We have decided to start using Reddit as a way to combine our video, short form and long form content in one hub. We’d really appreciate you joining our page and checking it out!

Got a story for ya, Prospero Family. On Saturday morning I was doing my research for the newsletter and I came across some interesting data that suggests we might be ready for a reprieve from this ugly correction. One, we saw a solid bounce on Friday, but despite the bounce, stocks are still way oversold. In light of that, one article I read suggested we might have already hit bottom. There's a group of Wall Street, hedge fund type's called CTA's (Commodity Trading Advisors registered w/ the National Futures Association) that are potentially about to step in and start buying equities. The market has fallen to a level that they historically step in to start purchasing stocks. I reached out to our CEO, texted him the data and asked if he thought I should write a story about how stocks may be done declining. He wrote back "I disagree, lol." I saw the text and couldn't help but smile. I have grown to really like George Kailas, and one of the things I like about the guy is his directness. It's actually quite refreshing. And by the way, he is rarely wrong in his assessment of the stock market, so I decided to call him and ask why he disagreed that stocks would go higher. He said to me: "We may see a short term bounce, but we need to zoom out a bit and look at the whole picture. There's one piece of data that makes me think any bounce will be short lived." As we talked, George sent me a chart he had been working on regarding insider selling of the Mag 7 stocks. You can see it here:

Some important takeaways here.

Of the big 3, which had 3M trailing Net inside sellers of stock - META has sold 38.64% of the total dollar amount of the last 12M Vs. TSLA at 68.5% and Amazon at 1.84%. One of the things we wanted to dig into in this letter was the question: Is the media overblowing the insider sales of TSLA? This data points to those stock sales accelerating more than the other Mag 7 stocks by a good margin.

Purely based on insider selling data, NVDA looks like the best stock. They're the only company were insiders were net positive in buys over sells. Highly interesting to see that big Net Selling amount on 12M flip positive in the 3M.

Are the execs at GOOG and AAPL starting to see value in thier beaten up stocks? Well it is clear that they do not think the stock is trading over value anymore. But we should watch this data to see if they are starting to buy, because if they do, it's a good sign they're confident they’ve seen the bottom.

What this insider data shows is telling. Mag 7 Company insiders have been dumping stocks at concerning levels the last 12 months. Now for those of you brand new to trading, let me explain why that is a bad thing. First of all, we typically look at Net Options Sentiment here at Prospero. Net Options measures where financial institutions are betting in aggregate. Why do we place so much weight on what hedge funds are doing? Because they typically have unique access to data and often get ahead of what direction stocks will go. BUT, the reality is that hedge funds are not always right. There are MANY factors that influence the direction of the market that hedge funds have no control over. But, there is one piece of data that can be just as telling to stock market direction as hedge funds; and that is insider buying and selling. Insiders are Company Executives and Board Members. Like hedge funds, they don't have information FROM insiders, they ARE they insiders. They see their company data in real time. They know the forecast of their company's earnings before anyone in the world. So, when they start selling their company's stock, THAT is something we should pay attention to. It's important to keep in mind that insider selling is not always a bad thing. They're human beings with bills and kids in college just like the rest of us. But when there is an obvious trend like the one in the chart, it causes us to stop and take notice.

There's one final data point in the chart that is worth taking note of. The two companies with the largest amount of insider selling the last 3M were META, AMZN and TSLA. That's a bad sign and I'll tell you why. First of all, AMZN is actually a value play right now. Its P/E ratio is relatively cheap compared to other Mag 7 stocks. If we were in a sustained Bull Market, you'll likely see insiders BUYING Amazon stock hand over fist. They're not. They're selling. A lot. What about TSLA? You might say: "Well, maybe TLSA insiders are selling because of all the negative sentiment". That very well may be true. But there was some data released on Friday that showed retail traders bought TSLA stock on Friday at the highest rate in history. So, what is a more likely scenario, for the insider selling, is a data point that George showed me. Both TLSA and AMZN are consumer cyclical. We think this could be a huge factor for META too, ad bugets, their major revenue source also get hit in tough economic times. And if you are wondering why META might be selling while GOOG in a similar business is not. Well META has been on a 2+ year Bull run and GOOG has been going the other way. These consumer driven stocks do not do well when a potential economic downturn is on the horizon. Insiders are likely selling because they're concerned about the future of the economy. And by the way, you know what the one of the most accurate indicators of future economic activity is? Home Builder stocks. It's eerily accurate in predicting future stock market sentiment. How are they doing you ask? Home Builder Stocks are falling off a cliff. When you add all that data together with the reality that SPY Net Options is still at 0 and QQQ is still at a very bearish 11. It's not painting a rosy picture; so we are entering this coming week firmly in the bearish camp. Could we see a short term bounce? Of course, but the overall data is pretty clearly leaning toward more longer term pain. Now a word from our CEO.

A WORD FROM OUR CEO

We were happy with the performance of our more risk-off portfolio, we saw a slight gain on the week. Our paper trading portfolio is beating the S&P 500 by 68% annualized, with a win rate of 64% against SPY benchmarks.

