Welcome to the 29th edition of the Prospero weekly newsletter. You are receiving this if you downloaded our app or subscribed via Substack.

Offering a free week of our 2X weekly paid newsletter for filling out this ~1 minute survey

If you do not yet have the app:

Educational Videos: How to get the most out of our app and deep dive on the inner workings of institutions.

Newer to investing? Confused by any terms? Click our glossary help file. The first mention of a signal unique to our platform we will link to the help file IE Net Options Sentiment.

QQQ and SPY Net Options Sentiment showing potential for a larger reversal on the way

From 4/2 letter: For Tech: QQQ Net Options Sentiment > 30 = Bullish. < 20 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

QQQ returned -1.09% this week vs. -.24% for the SPY. Pre-Market 4/3 to After-Market 4/6. Reflecting an unsure market moving from a clear Bull pattern back to murkier waters without a major news event.

Two perspectives exemplify this lack of clarity: Axios: “Markets, on the other hand, think significant rate cuts are a near-certainty. Thursday morning, futures market prices calculated by the CME FedWatch tool implied only about a 2% chance the Fed's target rate will be the same or higher at the end of the year.”

On the other side BlackRock warns that investors are making a mistake by betting on the Fed to cut rates.

We generally agree with “the market” over any individual source, no matter how large. You never know why people on Wall St. are saying things. Trust the numbers.

Jobs came in weaker than expected, reducing the probability of inflation worries preventing rate cuts this year. BUT Powell is consistent about being “data driven” meaning models have to reflect some uncertainty. We expect choppy but overall Bullish direction. The flip side is strong evidence we are on top of inflation could cause a bigger rally and we will keep a close eye on that in this letter.

Before this data we were leaning Bearish but now slightly Bullish. As a reminder, if you fill out this 1-minute survey you get a free week of our paid letter where we will update the averages from the above graphs.

For Tech: QQQ Net Options Sentiment > 35 = Bullish. < 25 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 15 = Bullish. < 10 = Bearish.

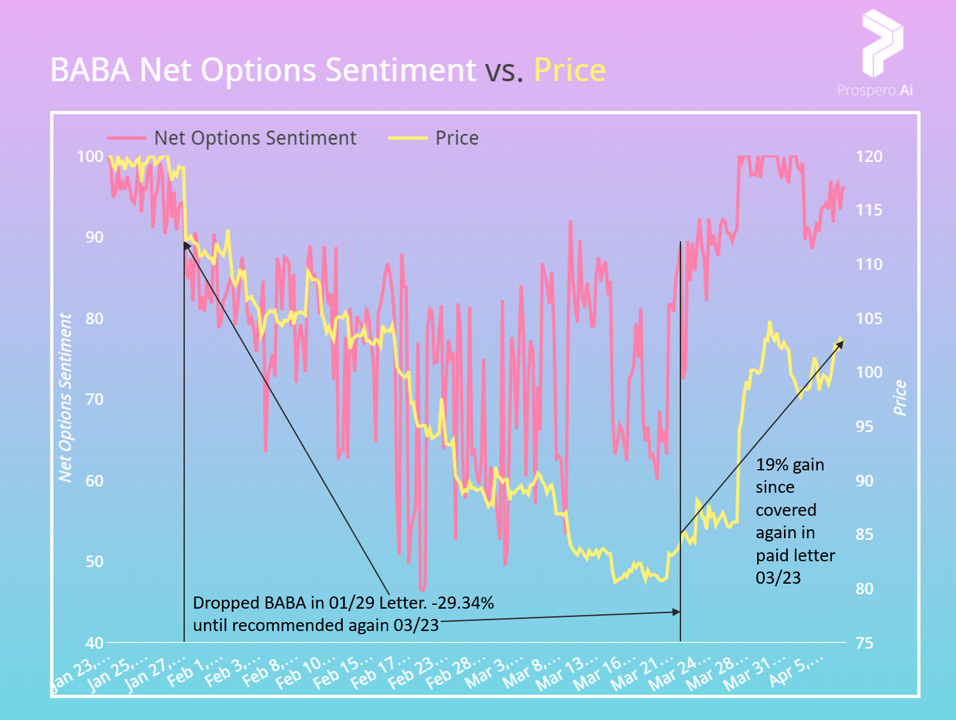

BABA (Alibaba Group Holding Ltd) holding BABA from our 1st mention 12/18 to now: $1,000 —> $1,187 but if you sold after it dropped from our letter 01/27 and re-bought 03/23 on our 2nd recommendation: $1,000 —> $1,624! Full Case Study

From 4/2 letter: We remain Bullish if: BABA Net Options Sentiment > 70, BABA Net Social Sentiment > 50 and QQQ Net Options Sentiment > 30

BABA returned .79% this week vs. -.24% for the SPY. Pre-Market 4/3 to After-Market 4/6. In a tough market to predict BABA continues to show strength.

Daily averages illustrate a different perspective on timing. Not only did we drop it descending vs. add ascending it was at similar averages. Not something we looked at before but it does reflect a concept we emphasize: the importance of volatility reduction in Net Options Sentiment. A reading above 80 is nice but you see it bouncing back below 50 soon after, that is a reflection of risk.

We used Net Options Sentiment to clip a quick 87% gain as well:

Still own 05/19 $125 Calls but we added long when we saw Net Options Sentiment remain strong (99 average) on 04/03 in a slightly down market. The intention was to hold these until the end of the week at most to avoid Theta decay. Selling the above does not mean we turned Bearish.

From last week Growth +2 (59 from 57) and Net Social Sentiment jumps to 89 from 62. Makes up for the small decline in Net Options Sentiment. Any time Net Options Sentiment AVG is above 90 is Bullish, even if declining. Setting different guidance to reflect a watchful eye on this:

Bullish if: BABA Net Options Sentiment > 80, BABA Net Social Sentiment > 50 and QQQ Net Options Sentiment > 35

Bear Review - PRK (Park National Corporation)

From 4/2 letter: Bearish if: PRK Net Options Sentiment < 50, PRK Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

PRK returned -3.55% this week vs. -.24% for the SPY. Pre-Market 4/3 to After-Market 4/6. We were right on the money here.

Still Bearish if: PRK Net Options Sentiment < 50, PRK Net Social Sentiment < 50 and SPY Net Options Sentiment < 10

A filter for a potential bottom / the market’s pricing of rate cuts

Market is betting ~50% on one more .25% raise. Our take is the market bottom will be before the first rate cut. So depending on your view, it may be a great time for growth stocks again. Net Options Sentiment is in as a short term signal because that helps insulate against short term losses.

While these are long term holds we would say it is worth re-evaluating if you see the total drop below 175. We are writing about this based on a question about Gold which looks riskier than other commodities as it approaches all-time high:

In Ray Dalio’s book: Principles there is a concept that boils down to “if everyone else looks to have the same idea, your upside is limited compared to your downside”

In thinking more broadly about commodities, we would rather focus on the potentially undervalued or due for growth:

Long Term Bull - GEVO (Gevo Inc.)

From WikiPedia: “Gevo operates in the sustainability sector, pursuing a business model based on the concept of the "circular economy". The company develops bio-based alternatives to petroleum-based products using a combination of biotechnology and classical chemistry.”

A 90 in Growth reflects what you’d think about this business, a bright future. Despite lower Profitability forecasts, long term options bets are weighted much more for than against. Plus short term signals like Net Options and Social Sentiment are healthy. If you are debating entry watch out for Net Options Sentiment < 50 but we think if you buy and hold for a few years you will be happy.

Glad about the BABA tips

Ok, I completed the survey for the free access, how do I activate the free access?