The origins of the phrase "If it ain't broke, don't fix it" are murky. There's an ancient Japanese proverb that has the same basic sentiment, "If your team is winning, keep the same approach to the game". Another theory of its origin is that during the Industrial Revolution of the last two centuries. Machines became more complex, and routine maintenance became a real need. Let's take for example the cotton gin. Because the average Joe had no idea how a cotton gin functioned, if it was running well, it seemed completely counterintuitive to provide maintenance on a machine that was working properly. You can almost picture an old farmer wearing overalls with a stalk of wheat hanging out of his mouth, watching some guy working on a properly functioning cotton gin, and saying: "hey…if it ain't broke, don't fix it".

Regardless, the phrase holds a lot of merit if you're talking about team dynamics in ancient Japan; but the stock market, not so much. When it comes to crafting a strategy to beat the market at levels Prospero has enjoyed over the last few years, you have to constantly evolve and adapt, or the market will leave you behind. Why? Because market conditions change, literally on a daily basis. Here at Prospero, our team works diligently to stay on the cutting edge of those changes, so we can give you the most accurate and up to date market information available.

After sharing an input of the momentum score - Net Options Sentiment movers for a few days in a row we said “if it ain’t broke don’t fix it.” In was a bit tongue in cheek but the truth is we probably misspoke. That isn’t how we operate at all. A closer to real motto would be “if it ain’t broke, use it until we evolve to a better process or we see any cracks in the foundation” One recent example of our desire to evolve, is a new data set we are building on the way to our alerts product release "Momentum Score". To get our Momentum Score, Prospero's algorithms evaluate hundreds of stocks at once, filtering the best(and worst) stocks based on the following criteria:

1. Net Options Sentiment (Short term signal looking at options data that reveals whether large institutions are bullish or bearish)

2. Upside Breakout (A signal that looks at long term option bets by institutions, as well favorable analyst coverage and price momentum)

3. Technical Flow (Takes many different time horizons and technical indicators and combines them into one score)

4. Social Sentiment (Short term signal that evaluates how positively or negatively users of social media view a stock)

Until recently, access to this kind of real-time, in-depth market research was next to impossible to find. Large Hedge Funds would hire armies of interns to even get close to this level of market insight. And by the time the research was completed, it would be outdated. Prospero gives you this data in real time. It's a game changer.

So, if you're doing some routine maintenance on a cotton gin, the old adage, "If it ain't broke, don't fix it" might apply. But here at Prospero, we're going to continue to evolve, innovate and fight for excellence, so that we can provide the best possible returns for the amazing people that have joined us on this journey!

A WORD FROM OUR CEO

We have been highly defensive since we’ve seen QQQ Net Options Sentiment as volatile as it has been the last few months. Probably a little too defensive to end last week with QQQ Net Options sitting at 60+. Some of those downside hedges caught up to us but we continue our strong year beating the S&P 500 by 82% annualized, with a win rate of 61% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! Monday 8/26 at 11 AM EST and Wednesday 8/28 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

