Ever heard the old adage: "You can take a man fishing and feed him for a day. Or you can teach that man to fish and feed him for a lifetime”. Turns out that statement is just as true for trading and investing as it is for fishing; and that sentiment at the white hot center of WHY we do what we do here at Prospero. Allow me to tell you a quick (and somewhat humorous) story to explain what I mean.

My name is Matt and I'm a 4th generation Texan. That matters because I help write Prospero's newsletters every week with our CEO George Kailas, who was born and raised in New York. In other words, there’s a fairly significant cultural difference in our two upbringings! Honestly, we couldn't be more different, and that's what makes working for him so much fun! He asked me to write today about the "teach a man to fish" analogy and I asked him if I could tell a Texas deer hunting story to illustrate it. His response via text was: “LOL, sure….". Translation: "You Texans are crazy but go for it". So here goes….

In Texas, most boys grow up learning how to hunt. For example, my son (who's now a 2nd year Medical School Student) harvested his first deer at 9 years old. An important part of any young hunter’s training is to teach them how to “field dress” a deer. That's a nice way of saying that you cut the deer open, get out all its organs, skin it, then cut the meat out and put it in the freezer. For those of you cringing in horror right now, it's important to remember that men have been learning that process for several thousand years. It’s only been in the last four or five generations that men haven’t learned how to field dress an animal. Why? Because for about a century now, meat just magically appears on the shelves of everyone’s local grocery store.

So, when my son got his first deer, we celebrated, then I handed him a knife and attempted to show him how to field dress it. Because he was 9 years old, he was going really slow, kept making mistakes and even gagged a few times in disgust. I got impatient and ended up grabbing the knife and doing it myself. Turns out that over the course of his childhood and our many years of hunting together, I never took the time to make him learn the skill for himself! Every deer he harvested after that, I’d either jump in and do it for him, or we’d pay a fee at the place we were hunting and a ranch hand would do it.

That wasn’t a big deal UNTIL the first time he hunted alone, with his future father in law, who happened to be the owner of a large ranch in Texas; and who was planning to test his future son in law’s worthiness to marry his daughter by taking him hunting and see how the young man handled himself.

You see where this is heading yet?

Sure enough, after the first morning of them hunting together, my son bagged a great Buck. He breathed a sigh of relief because he made a clean, accurate shot. So far so good! But then, Roger (the future father in law) looked at my son and said: “Great shot, I’m impressed. Now let’s watch you field dress it”. Uh oh. 😬

My son broke out in a cold sweat, wracking his brain trying to figure out how to avoid looking like some city-boy that grew up in Manhattan. So, in that moment of desperation, my brilliant medical-school student son formulated a plan! He looked at his father in law and said: “Roger, I’m so sorry, I’ll field dress the deer in a minute, but I just remembered I have an important phone call”.

I was sitting at my desk in Houston when the phone rang….

I answered and my son said in a tone of desperation: “Dad! I just killed a deer at my future father in law’s ranch and he just told me to field dress it! I need you to teach me how to do it! If I mess this up he’s gonna think I’m a city-slicker and he’s never going to let me marry his daughter!”

At first, I laughed out loud. But then my heart sank because I realized that I had failed him as a father. I never forced him to learn that vital skill for himself. I took him hunting, but I never taught him how to be a hunter. There’s a big difference.

The story actually ended well. I walked him through the process as best as I could over the phone. Then in front of his watching, future father in law, he did it. Not very well, but he did it.

Two things came out of that hunting trip. First, my son is now married to Roger’s daughter. Second, my son now knows how to field dress a deer.

What’s the moral of this redneck-themed story and what does it have to do with trading and investing? At Prospero, our goal is not to pick stocks for you and help you make money for the day. Our goal is to teach you how to be a good investor, so you can make money for a lifetime.

Prospero's app offers you, for free, some of the most cutting edge stock market technology known to man. We're finding out that analysts from huge institutional investors are using our product at a rapidly growing pace. But we choose to give them to you for free, so that you can personally learn the process and over time, become a great investor for yourself! And the good news is that at Thanksgiving this year, if your father in law asks you if TESLA is a good move for his retirement portfolio. You’ll be ready! 😉Now a word from our CEO, George Kailas.

