This is one of the hardest letters we’ve had to write. We are concerned for the world and hope tensions do not escalate. Originally, we were going to hold our positions because if the market was crashing it would not be right to exit at Friday close prices, but with pre-market up we feel comfortable writing the letter as we normally would. (For the record the only time we ever deviated from Friday close positions we actually took a larger loss on an ABNB short)

Prospero had a hell of a week last week. After a tough start we positioned ourselves well for the CPI reading (net Short) and went from 119% up on the S&P to 160% that day. One of our best days ever. And that is about where we sit now, beating the S&P 500 by 153% with a win rate of 65% against that benchmark.

Every Friday (or Saturday) after the market closes for the week, I (Matt) have a conversation with our CEO George Kailas. He’s one of the primary architect’s behind Prospero’s system, and on top of that, he’s been a professional investor since he was 17 years old. He’s a wealth of knowledge and I call him to get his take on 3 things:

What are his thoughts on the previous week?

What are his thoughts on the week to come?

What are the factors driving market sentiment?

The last two weeks (especially) I have been paying careful attention to what he has to say. Why? The last couple of weeks have been some of the weirdest weeks in the market I’ve ever experienced. As we shared in last week’s letter, many of the social media traders bragging about their wins over the last year, have grown spuriously silent. The market is all over the place…but especially it’s been on a downward trajectory. Are we in a bull market or not??

(Side Note: After the initial writing of this letter, we learned of Iran’s attack on Israel. This MIGHT be the reason that QQQ Net Options sentiment dropped into the 20’s on Friday. It will be worth watching as next week progresses.)

As George and I talked, here’s the question I asked him: “George, help me out here. During the bull market of 2021, everyone was euphoric and in complete agreement the market was going to go up. In 2022, everyone was dejected and in complete agreement the market was going to go down. But from 2023 through April of 2024, we’re clearly in a bull market, but NOBODY agrees which direction we’re ultimately headed. You have some of the most brilliant financial minds in the world screaming from the rooftops that we’re at the beginning of a historic melt-up, while similarly brilliant people are screaming from the rooftops that the market is about to fall off a cliff. George, why in the world can nobody agree on the market direction, and why is the market up one day and down the other?”

What he said was interesting…

He said: “It’s all about A.I. The reality is that NOBODY knows what the proper value of A.I. is. We all see the paradigm shift that is changing the landscape of the world as we know it. But it is hard to know how much hype is baked into the prices or how to properly forecast what is to come. Case and point this wild weekend. Can’t even count on conflict to ruin pre-market these days!

But even if you were best friends with Fed Chairman Jerome Powell, and asked him: ‘Jerome, are you going to cut rates in the days to come?’ He’d pause and say: ‘I don’t know man, just watch the tape.”

To “Just watch the tape” means that the market is unsure of the future, so we’re in a “wait and see mode”. THAT is the reason the market is making radically volatile movements in both directions. Everyone is unsure of the future. Is that difficult to trade? You better believe it. But that is the beauty of Prospero. Is it a crystal ball that will tell us the future? Not yet. But it gives us echoes and whispers of the direction the market is heading. If we’re careful and wise during this season, we’ll continue to come out on top!

For newer readers linking our short intro + learning videos.

Regular livestream times this week! Tomorrow 4/15 at 11 AM EST and Wednesday 4/17 at 3 PM EST.

FYI we had a Bull Screener in our app since 12/15 since we were so confident in the market but we updated it today to a different Bull Screener that controls for risk better. Check it out in the app!

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Just watch the tape. Outline:

Market/Macro Update with Special Cap / Value Analysis

QQQ Net Options Sentiment and Value and Growth returns by Market Cap

Sector Analysis

How we will form our Portfolio Management strategy from Sector movements

Portfolio Strategy

Using the above data to decide on the extent we want to be long and short and what the best ways to manage risk around Sector performance

Longs

Adds, Holds and Drops

Shorts

Adds, Holds and Drops

Portfolio Summary

Last week’s Net Options Sentiment levels from the 3/31 letter:

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

QQQ returned -.50% this week vs -1.46% for SPY.

MARKET/MACRO UPDATE

This last week was a testament to how as a trader, you have to manage risk and stick to your convictions. What do I mean? Well, the market was ALL OVER THE PLACE. Why? CPI report, tax day, and global-political unrest in the Middle East, all led to the market’s volatility. But here is what we knew for sure. Prospero’s QQQ Net Options Sentiment has been on a slow and steady decline for a few weeks now. In the past, every time that’s happened, tech and communications didn’t perform as well. So we stuck to our guns and trimmed down our portfolio, diversified, hedged and went net-short. At the beginning of the week, we were bleeding on our shorts but we stayed with our conviction. And the CPI report came out and the market tanked. In uncertain times like these, it’s vitally important to look at the data Prospero gives us. Linking our trading letter which sends out daily updates.

