MAG 7 & SMALL CAPS: WILL SANTA BRING A RALLY?

12/01/24 Prospero.Ai Investing (174th) Edition (Weekend)

Now that Thanksgiving is behind us, here at Prospero it's time for us to set our sights on the Holiday season that singer Anday Williamson so famously coined: "The Most Wonderful Time of the Year". Some of the fondest memories of my childhood were during this season when I could hardly contain my excitement that Santa might bring me the gift I had been hoping for all year. Odds are, if you're reading this letter, you might be hoping for a different kind of gift from Santa this year; a good old fashioned Santa Claus Stock Rally!

The "Santa Claus Rally" was first coined in 1972 by Yale Hirsch, the founder of The Stock Trader's Almanac. A recent study done by that same publication, looked at every year from 1950 through 2022 and determined there was a December Santa Claus Rally 79.2% of the time. Those are pretty good odds. But what about this year when the S&P and Nasdaq have reached all time highs? History tells us that the odds of a December increase are still excellent. According to Dow Jones Market Data, The S&P 500 has averaged gains of about 2% for December, in years when it entered the final month up by at least 20%.

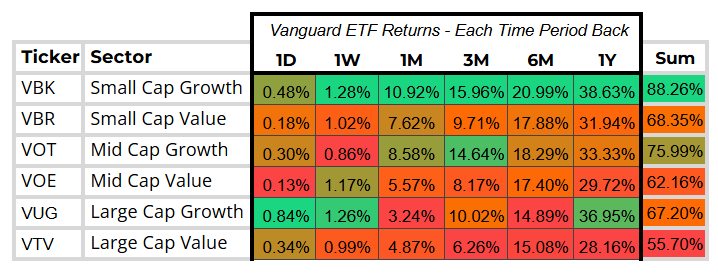

There's one more interesting piece of data that lends itself to a strong December. Small Caps have been on a tear lately. When you look at our Cap Analysis Table later in the letter, you will see that Small Cap Growth has actually taken the lead over all the other Caps over the last 365 days. As a matter of fact, Small Caps have outperformed the Mag 7 (and other Large Cap Growth stocks) over the last couple of months. But that brings us to a question? In light of recent market performance how will Prospero position its portfolio heading into December? Are we going to go all in with Small Caps? The short answer is we’re hesitant, and it totally depends on our data. Let me take a second to explain.

Small Caps as a sector are currently showing strength, but picking individual small cap stocks for our portfolio poses a lot of downside risk. First of all, small caps are less profitable (or often not profitable), so any cap-ex (or any other large or unexpected expenditures) by the company might seriously impact its bottom line, causing the stock to decline. That doesn't take into account stock dilution and other variables that cause small cap volatility. Because there is so much downside risk to individual small caps stock, we are VERY careful when picking them.

