Welcome to the 20th edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Don’t have the Prospero.Ai app yet?

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

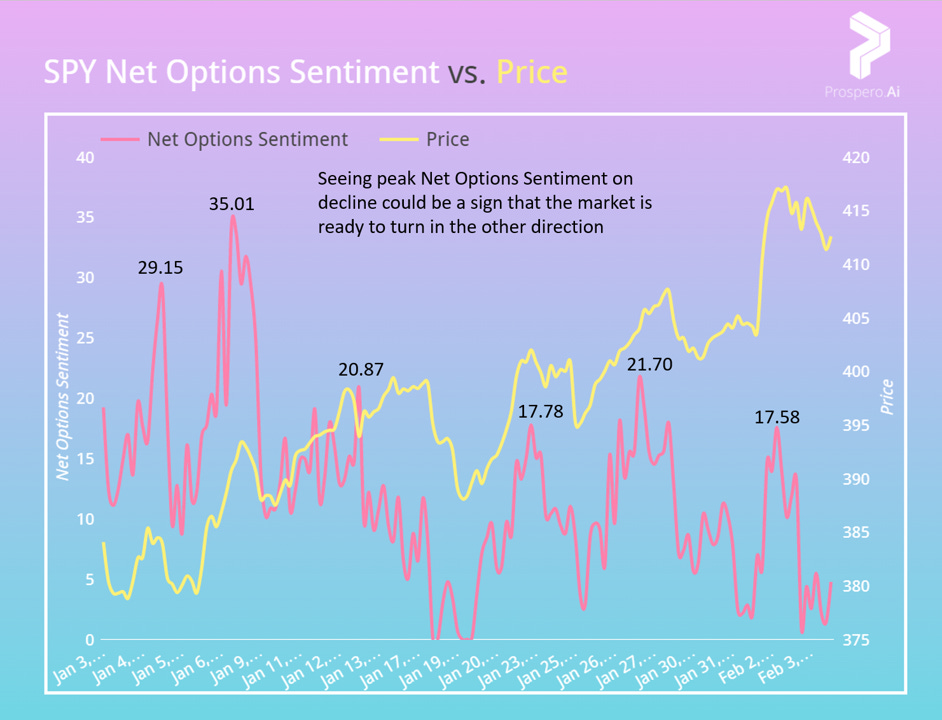

QQQ Net Options Sentiment is trending down and lower highs for SPY Net Options Sentiment could spell trouble

“For Tech: QQQ Net Options Sentiment > 45 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.”

QQQ returned +4.29% vs. 2.40% for the SPY, Pre-Market Open 01/30 to After-Market Close 02/03. While QQQ Net Options Sentiment spent time in Bull guidance, SPY did not, so the relative performance makes sense. Overall, both spent the majority of their time in neutral space. We are seeing signs that neutral will turn Bearish.

