Happy Sunday! You are receiving this if you’ve downloaded our app or subscribed via Substack.

We are currently beating the S&P 500 by 93% on our 2023 picks, with a 71% win- rate per pick against their S&P 500 benchmarks.

YouTube livestream tomorrow 9/11 at a special time of 11 AM EST

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

Newer to investing? Looking for educational videos? Confused by any terms?

Click our glossary help file.

Larger Bear Turn Coming? Outline:

Market Update

QQQ and SPY Net Options Sentiment and Portfolio Allocation

Portfolio Macro Strategy

How we are approaching the number of longs/shorts and sectors

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Allocation Notes

The market was extremely volatile this week. How we added upside, while limiting our risk.

Market Update

For Tech: QQQ Net Options Sentiment > 40 = Bullish. < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish. < 15 = Bearish.

QQQ returned -1.33% this week vs -1.26% for SPY. The down week is not surprising, as we saw both QQQ and SPY Net Options Sentiment slip out of the Bull zones.

Nothing too complicated this week, but we basically saw all hope of rate cuts this year die. Bets on a cut for the December meeting, dropped from over a 5% chance last week, to a .76% chance this week.

We’ve seen SPY Net Options Sentiment leading price well over the last few weeks, and we will continue to keep a close eye on it in our trading letter. We are more Bearish this week than last week, so we are leaving guidance levels the same as last week, to reflect this Bearish sensitivity.

For Tech: QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

For Non-Tech: SPY Net Options Sentiment > 25 = Bullish < 15 = Bearish.

Portfolio Macro Strategy

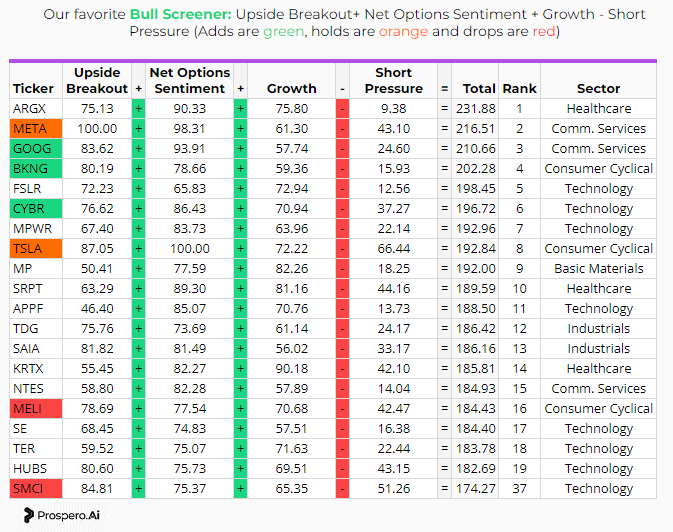

We continue to see a much better Bull case for Growth stocks, especially ones touching AI, than other factors. We are adding Short Pressure to the screen this week, because we would like lower Short Pressure stocks for Bulls, for the following 2 reasons:

In the last month, AMC is down 80% and GME12%. Especially for AMC, retail investors looking for squeeze plays, are less likely to put their money in those, and more likely to be looking for new opportunities with high Short Pressure.

Other “memestocks” (broad strokes term for stocks that move largely outside of the value of their business) have performed well lately. So we are avoiding high Short Pressure for Bulls and Bears.

This is why, on the Bear side, we are using a window of Short Pressure between 50-70, because we want it to be above average, but not too high.

Due to our more Bearish stance this week, we are moving to 5 Bull picks and 6 Bear picks.

Long / Bull Adds

We are stepping up our game and getting even more organized in both how we make our decisions and how we present them. See our newest addition the “decision chart”

Link to the below Bull decision chart picture

A big reason we built the Prospero signals was that we found analyst recommendations and price targets to not be very helpful and technical analysis to offer limited help. The issue with technical analysis is it is essentially drawing the data into a line of “normal” behavior for the market, but fortunes are made and lost outside of the normal behavior of the market. Which is why we don’t like to build our investment thesis with technical analysis, but we love it as an added check to help de-risk our decisions.