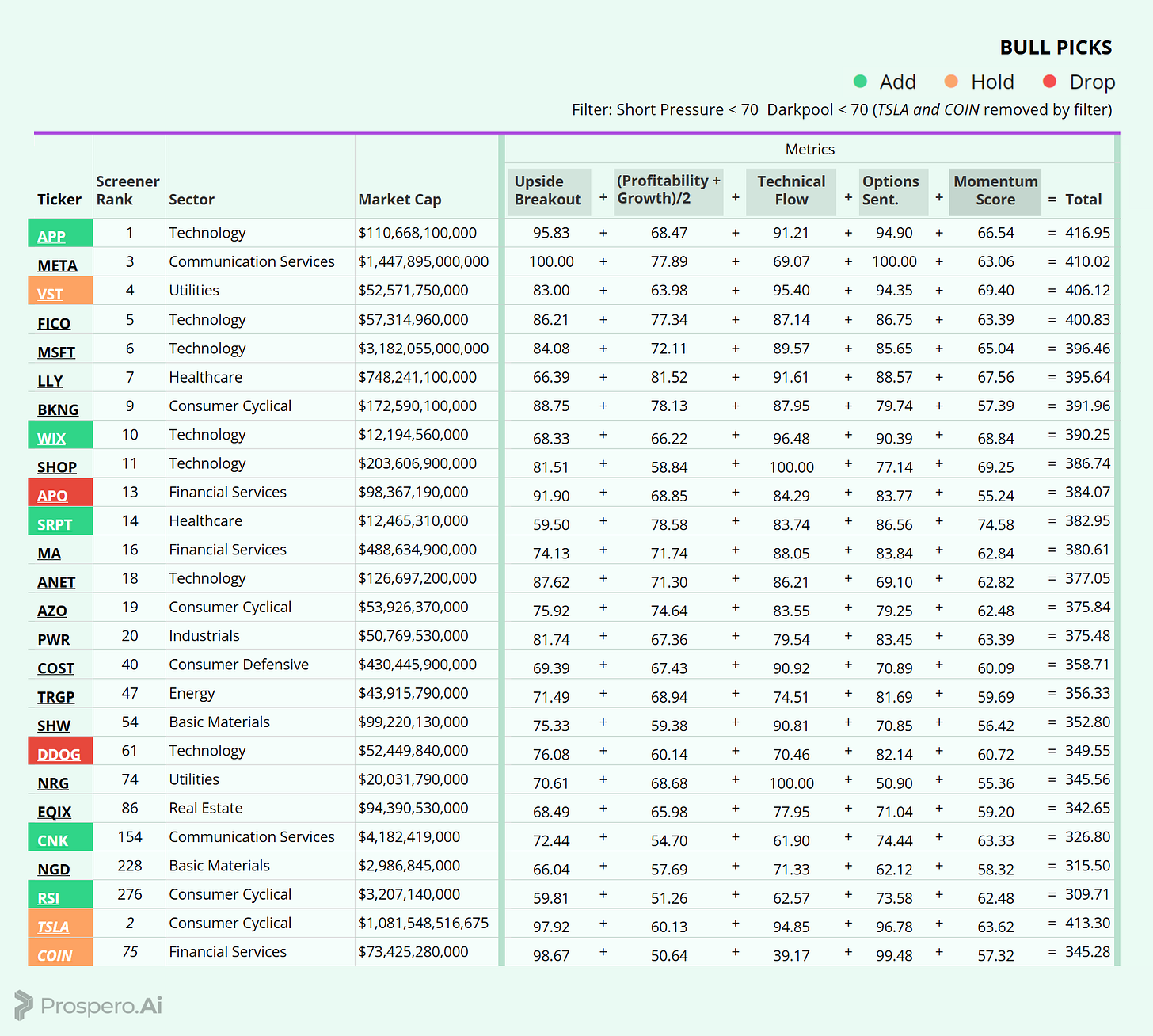

Now, we WILL pick a Small Cap stock for our portfolio, but only when they show a significant rise in our screeners. Bottom line is that our metrics run much higher for Large Caps. You're going to typically see a much larger Net Options Sentiment or Upside / Downside numbers, say for META (Net Options 100) than you would for one of our recent small cap pick, ASTS (Net Options 70). Why? Because the size and quantity of Large Cap Options bets, make their number run higher. So, when you see a smaller than mega cap stock like APP, whose Net Options just jumped to 96, THAT GETS OUR ATTENTION! It means that the sheer magnitude of bullish options bets have driven the smaller cap stocks' net options to the level of a Large Cap! That's when we might jump in. Bottom line is that regardless of the Small Caps meteoric run, we will still be very selective.

Let's end this section of the letter with some good news regarding a potential Santa Rally. Even though they've lagged Small Caps, Large Cap Growth stocks are starting to show some real strength in our signals. As our CEO George Kailas put it in Friday's Trading Letter, we had a "Bullish end to the week". Why did he say that? It has everything to do with the volatility that defined the market over the last 3 months. We've had constant ups and downs, while different sectors went in and out of relevance. The market couldn't make up its mind. But last week, things seemed to smooth out and our QQQ and SPY Net Options Sentiment ended the week in a solid, bullish trend. From a sector perspective, all of them had a positive week, with Large Cap Growth (Tech/Mag 7) having a strong week and an even better Friday.

