Welcome to the 28th edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

CEO George Kailas appeared in a new YouTube video with a deep dive on the inner workings of institutions

If you do not yet have the app:

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

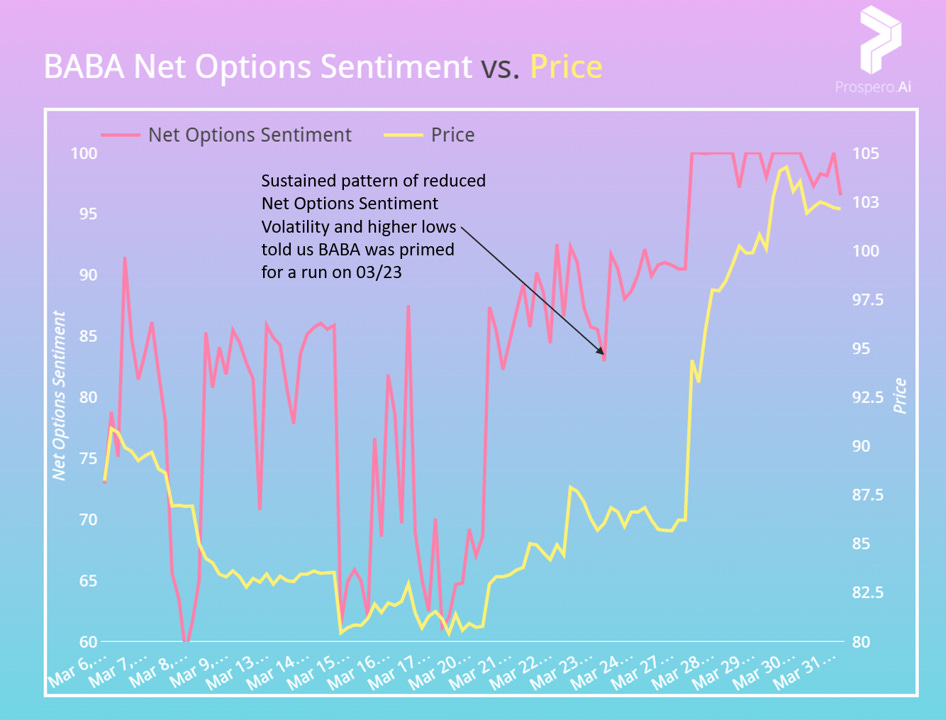

Near perfect execution on BABA (Alibaba Group Holding Ltd)

We were able to time BABA up and downs the last 4 months as well as anyone can hope. Even more astounding is our metrics predicted a price jump before major news events 2X. Marti Subrahmanyam said:

The repetition of events exemplifies how powerful our metrics and newsletter processes are. We use these patterns to gain conviction as could any of our users.

12/18/22 letter: “BABA is probably Prospero’s favorite stock right now. BABA has max Upside Breakout, close to it on Net Options Sentiment. And good to great Net Institutional Flow, Profitability and Net Social Sentiment. Even before running this filter it frequented the top of “our picks” for long and short term”

Last mention in 01/22/23 letter, was not covered in 01/29/23 letter due to declining key metrics and more Bearish outlook “However, the AVG values for QQQ and SPY Net Options Sentiment are trending down for the 2nd half of the month vs. the 1st.”

Recommend on the way up: 1st Mention (12/18) to Coverage Drop (01/27) = Gain 36.41%

Dropping coverage before it declines: Drop (01/27) to Reappearing in Letter 03/23 = Loss 29.34%

It reappeared in our 03/23/23 letter: “Our favorite Bull today an old friend BABA. BABA looks strong all around. High Upside to Downside ratio. Profitability + Growth is well above average and the Sentiment scores in the short term are where you want them to be for a potentially big move.”

Reappearance in coverage to current: Reappearing to now = Gain 18.13%

Could not design a better ad for Prospero than finding the trade the same way both times: checking the app and seeing it appear in “our picks” for both short and long term. Not to mention the first look coming from our mid-week paid letter.

It was not just a mention. 03/23 letter was 1st ever rec for an unhedged long AND 1st Call option rec “If you trade options we say let it rip with some Calls here.” We also put our money where our mouth was.

03/26 letter: “Bullish if: BABA Net Options Sentiment > 70, BABA Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30”

BABA returned 17.25% this week vs. 3.35% for the SPY. Pre-Market 03/27 to After-Market 03/31.

We remain Bullish if: BABA Net Options Sentiment > 70, BABA Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

Our QQQ and SPY Net Options Sentiment Bull Levels also epitomized “Pro Timing” this week

03/26 letter: “For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.”

Bull levels were on point. QQQ returned 3.12% this week vs. 3.35% for the SPY. Pre-Market 03/27 to After-Market 03/31.