MELI and SMCI look solid, but we did not want 3 stocks in Consumer Cyclical or multiple in Tech, going into the week after the index Net Options Sentiment values started heading south. They simply lost out to better rated stocks in their sectors by the Prospero signals (which as we stated we lean on to make our thesis then support with technicals).

Bullish this week if:

GOOG/BKNG/CYBR Net Options Sentiment > 65

GOOG/BKNG/CYBR Net Social Sentiment > 40

QQQ Net Options Sentiment > 35

SPY Net Options Sentiment > 15

Long / Bull Keeps

Bull review - META (Meta Platforms Inc) Bullish this week if:

META Net Options Sentiment > 80

META Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

META returned .51% vs -1.26% for SPY and is kept as a Bull because it is ranked 2 on the screener above.

Bull review - TSLA (Tesla Inc) Bullish this week if:

TSLA Net Options Sentiment > 85

TSLA Net Social Sentiment > 50

QQQ Net Options Sentiment > 35

TSLA returned 1.42% vs -1.26% for SPY and is kept as a Bull because it is ranked 8 on the screener above.

Long / Bull Drops

We are dropping MELI as a Bull, primarily because it was 16 on the screener and we did not want to over-allocate to Consumer Cyclical. (Despite the differentiators of international businesses it still moves with sector ETFs, meaning there is some overconcentration risk) Covered on 9/4-9/10 and finished +.46% and a Win, Beating the SPY benchmark by 1.72%.

We are dropping SMCI as a Bull, because it was 37 on the screener. Covered on 9/4-9/10 and finished +.14% and a Win, Beating the SPY benchmark by 1.39%.

Short / Bear Adds

Link to the below Bear decision chart picture

Adding OTTR, FULT, BGXX and NAVI. Taking some risks this week. We generally do not like Net Options Sentiment over 50 and BGXX 58 but the downward trend in Upside Breakout and upward trend in Downside Breakout gets us comfortable enough to add it.

Taking on some risk with Financial Services exposure as well and we’ve been burned on these stocks in the past but we thought FULT a more traditional consumer bank and NAVI which specializes in especially education loans had sufficiently different businesses to mitigate the concentration risk. LKFN was not selected because the business was too similar to FULT.

SWX was not selected because OTTR above it in the screener and OTTR is in a downward trend in Net Options Sentiment.

Bearish this week if:

Above Stocks Net Options Sentiment < 50

Above Stocks Net Social Sentiment < 60

QQQ Net Options Sentiment < 30

SPY Net Options Sentiment < 15

Short / Bear Keeps

EXPD returned -.72% vs -1.26% for SPY and is kept as a Bear because it is ranked 16 on the screener above and we are willing to overlook the low Short Pressure because of the downward trend in Net Options Sentiment.

Short / Bear Drops

Dropping ESCA as a Bear purely because it was lower in the screener. Covered 9/4-9/10, it finished -8.23% and a Win, Beating the SPY benchmark by 6.97%.

Dropping XRX as a Bear because technicals look bad for a short and it was both filtered out of the screener for low Short Pressure and would have finished 37 if it was included. It ended the week at 46 Net Options Sentiment, a little too high (note the filter above cuts off at 40). Covered 8/6-9/10, it finished +7.38% and a Loss, Losing to the SPY benchmark by 7.67%.

Portfolio Allocation Notes

5 Longs: TSLA, META, GOOG, CYBR, BKNG,

6 Shorts: MED, EXPD, OTTR, FULT, BGXX and NAVI

Explained a lot already but despite being the Communications sector META and GOOG are AI plays. So we are managing our risk this way: If the market swings Bullish we think it will reward AI plays the most and if it is Bearish they we think they will get more support (although we are more sure of the former statement than the latter)

Paid Investing Letter Bonus

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.