IF IT AIN'T BROKE, DON'T FIX IT

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

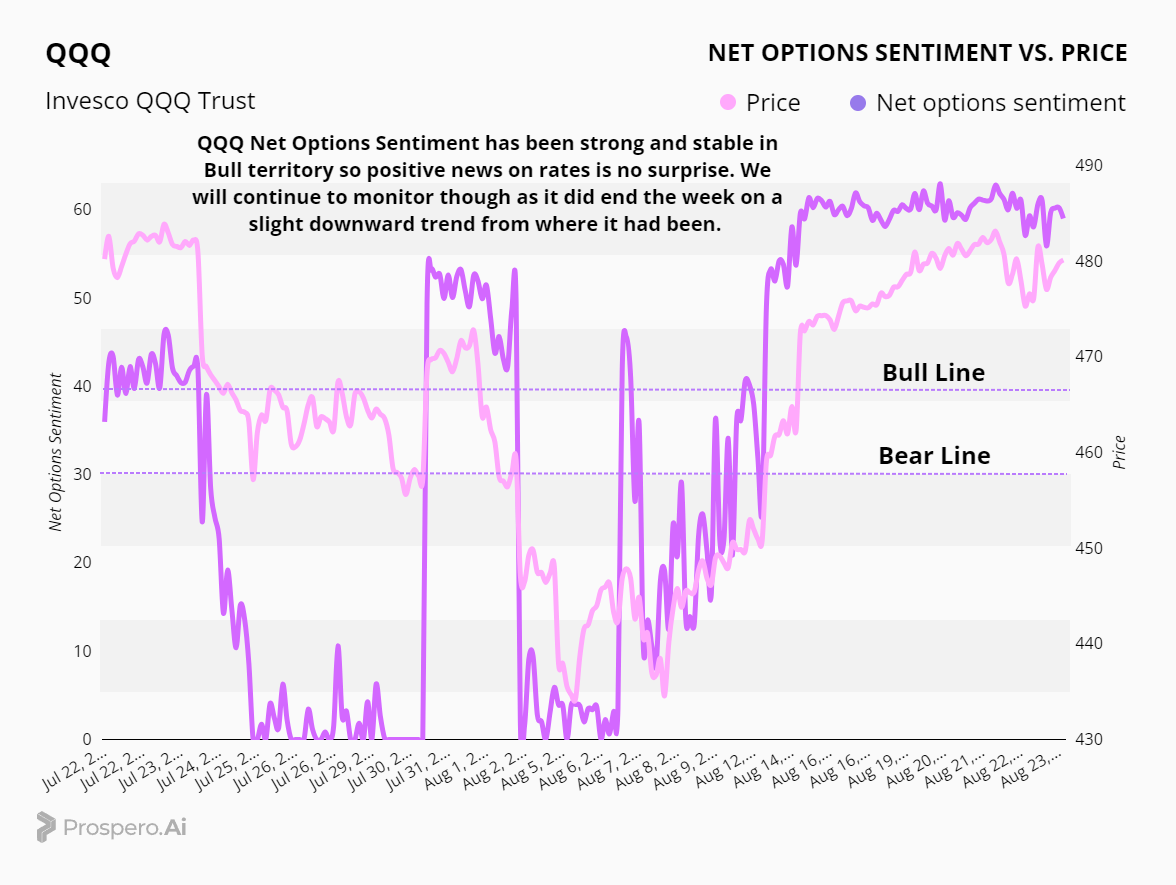

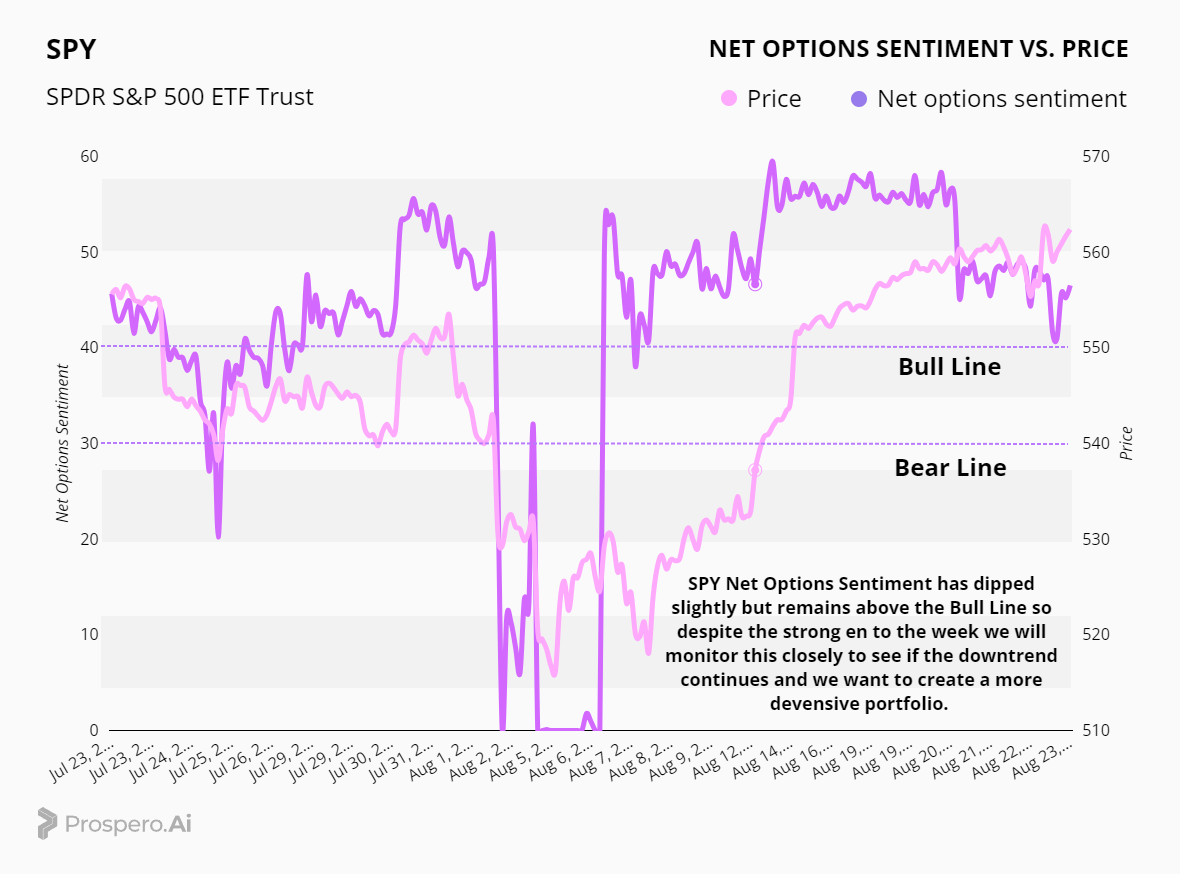

Last week’s Net Options Sentiment levels from the 8/11 letter: SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Last week saw Fed Chairman Jerome Powell give some historic comments from his speech in Jackson Hole, Wyoming. He signaled a clear pivot from the Fed's historic inflation fighting campaign and highly insinuated that rate cuts were on the near horizon. Here's why that matters…

In early 2022, inflation was skyrocketing and the Fed began to raise interest rates in order to cool down the troubling inflationary trend. Interestly, job numbers continued to remain strong despite the harsh increase in interest rates. Over the last few months, that has begun to change. Powell stated: "The cooling in labor market conditions is unmistakable" (Translation: joblessness claims are rising at a rate that has the Fed's attention) Powell then said: "We will do everything we can to support a strong labor market as we make further progress toward price stability" (Translation: It's time to cut interest rates, because we're alarmed at the rising unemployment numbers and increasingly poor economic data). Bottom line, the economy is teetering on recession and the Fed thinks it's time to ease back on their tightening. When they will cut rates and how big of a cut remains a mystery. But the real question is how does all this affect the market? The answer is long and complicated, but let's take a minute to focus on one interesting impact of lowering interest rates.

Small Cap Stocks.

As we’ve shared in recent letters, over the last couple of years, Small Cap Stocks (A company with a market cap between $250 Million and $2 Billion dollars) have had a historically poor performance against the S&P 500. Small Caps are WAY overdue for a rebound. On top of that, Small Cap stocks typically perform best in a lower interest rate environment. Smaller companies often have to borrow money to stay afloat. Higher interest rates hurt their bottom line. Additionally, investors are less likely to invest heavily in smaller companies in a higher interest rate environment. So, when interest rates begin to lower, that frees up capital that allows small cap companies to thrive. When Fed Chairman Powell made his obviously dovish comments on Friday, Small Caps rallied hard into the weekend. Below, you can check out our Cap Analysis Table and you'll see that Small Caps rallied over +3% for the week!