A WORD FROM OUR CEO

We continue to pursue a defensive, well hedged strategy and are sitting in pretty much the exact same spot. We willdo this until we see volatility stabalize more. No better reason to do this than seeing SPY Net Options in the 20’s and QQQ in the 50’s. We are currently beating the S&P 500 by 75% annualized, with a win rate of 60% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Normal streams this week! Monday 10/21 at 11 AM EST and Wednesday 10/23 at 3PM EST.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

LEARNING TO FISH

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

Portfolio Strategy

For the Macro Update today we want to talk about two interesting events that happened on Thursday in the Chip Sector (A.I.). Both of them have given us a bearish pause. The first was the earnings of ASML. ASML is a major player in the chip sector and has had a strong run up over the last year and half. When they reported their earnings last week they gave a mixed report, with slowing revenue and mixed guidance for 2025. The primary reason for this slowing revenue was the U.S.'s tightening export controls and lowering EV demand. But at the same time, management pointed to the reality of their A.I. segment performing well with a robust future. Their stock tanked. Over the course of the next day, ASML lost a quarter of its value. The market got very concerned with this as well as more comments from Trump RE: tariffs but the day this happened it turns out we were right to point to a strong AI market still.

The second event that concerned us was Taiwan Semiconductors earnings and the subsequent response of their price action. TSM gave their quarterly earnings last week and essentially blew them out of the water. They showed robust growth on their top and bottom line, as well as strong demand for their A.I. product line. The next morning, the stock rallied, but by the afternoon, TSM began to lose a good portion of their gains. This also concerns us. Continued strong AI results do not seem to be carrying the market up the way it has all year. It's also possible that the market “knew” some things early in regards to a report that came out Saturday morning about TSM coming under investigation by the U.S. Commerce Department. The outcome of that remains to be seen, but despite the strong QQQ Net Options Sentiment, with those two chip company earning's reactions and SPY Net Options showing a strong downward divergence; we're going to enter this week with our guard up.

CAP/VALUE ANALYSIS

Check out the Cap Value Analysis Table above. Once again, this market is all over the map. To get your mind around this, look at the 3 month numbers. The two biggest gainers were Mid Cap Growth and Mid Cap Value. Those two Caps typically don't lead simultaneously. Those two Caps, more often than not, rotate in and out of relevance. If one is up, the other is down. Mid Cap Growth gained the most for the month, but had a rough last week. Mid Cap Value (as well as Small Cap Value) had a strong week, but a rough month. This market has Schizophrenia, but that's ok. The brilliance of Prospero is that we can watch the numbers on a daily basis, see what the Market is doing in real time and adapt as we go.

NET OPTIONS SENTIMENT

SPY and QQQ Net Options Sentiment > 40 = Bullish < 30 = Bearish.