As far as the future of the market, there’s one interesting piece of data I came across (via X @banana3stocks) that points to a possible bullish divergence in the near future. See the chart below. It’s a graph of the Nasdaq McClellan Oscillator Index. Every single time in the last two years that the Index hit -40 or below, it has led to a big bounce, and an initiation of an uptrend. In light of the fact that we’ve seen so much negative sentiment over the last 3 weeks, it wouldn’t surprise any of us to see this play out.

Cap/Value Analysis

See the chart below. Couple of things to note. Small Cap Growth continues to underperform. As a matter of fact, we are in a historic period of small cap underperformance. This very well could be what gives any future bull run its legs. When (and if) small caps break out, they could potentially break out in a very big way! The bottom line is that none of the Caps are standing out and performing at the levels we’ve been accustomed to. They were all negative for the month. Friday got worse, not better. In light of the conflict in the Middle East and the declining QQQ and SPY Net Option numbers, our current portfolio allocation (short heavy) seems wise. But if Geopolitical turmoil eases, it wouldn’t surprise us to see things turn around.

NET OPTIONS SENTIMENT

We aren’t even going to show you the trailing QQQ and SPY graphs this week because whatever market we were trading in Friday, tomorrow is a new one. And we will need to see how large models beyond our comprehension bake in this added world destabilization risk. We have been discussing the increasing trepidation we saw. It is even possible the “powers that be” were expecting tensions to increase. On Friday we saw SPY dip to the low 40’s which is the lowest we’ve seen in awhile.

QQQ has been in an extended downward trend and finished the week in the high 20’s, that’s pretty low historically. We’ll be watching the numbers closely into the opening bell and you should too. If you’re an active trader, Monday would be a great day to pay attention to George’s activity on Discord. We are making some big changes to our levels to account for this risk and volatility:

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 20= Bearish.

For Non-Tech: SPY Net Options Sentiment > 50 = Bullish < 35 = Bearish.

Sector Analysis

Take a look at our Sector analysis chart. One thing that stands out to me is the 1 Day and 1 Week numbers. They were all down. Even Energy that's been on a tear, is showing signs of softening. One thing that’s interesting to note is that on the S&P Seasonality Charts, this coming week in April is one of the better performing weeks of the year. Hopefully we’ll see a turnaround in the market. If we do see a bullish divergence, what we’ll be looking for is whether or not the market expands its breath into other sectors. If that happens, we might be in for a wild ride upward.

Portfolio Strategy

We care about two things this week and it is pretty simple, protecting our downside against a bad open due to war concerns while ensuring if AI / tech / large cap growth continue their rampage up despite this it won’t hurt us too much.

That is why we are going 3 longs and 5 shorts. And one of them, SMCI, is one of our riskiest long choices going into tomorrow. We constructed our portfolio this way because if it is a bad day we think being overweight shorts will overcome SMCI losses. But if it is a good day SMCI should be one of the biggest beneficiaries and that will balance out our higher short construction.

