After beating the S&P 500 by 71% in 2022 and 47% in 2023 we have stayed hot in 2024 beating the S&P 500 by 84% on an annualized basis through the first half of this year.

Even more impressive is that we’ve done it while more than doubling our number of picks all year in 2023 (151) and doing that at a higher win rate vs SPY benchmarks 62% vs. 60% last year.

We take great pride in the consistency of our signals across many different strategies. Our model portfolio from our trading letter has made 1,534 picks since inception 6/4/23. It really shows the strength of our signals that we can make 100 picks per month in that portfolio and still maintain that consistent win rate of 61%.

For a deeper dive on the actual picks see our Bull and Bear picks in chronological order.

Prospero.AI Where We’ve Been, How We Got Here and Where Are We Going

Today is a special addition of our weekly investor newsletter. Last week marked the halfway point of the trading year, so we want to take some time and answer 3 questions.

Where have we been? We want to take a quick look at the last 6 months here at Prospero and how far we’ve been able to come on this journey together.

How did we get here? We’re going to talk about a trend that we think is driving the market and how we used our data to get in front of it.

Where are we going? We talk about the next six months and where we think the market might go from here and how we’re preparing for it.

But let’s start with the first question:

Where have we been:

First of all, I think we need to take a second and let it sink in the success we’re experienced together here at Prospero.Ai. We beat the S&P 500 benchmark by a whopping 84%! EIGHTY-FOUR PERCENT!! I (Matt) was on a fishing trip last week with a guy that I found out was on the Forbes Magazine Top 50 Best Private Wealth Managers in the US list. He’s 63 years old and oversees a portfolio of 22 Billion dollars with some of the wealthiest clients in the country. As we hung out, I started talking to him about Prospero. He politely listened and asked a few questions. You could tell that he thought to himself “I’ll listen to this young buck tell me about his fancy new fly-by-night product”. But everything changed when he asked me, by how much we beat the S&P? I said: “Well, as of last week, year to date about 84%” He paused…put his fishing pole down and said: “Excuse me? WHAT DID YOU SAY? Ya’ll beat the S&P by 84%!?” He immediately got out his phone and downloaded the app. Within a few minutes he was asking me questions about Net Options Sentiment, and what some of the other indicators were. By the end of the trip he was asking me everything from how we get our Short Term Bull Picks, to how we determine Short Pressure. It was awesome to see a HIGHLY successful Wall Street legend become intrigued by our story.

Why did I tell you that? Because it’s a great example of how Prospero is starting to get noticed, not just in the US, but around the world. Our CEO George Kailas is being asked to speak all over the world and some of the top traders and investors in the country are discovering our tools. But here’s the amazing part. We’re just getting started and we believe that Prospero’s best days are ahead of us!

How Did We Get Here?

Some skeptics might read our win rate against the S&P and say: “Well, you’re successful b/c we’re in a historic bull market. And they’d be right, but that wouldn’t explain the two years prior. And that would only be part of the story. As we’ve hit new all time highs in the market over and over again the past 6 months, the chorus of calls to short the market and comparisons to the “Dot.com Bubble” of the early 2000’s began to get louder and louder. Investors began to hoard cash and put record amounts of money into the safety of money market funds. But at Prospero, we saw a trend emerging in Large Cap Growth Stocks (What we often call our “Proxy for A.I”) , driven by A.I. that was telling a different story. We use that proxy because looking at say the Tech Sector leaves out Communications giants like META and GOOG. Let me give you a couple of examples….One would be META. On February 16th of 2023 (a year and a half ago) Meta had barely turned the corner on a meteoric decline from the Bear Market of ‘22 and finally began to rise. BUT…people were screaming from the rooftops “It’s a Bull Trap”. In February of 23, sure enough, Meta began to decline over the course of a couple of weeks and you could almost hear the “I told you so’s” from the peanut gallery. For context, let me show you in a picture where Feb 16, 2023 was. See the graph below.

