Outside of "Hasta La Vista Baby", Arnold Schwarzenegger's most famous quote from the Terminator movies was "I'll be back". Arnold played an evil cyborg with artificial intelligence who decided, along with some pals, to take over the world. He'd come back in time to kill the mother of the leader of a human resistance movement named Sarah Conner. The "Terminator" walked into a police station where Sarah was hiding. He asked if Sarah was there. The police said no. And then came the famous quote: "I'll be back". A short time later, the terminator drove a vehicle through the front of the police station and killed everyone in sight.

Why am I telling you this story? Because, as a society, we just took one step closer to that level of artificial intelligence (hopefully without the violence) becoming a reality. Our CEO George Kailas sent me an article this week from Wired.com called: "OpenAI Announces a New AI Model, Code-Named Strawberry, That Solves Difficult Problems Step by Step." What I read was fascinating and a tad bit scary. ChatGPT maker "OpenAI" has recently revealed details of what's officially known as OpenAI o1. It's the latest major breakthrough in artificial intelligence. As significant as CPT-4 was, OpenAI o1 might be more significant, not because it's larger or faster, but because it signals a new approach to AI. Bottom line, OpenAI o1 is a model that can "reason". It's basically the first artificial intelligence that actually shows signs of human-like intelligence. Instead of just spitting out data that it got from a book or website, it can logically reason through difficult problems and is significantly smarter than any existing AI model. It can solve problems that would stump OpenAI's GPT-4. The article stated: "Instead of summoning up an answer in one step, as a large language model does, it reasons through the problem, effectively thinking out loud as a person might, before arriving at the right result.

The new model was codenamed "Strawberry" and is actually not a successor to GPT-4 but a compliment to it. The company is currently working on GPT-5, but has introduced technology that can essentially "think" its way through problems, previously thought impossible. Thus far, large language models, which have vast quantities of data, exhibit remarkable linguistic and logical abilities, but traditionally struggle with questions that involve even basic reasoning skills. For example, the article stated that GPT-4 cannot answer the following question:

A princess is as old as the prince will be when the princess is twice as old as the prince was when the princess's age was half the sum of their present age. What is the age of the prince and the princess?

Answer: The prince is 30 and the princess is 40.

To be honest, I'm so confused I had trouble even writing that sentence! That's a complex mathematical equation that requires the ability to think and reason. GPT- couldn't, but OpenAI o1 solved it. Pretty impressive, and also pretty scary. Why are we telling you this story? Because the implications of this are mind-bending. It's a huge step toward mankind's ability to create life-like robots that can perform complex and changing tasks.

Think about it. Will "middle management" of companies be needed if a robot that's smarter than them can reason and then clearly, without mistake solve complex problems that only humans could before? Will highly intelligent robots one day soon, be policemen and firemen, doctors and lawyers? Will they drive our cars and make our food? The implications are limitless. If you're like me, you can imagine a lot of good things (curing cancer) and a lot of bad things (like deciding one day we aren't needed). But the bottom line is that the world is changing faster than anyone could have thought possible just a short decade ago.

Last week we showed you a graph of how the number of jobs being lost in an economy correlates closely to the S&P 500. S&P goes up if jobs go up. Economy slows, S&P slows with it. Well, there was just a divergence. The economy is slowing with jobs trending downward, while the S&P just keeps going up…led by a handful of stocks. Why? Because people are beginning to see the writing on the wall, that a company's ability to impact their profit margins by AI, is literally just around the corner. Not everyone is buying stocks. Warren Buffett looks at the economy and is hoarding cash at the highest rate in his life. My friend that oversees a huge private wealth firm is doing the same. You simply can't buy stocks with all the warning signs blaring! So, are we telling you to buy? No. We're telling you that not only is it a new day with the onset of AI. It's also a new day in the market with the onset of AI through Prospero. We don't have to hoard cash and cross our fingers hoping the sky isn't falling. We can simply watch the numbers and trade accordingly. It's a fascinating time that we live in and the future is uncertain. Are we on the verge of cyborgs that look like Arnold Schwarzenegger? I hope not. But barring a Terminator style takover, our tools are here to help you navigate that path in an effective and profitable way. Now let's hear a word from our CEO George Kailas.

