Before we start the letter I want to brag on Prospero and our CEO George Kailas. This week we learned that Prospero is #44 on Substack’s rising in Finance list. And there are literally thousands. So way to go George! We're all thankful we're in this with you! Especially after last week….Last week was literally historic. We saw one of the largest declines and then the 2nd largest single day increase of the Nasdaq in HISTORY. You'll be able to tell your grandkids: "I traded through the 2025 Tariff Kerfuffle." The bad news is that we dropped below what is officially considered a bear market. Now, we've since increased and gone above it. And as we speak, nobody knows if we'll continue going up or down. But the good news is that on Friday our SPY and QQQ Net Options Sentiment ended the week headed toward a bullish direction. It was near an all time low earlier in the week, but as the bell rang to close on Friday, QQQ had jumped into the 20's which is a sizable increase. Again, nobody knows where we're going from here; it's just too volatile and we can change direction on a dime. So the question we want to answer today is NOT what direction is the market headed, but rather answer a question that could have a huge impact on whether or not you're successful, regardless of whether we keep dropping or sentiment turns and we head to all time highs. And that question is this: Are you making decisions with an "outside-in" or an "inside-out" approach. We want to argue the more complexity in the market an inside-out approach is the way to go. Here's how we would define the two.

Outside-In: Trying to figure out the macro economic data yourself and trying to personally interpret it, and make your trading decisions based on your own interpretation of the market and the world.

Right? Have you noticed that everybody is suddenly a macroeconomic expert that has a Phd in Economics from Harvard? It's amazing how many people I read on X that are SO confident in the impact of Tariffs, not only the market, but bond yields, the Dollar and the Yen Carry trade. It's fascinating. My dad used to talk about people like that and he described them this way: "Often wrong…but never in doubt". And listen, you may have a PhD in finance and that's amazing, but even our CEO, who's been on Wall Street since shortly after puberty, and he literally has no idea which direction we're going. On Friday as the QQQ Net Options were rising, the general consensus was that the Markets have gotten so, historically oversold that a bump is all but inevitable. Well, news got released this afternoon that Trump is considering adding additional tariffs onto the semiconductor and Bitcoin dropped like a rock. The reality is that the market might change directions 2-3 before we wake up tomorrow. Now let's define "Inside-Out" decision making.