See the orange circle with the small dip in it? That’s Feb 16th 2023, and it was in the middle of that dip and Meta was at $170 bucks a share. But all of a sudden, META rose to the top of our Bull filters and we made the call to buy it. One year and 4 months later, META is valued at over $500 dollars a share. Prospero’s numbers helped us see a trend emerging BEFORE it happened. Link to full META case study

Another example is our call to buy SMCI on Jan 19th of ‘24. (6 months ago) See graphic below:

SMCI had begun its meteoric rise and was in the mid $500 range when experts began to recommend shorting it. But once again, our QQQ Numbers told a different story and our CEO sent out a buy single (Orange Circle). Since that call, SMCI rose from $547 to over $1200 in the course of two months!! We don’t tell you those stories to brag on ourselves, but we ARE bragging on Prospero. We simply do what the numbers tell us to do; and the numbers don’t lie!

Where Are We Going?

That’s the Million Dollar question isn’t it? Where are we going? An article that just came out in the Wall Street Journal that talks about the A.I. driven rally for the first 6 months of the year. The article argues that even as the odds of a 6 rate cuts grow less and less (as well as hot inflation numbers keep coming), the market keeps moving higher. That is because of A.I. driven stocks like NVDA that have contributed 30% of the S&P’s total returns. If you throw in Alphabet, Meta, Microsoft and Amazon, those stocks contribute well over half of the S&P’s returns. Our Cap Analysis Chart shows this visually in a very compelling way.

Zooming too far out it might look like bubbles of all bubbles. But you can actually see that Large Cap Growth is the only part of the market actually in a Bull run the last 3 months. With closer inspection you have to pause and realize that each and every one of those stocks has something in common. They’re companies spending BILLIONS in Capital Expenditures to capitalize on the artificial intelligence revolution. What’s crazy is that so far, those companies' revenue and profits are showing that their bets are paying off. For example, Nvidia’s revenue grew a whopping 200% in a window of time that was previously thought impossible.

Bottom line, we could be wrong, but here at Prospero we believe that the market is in unprecedented territory. Traditionally we’d be talking about needing the market breadth to expand. I actually suggested talking about that in this letter until CEO George Kailas laughed at me (my favorite part of working with George is how he responds when I say something stupid), and he kindly showed me the error of my ways. He said: “I know that’s what everyone would typically say. That if Market Breadth improves we’ll keep going up. But I disagree. Sure, market breadth would help, but I just don’t think that’s going to drive this market higher. It’s all about A.I. If companies continue to see rapidly accelerating sales/profits coming in b/c of A.I., there’s no telling how high we can go. But if they don’t, we’re in trouble”. Translation: We’re in unprecedented territory and if profits and cash flow continue to grow and grow because of A.I., then it’s likely we continue to see growth over the next 6 months. If those companies don’t produce and continue to grow, then that lack of market breadth will catch up with us and we will see a pretty significant decline. He always tells me “look at the data.” And the data says that AI is capable of carrying the market without breadth and investors simply do not appear to have nearly as much confidence in the rest of the market recently. Could that change? Yes, absolutely. But to his point, why expect it to if that isn’t what we are seeing in the data? Why should we expect a market driven by a game changing technological shift to behave as the “normal” market, when we are already seeing this Bull market behave abnormally?

As we speak, our QQQ and Net Options Sentiment numbers continue to be elevated. But as we have stated over the last several weeks, we remain “cautiously bullish” heading into the second part of ‘24. Will A.I. continue to dominate the landscape? Will the outcome of the election swing sentiment and create volatility? Will the market thrive or crash? While nobody knows the future, Prospero is committed to doing everything we can to keep you ready to succeed and thrive. And who knows, maybe the next 6 months will be better than the first!