Here at Prospero, we're going to take this Small Cap run seriously and be actively looking for opportunities to profit from this market shift.

CAP/VALUE ANALYSIS

As we mentioned above, Small Cap Stocks had a remarkable week, with the majority of their gains coming Friday after Chairman Powell's speech. Whether we'll see a pullback (after the rally) in the coming week remains to be seen, but based on that reaction if rates decline in line with expectations it could mean Small caps are just getting started with their run. We were a little slow to react to the Small Cap rally last time so we are not going to get caught like that again! One other note of interest is that Mid & Large Cap Value stocks had a good month. This could be an encouraging sign that stocks outside of The Magnificent 7 can carry the market forward. about above well. There is some evidence this trend is changing in the short term but until we see these trends move out further we are only willing to bet on that shift so much. But you can see that on both 1D and 1M Small Cap Growth is lagging behind which is why we are more comfortable in that zone on the short side.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

I continue to be amazed at the power of our Net Options Sentiment tool. If you're an active trader and aren't consistently looking at QQQ and SPY Net Options Sentiment Numbers, you're missing out (in my opinion) on one of the most accurate indicators of FUTURE market movement. Look at the above chart. In early August, QQQ Net Options Sentiment ceased the volatility we saw in July, then shot up into bullish territory and stayed elevated through Fed Chairman Powell's Speech on Friday. Let me explain how amazing that is. About the time our Net Options numbers jumped into bullish territory, the Nasdaq and S&P 500 had just dropped below it's bottom trend channel for the first time in months. That is EXTREMELY BEARISH. When that happens, it usually indicates more downside is coming. Pretty much all the talking heads on T.V. were calling for further downside, or even an end to the Bull Market. Well, when everyone was calling for doom and gloom, our QQQ Net Options Sentiment jumped into bullish territory and sure enough, the market turned around and resumed its upward trend. Bottom line is that Prospero predicted that the Bull Market wasn't finished and we were experiencing a false breakdown.