Regular streams this week - Monday 3/24 at 11 AM ET and Wednesday 3/26 at 3 PM ET.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Insider Trading

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/ ANALYSIS

As bearish as everything feels, Small and Mid Cap Growth stocks had a pretty decent week. But on Friday, most sectors had turned to the downside. Zooming out, looking at the monthly numbers, Large Cap Growth has taken it on the chin with a decline of -8.57%. This aligns well with our argument in the intro that the Mag 7 insiders are net sellers of stocks. It's very difficult at this point to pick or give any insight into a bright spot. If there is going to be a mean reversion type bounce, it's likely to be in the growth sector, but so far, every time they make a move they get hammered. With Net Options Sentiment sitting firmly in the Bear Zone, we have no choice but to continue playing defense.

SECTOR ANALYSIS

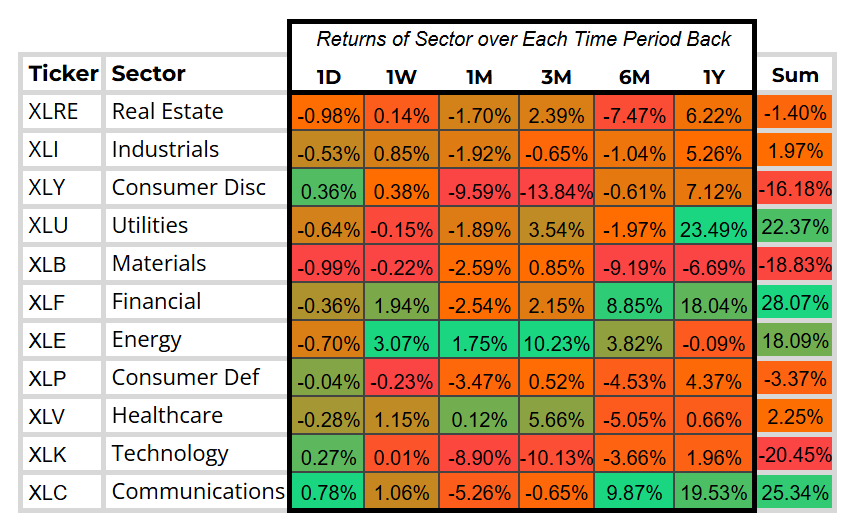

In the sector analysis chart below, take a look at the monthly numbers for Technology and Consumer Discretionary. Both of those sectors have gotten murdered. This kind of decline in those two sectors would typically give us two data points. One, in a correction, Technology is the one to get wholloped, especially if the overarching sentiment is that Tech Stocks are overvalued. Second, Consumer Discretionary being so red gives some insight into the investors view of the economy. Both are pretty bad. On the bright side, Energy and Financials had a solid week. Energy especially looked solid and was overdue for a bounce.

SPY/QQQ NET OPTIONS SENTIMENT

Check out the SPY Net Options Sentiment Chart below. AS you can see, SPY Net Options Sentiment is in the dog house. Until this number sees a significant jump, we are bearish. SPY NOS being at 0 demonstrates that hedge funds are still positioned very bearishly…or at least are strongly hedging against SPY. As we've shared many times, SPY Net Options going to zero has historically been indicative of a longer correction.

Now Check out the QQQ Net Options Sentiment Chart. As you can see, it's not at zero, but it's still in bearish territory. This is a VERY IMPORTANT piece of information to learn as an investor using Prospero. If we see a big market rebound this week, take a moment and check out QQQ and SPY Net Options. If the market rebounds AND we see a bullish increase in options sentiment, then we'll feel better about a reversal having some teeth. But if SPY stays at zero and QQQ is in the teens, you can determine that institutions and hedge funds are still overarchingly bearish and should proceed with caution when going long.

PORTFOLIO STRATEGY

We will be a little more risk on this week than last. We are balencing our long term Bearish outlook with some promising short term signals. 6 Longs and 6 shorts.

Long / Bull Moves

Long / Bull Moves - URI, BKNG, ULTA and ARGX adds / META and APP holds / BABA and SPOT drops

Adds

URI and BKNG were added because of excellent Screener performance. ULTA was added for diversification and good numbers for a close to Mid Cap stock. And ARGX was added due to its excellent Momentum Score.

Holds

META was held because it returned as the top pick in our Screener. APP was a tough call as it was higher risk because it was filtered out. But we kept it because of strong Upside, Technical Flow and Momentum Score.

Drops

BABA was dropped primarily due to its poor marks in 52 Week High and EPS / Sector. SPOT was dropped because it did not quite make the mark on our Screener and we did not want to overconcentrate on Communications.

Short / Bear Moves

Short / Bear Moves - SWKS, UAA, CPB, TECH, NWS and CTSH adds/ VC, CRESY, ANSS, PAYX, SYNA and ROST drops

Adds

SWKS and UAA were added because of their good marks in the Screener in attractive Sectors to short. CPB, TECH, and NWS were picked for a combination of Screener performance as well as pair trading in Consumer Defensive, Healthcare and Communications respectively. CTSH was kept as the largest Cap Tech play that looked good to balance out our overall Growth / Downside risk.

Drops

VC, CRESY, ANSS, PAYX, SYNA and ROST were all dropped due to poor Screener performance.

Portfolio Summary

Long / Bull Moves - URI, BKNG, ULTA and ARGX adds / META and APP holds / BABA and SPOT drops

Short / Bear Moves - SWKS, UAA, CPB, TECH, NWS and CTSH adds/ VC, CRESY, ANSS, PAYX, SYNA and ROST drops

6 Longs: URI, BKNG, ULTA, ARGX, META, APP

6 Shorts: SWKS, UAA, CPB, TECH, NWS, CTSH

Paid Investing Letter Bonus with Momentum Score

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.