2024 Bull Pick Performance

In the first half of 2024, our bull picks have demonstrated robust performance, especially in the Technology sector, which has become the primary focus in light of the AI boom. Let's break down the performance of our long positions across various sectors:

Technology leads with the highest number of picks, showcasing significant gains and outperforming SPY, reflecting strong market sentiment towards tech innovations. A notable number of picks for Communication Services with moderate returns, slightly outperforming SPY. Financial services have faced challenges, showing negative returns and underperforming SPY. Healthcare remains strong with positive returns, significantly outperforming SPY. Industrials show modest gains but slightly lag behind SPY. Consumer cyclical stocks have struggled, with negative returns and underperformance compared to SPY. The energy sector shows resilience with solid gains and outperformance relative to SPY. Utilities exhibit strong performance, reflecting stable and high returns. Basic materials have shown modest gains but underperformed compared to SPY. Consumer defensive stocks have faced challenges, with negative returns and underperformance. Despite a single pick, real estate shows remarkable returns, significantly outperforming SPY.

Comparing our sector picks year-over-year, we notice a strategic shift in focus and performance outcomes:

In 2023, Consumer Cyclical was our top-performing sector, with a substantial average profit of 7.29% and outperformance of SPY by 5.68%. However, in 2024, Technology has taken the lead, reflecting our adaptability to market trends and emerging opportunities.

Chip Companies vs. Non-Chip Companies

Analyzing the performance of chip companies versus non-chip companies reveals significant insights:

We mentioned our bet on AI, here is a clear result that is causing our big year. Chip companies have delivered outstanding performance, significantly outperforming SPY while Non-chip companies have also performed well, but not as spectacularly as their chip counterparts.