Right now, if you forced us to pick two stocks we feel the best about, it would be Tesla (TSLA) and Coinbase (COIN). Two, Large Cap Growth Stocks that are showing REAL STRENGTH in Prospero's Net Options and Upside signals. META too, has a Net Options and Upside of 100! While we haven't picked them for our portfolio, the rest of the Mag 7 (NVDA, AMZN, GOOG & MSFT) are all showing real strength in our signals. Unless the Fed surprises us with some kind of hawkish pivot, it's hard to imagine this December not ending with an upswing. But here is where we highlight the difference between even signals and portfolio management in this letter. There are a lot of Large / Mega Cap stocks that look good in our signals. What we do in this letter is either pair them with expected macro forces or balance risk paramount. We have been writing about the Macro forces coming for TSLA and COIN with Trump. But even zooming out further, Consumer Cyclical were our big wins in 2023 on the Bull side and in 2024 that shifted to Tech. And we’ve been targeting Consumer Cyclical for a lot of our short wins this year. It isn’t that Tesla hasn’t looked good in our signals earlier in the year but that it hasn’t looked as good as other stocks like META, SMCI (earlier in the year) NVDA or LLY; and more recently APP. This year we targeted Tech, expecting a great year for Macro reasons, and we were 100% right.

As we approach the coming week, stay vigilant, watch the signals and be prepared for anything. Now a word from our CEO, George Kailas.

A WORD FROM OUR CEO

We run a 50% off this letter around the holidays and we decided to do it for Cyber Monday this year! We will extend it in some form for the holidays but it will be lower.

I will be virtually speaking at the Finimize - Modern Investor Summit 2:15 PM Tuesday the 3rd on a panel about AI for Retail Investors with the Head of eToro US.

The whole market took a bit of a hit and we held because the signals looked good and we are currently beating the S&P 500 by 84% annualized, with a win rate of 60% against SPY benchmarks.

To help newer readers get up to speed linking our short intro + learning videos.

Only one stream this week again Tuesday 12/03 at 10AM EST as I am going to London for an in person portion of the Modern Investor Summit.

Don’t have our app yet? Use it to track your investments with Prospero’s proprietary AI tech.

MAG 7 & SMALL CAPS: WILL SANTA BRING A RALLY?

Market/Macro Update w/ Cap/ Value Analysis

QQQ and SPY Net Options Sentiment

Sector Analysis

How we view the Sector performance and momentum

Portfolio Strategy

Putting it all together to make a portfolio that first controls for risks but also has upside

Longs

Adds —> Keeps —> Drops

Shorts

Adds —> Keeps —> Drops

Portfolio Summary

CAP/VALUE ANALYSIS

Check out the Cap/Value Analysis Table above. Look at the yearly numbers. As we said earlier, Small Caps are on a run and have surpassed over the last year, even Large Cap Growth. Now, look at the weekly numbers. Large Cap Growth stocks had a very strong week and had a great day on Friday. Could this be the beginning of a Santa Claus Rally led by the Mag 7? There could be some volatility left in the coming days. We still have a war raging in Ukraine that shows no signs of easing up. Political rhetoric is hot and the Fed is speaking soon. Lots of potential downside catalysts. But, things are looking hopeful. Tis the season for hope, right?

QQQ/SPY NET OPTIONS SENTIMENT

Check out the QQQ Net Options Sentiment Chart below. We ended the week on a solid bullish note with QQQ numbers ending the week at 47. It even jumped into the 50's at times last week, which is a tad bit stronger than we've seen of late. On Friday, it dipped slightly below our bullish line, but recovered and stabilized into the close. Hopefully that's a sign of things to come. Be sure and watch carefully at Market Open tomorrow to see if this Bullish trend continues.

