of their fellow Bull victors are going to take profits. There are still a lot of short bets in the market that might relish the opportunity to pile on a Bearish move so we’d still recommend caution despite our overall Bullish outlook.

Some big announcements coming up this week: CPI and the FOMC meeting RE: rates. The last 2 CPI readings of 5 and 4.9 both beat consensus and the estimate for May is 4.1 a 3rd beat in a row with such a reduced increase from last year should meet a fairly enthusiastic market response. Indeed, disappointing news from FOMC seems to be expected more in following months than this one. CME FEDWatch:

We would make sure to use your best defensive tactics going into Tuesday’s CPI announcement in case CPI is higher than consensus which would likely result in a sharp Bear turn. But given the recent beats and the recent Bullish market trend I think a beat is more likely.

One other Macro Bull trend we like is we do think given the Crypto crackdown and ongoing turmoil there we could see dollars coming out of those markets and into stocks this week. One of many reasons we remain in our more Bullish index guidance:

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

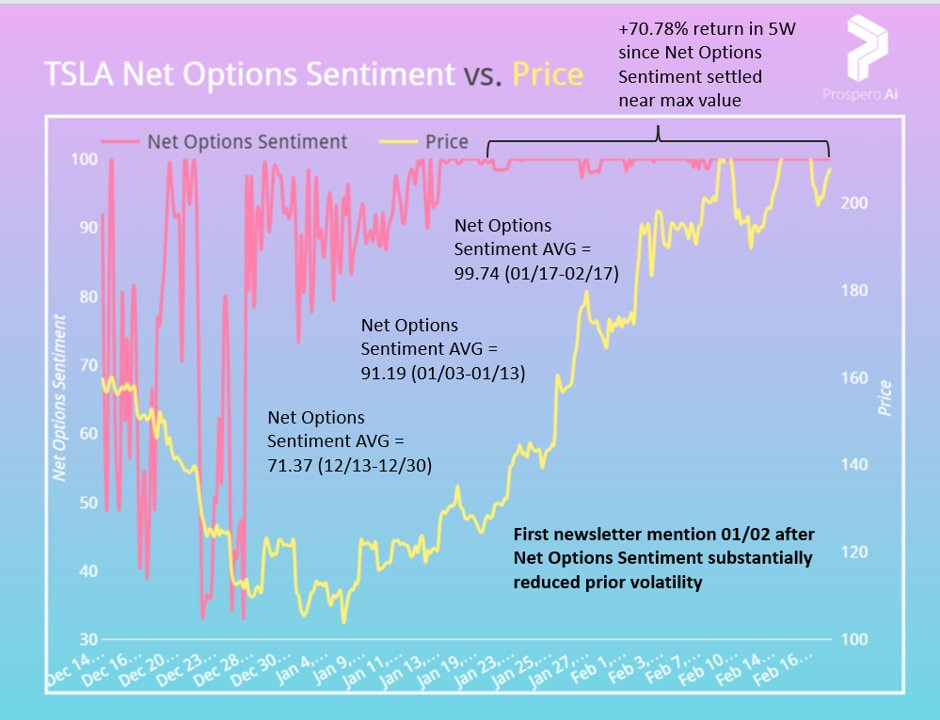

In Review - Bull Potential - TSLA (Tesla Inc)

From 06/04 letter:

TSLA Net Options Sentiment > 75

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

TSLA returned 14.22% this week vs. .46% for the SPY. While we simplify things in this letter as much as we can, we try to convey the high level of difficulty it takes to be right about stock movement. We pointed out a pretty obvious repetition in our signals for BABA earlier this year where for the 2nd time we were out in front of a big gain. Hard not to say Net Options Sentiment made it easy for our TSLA rec again given the high similarity of this week’s option sentiment graph vs. the Bull run near the start of this year.

From 02/20/23 letter:

Not overthinking this one. Unless you see Net Options Sentiment break from the top of our scale we are Bullish.

Bullish this week if:

TSLA Net Options Sentiment > 85

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

Keeps - to prioritize new information we added this section to summarize Bull/Bear holds whose signals haven’t moved materially

Bull review - CFLT (Confluent Inc) from 6/4 letter and Bullish this week if:

CFLT Net Options Sentiment > 70

CFLT Net Social Sentiment > 25

QQQ Net Options Sentiment > 30

CFLT returned 5.27% this week vs. .46% for the SPY. The only signal move that is worth noting is that short pressure has moved down to 68 from 77. Meaning shorts have started to give up on this stock and this week could be even bigger if that trend continues.

Bull review - META (Meta Platforms Inc) from 6/4 letter and Bullish this week if:

META Net Options Sentiment > 75

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 30

META returned -2.81% this week vs. .46% for the SPY. We aren’t phased by the correction on this stock, nothing much has changed for our signals. Our two most important Bull signals are Net Options Sentiment and Upside Breakout and META has a 196/200 for those two signals combined, 4 off from perfect. Anything over 180 is a pretty simple buy and hold from our perspective.

Bear review - FRHC (Freedom Holding) from 6/4 letter and Bearish this week if:

FRHC Net Options Sentiment < 40

FRHC Net Social Sentiment < 60

SPY Net Options Sentiment < 10

FRHC returned .04% this week vs. .46% for the SPY. This continues to be driven by extremely low, 2, Net Options Sentiment and Profitability (38) + Growth (28) = 66.

1 New Bulls and 1 New Bear Below

Running a 30% discount on both monthly and yearly Bonus pick subscriptions this week.

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.