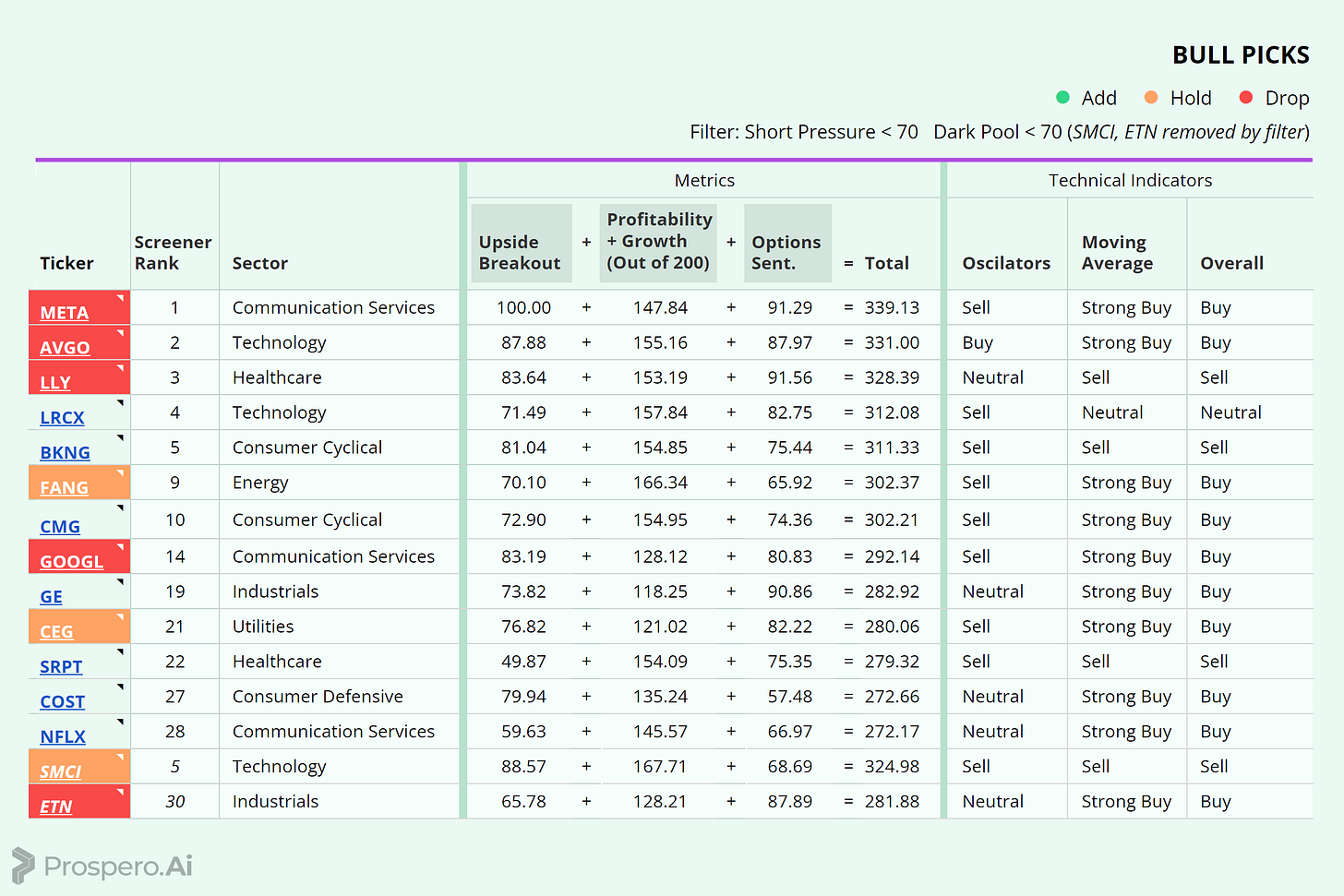

Long / Bull Adds - Link to Below Picture

Long / Bull Moves - None added / CEG, FANG, SMCI hold / META, AVGO, LLY, GOOGL, ETN dropped

Adds

No stocks were added but we will look at the market at open and see if we are feeling reassured enough to get back into our favorites LLY, META and/or GOOGL

Holds

If there are any Sectors we feel good about heading into tomorrow it would be Energy and Utilities. But Energy is showing some signs of softening so we will keep a close eye on that. CEG and FANG are our favorite longs to balance risk and return and SMCI was kept primarily as a hedge in case the AI market stays hot. We think SMCI will be one of the biggest winners if that happens.

Drops

META, AVGO and LLY were our top 3 stocks but the technicals had gone sour on META and LLY and we dropped AVGO because we didn’t want to hold two tech stocks and we think SMCI has more upside if there is a Bull move. It was a tough call and we are going against both technicals and the Screener rank but we are only doing so as part of a the larger strategy described above. GOOGL would have been dropped on a normal week due to the Sell Oscilator and we could not get comfortable with ETN at such high Short Pressure for an Industrials stock. (73)

Short / Bear Moves - Link to Below Picture

Short / Bear Moves - PTCT added / JBGS, LEG, LPL, XRX hold / PGRS, RCM, SGBI, SLVM, CBRL dropped.

Adds

PTCT made a little Price run last up last week and we dropped it but it is again looking like it is in good position to short. You’ll notice CYCC at the top but it is a very small cap stock and not worth the risk in this market.

Holds

JBGS, LEG, LPL look to be the best stock in the Screener and technicals. MAXN we considered but did not want to add because it has been trading at such high volatility since we’ve been watching it the last few months. XRX we like as a larger cap Bear to hedge the downside on SMCI.

Drops

PRGS, RCM, CBRL, SLVM, SGBI (to a lesser extent) were all dropped due to poor screener performance.

Portfolio Allocation

3 Longs: CEG, FANG, SMCI

5 Shorts: PTCT, XRX, JBGS, LEG, LPL

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.