Look at the SPY Net Options graph above. After lagging QQQ for some time, SPY Net Options has stabilized and finished the week on a much more bullish note. One other note of interest; since November 15th, though there has been some volatility, we are in a sustained bullish trend. This is potentially as a result of optimism as we headed into Black Friday and the Holiday Season. But, as you can see by looking at the chart before November 15th, things can turn south in a hurry in this volatile market.

SECTOR ANALYSIS

Check out the Sector Analysis Chart above. Three things stand out to us here. First, Real Estate had a tough end to the week and might be showing signs of cooling. Hopefully this is not in anticipation of some hawkish words from the Fed. Second, Consumer Discretionary showed some real strength last week. Black Friday might have blown some wind in those sails. At Prospero, we will be looking at opportunities this week in that Sector. Finally, Healthcare had a strong turnaround last week. After getting brutalized since the election, folks are realizing that JFK will likely not shut down the entire healthcare industry, and there's still some profit to be made there.

PORTFOLIO STRATEGY

Building on the positive momentum from last week, both SPY and QQQ exhibit bullish signals, particularly in terms of net options sentiment. As a result, we are adopting a more bullish stance in our portfolio, with an emphasis on diversification across both market cap and sectors. We will continue to prioritize stocks with strong secular tailwinds, as well as maintaining positions in the Trump trade picks we highlighted last week. On the short side, we aim for diversification across sectors and market caps to help manage downside risk. 9 longs, 5 shorts

Long / Bull Moves

Long / Bull Moves - APP, WIX, SRPT, CNK and RSI adds / VST, TSLA and COIN holds/ APO, and DOOG drops

Adds

We added APP to the portfolio, as it ranked highly in our screener with strong tech flow and impressive net options sentiment metrics. WIX was included due to its excellent overall metrics, along with its position as a promising lower-cap tech stock. We added SRPT based on its robust Momentum Score, providing valuable market cap and sector diversification. CNK and RSI were also added for small-cap exposure, both showing solid Net Options Sentiment and strong Momentum Scores.

Holds

We continue to hold VST due to its consistently strong performance across all metrics. TSLA and COIN were retained for their high Net Options Sentiment scores and breakout potential, with both stocks aligned with the Trump trade and positioned for substantial gains. We hold COIN over the weekend regardless because it is closely tied to BTC which trades over the weekend but we will likely exit 1/2 positions Monday due to lower Technical Flow.

Drops

We decided to drop APO as it ranked lower in our screener. DOOG was also removed due to weaker Tech Flow and subpar performance relative to our higher-quality tech names in the portfolio.

Short / Bear Moves

Short / Bear Moves - WEN, BCH, NVS and INFY adds / AES hold / HSBC, BTI and TXN drops

Adds

We added WEN for its strong position on our screener, which helps balance our smaller-cap consumer cyclical exposure on the long side. BCH was included for its larger market cap, despite low Tech Flow and Net Options Sentiment, providing valuable diversification. NVS was added as a solid large-cap healthcare stock, complementing our portfolio with its stability and low Net Options Sentiment. We also included INFY to further diversify our long side with a larger tech name, helping balance out our existing large-cap tech positions.

Holds

We retained AES as a well-placed mid-cap utilities stock with low Net Options Sentiment, complementing VST on the long side and providing sector balance.

Drops

HSBC, BTI, and TXN were removed due to their lower rankings on our screener.

Portfolio Summary

Long / Bull Moves - APP, WIX, SRPT, CNK and RSI adds / VST, TSLA and COIN holds/ APO, and DOOG drops

Short / Bear Moves - WEN, BCH, NVS and INFY adds / AES hold / HSBC, BTI and TXN drops

9 Longs: APP, WIX, SRPT, CNK, RSI, VST, TSLA and 2XCOIN (likely to drop to 1X tomorrow)

5 Shorts: WEN, BCH, NVS, INFY and AES

Paid Investing Letter Bonus - With Momentum Score Screener

Keep reading with a 7-day free trial

Subscribe to Prospero.Ai Investing Newsletter to keep reading this post and get 7 days of free access to the full post archives.