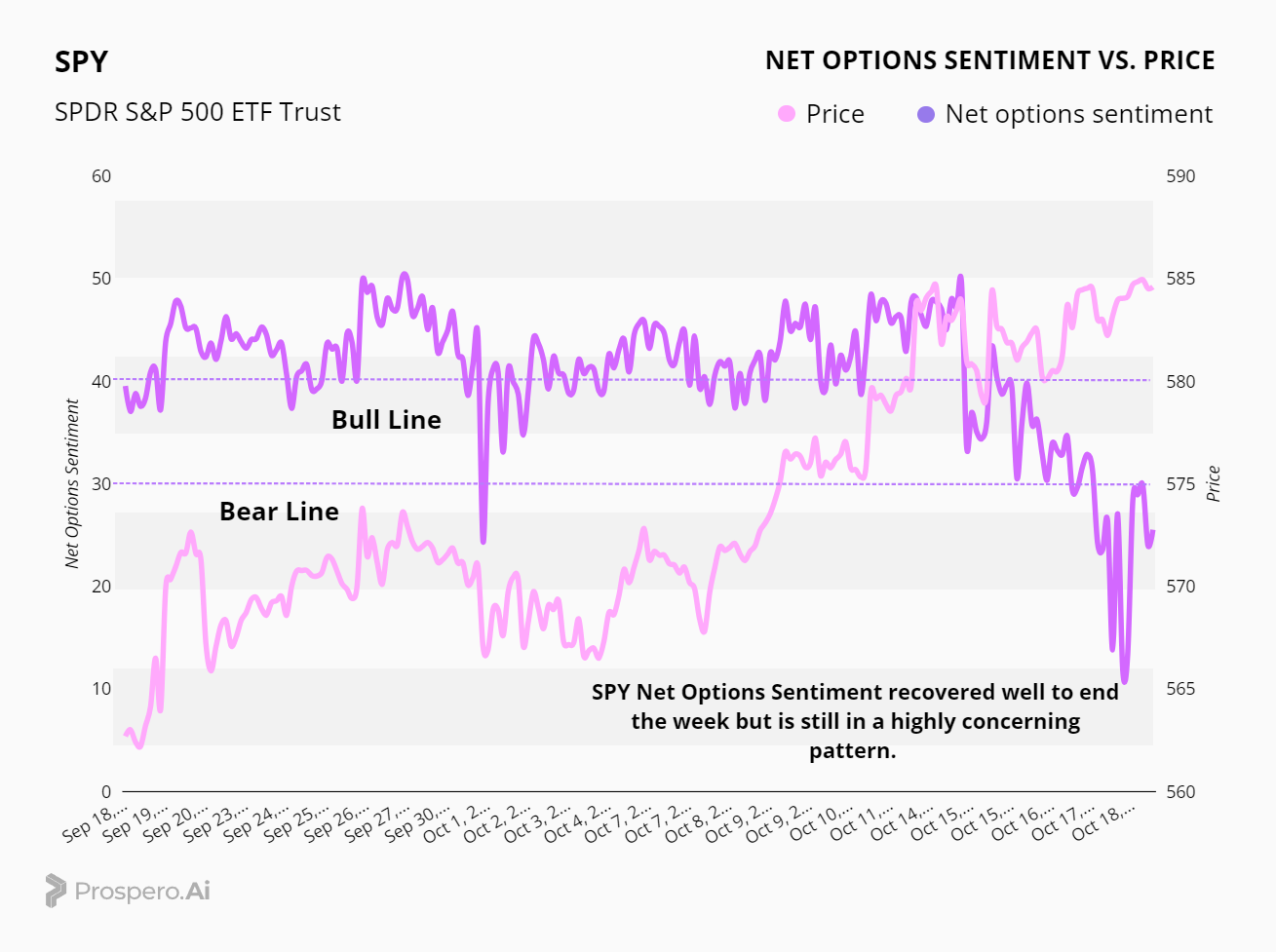

It was an interesting week with our QQQ & SPY Net Options Sentiment numbers. I (Matt) learned an important lesson from George this week that I want to teach you. Here's the situation. We saw QQQ numbers begin to decline last week, but then they stabilized and entered an uptrend, and finished the week strong. All good, right? Not so fast. As you're going to see below on the SPY Net Options Sentiment Chart, SPY numbers are on A SHARP downtrend. Whenever you see QQQ and SPY Net Option Sentiment Numbers diverge like that, one of the two, will move toward the other. In other words, QQQ will either drop toward SPY, or SPY will go upward toward QQQ. As of the writing of this letter, this downward divergence in SPY deeply concerns us. We are being defensive around the possibility that QQQ might move toward SPY in the coming week. If you're not hedging, now would be a good time to do that. (See George's notes below)

Check out the SPY Net Options Chart above. As you can see, the SPY numbers have fallen off a cliff. This is deeply concerning to us. This represents institutions being bearish on the S&P 500. The good news is that it recovered a bit at the end of the week, but we need to remain extremely cautious this week, for this could be a sign of a downturn.

SECTOR ANALYSIS

Check out the Sector Analysis Table above. Take a second and look at the weekly numbers. Financials had a strong week on the back of solid earnings from the banks. Be careful of chasing those financials though, Warren Buffett has sold essentially ALL of his U.S. banking stocks. The reason behind the sale is that U.S. banks are sitting on a mountain of unrealized losses from poor investments in US treasuries bought before Covid. At some point, those chickens will likely come home to roost. Utilities had a strong week again. Utilities are quietly having a stellar year. Look at the Sum Totals on the far right? See what I'm seeing? And once again, Energy is down. At some point there is likely to be a strong rebound, especially if Trump takes the White House.

PORTFOLIO STRATEGY

We have switched our stance from the last weeks, cognisant of low SPY Net Options Sentiment in the market. More focused on Market Cap diversity and downside protection, we will increase the number of short positions. 6 Longs and 6 Shorts.