One final note. At the end of last week, QQQ Net Options saw a slight downturn. We will be watching closely as we enter the trading week to see how the market digests last week's rate cut news.

Look at the SPY Net Options Sentiment Chart above. As you can see, last week it started declining, heading into Friday. That was likely a small amount of institutional hedging going into Fed Powell's speech. After the speech, we saw numbers begin to increase, but the most important data point is that SPY NOS numbers are still above our bull line. If it falls below 40, we will re-evaluate everything and take a more defensive stance.

SECTOR ANALYSIS

See the Sector Analysis Table above. The big takeaway is that a few interest rate sensitive Sectors are looking to be the best on the Bull side. Real Estate and Consumer Discretionary. Utilities had a strong month, but softened last week. Utilities are typically seen as defensive in nature and could be a further sign of transitioning into a more "risk-on" type of stocks. Another note of interest is that while Technology was negative for the month, it rallied last Friday and will hopefully regain some strength as we exit the seasonally poor performing early/mid August. One final area of interest to me is Materials. It had a strong showing last week. Steel prices have been on a downward trend and look to have potentially bottomed. STLD (Steel Dynamics) showed up as a top materials stock in last week's Momentum Score Chart. Materials and Energy could be worth watching as targets for growth in the coming month.

PORTFOLIO STRATEGY

Respecting the small cap rotation means carrying a larger portfolio to us as we will never rid ourselves of our favorite large cap names that put themselves at the top of our signals.

We are a bit worried about the way SPY Net Options Sentiment ended the week. So as we have been since we saw the period of elevated volatility the last 1-2 months we will stay with a slight Bullish lean to start the week. Leaning more on QQQ stocks due to that Net Options Sentiment remaining strong to end the week. 11 longs and 9 shorts.

Long / Bull Moves

Long / Bull Moves - SG, HIVE, MGNI, HASI, COMM adds / META, MELI, CMI, TSLA, AVGO and NVDA (1/2) holds / LLY, TDG, PDD, MA, AMSC, ROOT, VLO, TMDX, SMCI and CRWD drops

Adds

HIVE, MGNI, HASI and COMM were added because they performed the best in our Screener for small cap stocks in diversified Sectors. SG was a standout mid cap and we wanted to diversify accross the cap spectrum.

Holds

Going into this week we didn’t want to abandon our Large Caps completely but we did want to be selective so we tried to keep to the very top of the distribution with META and MELI. NVDA was kept because we expect it to run up into earnings but we probably won’t hold it through earnings. AVGO and TSLA looked too strong in the metrics to drop due to being filtered out and as both are in the QQQ in line with our portfolio strategy above.

Drops

LLY was our toughest drop but we just slightly preferred MELI due to better Technical Flow and Consumer Cyclical in a better trend than Healthcare. PDD and MA were easy cuts as large caps with better alternatives on the small cap side. AMSC and ROOT were cut because we saw better ranked alternatives in the same cap buckets. TDG was the toughest liked CMI a little better due to their smaller market caps. SMCI and CRWD were easy drops because of lower ranking and higher risk, being filtered out. TMDX was dropped for a combination of being filtered out as well as much lower Technical flow than the two stocks above it.