A WORD FROM OUR CEO

We have continued to do a great job picking our spots in a fast changing market and are beating the S&P 500 by 76% annualized, with a win rate of 61% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! Monday 9/16 at 11 AM EST and Wednesday 9/18 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

“I’ll Be Back” 🤖

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Market/Macro Update w/ Cap/ Value Analysis

We had a strong rally in the market starting at about 11am on Wednesday Sept 11th and the market performed well for the rest of the week. It was a much needed reprieve from its downward trajectory since September 3th. It's hard to pinpoint one single reason the market rallied. US jobless claims came in around expected. The debate between VP Kamala Harris and former President Donald Trump was completed without too many surprises. But likely more than anything is the expected rate cuts coming in September. As well as the lack of anything frieghtening coming out of the presidential debate. Which was a plus, we think! Despite the S&P 500 continuing strong performance, some top finance names are sounding the alarm bell. Jamie Dimon, chairman and CEO of JPMorgan spoke last week at the Institute of International Finance. He stated: "While the US economy is doing fairly well, it would be a huge mistake to believe that it will last for years". He blamed the war in Ukraine, tensions with China, growing personal debt, and "governments around the world spending like drunken sailors" as his reasons for concern. He very well might be right for his concern. Commodities are the cheapest they've been relative to the S&P 500 since the 1970's. This week, commercial traders of gasoline showed their lowest net short positions since 2006! While this could indicate a bottom for the beat up Energy sector, both of those statistics make Warren Buffett's historic cash position look pretty enticing.

It may seem like some of these themes keep repeating but that is the market we are facing. There is some tantalizing upside with A.I. and a friendlier interest rate environment approaching. But election volatility, global war tensions and strain from governments / individuals streching their spending limits loom large as Bear forces. This is why the only predictable thing we’ve seen is unpredictability. The market is taking sharp reversals out of Bull and Bear runs, because there are great reasons to be excited and worried about the market, especially in the short to medium term.

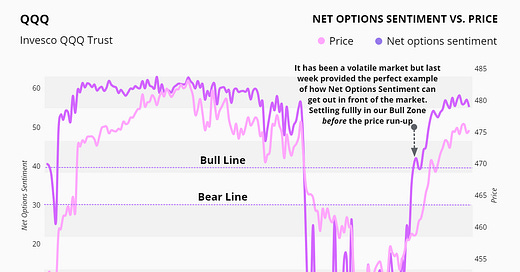

I personally can't remember a time in the market where there was this much uncertainty about its direction. The good news is that Friday ended with strong QQQ and SPY Net Options Sentiment. That tells us that for now at least, institutions are leaning bullish (more so in Tech). So our approach will remain the same and as Jerome Powell would say, we will continue to watch the data closely. You can access more frequent updates through our trading letter.

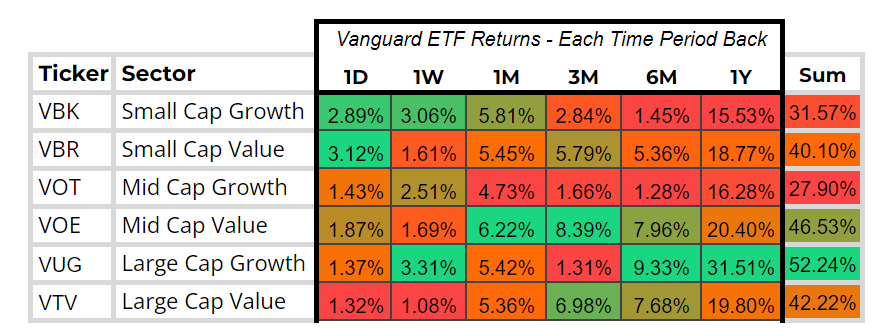

CAP/VALUE ANALYSIS

Check out the Cap/Value Analysis table above. One thing that stands out is the strong week by Large Cap Growth. They were due for a mean reversion, and it ensured that we were still bullish for the month in that sector. Small caps had a strong day on Friday. This is likely due to the expected coming interest rates. Finally, what had been showing relative strength over the last couple of weeks (Value Stocks), showed the most weakness last week. This definitely indicates a more "risk on" environment to end the week.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