Market Cap Classification Analysis

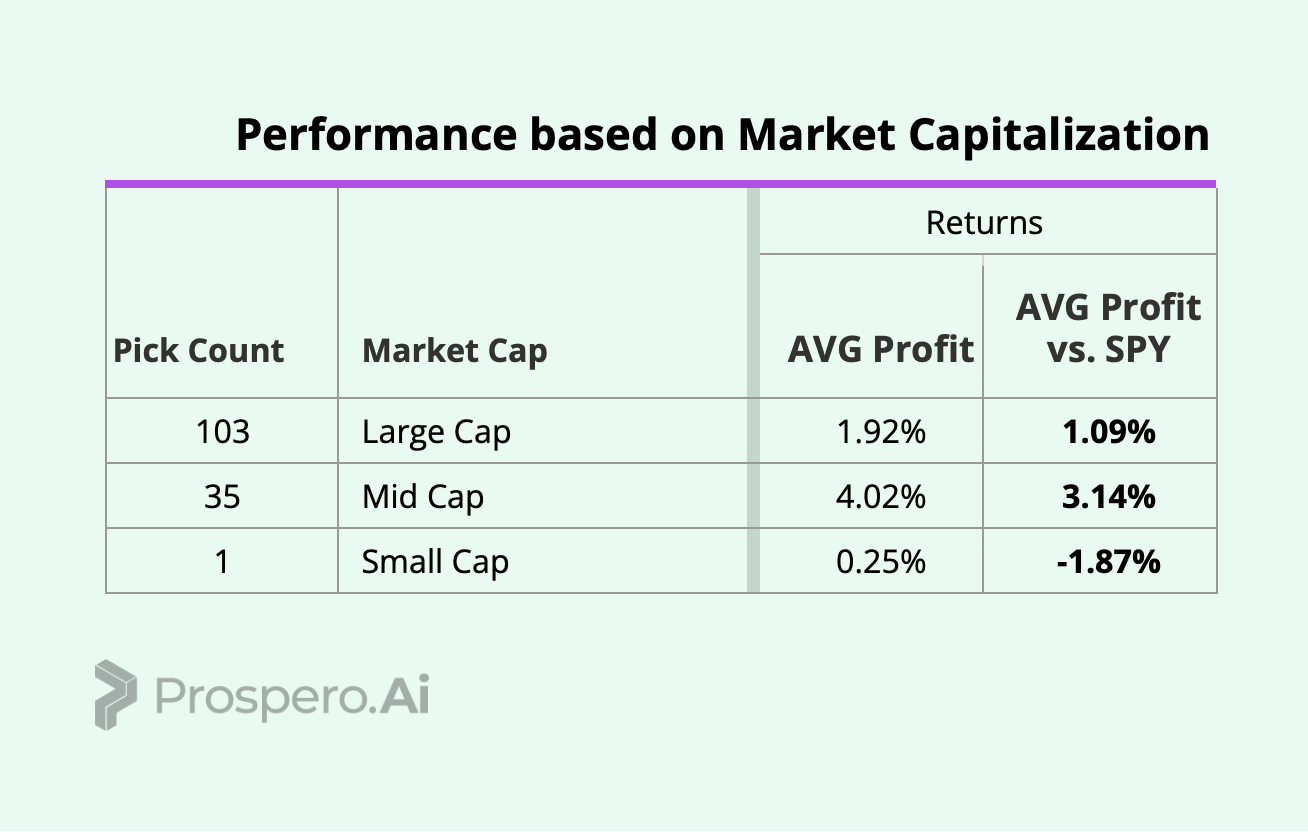

Our picks by market cap categories further elucidate our strategic allocation:

Large cap stocks have shown stability with modest gains and slight outperformance relative to SPY. while Mid cap stocks have delivered strong performance, significantly outperforming SPY. Before this analysis we thought we were going to be hanging our hat on mega caps but this shows that picking our spots with Mid Caps is more responsible for our great performance.

2024 Bear / Short Strategy & Comparison to 2023

Our approach to short positions has also evolved, focusing on quick profit-taking in a volatile market:

Despite high pick counts, Technology shorts have faced challenges, showing slight positive outperformance relative to SPY. But this is not surprising to us as frequently we are playing Technology not because we are Bearish but to hedge against or significant long exposure. After being our primary profit driver on the long side in 2023 Consumer Cyclical has turned into a prime target for our shorts. We always say how important it is to have a macro view, and you can see the fruits of adhering to that philosophy here. We’ve been Bearish on Consumer Spending on the macro level and making plays around that view has led to great results on our Bear picks. Industrials have shown positive returns with slight outperformance. Healthcare shorts have faced challenges with negative returns, but still managed to outperform SPY. Real Estate has shown modest gains but underperformed compared to SPY. Utilities have shown strong returns but underperformed SPY. Communication Services shorts have struggled with negative returns but outperformed SPY. Energy shorts have shown positive returns and outperformance. Financial Services have faced significant challenges with negative returns but have managed to outperform SPY. This indicates that our short strategies in this sector have been effective despite the overall negative returns. Consumer Defensive shorts have shown positive returns but underperformed SPY. Basic Materials shorts have struggled with negative returns but outperformed SPY, indicating some success in our strategic picks.

Market Cap Classification Analysis

Our performance analysis based on market capitalization reveals distinct outcomes across different market cap categories. Large cap stocks, with a pick count of 89, showed an average profit of -0.28%, yet managed to outperform SPY by 0.89%. Mid cap stocks, totaling 70 picks, achieved a modest average profit of 0.33% and outperformed SPY by 0.16%. A contrast to our Bull picks in which our best category was Mid Cap. Small cap stocks, though fewer in number with 29 picks, exhibited the most significant variance with an average profit of -1.35% but still managed to outperform SPY by 1.50%. This indicates that we were able to identify opportunities where smaller companies faced challenges.

Our Moves, Abridged

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

We are doing a highly abridged version of our picks this week as the review took up most of the space in this letter. QQQ net options sentiment continues to look stronger than SPY which closed the week on a downtrend. This created a strategy for us where we will weigh tech more heavily and short other Sectors other than one Tech stock to hedge our downside a bit.

Long / Bull Moves - No adds / MSFT, GOOG, AVGO, SMCI, BKNG, LLY, CELH holds /APO drop

Short / Bear Moves - AVT add / KSS, EL, BNTX, BOH holds / DEI, CALM, MGEE drops

7 Longs - MSFT, GOOG, AVGO, SMCI, BKNG, LLY, CELH

5 Shorts - AVT, KSS, EL, BNTX, BOH

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.