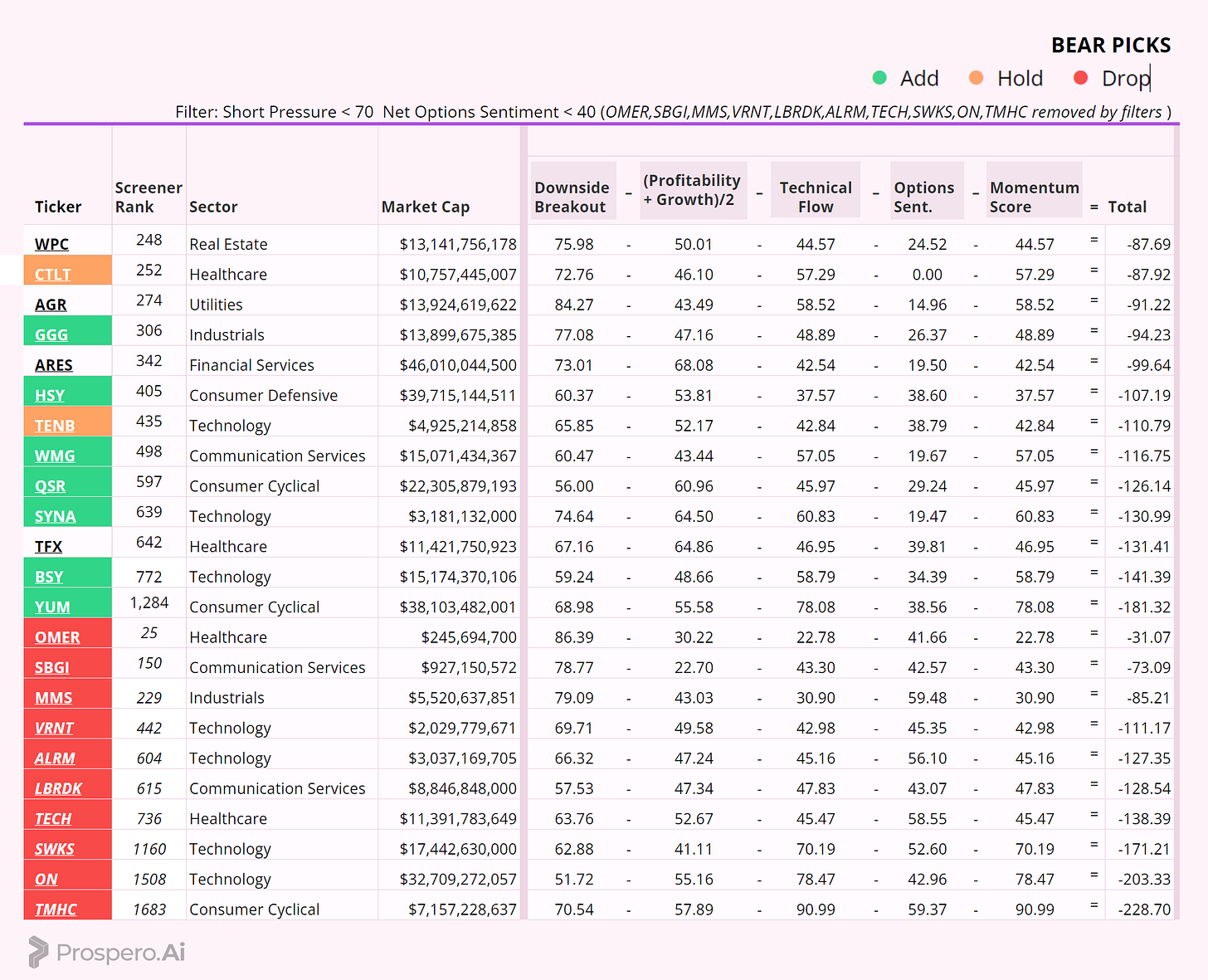

Short / Bear Moves

Short / Bear Moves - GGG, HSY, SYNA, WMG, QSR, BSY and YUM adds / CTLT and TENB holds / OMER, SBGI, MMS, VRNT, ALRM, LBRDK, TECH, SWKS, TMHC and ON drops

Adds

GGG, HSY, WMG, QSR, SYNA, BSY, and YUM were all targeted because they were larger cap stocks that were attractive in the Screener (relative to stocks of their Cap size) and they hedged our long positions well. We were not interested in WPC because of how Real Estate has powformed recently. And we did not select ARES because we could not get comfortable with the strong day it had on Friday.

Holds

CTLT was an easy hold because of the Screener performance and very low Net Options Sentiment. TENB we liked as a hold because of its Net Options Sentiment trend.

Drops

All drops were viewed as higher risk from being filtered out with > 40 Net Options Sentiment.

OMER, SBGI, MMS, VRNT, ALRM were all dropped because of our avoidance of smaller cap stocks. LBRDK was dropped because we liked WMG better, especially due to Net Options Sentiment trends. TECH, SWKS, ON, TMHC were all dropped due to Screener rank.

Portfolio Summary

Long / Bull Moves - SG, HIVE, MGNI, HASI, COMM adds / META, MELI, CMI, TSLA, AVGO and NVDA (1/2) holds / LLY, TDG, PDD, MA, AMSC, ROOT, VLO, TMDX, SMCI and CRWD drops

Short / Bear Moves - GGG, HSY, SYNA, WMG, QSR, BSY and YUM adds / CTLT and TENB holds / OMER, SBGI, MMS, VRNT, ALRM, LBRDK, TECH, SWKS, TMHC and ON drops

11 Longs: META, NVDA, TSLA, AVGO, CMI, MELI, SG, HIVE, MGNI, HASI, and COMM

9 Shorts: GGG, HSY, SYNA, WMG, QSR, BSY, CTLT, TENB and YUM

Paid Investing Letter Bonus - With Momentum Score Screener!

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.