Long / Bull Moves

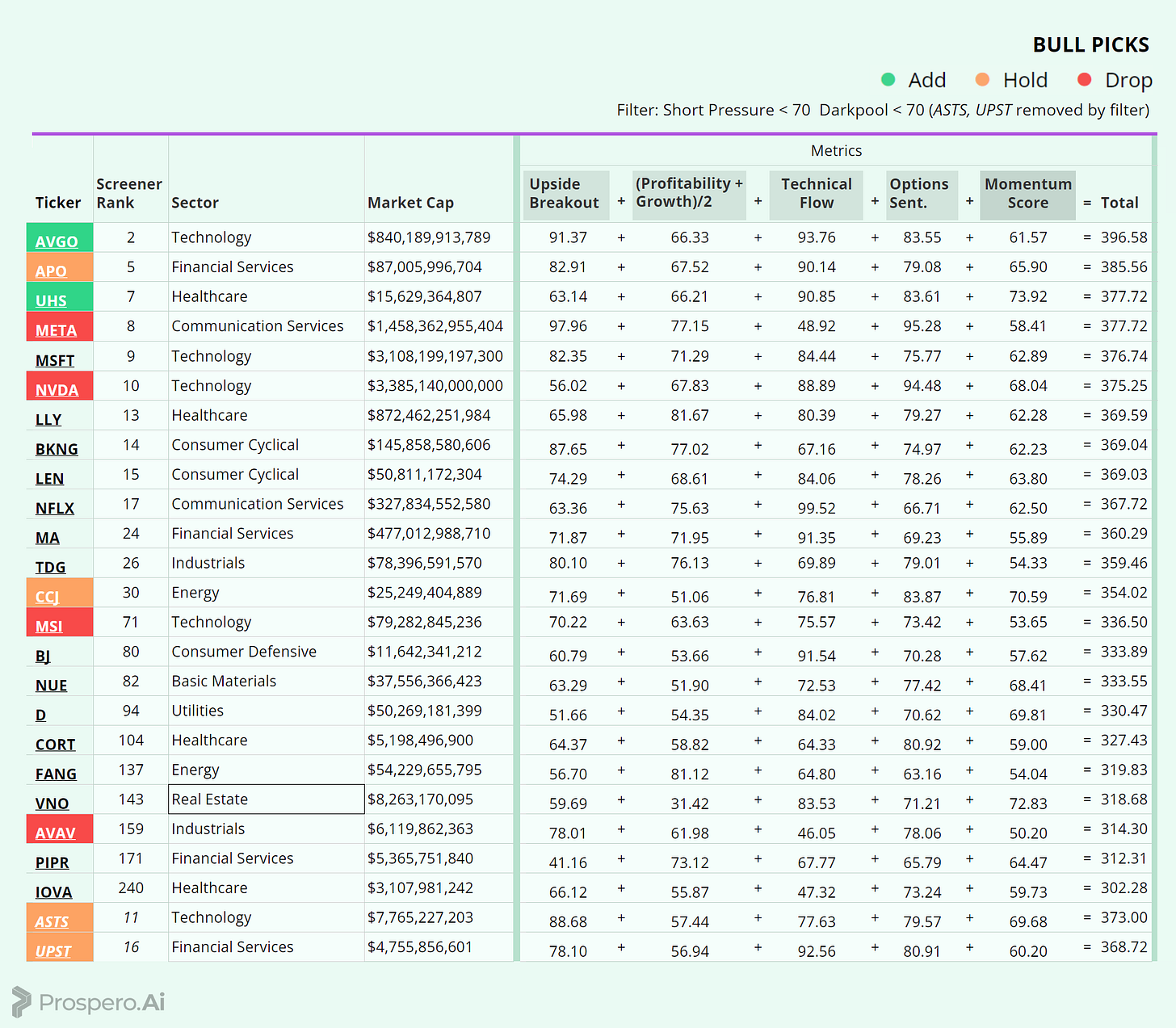

Long / Bull Moves - AVGO and UHS adds / APO, CCJ, ASTS, UPST holds / META, MSI, NVDA, AVAV drops

Adds

AVGO was an obvious choice, clinching the second spot in our screener due to its impressive tech flow and momentum. We added UHS to our list as well, thanks to its high ranking, particularly notable for a smaller-cap Healthcare company.

Holds

APO maintained its position in our portfolio due to its solid performance in our screener. We held CCJ for its mid-cap status and energy sector exposure. Meanwhile, ASTS and UPST stayed in the mix thanks to their relatively strong performance among small-cap stocks.

Drops

META was excluded due to its decline and subpar tech flow score compared to its peers. NVDA was dropped due to weaker upside breakout and our shift away from mega cap exposure. MSI and AVAV were also removed, given their underwhelming performance in our screener.

Short / Bear Moves

Short / Bear Moves - INFY, MAN, EXPO, CF and ERIE adds / PBR hold / KMT, APPF, HOG, AMKR, HSBC, and CDW drops

Adds

INFY was included to bring in large-cap diversity, balancing the long side of our portfolio. MAN made the cut due to its weak options sentiment. Lastly, EXPO, CF, and ERIE were added for their mid-cap exposure, low tech flow, and favorable net options metrics.

Holds

PBR remained in our portfolio as the largest-cap stock on our list, with its low tech flow.

Drops

APPF, HOG, AMKR, and CDW were dropped due to underperforming in our screener compared to peers. HSBC was removed in favor of ERIE's stronger Net Options Sentiment. CDW was specifically excluded because of its low ranking in our screener.

Portfolio Summary

Long / Bull Moves - AVGO and UHS adds / APO, CCJ, ASTS, UPST holds / META, NVDA, MSI and AVAV drops

Short / Bear Moves - INFY, MAN, EXPO, CF and ERIE adds / PBR hold / KMT, APPF, HOG, AMKR, HSBC, and CDW drops

6 Longs: AVGO, UHS, APO, CCJ, ASTS and UPST

6 Shorts: INFY, MAN, EXPO, CF, ERIE and PBR

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.