This is a special edition of our Investing letter. Since we know a lot of people might be interested in this and it is a paid letter we are running a 25% discount right now!

Here’s what we’ll discuss:

Our signals spotted both AMC and GME before they moved. We will talk about what you want to do about situations like that in the future.

Market Update - Discussion of Daily Averages for QQQ and SPY Net Options Sentiment and Upside Breakout.

Sector / Market Cap Movements Update.

This letter is about taking a reset on a crazy week in the market. I know it is a little later than normal but we wanted to gather more data first!

I’ll start with a few stories.

I (George Kailas) haven’t personally traded stocks in close to 2 years. I made that decision, to avoid even a whisper of a conflict of interest. Despite my commitment, I almost bought FFIE yesterday at $.80. As I write this letter a day later, it’s currently going for $3+. Some might call that a miss, but I stand by my decision. All this echoes the problem with meme stocks. Even though I chose not to buy the stock, I still checked it a bunch because these movements are fascinating, exciting and volatile. I ultimately passed, though I knew my wallet wasn’t likely to thank me. I could have made a lot of money. But let me frame it differently:

In order to compete with the market maker robots, you have to be able to process more social and price data than you can comprehend. I am ultimately happy I didn’t do it, because I have a lot of responsibilities and interests in my life. For me to even HOPE to execute well and time my exit from the stock, would have been my highest priority and taken most of my time during market hours. For those that might say: “set your stop losses!”. In my prior times on memestocks and memestock options, I cannot even begin to express to you how awful my execution price was even on Schwab. If you are in Robinhood or WeBull, or any other broker who primarily makes money off letting people front run your trades, you will, more often than not, be behind a halt on your execution. While other trades are executed in the dark pools while the market is closed.

This isn’t to say it’s impossible, it’s just that the biggest issue I see with retail investors is that they severely overestimate their skill levels. Over 70% of retail investors lose. And that is on stocks that you can, at least, make sense of. GME is a 33 Profitability and 12 Growth in Prospero. It’s already severely overvalued. So as it is falling in price, how do you know how far it can go? Do determine that is challenging, and is orders of magnitude more difficult. If you have tons of time and you want to play momentum, no reason not to build your technical analysis skills to train yourself to spot these and many other trades. But per my point above, I can count on about 4 hands how many technical traders with real chops I’ve met outside of Wall St. and a bajillion more that think they are…but frankly are not very good.

All this being said, Prospero did spot both AMC and GME BEFORE their big moves, and I’m going to talk about how you could spot these opportunities in the future based on our signals. But I hope all the caveats above were properly taken in!

Meme Mania (GME to start below)

The first thing to notice that is more pronounced in the below graphs, is that both Upside and Net Options Sentiment made huge (20+ point) moves up before the price went up. And when we warned that it might be over you can see that big drop in Upside and climb in Downside; evidence that long-term bets were flipping from Bullish to Bearish. Now the unique thing about this week is that we believe with Net Options Sentiment spiking to 100 so quickly, the demand for short term options reflected in that metric was so strong, that for the first time ever we’ve seen strong evidence that institutions were swing trading long term options. And this tracking did indeed prove to be important as we sounded the alarm when we saw Upside drop 30 points to open the day on the 15th. By far the largest and fastest move we’ve ever seen.

We also wanted to talk about the common refrain in retail, that Roaring Kitty and/or the Ape army started this. We aren’t really seeing good evidence of that, starting here:

GME is on the left and AMC is on the right.

The vast majority of options trades are institutional and one of the things our technology does is work to isolate institutional trade signatures. You have to be living in some alternate form of reality if you think retail investors are capable of moving the options markets this significantly, in a clear coordinated effort. To me, this paints a clear picture that institutions were betting on, and clearly trying to make gains on Meme Mania 2! Which is further supported by what we’ve been talking about in our letters. The market has been so choppy, Wall St. is always going to be looking for the best way to make risk adjusted profits. Leading another memestock charge where you can buy Call options while you short the stock, get retail excited and then sells your calls and buy Puts to make profit on the way down is a great trade. Why is it so great? Because the AMC and GME cults have become predictable!! Hedge funds KNOW retail will get excited and few will exit; so you can line up your options bets on the way up and way down to maximize profits.

One more piece of data supporting this. It seems pretty clear when you look at the averages that since April 24th institutions knew this move was coming.

So how do you play memestocks?

CAREFULLY and with a lot of attention if at all.

Watch Net Options Sentiment, Upside and Downside because as you can see these trades break rules and institutions will use long term options to make short term swing trades.

Take profits early and often.

Market Update

We are showing you the graphs above first to have a comparison point for GME. While GME was in a clear uptrend the market was volatile. Further cementing the point that people “in the know” were far more confident about this trade than the markets as a whole.

But we are also showing you them to show a few primary points.

Especially QQQ looks to be at its strongest point in the last 3 months

We have seen it get close to these levels and still take sharp turns down so we do want to keep our eye on that

SPY, unlike QQQ, is still a little below the stable high levels of late March / early April so don’t let these numbers and Meme Mania 2 let you get too far ahead of yourself

To that end, price in both graphs is above Net Options Sentiment average so it could be a sign all of this exuberance has made the market overpriced and we could be in for a sharp turn.

Sector Update Allocation

Current: (Link to live, it will be different since this letter was sent)

Takeaways:

Back to the inconsistencies that we’ve been experiencing the last few months. Energy flipped one way and Technology the other. Materials was bad yesterday and 2nd best today. That is why we added some shorts today (LCID, ENR, PBR) playing this defensively.

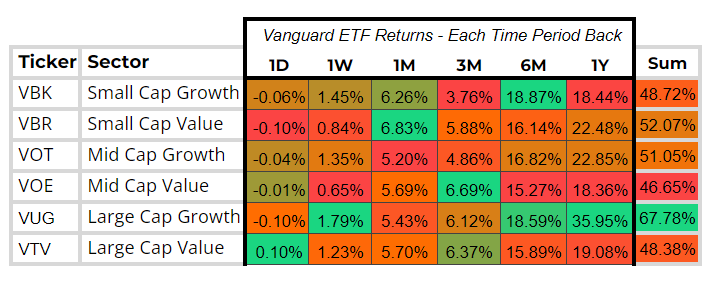

Market Cap and Value/Growth Performance Update

Current: (Link to live, it will be different since this letter was sent)

Takeaways:

Almost nothing interesting to see here. No big moves anywhere just a lot of neutral ones.