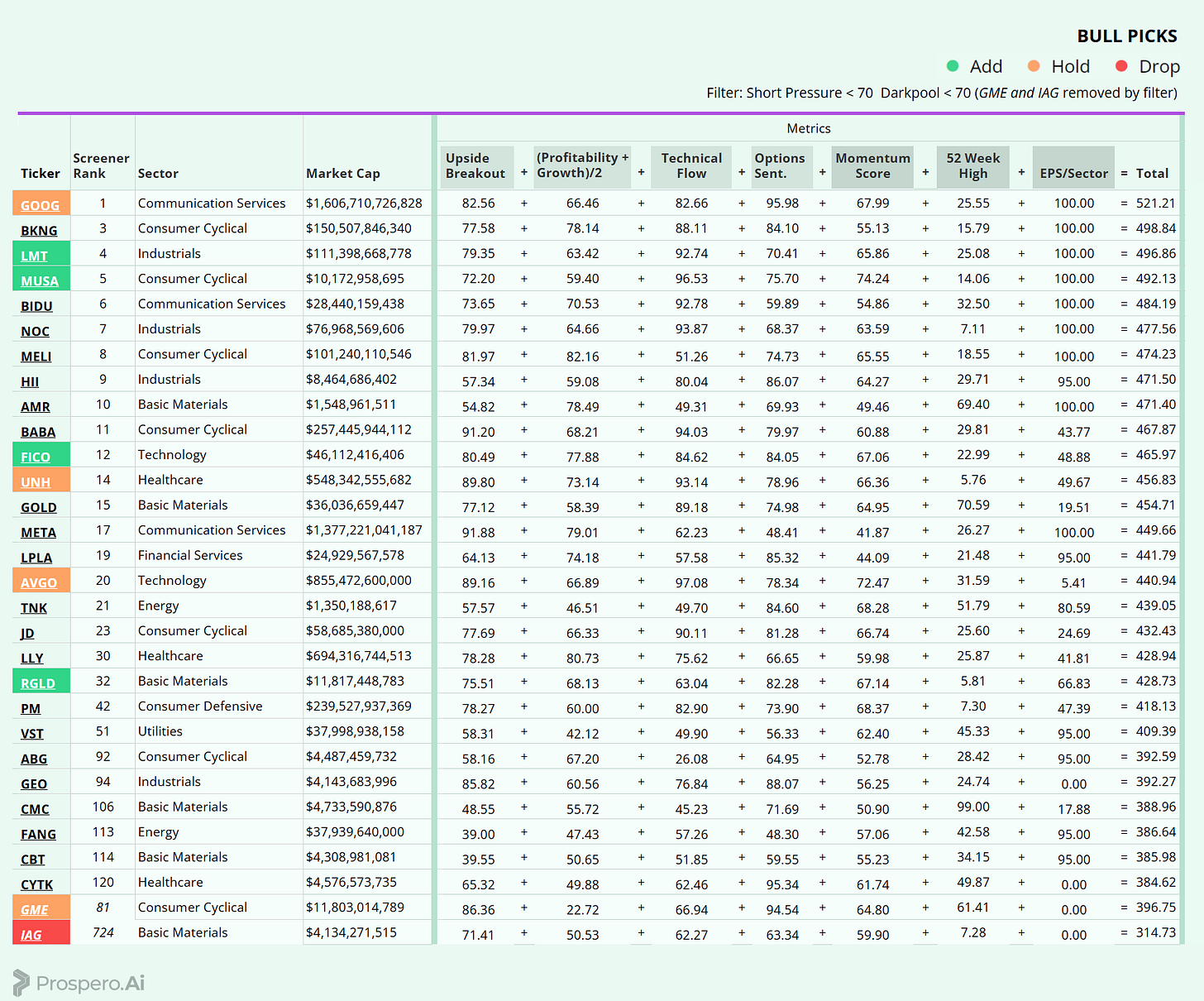

Inside-Out: Making decisions not based on isolated opinions, feelings or noise from social media, but an aggregation of informed data points. Inside out thinking is more about letting a sound data process lead to your decision. Let me give you an example of how we've done this at Prospero with a company called IAG. It's a Gold Mining company that focuses on mineral exploration and discovery. There is a good argument that gold is a great buy with unstable currency markets. But the way that the price has gone up you could argue Gold is in a bubble. It's at an all time high and with the equity market being oversold, common sense would tell you not to dip your toes into the overbought gold market. But think about the reality of the gold trade. How much do you REALLY know about the gold trade? How much real-life experience do you have? Are you an expert? Have you traded Gold in this same environment over the years? For me, the answer is a big fat no. But George was studying our indicators one day and saw that IAG was looking really good in our numbers. Its momentum score was way up and its Net Options was higher than normal. George didn't trust his gut, he trusted our numbers. And our numbers were right. We had a great gain off of it. This is why we’ve built our signals this way, focused on aggregating the net opinions of smart Wall St. options traders. Everything we do here starts a foundation of understanding where Wall St. insiders are betting.

Here's our point. Don't try to trade this market by instinct. There are a lot of people, including seasoned veterans that are getting hammered in this market. Always, always always start first with the data.

Are the stocks Net Options Sentiment and Upside Score on the higher range and increasing? Does it look good in Social Sentiment and/or TechnicalFlow? Is it profitable? Then, you're able to make a better informed, Inside-Out kind of decision based purely on data. The data lets you make an informed decision and truly weigh the risk vs reward. GME is another good example. It is 36 Profitability and 9 Growth. The business is not one we are excited about, especially because their most exciting initiative is buying Bitcoin, not any kind of improvement to their core business. But this week we successfully added it because it looked good in all of our short term signals. When the market is sending confusing signals, any confluence can be an important way to gain conviction and that is what we got with all of our short term signals saying “go for it.” We did and it helped our week.

Lastly, in this market, always, always be hedged. Never just go all in long or all short. We're seeing violent swings in both directions. Last week I personally did really well and saw a 22% increase in my portfolio. All I did was go 60% short (puts, SQQQ, etc) and 40% long (Calls, Stock) and as the market swung, I took profit as each position would turn green. It worked. But this week, all that could change. If Net Options turns Bullish, I'll switch the %'s, and go 60%-40% long vs short. When a clear trend emerges then we can pivot.

I'll end with this. Love or hate it, the market, the economy and the current political climate is in a period of radical upheaval. Whether you consider that good or bad, shouldn't matter in how you trade. Let vetted & agreeing data points drive your decisions. Now a word from our CEO:

A WORD FROM OUR CEO

As a thank you to our readers who made our rise up the Finance leaderboard possible we are making it easier to subscribe. We are offering a rare discount on monthly AND yearly subscriptions, 33% off! This gets you access to our live portfolio moves during the week which are even more helpful in these volatile times.

We are proud of the work we did hedging this week as we intended to de-risk around all the uncertainty and our paper trading portfolio ended the week just about where it started, beating the S&P 500 by 99% annualized, with a win rate of 62% against SPY benchmarks.