Check out the chart below. Last week was a classic example of how our Net Options Sentiment numbers can get out in front of a market rebound. QQQ NOS numbers had been in the doldrums since the end of August. Then on Sept 10th in the afternoon, Net Options Sentiment began to creep upward into bullish territory. Wednesday morning, right after market open, it climbed to 40 (our bullish line), and then on Sept 11th, the market went on a STRONG run. Our QQQ Net Options Sentiment saw it coming.

On a personal note, as a trader and investor, I have two portfolios. A long term, buy and hold portfolio and a trading portfolio where I utilize QQQ and SPY Net Options Sentiment on a regular basis. Keeping a close eye on those numbers, by utilizing Prospero's signals, has lead to my most profitable year (by far) in my short term portfolio.

Check out the SPY Net Options Chart below. While the numbers for last week ended bullish, we are less excited about the S&P than we are for QQQ. SPY Net Options Sentiment numbers followed a little more closely to the price action than its QQQ counterpart. That tells us that institutions are not as certain about bullish momentum in SPY as they are in Tech. We will continue to remain a little more cautious here, but this could also mean a stronger week in Tech than the broader market.

SECTOR ANALYSIS

See the Sector Analysis Table above. A couple of things stand out to me. First of all, look at the week Technology had! That certainly lines up with our QQQ Net Options Sentiment that showed a strong reversal in Tech. Second, Communications had a MONSTER of a day on Friday. Hopefully those two data points combined will lead to a week of stronger performance. Real Estate continues to show strength. And could have a good week running up into when rate cuts come. Finally, Energy had the worst performance of the week, but as we shared earlier in the letter, it looks as if Energy may have found a bottom. It will be interesting to watch that sector in the coming couple of weeks.