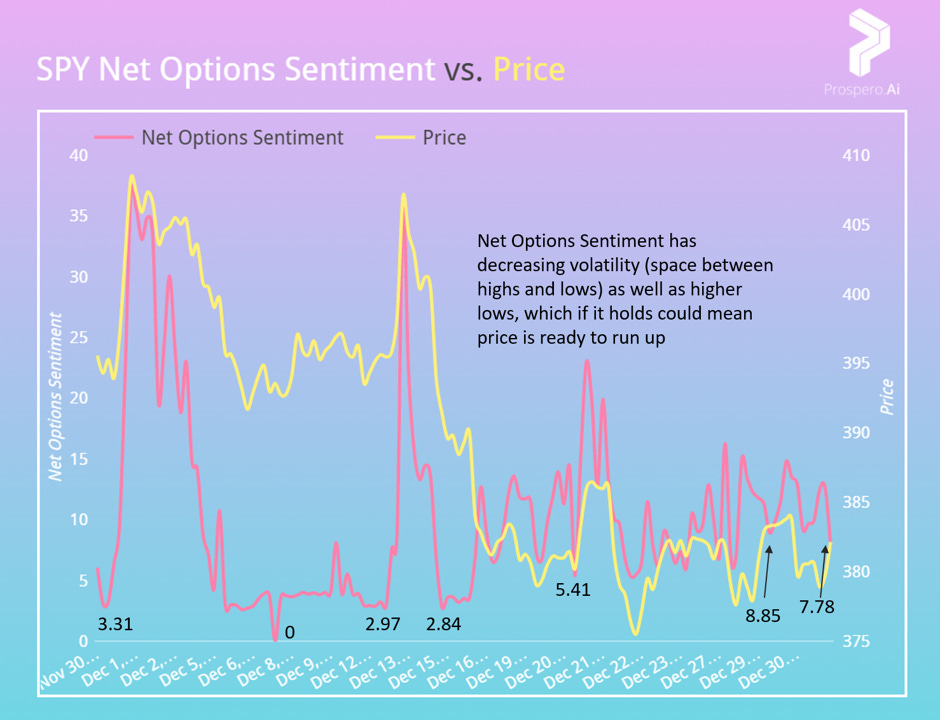

Other than one big run up for QQQ Net Options Sentiment this week is a down trend. Exhibited by the lower weekly average despite the 2nd highest peak value in the last month. SPY Net Options Sentiment could be the reverse of a pattern that we identified in our 01/02/23 letter:

We were able see signs of this Bull run by identifying higher lows in SPY Net Options Sentiment, as a result, lower highs makes sense as a Bear signal and if this trend continues we think we will move into a Bear run this week or next week.

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 20 = Bullish. < 10 = Bearish.

Following these levels mid-week could be of high value to any trader, which is why we added a bi-weekly newsletter:

Our signals predicted this breakout from TSLA (Tesla Inc)

From 01/29/23 letter: “Expect an up week if: TSLA Net Options Sentiment > 85 and QQQ Net Options Sentiment > 40. (Risk factor - Rising 1 Year Treasury Yields)”

TSLA had another strong week up 7.52% Pre-Market Open 01/30 to After-Market Close 02/03 vs. +2.40% for the SPY. As QQQ Net Options Sentiment spent time in Bullish and Bearish zones and most of the time in the middle it makes sense that maintaining a Net Options Sentiment close to 100 carried stock price up more.

Since we called out TSLA in our 01/02 letter for “close to max Upside Breakout (99) and Net Options Sentiment (99). As well as excellent Net Institutional Flow (92)” it has been up 78.44%.

Short Pressure Rating up to 70 vs. 65 would be more concerning in a down week and Downside Breakout is up to 18 from 15 but Upside Breakout is also up to 95 from 93. No material changes here, same guidance as last week. A caveat is if Net Options Sentiment on QQQ swings into Bear territory the downside could be massive on TSLA stock after this run up.

Expect an up week if: TSLA Net Options Sentiment > 85 and QQQ Net Options Sentiment > 40. (Risk factor - Rising 1 Year Treasury Yields)

Bear Potential - ONEM (1life Healthcare Inc)

Since we are leaning Bearish but do also think there could be some juice left in this Bull run we will also cover a few new Bears this week.

We have seen a downtrend in the price already, even without much Short Pressure (40) so if the following trend continues and/or the market flips, this could be a big Bear winner.

Beyond this bad trend, Net Social Sentiment (25) is low and very high (97) Downside Breakout mixed with low 19 Profitability is a great Bear combination.

Expect a down week if: Net Options Sentiment < 50 and Net Social Sentiment < 50. (Risk Factor - QQQ Net Options Sentiment > 45)

Bear Potential - GPS (Gap Inc)

Net Options Sentiment (36) and Net Social Sentiment (30) are low. Below average Profitability (44) and even worse Growth (36) projections are exponentially Bearish when both < 50.

Expect a down week if: Net Options Sentiment < 50 and Net Social Sentiment < 50. (Risk Factor - SPY Net Options Sentiment > 15)

In Review - Bull Pick - MDB (Mongodb Inc)

MDB, we are covering as a Bull and a Bear this week. As seen in the picture above, if Net Options Sentiment can stay largely above 50 the stock has huge upward potential. But if that number goes lower, combined with a Bear QQQ turn, could send price fast the other direction. So look for opportunities either way with this stock.

Expect an up week if: Net Options Sentiment > 50 and QQQ Net Options Sentiment > 40. (Risk Factor - Net Social Sentiment < 50)

Expect a down week if: Net Options Sentiment < 50 and QQQ Net Options Sentiment < 30. (Risk Factor - Net Social Sentiment > 50)

ENR did not make the letter this week because Net Options Sentiment > 50 ran it out of Bear guidance in a week where it performed at 3.19% vs. 2.4% for the SPY.