But a closer look shows our Bull levels to be quite precise recently:

For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

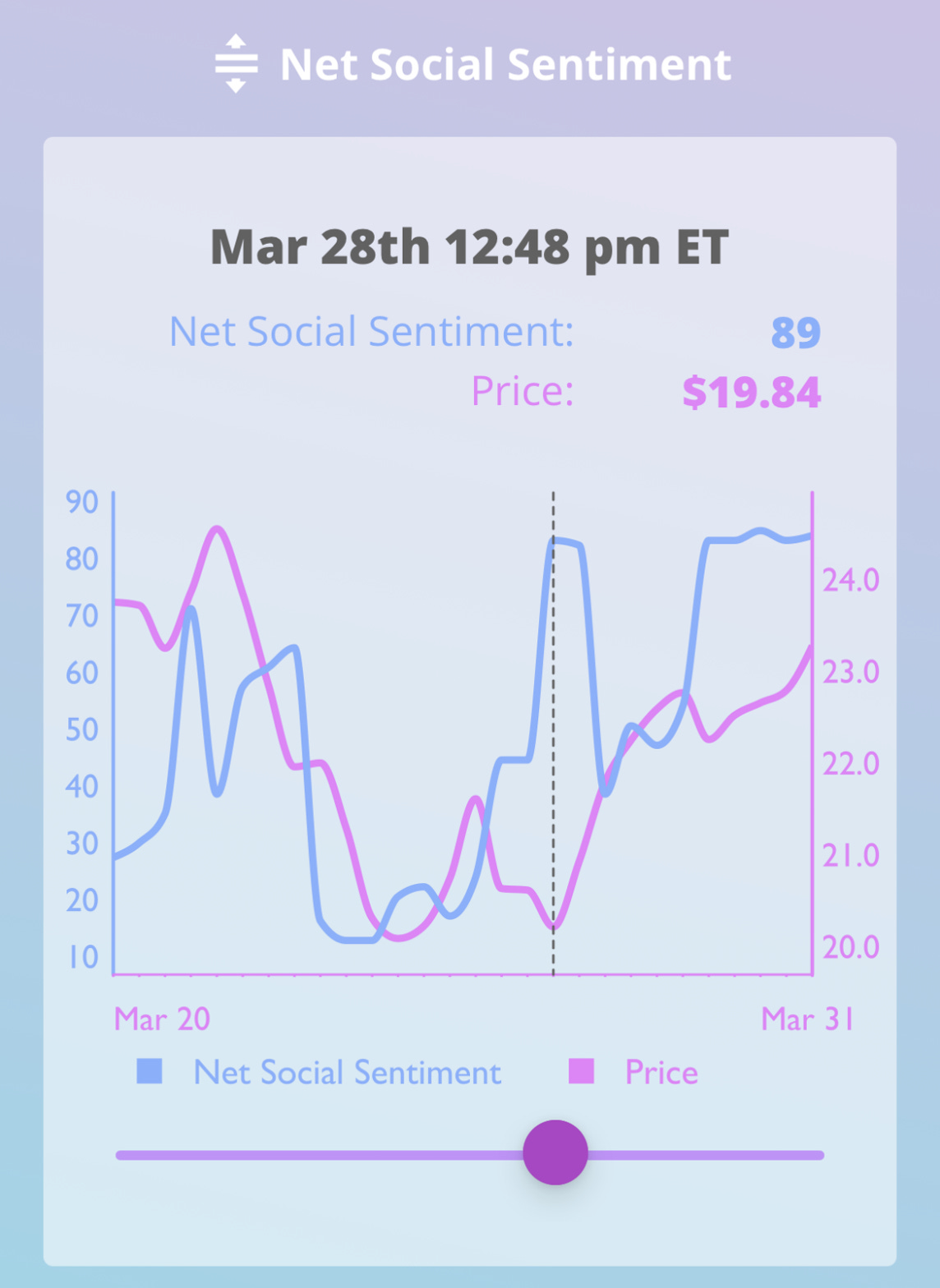

Bear Review - SLG (SL Green Realty Corp)

03/26 letter: “Bearish if: SLG Net Options Sentiment < 50, SLG Net Social Sentiment < 50 and SPY Net Options Sentiment < 15”

Despite a strong week for SLG overall we were still right. SLG returned 16.17% this week vs. 3.35% for the SPY. Pre-Market 03/27 to After-Market 03/31.

We were right because our Bear condition was strongly rejected 03/28 when Net Social Sentiment spiked to 89 the return was -2.17% for the week at that time.

Potential Bear Mover - PRK (Park National Corporation)

Bearish if: PRK Net Options Sentiment < 50, PRK Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

Keep an eye on MELI again as a Bull. It continues to be strong in almost all long-term signals and popped into our short term “picks” 03/31 from 81 Net Options Sentiment and 91 Net Social Sentiment.

So good info!

Hello Prospero, I'm interested in your newsletters and may even become a paid subscriber, however I just don't quite get the signals. They always have conditions which I'm unclear about like this is a but if this sentiment is > than this or other. How do I make a determination if the timing is right? Or why can't you just say the timing is right?