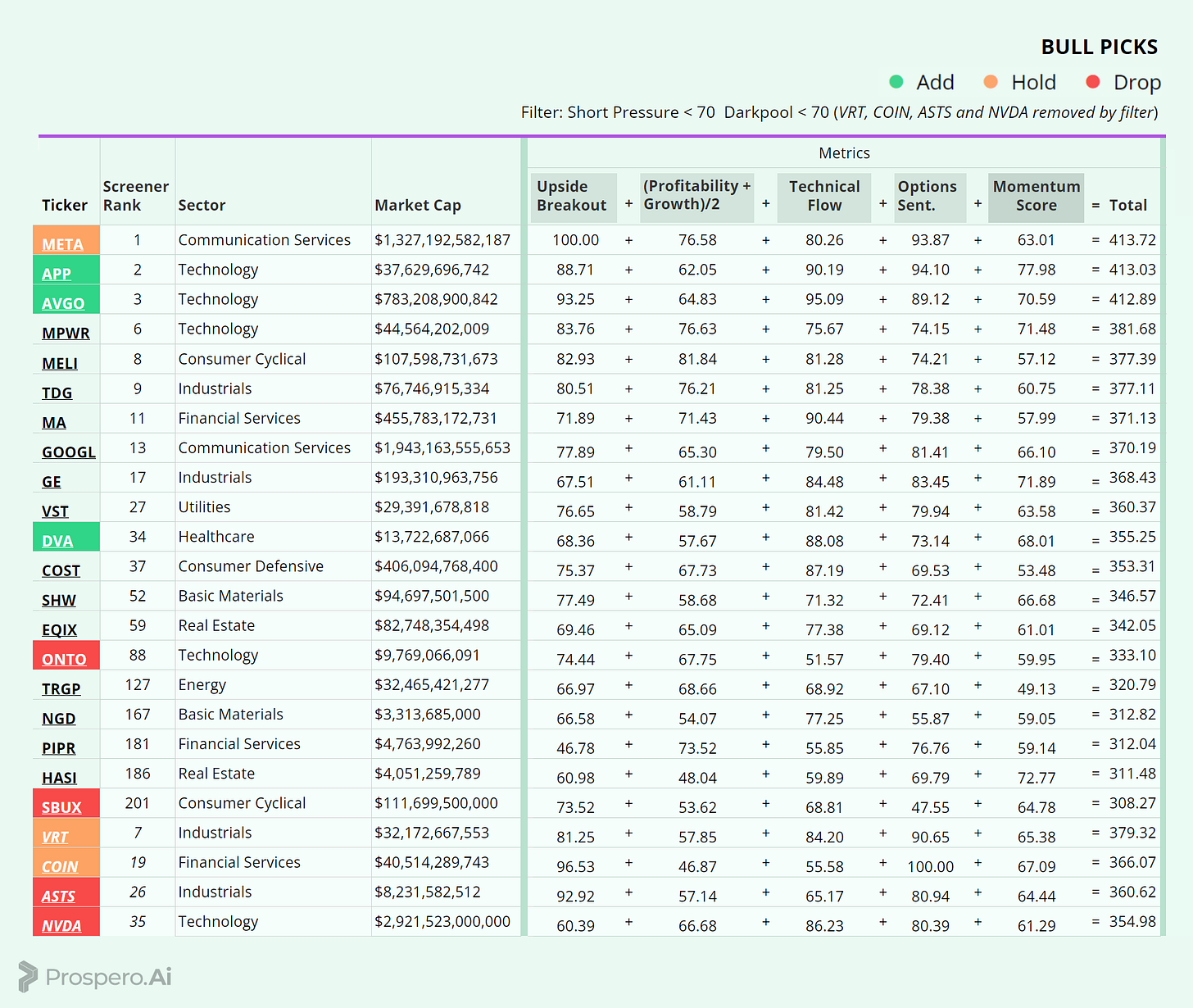

PORTFOLIO STRATEGY

And the yo-yo market continues. Last week we were 3 short and 6 long and we will be flip the other way because of the about face for QQQ Net Options Sentiment. We are taking “tech adjacent” picks like META, VRT, and COIN to get high upside while avoiding Sector based volatility risk. 6 longs and 4 shorts.

Long / Bull Moves

Long / Bull Moves - APP, AVGO and DVA adds / META, VRT and COIN holds / ONTO, SBUX, ASTS, NVDA drops

Adds

APP and AVGO were easy adds because they were the highest in the Screener. DVA was picked because we are trying our best to diversify on Sector and Market Cap when possible. And it was the best smaller cap stock with a high marks in Technical Flow and Momentum Score.

Holds

META was an easy hold as the top stock in the Screener. VRT was kept despite the elevated (72 Dark Pool) because the Net Options Sentiment trend looked to positive to cut it. COIN was held due to our policy of holding any cryptocurrency related stock until Monday because that asset trades over the weekend.

Drops

ONTO and SBUX were dropped because of poor Screener performance and ASTS and NVDA were dropped because better alternatives existed in their Sectors.

Short / Bear Moves

Short / Bear Moves - LPL, NVS, EIX, INFY adds / no holds / NAVI, MUFG, TRIP and LNC drops

Adds

NVS, EIX and INFY were added because they were the best looking Large Cap stocks outside of the Energy Sector which we are concernced might have found a bottom. It came down to MUFG vs INFY in the end and we went with INFY despite lower Screener performance because INFY has poor numbers despite Technology having a very nice week.

No Holds

Drops

NAVI was dropped because we were not comfortable with the 45.81 Tehcnical Flow. MUFG we explained above but the Momentum Score crossing 40 put us over the edge vs the other two picks we compared it with. TRIP and LNC were dropped due to poor Screener performance.

Portfolio Summary

Long / Bull Moves - APP, AVGO and DVA adds / META, VRT and COIN holds / ONTO, SBUX, ASTS, NVDA drops

Short / Bear Moves - LPL, NVS, EIX, INFY adds / no holds / NAVI, MUFG, TRIP and LNC drops

6 Longs: APP, DVA, AVGO, META, VRT, COIN

4 Shorts: LPL, NVS, EIX, INFY

Paid Investing Letter Bonus - With Momentum Score Screener!

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.