Regular streams this week - Monday 4/14 at 11 AM ET and Wednesday 4/16 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Inside-Out Thinking to Win More

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

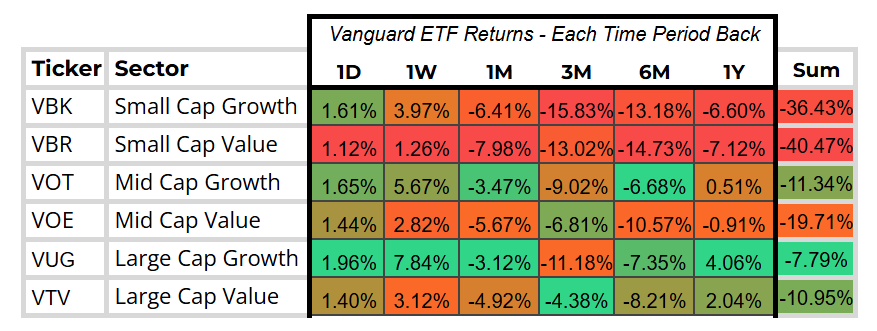

CAP/ ANALYSIS

With renewed optimism injected into the market, Large Cap Growth stocks have shown strong performance and are positioned to thrive, provided uncertainty continues to subside. However, should conditions shift, a move toward the stability of secure cash flows may drive interest in Large Cap Value equities. Meanwhile, Mid Cap Growth stocks could also benefit, as the effects of multiple compression have already taken hold in the lower market capitalization space, setting the stage for potential opportunities.

SECTOR ANALYSIS

Technology experienced a strong rebound following tariff exemptions, though the outlook remains uncertain due to mixed signals from the administration. Communication Services also benefited, showing resilience with stronger cash flows that seem well-suited for the current economic environment. Financials enjoyed a recovery after a solid earnings season, despite the emergence of credit losses. Meanwhile, Industrials saw positive momentum, supported by encouraging PMI figures.

SPY/QQQ NET OPTIONS SENTIMENT

SPY NOS continues to present a challenging outlook for the market, with unfavorable signals dominating the landscape. However, the potential for upside remains if there are shifts in messaging from the White House. Given the market's inherent volatility, conditions can pivot rapidly, and we are ready to adapt our positioning to seize emerging opportunities as they arise.

Now Check out the QQQ Net Options Sentiment Chart. Tech should rebound after the positive news over the weekend but mixed messaging from the administration will hurt the bullish wave that might come on Monday.

PORTFOLIO STRATEGY

Coming out of last week, we maintain a bearish outlook, with SPY and QQQ NOS painting a generally negative picture. However, market sentiment remains highly volatile and can shift rapidly. To adapt, we're diversifying our portfolio aiming to capture potential upswings. Concentration in a market this unpredictable only serves to diminish opportunities and heighten risk. 8 longs, 9 shorts.

Long / Bull Moves

Long / Bull Moves - LMT, MUSA, FICO and RGLD adds / GOOG, AVGO, UNH and GME holds / IAG drop

Adds

LMT was added for Industrials exposure and high Tech Flow with great earnings power. MUSA was added for market cap diversification, with excellent Tech Flow and Momentum. BABA was an interesting pick for the similar characteristics as mentioned. FICO seemed like a decent all around choice with decent Upside Breakout. We wanted some Basic Materials exposure so RGLD was simply a better substitute vs IAG which ranked lower in the signals, and we wanted to keep the gold exposure with good Net Options Sentiment / trend for the market cap.

Holds

GOOG was an easy choice at it ranked at the top of our screener for this week. UNH was also a good hold for its good Upside Breakout and great Tech Flow. GME had great Net Options Sentiment and thus we were compelled to keep it. AVGO was held because of excellent momentum score.

Drops

IAG was dropped because it performed poorly in our screener and we had a better alternative.

Short / Bear Moves

Short / Bear Moves - PARA, ZS, DBX, BMY, TRMX, SKY, UAA, ZS and YUM adds / SNY, IT, BAH, WOLF, WHR, ARES and STRA drops

Adds

PARA was an easy add at the top of our screener with low Net Options and great Downside Breakout. ZG was also great for larger market cap exposure with low Tech Flow. DBX was added for its low 52 Week Mid score. BMY was added for large cap Healthcare exposure with low 52 Week Mid score. TRMX was a good Financial Services pick. SKY had low Net Options Sentiment and thus was added. UAA was added with good Downside Breakout. Lastly, ZS was a good way to get large cap Tech exposure with low Net Options Sentiment. YUM looked like a great large cap Consumer Cyclical choice with low Net Options.

Drops

SNY was dropped as we had a better Healthcare pick on the short side. IT, BAH, WOLF, WHR, ARES and STRA were all dropped because they performed poorly in our screener.

Portfolio Summary

Long / Bull Moves - LMT, MUSA,FICO and RGLD adds / GOOG, UNH, AVGO and GME holds / IAG drop

Short / Bear Moves - PARA, ZS, DBX, BMY, TRMX, SKY, UAA, ZS and YUM adds / SNY, IT, BAH, WOLF, WHR, ARES and STRA drops

8 Longs: LMT, MUSA, AVGO, FICO, GOOG, UNH, GME and RGLD

9 Shorts: PARA, ZS, DBX, BMY, TRMX, SKY, UAA, ZS and YUM

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.